North America High Precision GNSS Antennas Market Analysis: Key Insights

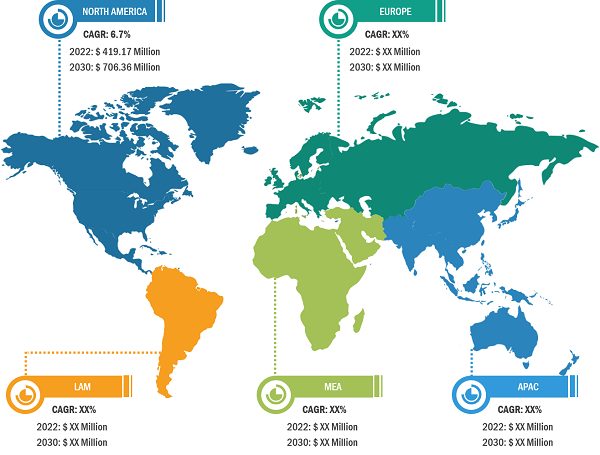

According to our latest study on "North America High Precision GNSS Antennas Market Regional Share, Trends, and Growth Opportunity Analysis – by Type, Technology, Frequency Range, End User, and Country," the high precision GNSS antennas market size is estimated to grow from US$ 419.17 million in 2022 to US$ 706.36 million by 2030; it is estimated to grow at a CAGR of 6.7% from 2022 to 2030. Factors, including the increasing use of military spending on drones and strategic initiatives by high precision GNSS antennas market players, are anticipated to drive the North America high precision GNSS antennas market growth during the forecast period.

The North America high precision GNSS antennas market is segmented into the US, Canada, and Mexico. The region is an early adopter of advanced technology as it is one of the most developed regions. The manufacturing industry is one of the major contributors to the region’s economy. Thus, the region's government is investing to boost its manufacturing industry. In January 2021, the US President announced plans to strengthen the US manufacturing sector under the “Made in America” initiative, which focuses on making technologically advanced and automated manufacturing sectors. The president announced an investment of US$ 300 billion for the R&D and inclusion of advanced technologies to boost the country's production output, majorly focusing on electric vehicle production. Subcommittee on Advanced Manufacturing (SAM) 2022 National Strategy for Advanced Manufacturing is focused on developing and implementing advanced manufacturing technologies such as robotics solutions. The rise in the inclusion of robotics solutions in the manufacturing industry drives the integration of GNSS technology. GNSS technology has been playing a crucial role in Industry 4.0 applications. It brings precision to the manufacturing operations.

North America High Precision GNSS Antennas Market Size - 2030

Download Free SampleNorth America High Precision GNSS Antennas Market Size and Forecasts (2020 - 2030), Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Type (Harsh Environment Antennas, Survey Grade Antennas, and Marine Antennas), Technology (GPS, GLONASS, and GALILEO), Frequency Range (L1, L2, and L5), and End User (Aviation, Consumer Electronics, Construction and Mining, Military and Defense, and Others)

The North America high precision GNSS antennas market in the US is undergoing drastic changes. For instance, according to the International Trade Administration (ITA), the US has one of the largest automotive markets in the world. According to ITA, the US, the technically advanced nation, is expected to remain the leading market for the 21st-century automotive industry owing to its large consumer base, available infrastructure, open investment policy, strong R&D capabilities, a highly skilled workforce, and local and state government incentives. Therefore, the demand for automobiles from the US contributes to the growing demand for North America high precision GNSS antennas for their application in the vehicle navigation system. Such trends are anticipated to drive the North America high precision GNSS antennas market.

The North America high precision GNSS antennas market in Canada is driven by various factors. Canada is one of the top ten light vehicle producers in the world. Stellantis, Ford, General Motors, Honda, and Toyota are among the five worldwide OEMs that construct more than 2 million vehicles annually in their respective Canadian assembly factories. Ontario has a unique ecosystem of world-class auto assemblers, parts manufacturers, and research institutes that have been serving foreign clients for decades. Hence, the country's robust automotive market is anticipated to offer lucrative opportunities for the players in the North America high precision GNSS antennas market.

