Knee Segment Leading the Joint Replacement Devices Market by Type, 2025–2031

According to our new research study on “Joint Replacement Devices Market Forecast to 2031 – Global Analysis – by Type and End User,” the joint replacement devices market size is expected to grow from US$ 24.07 billion in 2024 to US$ 34.53 billion by 2031, with a CAGR of 5.4% during 2025–2031. Major factors driving the joint replacement devices market growth include the demographic shifts toward an aging population, increasing prevalence of obesity-linked osteoarthritis, and rapid technological advancements in surgical precision and implant design.

Joint replacement devices are medical appliances used to surgically remove and replace damaged or infected parts of a joint. Their purpose is to restore lost joint function and relieve the pain caused by diseases, degeneration, or traumatic injuries. These devices are mainly used in the treatment of the joints that are affected by conditions such as osteoarthritis, rheumatoid arthritis, traumatic injuries, or degenerative joint disease. Deep integration of AI and robotics for precision surgery, additive manufacturing via 3D printing for hyper-customized implants, shift toward biodegradable and regenerative biomaterials are expected to be major joint replacement devices market trends in the coming years.

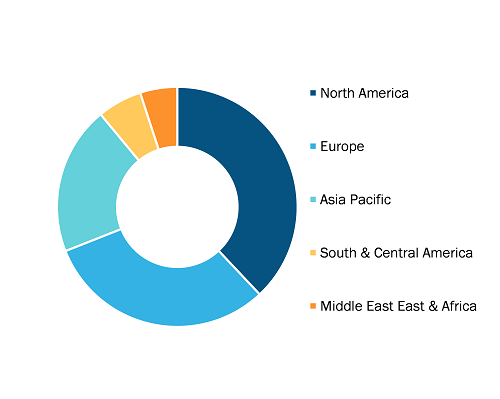

Joint Replacement Devices Market, by Region, 2024 (%)

Joint Replacement Devices Market Size & Forecast 2031

Download Free SampleJoint Replacement Devices Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type [Knee (Primary, Revision, Partial, and Patello-Femoral) Hip (Total, Partial, Revision, and Resurfacing), Shoulder, Ankle, and Others], End User (Hospitals, Orthopedic Clinics, Ambulatory Surgical Centers, and Others), and Geography

Source: The Insight Partners Analysis

oint Replacement Devices Market Analysis Based on Segmental Evaluation:

Based on type, the joint replacement devices market is segmented into knee, hip, shoulder, ankle, and others. In 2024, the knee segment held a significant joint replacement devices market share. This segment has been the main growth driver due to the high number of knee osteoarthritis cases, the aging population, and the increasing obesity rates. Total knee replacement surgeries are highly popular due to their positive outcomes, especially in terms of pain relief, regained mobility, and improved quality of life. Robotic-assisted surgery, computer navigation, and patient-specific instrumentation have contributed to improved surgical accuracy and implant alignment, thereby reducing revision surgeries and recovery time. Implant material innovations—such as highly cross-linked polyethylene and porous coatings—are improving the durability and stability of implants. Moreover, the growing shift toward outpatient knee replacement surgeries continues to support demand and increase the overall number of procedures performed worldwide.

The scope of the joint replacement devices market report includes an assessment of the market performance in North America, Europe, Asia Pacific, South and Central America, and Middle East and Africa. In terms of revenue, North America dominated the joint replacement devices market share in 2024.

The joint replacement market growth is highly advanced in the US. Key drivers include population aging, increasing rates of overweight and obesity, and the rising incidence of osteoarthritis. The main procedures are total knee arthroplasty (TKA) and total hip arthroplasty (THA). Examples include cementless THA for younger patients and robotic-assisted TKA for enhanced precision. Annually, total knee replacement procedures are estimated at approximately 790,000, compared to nearly 544,000 hip replacements.

In 2023, the American Joint Replacement Registry (AJRR) recorded 566,278 additional hip and knee procedures, contributing to a total of 3.7 million valid cases reported between 2012 and 2023. Primary TKA accounts for more than 1.9 million cases, and primary THA is close to 1.2 million cases cumulatively. The trends show that most procedures are being done in outpatient settings. For instance, ambulatory surgery center cases increased by 70% year over year, reaching 62,110 in 2023, while the average length of stay for TKA was reduced to 1.1 days.

The use of robotics in TKA has increased to 15.9%, while the use of cementless fixation has gone up to 21.8%. The revisions make up 9–10% of the hip cases, and usually they are a consequence of infection or loosening. In 2023, more than 1,447 institutions and 4,954 surgeons provided data, indicating that the program has been widely adopted across all states. Although these improvements increase the quality of care for the patients, they raise the costs in a mixed public-private system.

Zimmer Biomet, Stryker Corporation, DePuy Synthes (Johnson & Johnson), Smith & Nephew, Enovis Corporation, MicroPort Scientific, CONMED Corporation, Aesculap (B. Braun), Exactech, Total Joint Orthopedics are among the leading companies profiled in the joint replacement devices market report.

Based on type, the joint replacement devices market is segmented into knee, hip, shoulder, ankle, and others. By end user, the market is categorized into hospitals, orthopedic clinics, ambulatory surgical centers, and others. In terms of geography, the market is divided into North America (the US, Canada, and Mexico), Europe (France, Germany, the UK, Spain, Italy, and the Rest of Europe), Asia Pacific (China, Japan, India, Australia, South Korea, and the Rest of Asia Pacific), South and Central America (Brazil, Argentina, and the Rest of South and Central America), and Middle East and Africa (Saudi Arabia, the UAE, South Africa, and the Rest of Middle East and Africa).

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com