Antibiotics Segment to Lead Global Generic Drugs Market Based on Molecule Type During 2025–2031

According to our new research study on “Generic Drugs Forecast to 2031 – Global Analysis – by Molecule Type, Indication, Type, and Distribution Channel,” the market was valued at US$ 423.55 billion in 2024 and is projected to reach US$ 594.99 billion by 2031; it is expected to register a CAGR of 5.0% during 2025–2031. Major factors driving the generic drugs market growth include the presence of government policies and regulatory support for generics and, patent expiry and loss of market exclusivity.

Generic drugs are medications created to be the same as existing, brand-name drugs in dosage form, safety, strength, route of administration, quality, performance characteristics, and intended use. They contain the same active ingredients as the original branded drug and are bioequivalent, as they provide the same clinical benefit. These drugs are typically introduced to the market after the patent of the original branded drug expires, allowing other manufacturers to produce and sell the drug at a much lower cost. Because they do not have to repeat the extensive clinical trials required for new drugs and spend on branding and marketing, generic drugs are much cheaper than brand-name versions—often 80% to 85% less expensive. Regulatory agencies such as the US FDA, EMA (Europe), and CDSCO (India) require generic drugs to meet strict standards for identity, strength, purity, and quality. They must demonstrate bioequivalence through studies comparing the action of drugs in the body relative to the branded version.

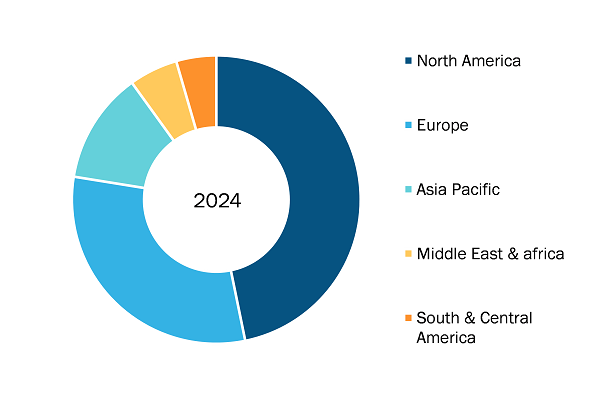

Pharmaceutical Membrane Filters Market, by region, 2024(%)

Generic Drugs Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Molecule Type (Antidepressants, Antihistamines, Analgesics, Antibiotics, Antivirals, Diuretics, and Others), Indication (Metabolic Diseases, Cancer, Immunology, Respiratory Disorder, Cardiovascular Disorder, Neurology Disorder, Rare Diseases, and Others), Type (Prescription and OTC Drugs), Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America)

Generic Drugs Market Key Findings, Size, and Share by 2031

Download Free Sample

Source: The Insight Partners Analysis

Generic drugs Analysis Based on Segmental Evaluation:

Based on distribution channel, the generic drugs market is categorized into hospital pharmacies, retail pharmacies and online pharmacies. In 2024, the hospital pharmacies segment held a significant generic drugs market share. As per the healthcare international 2022, the hospital pharmacy market in Europe was valued at ~€100–150 billion in 2021 (US$ 113.2–169.8 billion), with prescription (Rx) medications representing ~85% of expenditures. The remainder of the market comprises medical consumables, compounded medications, and specialized therapies, contributing ~€15–20 billion (US$ 11.3–16.9 billion). France and Germany lead in market value due to their extensive hospital networks and high inpatient care demand. Similar to the retail pharmacy sector, hospital pharmacy markets in Europe are highly fragmented, though consolidation efforts are underway, particularly through hospital group networks and centralized procurement models. This fragmentation is also reflected on a global scale, where the hospital pharmacy market, estimated at US$ 500–700 billion in 2023, remains shaped by regional regulations, healthcare funding models, and supply chain complexities.

In North America, hospital pharmacies are highly integrated with electronic health records, automation, and centralized drug distribution, particularly in the US, where group purchasing organizations (GPOs) play a crucial role in procurement efficiency, while Canada emphasizes formulary management within its publicly funded healthcare system. In Europe, each country operates under distinct regulations and structures. In the UK, National Health Service (NHS) hospitals have in-house pharmacy departments, with an increasing trend toward outsourced supply chain management. Germany maintains a decentralized model, requiring every hospital to have direct access to a licensed pharmacist, with limited outsourcing options. Meanwhile, Switzerland and the Nordic countries have largely integrated hospital pharmacies into broader healthcare networks, with a growing shift toward automation and digitalization to enhance efficiency. Asia Pacific is witnessing rapid expansion, particularly in China and India, where increasing hospital admissions and healthcare investments drive growth. Several hospitals in China operate in-house pharmacies that generate significant revenue, while India's private hospital chains employ a mix of in-house and outsourced services. Japan maintains a structured and highly automated hospital pharmacy system, emphasizing strict pharmaceutical regulations and patient safety.

