Natural Fiber Composites Market Analysis and Opportunities by 2028

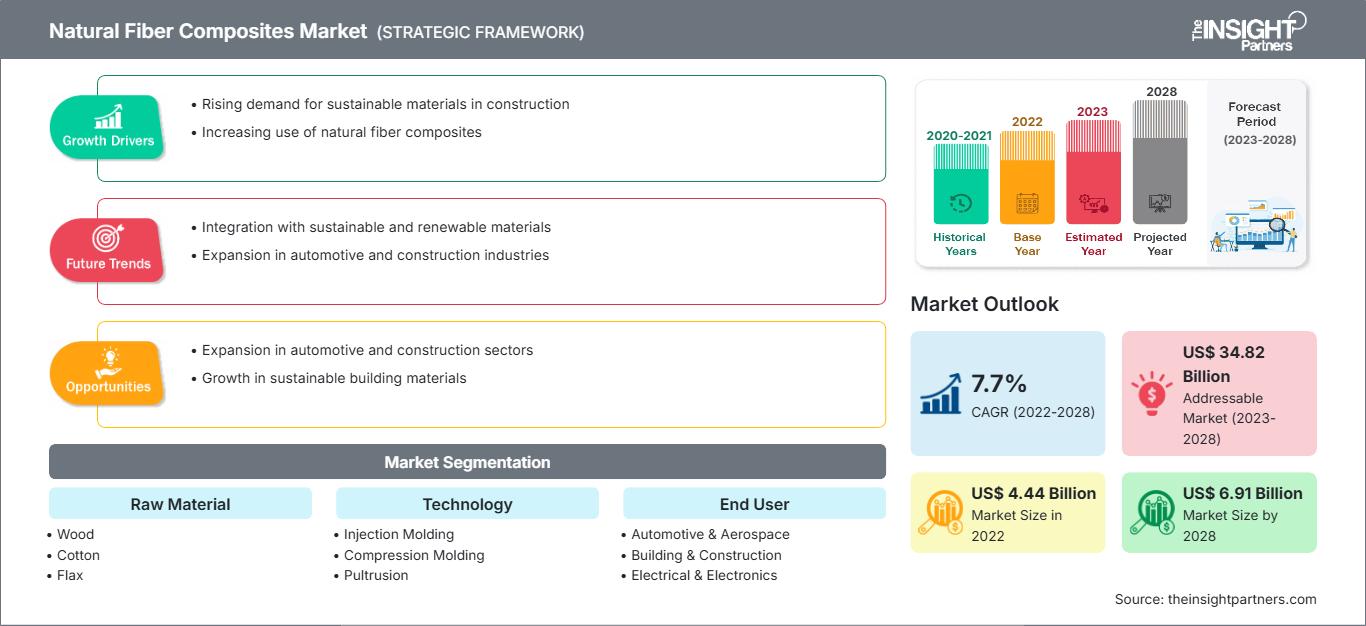

Natural Fiber Composites Market Forecast to 2028 - COVID-19 Impact and Global Analysis By Raw Material (Wood, Cotton, Flax, Kenaf, Hemp, and Others), Technology (Injection Molding, Compression Molding, Pultrusion, and Others), and End User (Automotive & Aerospace, Building & Construction, Electrical & Electronics, Sporting Goods, and Others)

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2028- Report Date : Mar 2023

- Report Code : TIPRE00003924

- Category : Chemicals and Materials

- Status : Published

- Available Report Formats :

- No. of Pages : 209

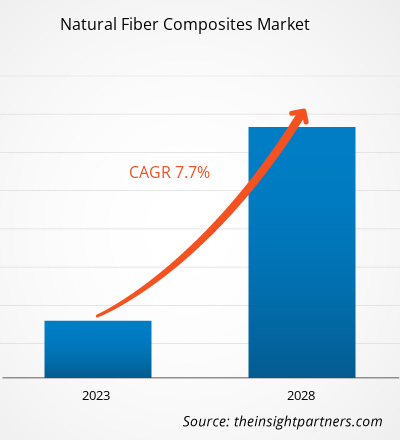

The natural fiber composites market is expected to grow from US$ 4,438.83 million in 2022 to US$ 6,910.46 million by 2028; it is estimated to register a CAGR of 7.7% from 2022 to 2028.

Natural fiber composites are composite materials with a polymer matrix embedded with high-strength natural fibers. Natural fibers are used as a component of composite materials, where the orientation of fibers impacts the properties. In composite materials, natural fibers often refer to plant fibers extracted from lignocellulosic biomass such as wood fibers and other plant fibers from the stem, leaf, fruit, and seed.

The demand for fiber-reinforced (glass and carbon fibers) composites is relatively high. However, they are expensive and are not environmentally friendly. These fibers are nonrenewable and nonrecyclable. Many European Union and Asian countries have introduced regulations for the automotive industry. According to European Union legislation passed in 2006, 80% of vehicles should be reused or recycled; in the 2015 revision, this percentage rose to 85%. According to a 2015 regulation in Japan, 95% of vehicles should be reused or recycled. Moreover, drawbacks such as high fiber density, poor recyclability, and handling hazards limit the use of glass fiber composites. These drawbacks of glass fiber composites boost the demand for natural fiber composites.

