EMC Testing Market Size, Share, Growth, Scope & Trend Analysis 2031

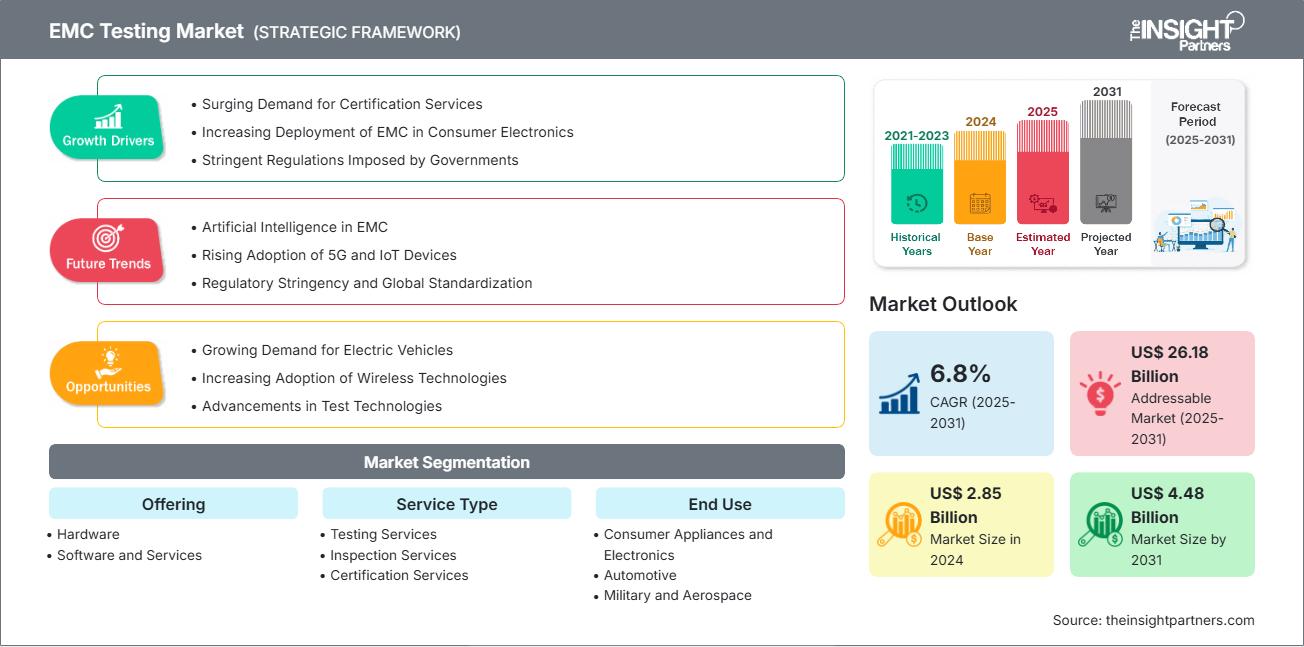

EMC Testing Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage:By Offering (Hardware and Software and Services), Service Type (Testing Services, Inspection Services, Certification Services, and Other Services), End Use (Consumer Appliances and Electronics, Automotive, Military and Aerospace, IT and Telecommunications, Medical, Industrial, and Others), and Geography

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Status : Published

- Report Code : TIPRE00008397

- Category : Technology, Media and Telecommunications

- No. of Pages : 212

- Available Report Formats :

The EMC testing market size is expected to reach US$ 4.48 billion by 2031 from US$ 2.85 billion in 2024. The market is anticipated to register a CAGR of 6.8% during 2025–2031.

EMC Testing Market Analysis

One major factor behind growth is the electrification of the automotive sector. This includes the increase in electric vehicles (EVs) and self-driving systems. These technologies have intricate electronic subsystems that require detailed EMC validation. The rapid launch of 5G infrastructure and the continuing growth of IoT ecosystems are also creating new testing challenges and expanding the market. Additionally, strict global regulations from groups like the FCC in the US, CE in Europe, and CISPR worldwide are urging manufacturers to meet compliance requirements.

The market offers significant opportunities. The growth of 5G networks, smart grid technologies, renewable energy systems, and smart consumer devices will all need improved EMC testing. Also, using artificial intelligence (AI) and machine learning (ML) in test equipment and processes is becoming a major trend. This change enhances test speed, accuracy, and data analysis skills. Moreover, the rising focus on eco-friendly and sustainable EMC testing practices supports global environmental goals.

