Single-Use Vials, by Type of Packaging, to Account for Largest Share in Lyophilized Injectable Market During 2022–2028. Increasing use of single-use vials owing to various advantages such as ease in self administration and reduction in medical waste along with the increase in home healthcare and self-administration of drugs is expected to generate demand for single use vials packaging and contribute the market growth over the forecast period.

According to our latest study on “Lyophilized Injectable Market Forecast to 2028 – COVID-19 Impact and Global Analysis – by Type of Packaging, Type of Delivery, Indication, and End User,” the market is expected to grow from US$ 2,719.42 million in 2021 to US$ 4,001.27 million by 2028; it is expected to grow at a CAGR of 5.8% from 2022 to 2028. The report highlights the key factors driving the market growth and prominent players with their developments in the market.

Based on type of packaging, the global lyophilized injectable market is segmented into single-use vials, point-of-care reconstitution, and specialty packaging. The single-use vials segment is likely to account for the largest market share during 2022–2028. By type of delivery, the market is segmented into prefilled diluent syringes, single-step devices, proprietary reconstitution devices, and multi-step devices. The prefilled diluent syringes segment held the largest market share in 2021 and is likely to continue its dominance during the forecast period. Based on indication, the global lyophilized injectable market is segmented into metabolic and oncology conditions, infectious diseases, autoimmune diseases, and others. The metabolic and oncology conditions segment is likely to account for the largest market share during 2022–2028. By end user, the market is segmented into hospitals, ambulatory surgical centers, specialty clinics, and others. The hospitals segment held the largest market share in 2021 and is likely to continue its dominance during the forecast period.

Lyophilization is especially popular in the pharmaceutical and diagnostic sectors. The increased quality and extended shelf life of lyophilized injectable drugs have created growth opportunities for manufacturers to implement the lyophilization process in product manufacturing. Furthermore, many pharmaceutical companies are refocusing on their core capabilities, including research and development, leading to divestments of in-house manufacturing capacities. This is growing the demand for contract research manufacturing services (CRAMs) for manufacturing lyophilized injectable, which is boosting the growth of the lyophilized injectable market.

The COVID-19 pandemic had a positive impact on the global lyophilized injectable market. The rise in the COVID-19 cases along with the increase in prevalence of chronic disorders, including cancer, metabolic conditions, and autoimmune disorders led to increase in the huge investments for the development of lyophilized injectables which drives the growth of market during the pandemic. Moreover, the launch of COVID-19 vaccines, such as remdesivir, and cosentyx, approved by the Food and Drug Administration (FDA) for emergency use has also generated the demand for lyophilized injectable. Moreover, surge in infectious diseases, increasing use of antibiotics for infectious diseases, rising inclination toward biologics, and surging contract research organizations will propel the growth of the lyophilized drugs market. Moreover, various advantages offered by lyophilized injectable include easy transportation, storage, reconstitution, reduction in cold chain, and reduced carbon footprint. Overall, the COVID-19 pandemic has positive impact on the lyophilized injectable market.

Baxter; Nipro; Curia Global, Inc.; Recipharm AB; Vetter Pharma; Jubilant HollisterStier LLC (Jubilant Pharma Limited); Aristopharma Ltd.; CordenPharma International; Credence MedSystems, Inc.; and S. G. Biopharm Pvt. Ltd. are among the leading companies operating in the global lyophilized injectable market.

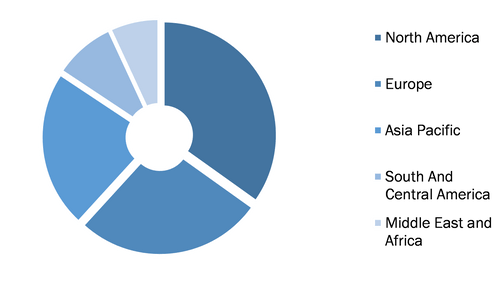

Global Lyophilized Injectable Market, by Region, 2021 (%)

Lyophilized Injectable Market Forecast to 2028 - Analysis By Type of Packaging (Single-Use Vials, Point-of-Care Reconstitution, and Specialty Packaging), Type of Delivery (Prefilled Diluent Syringes, Single-Step Devices, Proprietary Reconstitution Devices, and Multi-Step Devices), Indication (Metabolic and Oncology Conditions, Infectious Diseases, Autoimmune Diseases, and Others), and End User (Hospitals, Ambulatory Surgical Centers, Specialty Clinics, and Others)

Lyophilized Injectable Market Strategic Insights by 2028

Download Free Sample

Companies operating in the global lyophilized injectable market adopt various organic and inorganic strategies. Organic strategies mainly include product launches and product approvals. Further, acquisitions, collaborations, and partnerships are among the inorganic growth strategies witnessed in the market. These growth strategies allow the market players to expand their businesses and enhance their geographic presence, thereby contributing to the overall market growth. Further, acquisition and partnership strategies help the market players in strengthening their customer base and expanding their product portfolios. A few of the significant developments by key players in the global lyophilized injectable market are listed below.

- In March 2022, Curia announced a cooperative agreement with the Biomedical Advanced Research and Development Authority (BARDA), a part of the Department of Health and Human Services (HHS) Office of the Assistant Secretary for Preparedness and Response (ASPR), the Department of Defense Joint Program Executive Office for Chemical, Biological, Radiological and Nuclear Defense (JPEO-CBRND) and the U.S. Army Contracting Command to support the domestic production of injectable medicines. The agreement consists of funding to add a new advanced isolated high-speed fill-finish vial line including biosafety level 2 (BSL-2) containment at Curia’s existing facility in Albuquerque, New Mexico. Curia is also self-funding two lyophilizers for the high-speed fill-finish line and an isolated flexible filling line for vials, syringes, and cartridges to support smaller batch advanced therapies.

- In March 2021, Baxter International Inc. and Moderna, Inc. entered an agreement for Baxter BioPharma Solutions to provide fill/finish sterile manufacturing services and supply packaging for ~60–90 million doses of the Moderna COVID-19 Vaccine in 2021.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com