The natural fiber composites market is segmented into five major regions—North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America. In 2022, Europe held the largest market share, and Asia Pacific is estimated to register the highest CAGR during the forecast period. High demand for natural fiber composites from the automotive and construction industries favors the growth of the European natural fiber composites market. Further, Asia Pacific, the most populated region in the world, hosts one of the world's most rapidly developing construction and automotive industries. This factor contributes to the high demand for natural fiber composites in the region.

Customizee This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONNatural Fiber Composites Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on Natural Fiber Composites Market

Before the COVID-19 pandemic, the natural fiber composites market was mainly driven by industries such as automotive, building & construction, sporting goods, and marine. In 2020, various industries had to slow down their operations due to disruptions in supply chains caused by the shutdown of national and international borders. The pandemic hampered manufacturing processes due to restrictions imposed by government authorities in various countries. Natural fiber reinforced composites have major applications in the aerospace and automobile industries, wherein they are used to manage the body weight of vehicles and fuel management. It is used in cement paste and mortar in the construction sector. Hence, with the reduction in activity in these sectors, the demand for natural fiber composites also decreased. The pandemic also caused fluctuations in the prices of raw materials. All these factors led to a decrease in demand for natural fiber composites.

However, in 2021, the economies started reviving as various industries resumed business activities. As a result, several industries, including automotive and building & construction, showed signs of recovery in their operations. Various industries are also overcoming the consequences of disruptions in their raw material supply chains. With such a promising recovery, the global industrial sector is expected to provide the impetus for the natural fiber composites market growth in the coming years.

Market Insights

Strategic Developments by Key Players Favor Natural Fiber Composites Market Growth

In July 2022, BMW Group, the premium carmaker's venture capital firm, invested in a Swiss clean tech company Bcomp Ltd, a manufacturer of high-performance components made from natural fibers. Such strategic developments by key players are expected to bolster the natural fiber composites market growth in the coming years. In addition, key market players are involved in strategies such as mergers and acquisitions to expand their geographic presence.

Raw Material-Based Insights

Based on raw material, the natural fiber composites market is segmented into the wood, cotton, flax, kenaf, hemp, and others. The hemp segment is expected to register the highest CAGR during the forecast period. Hemp fibers are found in the stem of the plant, making them strong. They are essential for the fortification of composite materials. With the surging demand for sustainable, biodegradable, and recyclable materials, the use of hemp fibers as support in composite materials has increased. Natural fiber composites made from hemp are biodegradable.

End User-Based Insights

Based on end user, the natural fiber composites market is divided into automotive & aerospace, building & construction, electrical & electronics, sporting goods, and others. The automotive & aerospace segment dominated the market in 2022. Natural fiber composites are widely used in fabricating electric car components because of their lightweight qualities. Due to their better stiffness and strength compared to other synthetic fibers and better acoustic insulation properties, these composites are also employed in vehicle door panels, seat backs, floor panels, underfloor pans, and trunk liners.

UPM-Kymmene Corp, Flexform Technologies LLC, Polyvlies Franz Beyer GmbH, Amorim Cork Composites SA, Tecnaro GmbH, Lanxess AG, Bcomp Ltd, Cobra Advanced Composites Co Ltd, Plasthill Oy Ltd, and Lingrove Inc are among the major players operating in the natural fiber composites market. These companies mainly focus on product innovation to expand their market share and follow emerging market trends.

Natural Fiber Composites Market Regional InsightsThe regional trends and factors influencing the Natural Fiber Composites Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Natural Fiber Composites Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Natural Fiber Composites Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 4.44 Billion |

| Market Size by 2028 | US$ 6.91 Billion |

| Global CAGR (2022 - 2028) | 7.7% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Raw Material

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Natural Fiber Composites Market Players Density: Understanding Its Impact on Business Dynamics

The Natural Fiber Composites Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Natural Fiber Composites Market top key players overview

Report Spotlights

- Progressive industry trends in the natural fiber composites market to help companies develop effective long-term strategies

- Business growth strategies adopted by market players in developed and developing countries

- Quantitative analysis of the natural fiber composites market from 2020 to 2028

- Estimation of global demand for natural fiber composites

- Porter's Five Forces analysis to illustrate the efficacy of buyers and suppliers operating in the natural fiber composites industry

- Recent developments to understand the competitive market scenario

- Market trends and outlook, as well as factors driving and restraining the growth of the natural fiber composites market

- Assistance in the decision-making process by highlighting market strategies that underpin commercial interest

- Size of the natural fiber composites market at various nodes

- Detailed overview and segmentation of the market and growth dynamics of the natural fiber composites industry

- Size of the natural fiber composites market in various regions with promising growth opportunities

Frequently Asked Questions

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Related Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For