Coated Intermittent Catheters Segment to Contribute Significantly to Intermittent Catheters Market Growth During 2023–2031

According to our latest study on "Intermittent Catheters Market Forecast to 2031 – Global Analysis – Product, Indication, Category, System Type, and End User," the market was valued at US$ 2.67 billion in 2023 and is expected to reach US$ 3.83 billion by 2031. Factors such as the surging prevalence of urinary incontinence and the adoption of single-use catheters are the key factors contributing to the growing intermittent catheters market size. However, complications associated with catheterizations impede the intermittent catheters market growth.

Urinary tract infections (UTIs) are common complications associated with intermittent catheterization (CIC), which hampers individuals’ quality of life and adds to their healthcare expenditures. Residual urine, presumably related to the intermittent catheter's design, has been found as one of several risk factors for infections. Micro-hole zone catheters (MHZCs) have been developed to address the issue of incomplete bladder emptying. MHZCs include a drainage zone with multiple micro-holes from the tip and extending down the catheter's tube, which is contrary to conventional eyelet catheters (CEC) that typically have two drainage eyelets by the catheter tip. Micro-hole drainage zone catheters are claimed to reduce the probability of early flow stoppages in intermittent catheter users. This helps ensure uninterrupted drainage and bladder emptying without the user’s interference. Further, avoiding mucosal suctions eliminates the need for catheter repositioning and lowers the risk of mucosal microtrauma. In February 2023, Coloplast introduced Luja, a new catheter for males that redefines bladder emptying. Luja's unique design facilitates complete bladder emptying in a single free flow and represents a paradigm shift within intermittent catheterization. Thus, the advantages related to micro-hole intermittent catheters are expected to bring new intermittent catheters market trends in the coming years.

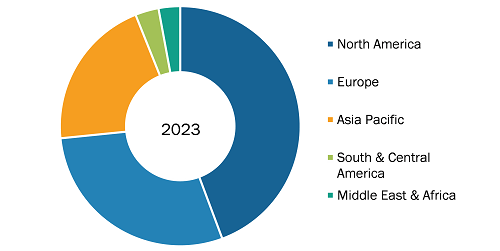

Intermittent Catheters Market, by Geography:

Intermittent Catheters Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product (Coated Intermittent Catheters and Uncoated Intermittent Catheters), Indication [Urinary Incontinence, General Surgeries, Spinal Cord Injuries, Parkinson’s Disease (PD), Multiple Sclerosis, and Others], Category (Female Length Catheters, Male Length Catheters, and Kid Length Catheters), System Type (Closed Intermittent Catheters Systems and Open Intermittent Catheters Systems), End User (Hospitals, Ambulatory Surgical Centers, Home Care Settings, and Others), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

Intermittent Catheters Market SWOT Analysis Report by 2031

Download Free Sample

Market Segmentation:

The intermittent catheters market analysis has been carried out by considering the following segments: product, indication, category, system type, and end user. Based on product, the intermittent catheters market is bifurcated into coated intermittent catheters and uncoated intermittent catheters. The coated intermittent catheters segment held a larger market share in 2023 and is anticipated to register a higher CAGR during 2023–2031. Coated catheters are intended to improve lubricant and facilitate insertion, perhaps reducing trauma and urinary tract infections. Gel- and hydrophilic-coated catheters are available in the market. Hydrophilic coating is the most prevalent coating type. Hydrophilic coated catheters meant for single use can help avoid some of the most common catheter-related problems, such as urethral damage and catheter-associated UTI.

By indication, the market is segmented into urinary incontinence, general surgery, spinal cord injuries, Parkinson’s disease (PD), multiple sclerosis, and others. The urinary incontinence segment held the largest intermittent catheters market share in 2023. The general surgery segment is anticipated to register the highest CAGR during 2023–2031. Urinary incontinence, i.e., involuntary urination, is a medical condition that causes uncontrolled leakage of urine. This is a symptom associated with various other health-related problems. UI is more common among women than men. Three major types of urinary catheters are utilized for managing urinary incontinence: Foley catheters, intermittent catheters, and suprapubic catheters.

By category, the intermittent catheters market is divided into female length catheters, male length catheters, and kid length catheters. The female length catheters segment held the largest market share in 2023 and is anticipated to register the highest CAGR during 2023–2031. Urinary catheters are designed by considering the average bladder sizes of people. Female urinary catheters are short due to the short length of bladders. These catheters are inserted into the urethral meatus to drain urine from the bladder. The catheterization process is more complicated in women due to the varying layouts of the genitalia. Female catheters are majorly used for bladder retention, urinary incontinence, multiple sclerosis, spinal cord injury, or other specific medical conditions that affect the normal function of the bladder. Female catheters are offered in slightly more size options, ranging from 15 cm to 30 cm (6–12 inches).

By system type, the market is bifurcated into closed intermittent catheter systems and open intermittent catheter systems. The closed intermittent catheter systems segment held a larger market share in 2023 and is anticipated to register a higher CAGR during 2023–2031. A closed intermittent catheter system is a sterile, pre-lubricated catheter with a collection bag attached. The sterile collection bag eliminates the need to pass urine into a receptacle or toilet. This catheter is best suited for patients with a history of urinary tract infections (UTIs) or immunocompromised. Closed intermittent catheter systems include advanced unique technologies such as "touchless" or "no-touch" catheters, wherein users can avoid touching the catheter tube. It reduces the risk of bacterial infection of the urinary system and bladder. Most closed-system catheters are ideal for use during commutes. Moreover, most people find these catheter systems convenient as they are ready to use.

By end user, the market is segmented into hospitals, ambulatory surgical centers, home care settings, and others. The closed intermittent catheters systems segment held the largest intermittent catheters market share in 2023 and is anticipated to register the highest CAGR during 2023–2031. Hospitals serve a major role by providing extensive medical services to patients suffering from various diseases. These are the prime healthcare centers where surgeries are performed on a frequent basis. They have technologically advanced infrastructures and integrated facilities, which enable them to perform complex procedures. In addition, owing to the availability of favorable reimbursement policies, a large number of surgical procedures are performed in these facilities, which require intermittent catheters during or post operations.

Intermittent Catheters Market, by Geography:

The scope of the intermittent catheters market report entails North America (US, Canada, and Mexico), Europe (UK, Germany, France, Spain, Italy, and Rest of Europe), Asia Pacific (China, India, Japan, Australia, and Rest of APAC), Middle East & Africa (South Africa, Saudi Arabia, UAE, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America). In terms of revenue, North America dominated the intermittent catheters market in 2023. An upsurge in the geriatric population affected by various types of urinary diseases, favorable reimbursement policies for catheterization, a rise in the number of hospitals and clinics, and an increase in healthcare expenditure and technological developments are a few of the factors propelling the growth of the intermittent catheters market in the region. The aging population is more susceptible to spinal cord injuries (SCIs), urinary incontinence, and benign prostate hyperplasia. According to the Centers for Disease Control and Prevention, urinary incontinence is a major symptom among people aged 65 or above due to various factors, including chronic conditions such as diabetes and stroke, cognitive impairment, and morbidity impairment. Moreover, according to estimates by the National Spinal Cord Injury Statistical Center, it was estimated that each year, 17,500 people suffer from SCIs in the US, especially among the geriatric population.

Apart from factors driving the market, the intermittent catheters market report emphasizes on prominent players operating in the market; these include Coloplast Corp, Boston Scientific Corp, Hollister Inc, Teleflex Inc, Convatec Group Plc, Advin Health Care Pvt Ltd, Medical Technologies of Georgia Inc., Wellspect HealthCare, Cardinal Health Inc, and B Braun SE.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com