DNA Plasmid Manufacturing Market Strategies, Top Players, Growth Opportunities, Analysis and Forecast by 2031

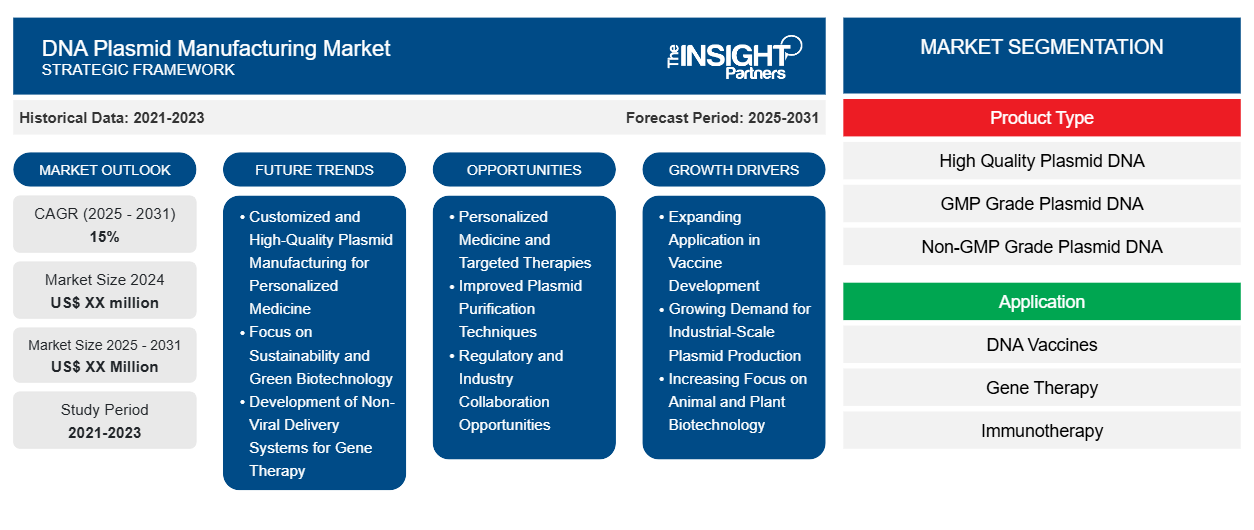

DNA Plasmid Manufacturing Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (GMP Grade and R&D grade), Application (Cell and Gene Therapy, DNA Vaccines, Immunotherapy, and Others), End User (Pharmaceutical and Biotechnology Companies, CROs and CDMOs, and Others) and Geography

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2024-2031- Report Date : Jun 2025

- Report Code : TIPRE00021640

- Category : Life Sciences

- Status : Published

- Available Report Formats :

- No. of Pages : 222

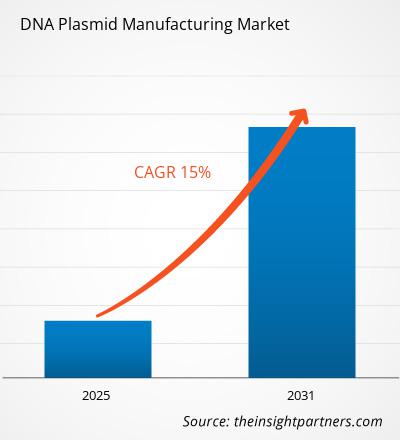

The DNA Plasmid Manufacturing Market size is projected to reach US$ 2.65 billion by 2031 from US$ 0.69 billion in 2024. The market is estimated to register a CAGR of 21.4% during 2024–2031. The integration of digital technologies in plasmid DNA manufacturing is likely to bring new trends to the market in the coming years.

DNA Plasmid Manufacturing Market Analysis

The DNA plasmid manufacturing market is primarily driven by the rising demand for gene therapies, mRNA vaccines, and advanced biologics, which rely heavily on high-quality plasmid DNA as a critical raw material. Increasing investments in personalized medicine, coupled with advancements in recombinant DNA technology and growing adoption of plasmid-based gene editing tools like CRISPR, are creating substantial growth opportunities. Additionally, the expansion of contract manufacturing organizations (CMOs) offering scalable and cost-effective plasmid production solutions further propels market growth, while emerging applications in agriculture and synthetic biology present new avenues for innovation and revenue generation.

DNA Plasmid Manufacturing Market Overview

The rise in the prevalence of genetic diseases, orphan diseases, and other cancers has accelerated the advancement of gene therapy technologies, which are based largely on plasmid DNA as the fundamental element. Plasmid DNA helps introduce genetic material into patients' cells. It acts as a non-viral vector to deliver therapeutic genes that can fix or replace faulty genes. Unlike viral vectors, plasmids are safer, easier to produce, and cheaper, making them popular in gene therapy.

As gene therapies transition from preclinical development to clinical trials and commercial launch, the demand for substantial quantities of high-purity, GMP-grade plasmid DNA has escalated significantly. In March 2023, Charles River Laboratories International, Inc. announced the launch of its off-the-shelf pHelper (Helper Plasmid) offering, which is designed to secure supply and streamline adeno-associated virus (AAV)-based gene therapy programs from early discovery through commercial manufacturing.

