According to the new research report published by The Insight Partners, titled “Middle Office Outsourcing Market - Global Analysis and Forecast to 2027”, the global middle office outsourcing market is expected to reach US$ 9,894.7 Million in 2027, registering a CAGR of 7.8% during the forecast period 2019-2027.

Globally, financial institutions are continuously facing challenges to reduce overhead costs, enhance operational efficiencies, and improve services. As a result, outsourcing business functions has become an integral part of banking operations but has also introduced new risks. An effectively managed outsourced process is one that reduces the cost of operation, improves the quality of service, provides greater compliance with regulatory requirements, increases customer satisfaction, and contributes to the value of the bank. Outsourcing by asset owners and multifaceted strategy fund managers has increased gradually over the past few years. Companies in the region have been spending huge resources for the development of solutions for those segments looking for transfer agency, integrated custody, middle-office, administration, as well as accounting solutions. Organizations are fulfilling these requirements through targeted acquisitions or organic development. Additionally, more component-based outsourcing proposals for services, including trade processing, fund accounting, and collateral management, are taking place. Asset servicers are beginning to face competition from non-traditional market players, such as business process outsourcing (BPO) and software providers providing stand-alone middle-office services.

Various analytics services are being adopted by the firms for transforming the unstructured data gathered from various online channels to structured data in order to gain meaningful insights. “Predictive analytics” is one of the major advanced analytics tools used to understand and code the behavior pattern of business and consumers. For increasing revenue at various organizational levels, such as stock exchange, private equity management, investment baking, clearing house companies, and hedge funding companies, analytical tools help numerous end users. This has encouraged most of the companies to adopt strategy of outsourcing middle office operations, which significantly reduces operational costs of the vendors and contribute towards the growth of middle office outsourcing market.

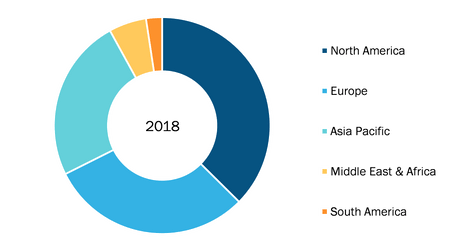

Middle Office Outsourcing Market - Geographic Breakdown, 2018

Middle Office Outsourcing Market to 2027 - Industry Analysis and Forecast by Offering (Portfolio Management, Trade Management, Others); End-Use (Investment Banking and Management, Broker- Dealers, Stock Exchanges, Others)

Middle Office Outsourcing Market by Size, Share & Trend Analysis 2027

Download Free Sample

The middle office outsourcing market has been derived from market trends and revenue generation factors from five different regions across the globe namely; North America, Europe, Asia Pacific, MEA, and SAM. The North America region holds the highest market share, whereas APAC is projected to be the fastest-growing region as well in the coming years. Asset servicing companies in the region are meeting greater demand for their services from large asset owners (government-backed pensions, sovereign wealth funds, and superannuation funds). More than 50% of the companies in APAC are providing new services to customers as they widen their global investment strategy and seek for new and more sophisticated asset classes, which includes real estate and private equity. With increasing pressure on margins, asset servicing companies would require to maintain the accurate balance between offering a high-quality, high-touch client experience as well as an economical technological solution, predominantly as the average size of hedge fund start-ups in the region is considerably smaller as compared to other parts of world. However such challenges are not new to the players operating in the market. Asset servicers in the region have a strong experience of onboarding funds in AUM.

The global middle office outsourcing market report focus on factors such as the growing need for new technologies and budget constraints, necessity for regulatory compliances, and market pressures. However, uncertainties in the implementation may lead to delay in the overall outsourcing process, unexpected operational risks and expenses, and the growing need for internal data control and its management may hamper the growth of the middle office outsourcing industry during the forecast period.

The major companies operating in the middle office outsourcing market include Adepa Global Services S.A., Brown Brothers Harriman, Caceis, Hedgeguard, JPMorgan Chase & Co., Northern Trust Corporation, Societe Generale Securities Services, SS&C Technologies, Inc., State Street Corporation, and The Bank of New York Mellon Corporation.

The report segments the global middle office outsourcing market as follows:

Global Middle Office Outsourcing Market - By Offering

- Portfolio Management

- Trade Management

- Others

Global Middle Office Outsourcing Market - By Component

- Investment Banking and Management

- Broker- Dealers

- Stock Exchanges

- Others

Global Middle Office Outsourcing Market - By Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- Russia

- UK

- Rest of Europe

- APAC

- China

- India

- Japan

- Australia

- Rest of APAC

- MEA

- Saudi Arabia

- UAE

- South Africa

- Rest of MEA

- SAM

- Brazil

- Argentina

- Rest of SAM

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com