EMC Testing Market Overview

Electromagnetic Compatibility (EMC) testing is important for assessing how well electronic devices deal with electromagnetic disturbances. It examines whether these devices keep functioning reliably amid electromagnetic interference. EMC testing makes sure that products meet international standards for both radiated and conducted emissions, as well as immunity standards. This testing plays a crucial role in ensuring the safety and performance of devices in different industries, such as automotive, aerospace, telecommunications, consumer electronics, and healthcare. As electronics and wireless technologies become more widespread, meeting EMC standards is becoming increasingly vital.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONEMC Testing Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

EMC Testing Market Drivers and Opportunities

Market Drivers:

- Rapid Growth of Certification Services: Throughout the increased use of electrical and electronic appliances, several issues arose due to unwanted interference and radiation impacting the performance and safety of those devices. The closer and more devices work together, the more essential proper electromagnetic compatibility (EMC) and immunity to electromagnetic interference (EMI) should become. EMC testing and certification provide confirmation to the designer and potential end user that an electronic product is in compliance with ascending standards and ensure safe performance.

- Growing Adoption of EMC for Consumer Electronics: In addition to new technologies, using faster clock speeds, higher data rates, and more variable voltage supplies continues to place demands on the potential for electromagnetic interference. Increasing efficiency, smaller or lighter devices, energy savings and regulation continue to fuel the pressure on manufacturers to attain reliable EMC shielding and testing to meet changing regulations, ensure end user safety, and product reliability. There is both a growing consumer electronics market, along with increased regulatory standards, which should expand the EMC testing market

- Regulatory Requirements Imposed by Governments: Regulatory requirements imposed by governments encompass obligations for complying with electromagnetic compatibility (EMC) standards in the interest of guaranteeing the safety and performance of devices. As a result, manufacturers have to spend additional money on EMC testing in support of legal and certification obligations. The demand for EMC testing services and equipment will continue to increase as regulatory structures develop around the world.

Market Opportunities:

- Unprecedented Demand for Electric Vehicles The extraordinary expansion of electric vehicles (EVs) is increasing the need for EMC testing to confirm that the vehicle components operate together without interference. As EVs use electronics as part of complex electronic systems, it is crucial to ensure the product meets electromagnetic compatibility (EMC) standards. This demand is boosting the need for EMC testing services, particularly in areas of automotive research & development, charging infrastructure, and battery management systems.

- Expanding Use of Wireless Technologies Wireless communication is becoming a requirement in many sectors such as healthcare, consumer electronics, and industrial automation. As an increasing number of products are becoming Bluetooth-, Wi-Fi-, and 5G-enabled, the risk of electromagnetic interference also increases. EMC testing ensures that devices with wireless capabilities can coexist without disruption, driving the demand for and expanding the services of compliance testing and certification services.

- Expansion of 5G Infrastructure The global rollout of 5G networks brings new frequencies and faster data transmission rates. This requires careful EMC testing. Equipment used in 5G must meet strict compatibility standards to prevent interference with existing devices and infrastructure. This ongoing development creates significant opportunities for EMC testing labs, especially in telecommunications and connected devices.

Market Trends:

- Artificial Intelligence in EMC AI is disrupting EMC testing environments by automating complex test procedures, providing insight into patterns of interference, and predicting EMC compliance issues. Using AI has both reduced human errors, improved efficiency, and sped up product certification cycles. The capabilities of AI tools will continue to improve, and they will eventually become indispensable tools in many EMC testing environments in various sectors.

- The growth in IoT devices and connected technologies in consumer and industrial products The boom in IoT devices in homes, factories, and cities is increasing the complexity of electromagnetic environments. The integration of connected devices requires strict EMC compliance testing to ensure that they can work well together without interference. Due to the rapid proliferation and increased use of IoT devices, there is continuous innovation and heightened demand for EMC compliance and EMC testing services globally.

- Movement toward the Utilization of In-House EMC Testing Capabilities A trend can be seen, however, many large manufacturers have established in-house EMC testing labs to help expedite the time to market and increase flexibility in testing. This trend is driven by greater product complexity and the need to test iteratively through the product development process. Having in-house EMC capabilities gives manufacturers better control, allows for quicker compliance and lower costs in the long term, changing the historical model of outsourced EMC testing.