Growing partnerships between companies to meet the quality and regulatory demands of gene therapy pipelines. In 2022, Myrtelle and Forge Biologics announced a viral vector and plasmid DNA cGMP manufacturing partnership. Forge will provide research-grade and GMP-Pathway plasmid manufacturing services as well as cGMP adeno-associated viral (AAV) process development and scale-up manufacturing services for Myrtelle’s program, Myr-201 (novel gene therapy for monogenic hearing loss).

Governments and regulatory agencies are also helping to drive this trend with expedited approvals for gene therapy products and national biotech infrastructure investment. VGXI, Inc. recently completed a successful FDA inspection at its GMP facility in Conroe, Texas. This inspection led to the approval of a client’s Biologics License Application (BLA). VGXI’s achievement reinforces its credibility as a plasmid DNA manufacturing leader as well as underscores its importance in enabling commercial-stage gene therapies, DNA vaccines, and RNA-based medicines.

The DNA plasmid market is transforming from a specialized research supply chain to an essential backbone of contemporary therapeutic development. Therefore, the increasing development of plasmids for gene therapy drives the DNA plasmid manufacturing market.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONDNA Plasmid Manufacturing Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

DNA Plasmid Manufacturing Market Drivers and Opportunities

Growing Research on DNA Plasmid Vaccine Development

DNA vaccines are a winning alternative to conventional vaccine platforms, with faster design, more stability at different temperatures, and easier to produce at scale. Several research institutes are studying DNA plasmid vaccines owing to their high performance. For instance, in February 2025, Imunon reported immunogenicity and safety data from a DNA plasmid vaccine trial. Imunon reported new immunogenicity and safety data from ongoing analyses of its proof-of-concept Phase I trial for the IMNN-101 DNA plasmid vaccine. This investigational vaccine, developed using the company’s PlaCCine technology, targets the SARS-CoV-2 Omicron XBB1.5 spike antigen and is being evaluated as a seasonal COVID-19 vaccine. The trial enrolled 24 healthy volunteers who had previously been vaccinated against the Omicron XBB1.5 variant. The data indicate that the vaccine is safe and immunogenic, demonstrating the potential of the PlaCCine platform to develop vaccine candidates.

The study “Safety and Outcomes of a Plasmid DNA Vaccine Encoding the ERBB2 Intracellular Domain in Patients With Advanced-Stage ERBB2-Positive Breast Cancer” was published in November 2022. In this Phase 1 nonrandomized clinical trial, the plasmid DNA vaccine encoding the ERBB2 intracellular domain (ICD) demonstrated immune activation at all tested doses, with the 100-μg and 500-μg doses showing the strongest immunogenicity. Notably, the 100-μg dose induced significant and sustained levels of ERBB2-specific type 1 T cells in most patients. The vaccine is being evaluated in a randomized clinical trial as an adjuvant therapy for patients with ERBB2 low-expression, hormone receptor-negative breast cancer who have residual tumors following neoadjuvant treatment.

The nucleic acid-based vaccine technology has been one of the rapidly growing sectors across the globe post-pandemic. With numerous clinical trials underway, the DNA vaccines are showing promising results and expanding research and clinical successes of plasmid DNA vaccines.

Expansion of Contract Development and Manufacturing Organizations (CDMOs)

The growing complexity of gene therapies and increasing regulatory demands have led to a significant rise in outsourcing plasmid DNA production to specialized Contract Development and Manufacturing Organizations (CDMOs). These CDMOs offer scalable, GMP-compliant manufacturing capabilities, enabling biopharmaceutical companies to accelerate time-to-market and avoid the high capital costs of building in-house facilities. Two leading CDMOs in this field are Aldevron, a Danaher company known for its high-quality plasmid DNA used in gene and cell therapies and mRNA vaccines, and VGXI, a subsidiary of GeneOne Life Science, recognized for its proprietary Helixfermentation technology and end-to-end-plasmid-DNA-service. Both have made significant investments to expand production capacity and meet the growing global demand for plasmid-based therapeutics.

In April 2025, ProBio—a global CDMO—announced the launch of its GMP plasmid DNA manufacturing service at its Hopewell facility. This new service enables the production of clinical-grade plasmid DNA from cell bank to batch release in three months, significantly faster than standard industry timelines. The offering provides reliable and accelerated access to high-quality plasmid DNA aimed at supporting gene and cell therapy developers. ProBio ensures that every batch—ranging from small-scale (50–200 mg) to gram-level quantities—meets client specifications with complete transparency and no hidden fees.

In June 2024, Bionova Scientific, a full-service biologics CDMO and part of the Asahi Kasei Group, announced a US$ 100 million investment to expand into plasmid DNA (pDNA) manufacturing. This investment aims to build a 100,000-square-foot development and production facility in The Woodlands, Texas, near Houston. Set to become operational in the first quarter of 2025, the facility will initially offer pDNA development services along with the production of research-grade and high-quality pDNA, with GMP manufacturing capabilities expected to come online in early 2026. Therefore, the expansion of CDMOs is expected to offer lucrative opportunities to the DNA plasmid manufacturing market in the coming years.