In the Middle East and Africa, hospital pharmacy services are developing through investments in healthcare infrastructure and public-private partnerships (PPPs) with the Gulf Cooperation Council (GCC) countries, including Saudi Arabia and the UAE, modernizing hospital pharmacy operations while access challenges persist in parts of Africa. Latin America's hospital pharmacy sector is also evolving, with Brazil, Mexico, and Argentina focusing on cost containment and digital pharmacy adoption. Across all regions, key trends shaping the market include automation and AI-driven inventory management, robotic dispensing, integration with precision medicine initiatives, and the expansion of telepharmacy services to improve access, particularly in remote areas. Sustainability efforts are also gaining momentum, with hospitals prioritizing waste reduction and optimized procurement. Factors such as cost containment, digital transformation, personalized medicine, and automation-driven efficiency are expected to shape the market's trajectory with evolving hospital pharmacy services.

The scope of the generic drugs market report includes an assessment of the market performance in North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. In terms of revenue, North America dominated the generic drugs market share in 2024. North America, comprising the US, Canada, and Mexico, is witnessing significant growth in the generic drugs market due to stringent regulations, rising biologics demand, and expanding manufacturing. The US leads with biotech advancements, Canada sees increased R&D investments, a strong biotech ecosystem, an aging population, and government investments in biomanufacturing. Mexico benefits from rising rates of infectious and chronic diseases such as HIV, influenza, and cancer, collectively driving market expansion.

In North America, the US holds the highest share of the generic drugs filters market. The generic drugs market in the US is experiencing strong growth, fueled by the rising burden of chronic illnesses, cancer, and infectious diseases, along with a push for affordable healthcare solutions. In 2024, ~2 million new cancer cases were diagnosed, up from 1.9 million in 2022, with ~0.61 million deaths, underscoring the urgent need for cost-effective treatments. While innovative options such as therapeutic cancer vaccines (e.g., Provenge for prostate cancer), neoantigen-based vaccines for triple-negative breast cancer, and mRNA vaccines such as autogene cevumeran for pancreatic cancer are showing promising results—with trials reporting up to 88% of patients remaining cancer-free after three years—the affordability and accessibility provided by generic drugs remain vital to large-scale public health impact. Generics play a pivotal role once patents expire, making life-saving medications accessible to a broader population. The US biopharmaceutical industry, which includes generic manufacturers, is a global leader in innovation and scale. According to the Pharmaceutical Research and Manufacturers of America, in 2022, the industry generated over US$ 800 billion in direct output and US$ 1.65 trillion in total economic contribution—about 3.6% of the US economy. Also, the industry invested US$ 141 billion in domestic R&D, representing 78.6% of all US industry-funded medical research, and operated 1,574 facilities producing FDA-approved products under strict GMP guidelines.

Policy measures such as the Inflation Reduction Act (IRA) of 2022 are reshaping the pricing landscape. In 2024, the US government finalized negotiations to reduce prices on the first 10 drugs, including widely used medications such as Eliquis, Stelara, and Jardiance, by 38% to 79%. These reforms are projected to save US taxpayers US$ 6 billion and provide US$ 1.5 billion in patient savings by 2026. The expanding demand, policy support, strong regulatory oversight, and manufacturing capabilities are positioning the US generic drug market as a backbone of the healthcare system—offering safe, effective, and affordable treatments.

Teva Pharmaceutical Industries Ltd, Viatris Inc, Sun Pharmaceutical Industries Ltd, AbbVie Inc, Sanofi SA, Glenmark Pharmaceuticals Ltd are among the leading companies profiled in the generic drugs market report.

Based on molecule type, the generic drugs market is segmented into Antidepressants, Antihistamines, Analgesics, Antibiotics, Antivirals, Diuretics, and Others. Based on indication, the generic drugs market is segmented into Metabolic Diseases, Cancer, Immunology, Respiratory Disorder, Cardiovascular Disorder, Neurology Disorder, Rare Disease, and Others. As per type, the generic drugs market is segmented into Prescription and OTC Drugs. In terms of Distribution Channel, the generic drugs market is segmented into Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies. Geographically, the market is categorized into North America (the US, Canada, and Mexico), Europe (France, Germany, the UK, Spain, Italy, and the Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, and the Rest of Asia Pacific), the Middle East & Africa (Saudi Arabia, South Africa, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com