Rising Demand from Automotive Industry Supports Natural Fiber Composites Market Growth

According to our latest study on "Natural Fiber Composites Market Forecast to 2028 – COVID-19 Impact and Global Analysis – by Raw Material, Technology, and End User," the natural fiber composites market is expected to grow from US$ 4,438.83 million in 2022 to US$ 6,910.46 million by 2028; it is estimated to record a CAGR of 7.7% from 2022 to 2028.

Natural fiber composites are composite materials in which at least the reinforcing fibers are derived from renewable and carbon dioxide-neutral resources, such as wood or plants. The availability of inexpensive lignocellulosic fibers such as sisal, banana, jute, oil palm, kenaf, and coir in tropical countries provides support to activities focused on exploring their use in the synthesis of inexpensive, biodegradable composites for automotive and aerospace applications, sporting goods, furniture, and low-cost housing & civil structures.

On the basis of raw material, the natural fiber composites market is categorized as wood, cotton, flax, kenaf, hemp, and others. In 2022, the wood segment accounted for the largest market share. Wood fibers have several advantages over synthetic fibers. For example, they have high specific stiffness and are available in industrial quantities. They are renewable, relatively inexpensive, and biodegradable. Wood fiber is extensively used for the production of composites for automotive applications. Other promising applications for wood-fiber composites include packaging materials, furniture, and nonstructural building components.

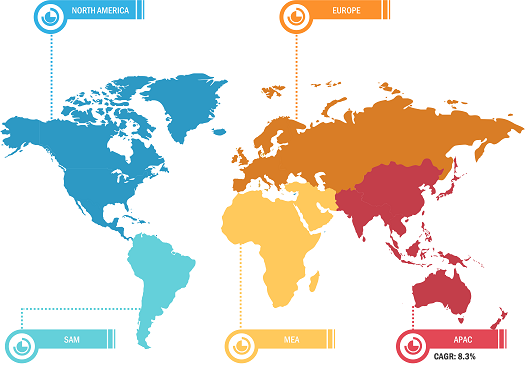

Natural Fiber Composites Market Breakdown – by Region

Natural Fiber Composites Market Trends and Top Players - 2028

Download Free SampleNatural Fiber Composites Market Forecast to 2028 - Analysis By Raw Material (Wood, Cotton, Flax, Kenaf, Hemp, and Others), Technology (Injection Molding, Compression Molding, Pultrusion, and Others), and End User (Automotive & Aerospace, Building & Construction, Electrical & Electronics, Sporting Goods, and Others)

In recent years, there has been a rising demand for lightweight materials from the automotive sector to meet the required performance standards for fuel economy. Natural fiber composites are increasingly used in the industry as it reduces vehicle weight, which helps in improving vehicle performance and lowering CO2 emissions. According to the European Union (EU) Commission, on a yearly basis, the European automotive industry consumes 80,000 metric tons of plant and wood fibers to reinforce composite products instead of other synthetic fibers. The EU has also been emphasizing on using recyclable and biodegradable parts for automotive interior components. Natural fiber composites have better acoustic and thermal properties than composites of nonrenewable origin, making them an ideal material to be used for manufacturing interior parts of a vehicle. Various properties of natural fiber composite make them suitable for the manufacture of nonstructural interior components, including seat fillers, seat backs, headliners, interior panels, and dashboards. These factors are driving the natural fiber composites market growth.

UPM-Kymmene Corp, Flexform Technologies LLC, Polyvlies Franz Beyer GmbH, Amorim Cork Composites SA, Tecnaro GmbH, Lanxess AG, Bcomp Ltd, Cobra Advanced Composites Co Ltd, Plasthill Oy Ltd, and Lingrove Inc are among the key players operating in the natural fiber composites market. These companies have a diverse geographic presence and offer an extensive product range to address consumer demands.

Impact of COVID-19 Pandemic on Natural Fiber Composites Market

Industries such as automobiles, aerospace, building & construction, electrical & electronics, and sporting goods have been the major contributors to the demand for natural fiber composites. In 2020, these industries had to slow down their operations due to disruptions in value chains caused by the shutdown of national and international boundaries. The COVID-19 pandemic hampered the major raw material supply chains and disturbed manufacturing processes due to restrictions imposed by government authorities in various countries. Furthermore, lockdown measures also impacted the availability of laborers, which hampered the production of natural fiber composites. Various biocomposite manufacturers had to temporarily suspend their operations or limit their production capacities, which negatively impacted the natural fiber composites market. However, in 2021, economies gradually resumed their operations, which positively affected the global marketplace. As large percentages of people from many countries were completely vaccinated by the end of 2021, manufacturers were permitted to operate at full capacities, which helped them consolidate their efforts toward closing the demand–supply gap. These transformations helped them focus on scaling up their production to revive their businesses.

The report segments the natural fiber composites market as follows:

Based on raw material, the natural fiber composites market is categorized as wood, cotton, flax, kenaf, hemp, and others. By technology, the market is segmented into injection molding, compression molding, pultrusion, and others. In terms of end user, the natural fiber composites market is segmented into automotive & aerospace, building & construction, electrical & electronics, sporting goods, and others. Based on geography, the natural fiber composites market is segmented into North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South & Central America.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com