EMC Testing Market Report Segmentation Analysis

The EMC testing market is divided into different segments for its growth potential and the latest trends. Below is the standard segmentation approach used in industry reports:

By Offering:

- Hardware and Software This segment is comprised of EMC testing instruments, analyzers, and software that use various devices to provide measurement and electromagnetic compatibility verification.

- Services This segment focuses on assistance in specialized EMC testing, certification, consulting, and compliance services that are provided to manufacturers to assist in complying with regulatory requirements effectively & efficiently.

By Service Type:

- Testing Services This includes all EMC testing to determine a product's conformity to EMC standards and regulations.

- Inspection Services This includes the inspection of devices and systems to determine potential EMC problems prior to formal testing or certification.

- Certification Services This includes the official approval and documentation that a product meets the required EMC standards for entry into the marketplace.

- Other Services This includes any other assistance such as consulting, training, and specifically tailored EMC solutions and services.

By End-Use:

- Consumer Appliances and Electronics

- Automotive

- Military and Aerospace

- IT and Telecommunications

- Medical

- Industrial

- Others

The EMC testing market serves many industries including, but not limited to, consumer appliances, automotive, military, aerospace, IT, telecommunications, medical, and industrial. These industries require strict electromagnetic compatibility (EMC) for safety, reliability, and regulatory requirements. The variety of applications and industries leads to continuous innovation and demand in the technology-based sector..

By Geography:

- North America

- Europe

- Asia Pacific

- South & Central America

- Middle East & Africa

EMC Testing Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 2.85 Billion |

| Market Size by 2031 | US$ 4.48 Billion |

| Global CAGR (2025 - 2031) | 6.8% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Offering

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

EMC Testing Market Players Density: Understanding Its Impact on Business Dynamics

The EMC Testing Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

EMC Testing Market Share Analysis by Geography

The EMC testing marketplace in Asia Pacific is evolving rapidly, largely driven by increasing uptake of next-generation electronic devices and expanding telecommunications infrastructure. Emerging markets in South & Central America, the Middle East, and Africa remain untapped for most EMC testing service providers, presenting opportunities to expand operation while benefiting from growing regulatory requirements.

The growth of the EMC testing market varies across regions due to differences in industrial development, regulatory frameworks, and technology adoption. Below is a summary of market share and trends by region:

1. North America

- Market Share: Significant share driven by advanced technological adoption and well-established regulatory standards

-

Key Drivers:

- Strong presence of automotive and aerospace industries requiring rigorous EMC compliance.

- High demand for consumer electronics and telecommunication devices.

- Government regulations enforce strict EMC standards across industries.

- Trends: Increasing integration of AI and IoT in EMC testing processes to enhance accuracy and efficiency.

2. Europe

- Market Share: Holds a significant share due to early adoption of strict and comprehensive EMC regulations across the European Union

-

Key Drivers:

- Strong presence of automotive, aerospace, and industrial manufacturing sectors demanding rigorous EMC compliance.

- Stringent regulatory frameworks such as the EMC Directive enforce high standards for product certification.

- Growing focus on renewable energy and smart grid technologies is increasing the need for reliable EMC testing.

- Trends: Increasing integration of Industry 4.0 technologies and smart sensors in manufacturing, driving advanced EMC testing requirements for sustainability and predictive maintenance.

3. Asia Pacific

- Market Share: Rapidly growing market driven by electronics manufacturing and telecommunications expansion

-

Key Drivers:

- Surge in consumer electronics production and increasing smartphone penetration.

- Expanding 5G infrastructure demands stringent EMC compliance.

- Growing automotive and electric vehicle markets are fueling EMC testing demand.

- Trends: Increasing government focus on EMC standards enforcement and rising investment in testing infrastructure.

4. South and Central America

- Market Share: Developing market influenced by expanding industrial and consumer electronics sectors

-

Key Drivers:

- Growing automotive manufacturing and telecommunications infrastructure.

- Increasing foreign investments and collaborations in technology development.

- Rising awareness of regulatory compliance and certification importance.

- Trends: Adoption of in-house EMC testing labs by manufacturers to speed up product development cycles.

5. Middle East and Africa

- Market Share: Emerging market with untapped potential in telecommunications and industrial sectors

-

Key Drivers:

- Growing adoption of wireless technologies and IoT devices.