DNA Plasmid Manufacturing Market Report Segmentation Analysis

Key segments that contributed to the derivation of the DNA plasmid manufacturing market analysis are product type, application, end user, and geography.

- Based on product type, the DNA plasmid manufacturing market is bifurcated into GMP grade and R&D grade. The GMP grade segment held a larger share of the DNA plasmid manufacturing market in 2024, and it is expected to register a significant CAGR during 2024–2031.

- By application, the market is categorized into cell and gene therapy, DNA vaccines, immunotherapy, and others. The cell and gene therapy segment held the largest share of the DNA plasmid manufacturing market in 2024.

- In terms of end user, the DNA plasmid manufacturing market is segmented into pharmaceutical and biotechnology companies, CROs and CDMOs, and others. The pharmaceutical and biotechnology companies segment held the largest share of the DNA plasmid manufacturing market in 2024, and it is expected to register a significant CAGR during 2024–2031.

DNA Plasmid Manufacturing Market Share Analysis by Geography

The geographic scope of the DNA plasmid manufacturing market report is mainly divided into five major regions: North America, Europe, Asia Pacific, the Middle East and Africa, and South and Central America. The DNA plasmid manufacturing market in North America is segmented into the US, Canada, and Mexico. North America is leading the DNA plasmid manufacturing market in terms of market share owing to its advanced biotechnology infrastructure, strong pharmaceutical industry presence, and significant investments in gene therapy and vaccine development. Additionally, the continuous R&D investments and expanding applications in personalized medicine, oncology, and infectious disease vaccines are expected to propel the market growth during the forecast period. The US holds the major market share as the country houses many leading biotech companies and research institutions focused on innovative genetic therapies. This region benefits from a robust regulatory framework and government initiatives that support cutting-edge research and development in plasmid DNA technologies. Additionally, the surging demand for gene therapies and DNA vaccines has further propelled the growth of DNA plasmid manufacturing in the region. For instance, companies such as PlasmidFactory and Aldevron have established large-scale plasmid DNA manufacturing facilities in the US allowing efficient production for clinical and commercial use. These organizations play a critical role in supplying high-quality plasmid DNA for various applications, including mRNA vaccine production, which gained global prominence during the COVID-19 pandemic.

The presence of CDMOs in the region enables scalable plasmid DNA production, catering to both small biotech startups and large pharmaceutical firms. Technological advancements such as improved bacterial fermentation processes and purification techniques have enhanced production efficiency and product quality. Additionally, collaborations between academic institutions and industry players, such as the partnership between the National Institutes of Health (NIH) and private companies, have accelerated innovation in gene editing and plasmid manufacturing technologies.

DNA Plasmid Manufacturing Market Regional InsightsThe regional trends and factors influencing the DNA Plasmid Manufacturing Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses DNA Plasmid Manufacturing Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

DNA Plasmid Manufacturing Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 0.69 Billion |

| Market Size by 2031 | US$ 2.65 Billion |

| Global CAGR (2024 - 2031) | 21.4% |

| Historical Data | 2021-2023 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

DNA Plasmid Manufacturing Market Players Density: Understanding Its Impact on Business Dynamics

The DNA Plasmid Manufacturing Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the DNA Plasmid Manufacturing Market top key players overview

DNA Plasmid Manufacturing Market News and Recent Developments

The DNA plasmid manufacturing market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the key developments in the market are listed below:

- WuXi Biologics launched EffiX Microbial Expression Platform to boost recombinant protein and plasmid DNA production. EffiX is designed to meet the industry’s demand for a high-yield, stable, and non-lysogenic E. coli expression system. It serves as a comprehensive solution for developing and manufacturing non-monoclonal antibody (non-mAb) recombinant proteins and plasmid DNA for clients across the globe. EffiX delivers high-yield production across multiple modalities, achieving titers of over 15 g/L for non-mAb recombinant proteins and over 1 g/L for plasmid DNA. (Source: WuXi Biologics, Company Website, March 2025)

- SK Pharmteco, a global contract development and manufacturing organization (CDMO), announced the launch of Plasmid-IQ Design's innovative and proprietary plasmid engineering platform designed to optimize genetic constructs and significantly enhance their performance, stability, and production efficiency. Plasmids serve as critical raw materials in developing and manufacturing cell and gene therapies, vaccines, and biologics. Inefficiencies stemming from poorly designed plasmids can lead to reduced yields, increased costs, and significant delays. Plasmid-IQ Design directly addresses these challenges by applying scientifically validated design principles to create superior plasmid constructs. (Source: SK Pharmteco, Company Website, May 2025).

DNA Plasmid Manufacturing Market Report Coverage and Deliverables

The "DNA Plasmid Manufacturing Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- DNA Plasmid Manufacturing Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- DNA Plasmid Manufacturing Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- DNA Plasmid Manufacturing market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the DNA Plasmid Manufacturing Market

- Detailed company profiles

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For