Incorporation of AI to Provide Growth Opportunities for Fraud Detection and Prevention Market During 2021–2028

According to our latest market study on “Fraud Detection and Prevention Market Forecast to 2028 – COVID-19 Impact and Global Analysis – by Component, Deployment, and End-user,” the market was valued at US$ 26,511.84 million in 2021 and is projected to reach US$ 75,139.66 million by 2028; it is expected to grow at a CAGR of 16.0% from 2021 to 2028.

The banking and financial services industries are early users of risk-prevention technology. Financial organizations are extremely vulnerable because of huge internet data exchanges. According to Facebook and BCG, India's online banking adoption rate is predicted to reach 150 million by 2022, thereby increasing the risk of fraudulent activity. As the use of digital banking grows, it is becoming increasingly vital for financial institutions to safeguard transactions against fraud. Financial institutions are now concentrating not just on financial risk mitigation but also on real-time fraud detection. With the emergence of pattern recognition, fraud detection systems are evolving. Machine learning technologies have given artificial intelligence a significant boost in its ability to defend any system since ML can safeguard firms from insider fraud and spot any irregularities in persons who may leak data. As the demand for AI and machine learning grows, so does the use of FDP solutions.

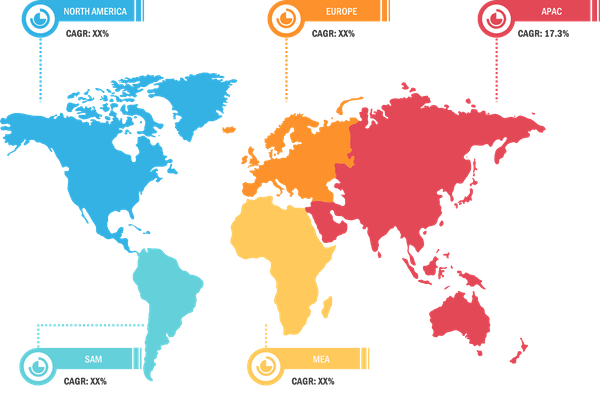

Fraud Detection and Prevention Market – by Geography, 2020 and 2028 (%)

Fraud Detection And Prevention Market Overview by 2031

Download Free SampleFraud Detection and Prevention Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component (Solution and Services), Deployment (On-premises and Cloud), and End-user (BFSI, Healthcare, Manufacturing, Retail, Telecommunication, and Others), and Geography

The fraud detection and prevention market is segmented into component, deployment, end-user, and geography. Based on component, the fraud detection and prevention market is bifurcated into solution and services. The solution segment is further bifurcated into fraud analytics and authentication. The fraud analytics segment held a larger revenue share in 2020. Based on deployment, the fraud detection and prevention market is bifurcated into on-premise and cloud-based. The cloud-based segment held a larger revenue share in 2020. Based on end-user, the fraud detection and prevention market is categorized into BFSI, healthcare, manufacturing, retail, telecommunication, and others. The BFSI segment held the largest revenue share in the global fraud detection and prevention market in 2020. Geographically, the fraud detection and prevention market is segmented into five key regions—North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and South America (SAM). North America held the largest revenue share in 2020, followed by Europe and APAC. The fraud detection and prevention market in APAC is projected to grow at the fastest rate from 2021 to 2028.

Impact of COVID-19 Pandemic on Fraud Detection and Prevention Market

In this COVID-19 environment, each country's national lockdown has widened the market for digital technologies. For several reasons, such as WFH, online transactions utilizing digital applications from their banks, or mobile/digital wallets, more than 60–70% of consumers now use one or more digital platforms. It has also provided an easy entry point for fraudsters and money launderers, as they can now hack into digital channels and obtain sensitive information. The worst-affected health sector is fighting a number of battles, as hospitals and healthcare organizations’ desperation to restart the IT processes under attack and avoid negative treatment effects due to stalled systems make them attractive targets for cybercriminals. Despite major attacks and overburdened business operations, many healthcare institutions continued to issue Requests for Proposals (RFPs) and Requests for Quotes (RFQs) prior to the crisis. These initiatives demonstrate to the rest of the world that the healthcare industry is committed and confident in its ability to overcome the current crisis and achieve its long-term goals.

ACI Worldwide, Inc.; BAE Systems Plc; Fair Isaac Corporation; Fiserv, Inc.; IBM Corporation; NCR Limited; Oracle Corporation; RELX plc; SAP SE; and SAS Institute Inc. are among the key players operating in the global fraud detection and prevention market.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com