Global EMC Testing Market Forecast to 2031: Key Insights

According to our latest study on "Global EMC Testing Market – Global and Regional Share, Trend, and Growth Opportunity Analysis – by Offering, Service Type, End-use, and Geography," the market was valued at US$ 2.85 billion in 2024 and is expected to reach US$ 4.48 billion by 2031. The EMC Testing market size is estimated to register a CAGR of 6.8% during 2025–2031. The burgeoning growth of e-commerce and the ever-expanding complexity and density of electronic devices propel growth in the global EMC testing market. As the world becomes more digital and connected, through technologies such as IoT, 5G, and electric vehicles, there is a growing demand for comprehensive EMC compliance. Artificial intelligence in EMC is expected to emerge as one of the EMC testing market trends in the coming years.

An increased use of electrical and electronic equipment has led to issues with undesirable interference and radiation with devices affecting their performance and safety. As electronic devices become incrementally closely coupled in engineering and functionality, the issues surrounding electromagnetic compatibility (EMC) and electromagnetic immunity (EMI) testing have surfaced to exploit. EMC testing and certification services are warranted to verify electronic products meet compliance in conformity to strict regulations, to retain the performance of devices and safe operation of equipment by users. As stricter regulations are adopted around the world, businesses are under pressure to comply with standards to avoid malfunctioning and market recall. Certification services also permit a business to administer a large catalog of testing processes including; safety, quality, environmental, social responsibility, to perform bespoke surveys. This service provides a company with an increased level of testing and reporting which adds to the companies reliability and consumer confidence and brand differentiation in the products supplied to end customers who purchase the product. The announcement of its automotive grade CAN transceiver NCA1044-Q1 published November 7, 2024 by NOVOSENSE is just one current example of this goal. NOVOSENSE was able to disclose that all of it's test certifications, were submitted to IBEE/FTZ-Zwickau, a leading European authorized testing organization, and all EMC testing successfully completed, in September 2024. These certifications not only establish quality but also help to systematize certification for automotive manufacturers, accelerating time to market. As industries forge ahead with potentially new capabilities and advancements in automation, the need for testing and certification services will continue to grow. Organizations rely on certification services to assist in demonstrating compliance to EMC standards and EMI requirements. Testing further reduces risks and competitiveness in the marketplace.

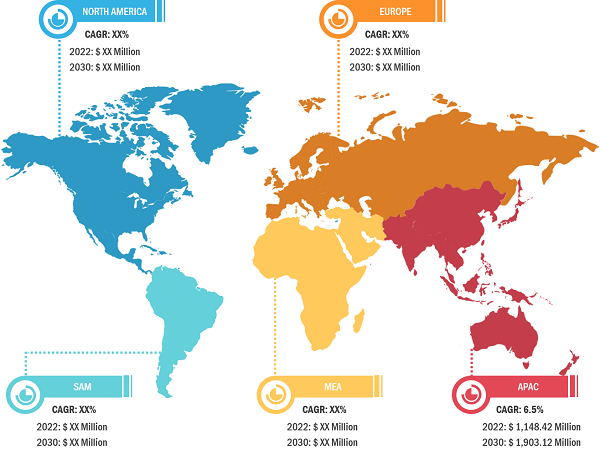

EMC Testing Market – by Region, 2024 and 2031

EMC Testing Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage:By Offering (Hardware and Software and Services), Service Type (Testing Services, Inspection Services, Certification Services, and Other Services), End Use (Consumer Appliances and Electronics, Automotive, Military and Aerospace, IT and Telecommunications, Medical, Industrial, and Others), and Geography

EMC Testing Market Size, Share, Growth, Scope & Trend Analysis 2030

Download Free Sample

Source: The Insight Partners Analysis

Increasing Deployment of EMC in Consumer Electronics Drives Global EMC Testing Market Growth

Eurostat indicated the consumer electronics industry in Europe is rapidly growing as the conceptualization, production of electronic equipment across EU member states provided a heightened demand, as EU sales of electronic equipment increased by about 85% from 2013 to 2021 period. The heightened demand was not only in cell phones but also computers, tablets, infotainment connected voice-assisted systems in cars and electronic devices in cars. The increasing electronic devices and the accompanying increase in the number of electronic devices sold, meant the many device use and consumer electronics market is recognizing and focusing more on electromagnetic compatibility (EMC) in order to ensure that the design process and product will produce a reliable functioning product and that the product will not emit electromagnetic interference.

