Lyophilized Injectable Market Key Companies and SWOT Analysis by 2028

Lyophilized Injectable Market Forecast to 2028 - COVID-19 Impact and Global Analysis By Type of Packaging (Single-Use Vials, Point-of-Care Reconstitution, and Specialty Packaging), Type of Delivery (Prefilled Diluent Syringes, Single-Step Devices, Proprietary Reconstitution Devices, and Multi-Step Devices), Indication (Metabolic and Oncology Conditions, Infectious Diseases, Autoimmune Diseases, and Others), and End User (Hospitals, Ambulatory Surgical Centers, Specialty Clinics, and Others)

Historic Data: 2019-2020 | Base Year: 2021 | Forecast Period: 2022-2028- Report Date : Aug 2022

- Report Code : TIPRE00004411

- Category : Life Sciences

- Status : Published

- Available Report Formats :

- No. of Pages : 200

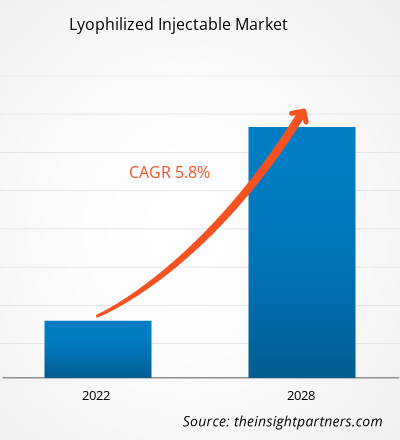

The lyophilized injectable market is projected to reach US$ 4,001.27 million by 2028 from US$ 2,719.42 million in 2021; it is expected to grow at a CAGR of 5.8% from 2022 to 2028.

Key factors driving the market are increasing demand for contract research manufacturing services, rising approvals of pharmaceuticals, and growing demand for biologics. However, product recalls restrain the market growth.

Lyophilized injectable are freeze-dried drugs that are stable during transportation. They are stored in single-use vials, point-of-care reconstitution, and specialty packaging for a longer period. At the time of use, required quantity of drugs can be reconstituted with the help of diluents. Lyophilized injectables are also termed as freeze-dried injectable as they are manufactured by the lyophilization process, a technique of isolating a solid material from a solvent by freezing and evaporating the solution under vacuum. Lyophilized injections are often considered as best alternative to oral solid dosage forms. In many case studies, the injections have immensely benefitted bedridden patients. Lyophilized injections are also prescribed to attain maximum bioavailability and stability in patients suffering from several diseases as these injectables have a longer shelf life than other dosage forms.

Customizee This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONLyophilized Injectable Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights

Rising Approvals of Pharmaceuticals Drive Market Growth

Ongoing studies are emerging about the safety and efficacy of novel lyophilized therapeutic agents used in hospitalized adult patients diagnosed with COVID-19. Manufacturers in the global lyophilized injectable market are taking approvals from the US FDA for the emergency use authorization (EUA) of such innovations to treat patients suffering from severe COVID-19 symptoms.

Since the COVID-19 pandemic, players in the global lyophilized injectable market are increasing efforts to gain approval by regulatory organizations, such as the Drug Controller General of India (DCGI), for restricted emergency use in India. The growing approvals for pharmaceuticals, such as Remdesivir, eventually lead to the high demand for lyophilized injectables. Following are a few instances of pharmaceuticals approved by the FDA and other regulatory bodies.

- In February 2020, Mylan secured regulatory approval from DCGI for Remdesivir lyophilized powder in India for restricted emergency use in COVID-19 patients.

- In June 2020, Cipla launched Cipremi, Remdesivir lyophilized powder for injection. Also, the US FDA issued an Emergency Use Authorization (EUA) to Gilead Sciences Inc. for emergency use of Remdesivir to treat hospitalized COVID-19 patients. It is the only FDA-approved EUA treatment for adult and pediatric patients hospitalized with suspected or laboratory-confirmed COVID-19 infection. Thus, in May, Gilead Sciences Inc. extended a voluntary nonexclusive license to Cipla to manufacture and market Cipla’s generic version of remedisvir called CIPREMI.

- In July 2020, Jubilant Life received approval from the Drug Controller General of India (DCGI) to manufacture and market Remdesivir for 100 mg/vial (lyophilized injection) for restricted emergency use in India for the treatment of severe COVID-19.

- In August 2020, Cosentyx lyophilized powder in a single-use vial by Novartis AG received EU approval. The drug approved was highly productive in rapidly improving skin symptoms and improving the quality of patient’s life suffering from psoriasis.

Thus, the increasing approvals across the world propel the growth of the lyophilized injectables market.

Type of Packaging -Based Insights

The global lyophilized injectable market, based on type of packaging, is segmented into single-use vials, point-of-care reconstitution, and specialty packaging. In 2021, the single-use vials segment accounted for the largest market share, whereas the specialty packaging segment is expected to register the highest CAGR of 6.7% during the forecast period.

Type of Delivery -Based Insights

Based on type of delivery, the global lyophilized injectable market is segmented into prefilled diluent syringes, proprietary reconstitution devices, single-step devices, and multi-step devices. The prefilled diluent syringes segment held the largest market share in 2021 and is anticipated to register the highest CAGR of 6.3% during the forecast period.

Indication-Based Insights

Based on indication, the global lyophilized injectable market is segmented into metabolic and oncology conditions, infectious diseases, autoimmune disease , and other indications. The metabolic and oncology conditions segment held the largest market share in 2021 and is anticipated to register the highest CAGR of 6.2% during the forecast period.

End User-Based Insights

Based on end user, the global lyophilized injectable market is segmented into hospitals, ambulatory surgical centers, specialty clinics, and others. The hospitals segment held the largest market share in 2021. However, the specialty clinics segment is estimated to register the highest CAGR of 6.3% in the market during the forecast period.

Companies operating in the global lyophilized injectable market adopt the product innovation strategy to meet the evolving customer demands across the world, which also permits them to maintain their brand name in the global market. For instance, in April 2022, Recipharm acquired advanced therapy CDMO Arranta Bio and virotherapy CDMO Vibalogics. The acquisition also enabled Recipharm to establish a robust base in the US, with facilities in Boxborough, MA, and provide a platform from which to build its capabilities in new biologics modalities.

Lyophilized Injectable Market Regional InsightsThe regional trends and factors influencing the Lyophilized Injectable Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Lyophilized Injectable Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Lyophilized Injectable Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 2.72 Billion |

| Market Size by 2028 | US$ 4 Billion |

| Global CAGR (2021 - 2028) | 5.8% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type of Packaging

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Lyophilized Injectable Market Players Density: Understanding Its Impact on Business Dynamics

The Lyophilized Injectable Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Lyophilized Injectable Market top key players overview

Global Lyophilized Injectable Market – by Geography

Geographically, the global lyophilized injectable market is segmented into North America (the US, Canada, and Mexico), Europe (Germany, the UK, France, Italy, Spain, and the Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, and the Rest of APAC), Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of MEA), and South and Central America (Brazil, Argentina, and the Rest of South & Central America).

Company Profiles

- Baxter

- Nipro

- Curia Global, Inc.

- Recipharm AB

- Vetter Pharma

- Jubilant HollisterStier LLC (Jubilant Pharma Limited)

- Aristopharma Ltd.

- CordenPharma International

- Credence MedSystems, Inc.

- S. G. Biopharm Pvt. Ltd

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For