Over the years, Mexico has experienced significant market growth in its industrial sector due to the trade agreement between the US, Canada, and Mexico. This agreement enables free goods transportation within the countries, showcasing the rise in manufacturing plants nationwide. Several major vehicle manufacturers operating in the country include Volvo, Mercedes, and Kia. The presence of these companies has thereby increased the production volume of vehicles, contributing to the demand for GNSS systems in the automotives. In addition, several major electronics manufacturers operating in the country include Samsung, Foxconn, Intel, and Panasonic. The presence of these companies has increased the production volume of electronics such as fitness trackers, smart speakers, phones, and AR/VR headsets, which generates the demand for high-precision GNSS antenna to communicate and transfer data effectively and efficiently through advanced antenna networking systems. Such developments in the country are anticipated to propel the North America high precision GNSS antennas market growth in the near future.

Increasing use of military spending on drones drives the growth of the North America high precision GNSS antennas market

The change in the modern warfare system has encouraged governments across the globe to allocate higher funds to respective military forces to procure advanced technologies and equipment. The defense forces across the globe are investing substantial amounts to strengthen military forces with advanced technologies, machinery, and vehicles. For instance, according to the Stockholm International Peace Research Institute (SIPRI), global military expenditure increased by 3.7% in 2022 and reached a new high of US$ 2,240 billion. The continuous urge for new technologies for combat and non-combat operations by the defense forces is further boosting the demand for drones for their applications in warfare, intelligence, surveillance, target acquisition and reconnaissance (ISTAR), cargo services, and others. The North American government and military forces are engaged in developing and providing drones to the military forces of the region and other nations to carry out military operations.

A few of the developments in the military forces are:

- In February 2022, Skydio, an American manufacturer of drones, bagged a contract worth US$ 20.2 million annually to supply X2D UAVs to the US Army for the Short-Range Reconnaissance Program (SRR).

- In December 2022, Lockheed Martin Corporation won a US$ 157.5 million contract from the UK Army to provide 105 fixed-wing Stalker VXE30 drones and 159 rotary-wing Indago 4 uncrewed devices for ten years.

Such focus of military forces on drones generates the demand for GNSS systems as they offer a high degree of positioning accuracy for applications such as mapping, surveying, search and rescue, and targeting operations. It is also used to georeference gathered data, avoid collisions, or provide tracking capabilities. The GNSS antennas are mounted on the drones to gather the data and act according to their designed operations. Thus, the rise in spending on drones fuels the North America high precision GNSS antennas market.

North America High Precision GNSS Antennas Market: Segmental Overview

Based on type, the North America high precision GNSS antennas market is segmented into harsh environment antennas, survey grade antennas, and marine antennas. The harsh environment antennas segment dominates the North America high precision GNSS antennas market. The demand for high precision GNSS antennas is rising in construction, mining, industrial, and other applications. In these applications, it is used for vehicle productivity tracking and routing, equipment positioning, collision avoidance, equipment monitoring and maintenance, and semi or fully autonomous operations. These antennas perform well in dusty, greasy, high-vibration locations. Thus, the rise in industrialization and the construction industry is one of the major factors driving the growth of North America high precision GNSS antennas market.

North America High Precision GNSS Antennas Market Analysis: Competitive Landscape and Key Developments

Hexagon AB, Trimble Inc, Septentrio NV, 2J Antennas S.R.O., Tallysman, Taoglas, Abracon, and u-Box Holding AG are a few of the key firms operating in the North America high precision GNSS antennas market. The North America high precision GNSS antennas market players focus on new product launches, expansion and diversification, and acquisition strategies, which allow them to access prevailing business opportunities.

- In October 2023, Hexagon’s Autonomy & Positioning division and Munhwa Broadcasting Corporation (MBC) announced their agreement to bring precise positioning to South Korea through the TerraStar-X precise positioning GNSS correction service. The hardware-agnostic correction service provides instant convergence and lane-level accuracy in automotive, mobile, and autonomous applications. Through this collaboration, the TerraStar-X Enterprise service is now supported in testbeds across South Korea, China, Japan, Europe, and North America to accelerate development for advanced driver assistance systems (ADAS), safety-critical applications, micromobility, industrial and smartphone applications.

- In December 2023, Trimble and Sabanto announced the integration of Trimble BX992 Dual Antenna GNSS receivers with Trimble CenterPoint RTX into Sabanto's autonomy solutions. Trimble will act as Sabanto's key autonomous technology provider, delivering high-accuracy positioning to its fleet.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com