Testing and certification service providers are investing in parts of their organizations to continue maintaining their EMC testing and certification services. A recent example of this sector reacting to consumer electronics growth is SGS Société Générale de Surveillance SA and their announcement in May 2020 that they had completed the expansion of their EMC testing services by relocating to a larger lab. Their new lab is 6,300 m² with state-of-the-art testing facilities located in Puchheim near Munich, Germany. Their new facility is ISO/IEC 17025 accredited and benefits SGS to provide more comprehensive and robust EMC testing and certification services for industries including consumer electronics. The new lab and comprehensive testing environment will facilitate products of all types and manufacturing groups and allow testing in part or whole covering everything from smaller components to larger more complex systems under one roof. Ultimately this investment means testing will be completed faster and more reliably certified.

With greater adoption of advanced technologies such as 5G networks, faster operating speeds, variable voltage power supplies, and an increased emphasis on more power efficient, lighter weight, and smaller electronics, devices are increasingly vulnerable to electromagnetic interference. As a result, manufacturers place more and more emphasis on a reliable EMC shielding and testing process as part of the product development process to ensure compliance with evolving standards, improve safety, and improve performance of the device.

In summary, the booming consumer electronics market and evolving regulatory standards are clear drivers of the EMC testing market.

In terms of offering, the EMC testing market is divided into hardware and software and services. The hardware and software segment held a significant EMC testing market share in 2024. The hardware and software segment is critical in the EMC testing market, driven by increasing global emphasis on product safety, regulatory compliance, and the rapid proliferation of electronic devices across industries. Traditionally dominated by hardware-centric setups, the segment has evolved significantly by integrating advanced software solutions to improve testing accuracy, efficiency, and automation. Software and hardware integration is essential for specialized testing scenarios. For example, SGS offers in-situ EMC testing services aimed at large or installed equipment manufacturers, where transporting units to test chambers is impractical. This service reduces logistical challenges and enables significant cost and time savings by eliminating the need to ship products or deploy personnel to external labs. The hardware and software segment is witnessing continuous innovation, underpinned by demand for automation, flexibility, and higher test coverage, act as EMC testing market trend.

The geographical scope of the EMC testing market report primarily entails North America (US, Canada, and Mexico), Europe (Spain, UK, Germany, France, Italy, and Rest of Europe), Asia Pacific (South Korea, China, India, Japan, Australia, and Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, UAE, and Rest of Middle East & Africa), and South & Central America (Chile and Rest of South & Central America). Asia Pacific accounted for the largest EMC testing market share in 2024.

The EMC testing market is currently dominated by the Asia Pacific region and is likely to remain the fastest growing region. Countries such as China, Japan, South Korea, and India are all major centers for electronics and automobile manufacturing. And with their rapidly expanding production bases, there is a growing demand for electromagnetic compatibility (EMC) testing from these regions. In addition, as all of these countries are dramatically increasing their exports, there are additional legal requirements requiring them to comply with international EMC standards, which will further drive the EMC testing market. The North America region also represents a significant market, as it has a well matured regulatory environment particularly with regard to aerospace, defense, telecommunications, and automotive. North America also is home to a number of leading manufacturers of test equipment and spends a significant amount of money on research and development, boosting the North America EMC testing market share. Europe is also noteworthy due to strict regulatory mandates like CE marking, advanced automotive and industrial electronics, and increasing attention on sustainable technologies. Emerging markets like the Middle East & Africa (MEA), and Latin America now show some promise, particularly for a mix of reasons including infrastructure modernization, expansion of telecom networks, and the introduction and adoption of international standards. While they still are relatively early, these emerging markets hold promise considering their rapidly growing industrial and consumer electronics markets.

AMETEK Inc., Element Materials Technology, Bureau Veritas, Eurofins Scientific, Intertek Group plc, NTS, ROHDE&SCHWARZ, SGS SA, and TÜV SÜD are among the key players profiled in the EMC testing market report

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com