- Expansion of industrial automation and energy sectors requires EMC compliance.

- Increasing government initiatives to align with international EMC standards.

- Trends: Growing demand for portable and cost-effective EMC testing solutions.

EMC Testing Market Players Density: Understanding Its Impact on Business Dynamics

High Market Density and Competition

Competition is intense due to established players such as Bureau Veritas, Intertek Group plc, and SGS SA. Regional and niche providers such as Dekra SE (Germany) and Eurofins Scientific (Luxembourg) add to the competitive landscape across regions.

This high level of competition urges companies to stand out by offering:

- Advanced EMC testing solutions with AI-driven automation and analytics.

- Comprehensive services focused on regulatory compliance and faster certification.

Opportunities and Strategic Moves

- Growing adoption of AI and machine learning to enhance testing accuracy and efficiency.

- Increasing demand for sustainable and energy-efficient electronic products is driving EMC compliance requirements.

Major Companies operating in the EMC testing Market are:

- Ametek Inc – Pennsylvania, US

- Element Materials Technology Group Ltd – London, UK

- Bureau Veritas SA – Neuilly-sur-Seine, France

- Eurofins Scientific SE – Luxembourg

- Intertek Group Plc – London, UK

- Rohde & Schwarz GmbH & Co KG – Munich, Germany

- SGS SA – Geneva, Switzerland

- TUV SUD AG – Germany

- UL, LLC – Illinois, US

- TÜV NORD GROUP.– Hanover, Germany

Disclaimer: The companies listed above are not ranked in any particular order.

Other companies analyzed during the course of research:

- Element Materials Technology

- Signify

- Japan Testing Laboratories Co., Ltd.

- CESI SpA

- Kiwa NV

- Exova (now part of Element)

- National Technical Systems (NTS)

- CKC Laboratories, Inc.

- F2 Labs

- MET Laboratories, Inc.

- Green Mountain Electromagnetics, Inc.

- Cosmic Compliance Test Lab (CCTL)

- Element (alternate listing)

- Midwest EMI LLC

- E Labs Inc.

- QAI Laboratories, Inc.

- Intertechnology Inc.

- Ascendant Engineering Solutions

- Accurate Technology (ATC)

- Accutest Systems

- Advanced Compliance Laboratory

EMC Testing Market News and Recent Developments

- TÜV NORD International GmbH & Co. KG acquired a stake in SIPIZ AG The TÜV NORD GROUP is further expanding its testing, inspection, and certification services for building materials, components, windows, doors, gates, and facades. In June 2024, TÜV NORD International GmbH & Co. KG acquired a stake in SIPIZ AG, which emerged from the predecessor organizations EMPA and VKF ZIP. A modern test center for construction products will be established in Switzerland. TÜV NORD's many years of expertise in setting up and operating test centers will be brought to bear. SIPIZ's established services in the testing, inspection, and certification of construction products and its comprehensive range of training courses in windows, doors, and fire protection will be bundled and further expanded.

- Development of a New Advanced Automotive Electromagnetic Compatibility (EMC) Laboratory UL Solutions Inc. (NYSE: ULS), a global leader in applied safety science, announced plans to develop a new advanced automotive electromagnetic compatibility (EMC) laboratory in Toyota City, Japan, to provide testing to help manufacturers protect against electromagnetic interference that can cause critical systems in vehicles, such as braking and engine control, to malfunction.

EMC Testing Market Report Coverage and Deliverables

The "EMC Testing Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering the following areas:

- EMC testing Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- EMC testing Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- EMC testing Market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the EMC testing Market

- Detailed company profiles

Frequently Asked Questions

Ankita is a dynamic market research and consulting professional with over 8 years of experience across the technology, media, ICT, and electronics & semiconductor sectors. She has successfully led and delivered 100+ consulting and research assignments for global clients such as Microsoft, Oracle, NEC Corporation, SAP, KPMG, and Expeditors International. Her core competencies include market assessment, data analysis, forecasting, strategy formulation, competitive intelligence, and report writing.

Ankita is adept at handling complete project cycles—from pre-sales proposal design and client discussions to post-sales delivery of actionable insights. She is skilled in managing cross-functional teams, structuring complex research modules, and aligning solutions with client-specific business goals. Her excellent communication, leadership, and presentation abilities have enabled her to consistently deliver value-driven outcomes in fast-paced and evolving market environments.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For