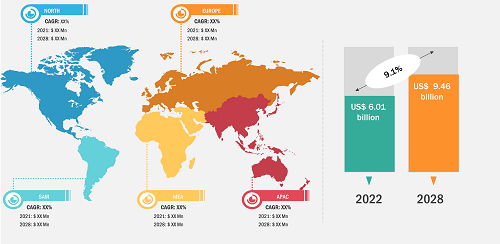

The In-flight Entertainment Market size is expected to reach US$ 9.46 billion by 2028; registering at a CAGR of 9.1% from 2022 to 2028, according to a new research study conducted by The Insight Partners.

Modernization of Existing Aircraft Fleet to Provide Growth Opportunities for In Flight Entertainment Market During 2022–2028

The aviation sector is growing rapidly due to the rise in the count of passengers and aircraft, upgradation of existing technologies, and the emergence of new technologies. Travellers' inclination toward air travel is constantly climbing across geographies, which is pressurizing airline companies to procure an increased number of aircraft. On a global scenario, the count of commercial air passengers is anticipated to maintain a continuous growth over the years. According to International Air Transport Association (IATA), the commercial aviation passenger number is expected to rise to 7.2 billion by 2035. Over the past decade, airline companies are witnessing significant pressure from their customers to integrate their fleets with advanced technologies, which would facilitate flyers to smoothen their flight time. These factors are driving the businesses of the global in flight entertainment market players.

Owing to the rapidly growing demand for in-flight entertainment (IFE) from air passengers, a significant percentage of airlines have integrated their fleets with new in flight entertainment solutions and are continuing to integrate with upgraded technologies. This factor is majorly aimed at enhancing customer experience. In the current scenario, air travelers experience a wide variety of options in onboard entertainment systems as compared to earlier days. The continuous change in the in-flight entertainment sector is majorly driven by passenger habits, market demands, and pricing. Seatback TVs or screens have dominated the in flight entertainment market in the past decade and are continuing to dominate the market. As technology evolves and more passengers bring personal electronic devices onboard, in-flight connectivity is increasingly in demand. This factor has led to the emergence of bring-your-own-device (BYOD) trend. Earlier, IFE systems contained stored media, and the same was screened. However, with the increasing adoption of advanced in-flight connectivity among airlines and customer demand, several in-flight entertainment solution providers are offering a live streaming facility, which is increasing the scalability of content selection. Thus, the availability of live streaming is another factor boosting the in flight entertainment market growth.

The COVID-19 outbreak declined the demand for aircraft across the world in the first two quarters of 2020. Therefore, aircraft manufacturers reported a reduction in the volume of orders. The decline in production volumes adversely affected the businesses of various component manufacturers and associated technologies. Also, Supply chain disruptions and labor shortages hindered the production of in flight entertainment systems in 2020. Thus, the in flight entertainment system providers experienced a negative impact of the pandemic in 2020. However, aircraft demand started to increase with the normalization of economies and the reopening of borders for trade in Q3 of 2020. Therefore, the in flight entertainment market size started to revive with the rise in demand from aircraft manufacturers.

In Flight Entertainment Market – by Region, 2022

In Flight Entertainment Market Overview and Forecast by 2031

Download Free SampleIn Flight Entertainment Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Fit Type (Line Fit and Retro Fit), Aircraft Type (Narrow Body Aircraft, Wide Body Aircraft, and Business Jets), and Product Type (In-Flight Entertainment Hardware, In-Flight Entertainment Connectivity & Communication, and In-Flight Entertainment Content) and Geography

The global in flight entertainment market size is experiencing steady growth and is anticipated to rise in the coming years. The market comprises a few renowned players operating across the world and focusing highly on investing a significant amount to deliver the most advanced technology to the customers. The aircraft manufacturers are procuring advanced technologies from the aircraft solution and service developers to deliver value-added services and superior travel experiences to passengers. Moreover, it is observed that the maximum percentage of passengers prefer to fly with an airline offering in flight connectivity, as high-quality in flight connectivity is no longer a luxury; it’s a necessity. Thus, the demand for in flight entertainment solutions is anticipated to rise as many passengers are adopting air travel coupled with rise in flight connectivity solutions among airlines. These are a few key factors boosting the in flight entertainment market growth.

Astronics Corporation, Burrana Inc, Deutche Lufthansa AG, Anuvu, Honeywell International Inc, Panasonic Corporation, Thales Group, and Viasat Inc are among the key in flight entertainment market players. A few major developments in the market are mentioned below:

- In 2022, Moment announced the launch of its new in flight entertainment and connectivity system for jet operators.

- In 2022, Emirates announced its intentions to invest over US$ 350 million in IFE systems. The company is procuring Thales AVANT Up systems for its A350 flights.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com