Knee Segment to Lead Joint Resurfacing Devices Market Growth Based on Type During 2025–2031

According to our new research study on “Joint Resurfacing Devices Market Forecast to 2031 – Global Analysis – by Type, Material, and End User,” the joint resurfacing devices market size is expected to grow from US$ 2.35 billion in 2024 to US$ 3.25 billion by 2031, with a CAGR of 4.9% during 2025–2031. Major factors driving the joint resurfacing devices market growth include demographic aging and the global osteoarthritis epidemic. Additionally, advancements in minimally invasive techniques and innovation in next-generation implants contribute to the joint resurfacing devices market growth.

Joint resurfacing is a bone-preserving orthopedic intervention, where the surgeon caps or covers the damaged part of the joint with a smooth implant instead of cutting and removing large portions of bone, as is the case in total joint replacement. The AI-driven precision in joint resurfacing surgeries, smart biomaterials for adaptive joint implants, and telemedicine-enabled remote monitoring for resurfacing recovery are expected to be major joint resurfacing devices market trends in the coming years.

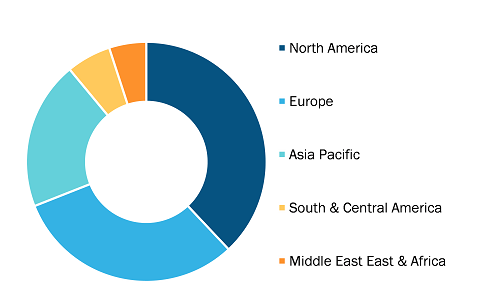

Joint Resurfacing Devices Market, by Region, 2024 (%)

Joint Resurfacing Devices Market Trends & Growth Outlook 2031

Download Free SampleJoint Resurfacing Devices Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Knee, Hip, Shoulder, Ankle, and Others), Material (Metal, Ceramic, and Others), End User (Hospitals, Orthopedic Clinics, Ambulatory Surgical Centers, and Others), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South and Central America)

Source: The Insight Partners Analysis

Joint Resurfacing Devices Market Analysis Based on Segmental Evaluation:

Based on type, the market is segmented into knee, hip, shoulder, ankle, and others. In 2024, the knee segment held a significant joint resurfacing devices market share. Knee resurfacing is essentially the most targeted and localized approach of joint replacement techniques. It also serves as a transitional option for those who need cartilage repair but are not yet ready for a full knee replacement. Types differ visually: focal condyle resurfacing (e.g., HemiCap and UniCap), patient-specific resurfacing (such as Episealer), and patellar resurfacing in total knee arthroplasty (TKA). A Danish registry study of 379 shoulder resurfacing procedures, with an average patient age of 50, reported a 10-year revision-free survival rate of approximately 80%, demonstrating the durability of this method in appropriately selected patients. A systematic review of 1,465 knees further showed a revision rate of nearly 13% at an average follow-up of 5.9 years for focal implants. Similarly, in total knee arthroplasty (TKA), randomized trials have found that patellar resurfacing leads to significantly less anterior knee pain and higher patient satisfaction compared with non-resurfacing after more than five years of follow-up. Although knee resurfacing involves challenges such as technical complexity and the need for highly accurate patient selection, the procedure is still gaining popularity. Enhanced patient-specific designs, improved surgical planning, and robust long-term outcomes drive this growth. As a result, knee resurfacing remains an effective option for preserving function in early to mid-stage disease.

The scope of the joint resurfacing devices market report includes an assessment of the market performance in North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. In terms of revenue, North America dominated the joint resurfacing devices market share in 2024.

In the US, the joint resurfacing devices market is changing at a rapid pace due to the aging population and the development of minimally invasive technologies that are more bone-friendly for young and active patients. According to the American Joint Replacement Registry (AJRR) data, as of 2025, hip resurfacing operations account for ~0.3% of the total primary hip arthroplasties. The data shows that over 4.3 million hip and knee operations have been performed from 2012 to 2023, which means that the number of hip resurfacing surgeries is only between 1,500 and 2,000 per year. The downturn of metal-on-metal implant wear was followed by the rise of ceramic innovations in recent years. According to the Centers for Disease Control and Prevention (CDC), more than 32.5 million adults living in the US have arthritis, with the knee and hip joints being the most affected. This prevalence has led to the demand for the resurfacing technique as a replacement for total joint replacement. The projections also show that the volume of primary total hip arthroplasty could increase by 75% in 2025, with most patients choosing the resurfacing method being under 65 years of age.

The Birmingham Hip Resurfacing (BHR) System was an FDA-approved device in 2011 for males aged 18-60 with severe osteoarthritis. The procedure involves capping the femoral head with metal while the acetabulum is resurfaced. The technique saves up to 30% more bone compared to traditional replacements. The FDA cleared the HemiCAP Patello-Femoral Resurfacing Prosthesis for local knee resurfacing, and it is designed to provide support for the isolated patellofemoral region of the knee in active individuals.

The National Institutes of Health (NIH) points out that the patient satisfaction rate for the resurfacing procedure is between 90 and 95% after five years. At the same time, the risk of revision is lower in the case of the patella that has been resurfaced in total knee arthroplasty (TKAs), where the survivorship of the resurfaced cases is higher than the non-resurfaced ones.

The FDA’s regulatory oversight ensures thorough pre-market evaluation of medical devices, with 510(k) clearance being the most common pathway. For instance, the ReCerf all-ceramic hip resurfacing system received 510(k) clearance in 2024, using a biocompatible ceramic design intended to eliminate metal-ion release. According to orthopedic registries, the market expansion will be supported by the introduction of robots that assist with precision, shortening operation times by 20%. The US market is highlighting the transition toward solutions that are created for patients, thereby improving the mobility of over 450,000 hip procedures performed annually.

Smith & Nephew, DePuy / Johnson & Johnson, Zimmer / Zimmer Biomet, Eska Implants, Exactech, Stryker, Enovis, MatOrtho Ltd., Medacta International, MicroPort Scientific, and Corin Group are among the leading companies profiled in the joint resurfacing devices market report.

Based on type, the joint resurfacing devices market is segmented into knee, hip, shoulder, ankle, and others. By material, the market is divided into metal, ceramic, and others. In terms of end users, the market is categorized into hospitals, orthopedic clinics, ambulatory surgical centers, and others. In terms of geography, the market is segmented into North America (the US, Canada, and Mexico), Europe (France, Germany, the UK, Spain, Italy, and the Rest of Europe), Asia Pacific (China, Japan, India, Australia, South Korea, and the Rest of Asia Pacific), South and Central America (Brazil, Argentina, and the Rest of South and Central America), and Middle East and Africa (Saudi Arabia, the UAE, South Africa, and the Rest of Middle East & Africa).

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com