Increasing Demand for Offshore/Deep-Water Discoveries to Provide Growth Opportunities for Oilfield Service Market during 2021–2028

According to our latest market study on “Oilfield Service Market Forecast to 2028 – COVID-19 Impact and Global Analysis – by Application and Service Type,” the market is expected to grow from US$ 96,465.86 million in 2021 to US$ 145,963.08 million by 2028; it is estimated to grow at a CAGR of 6.1% from 2021 to 2028.

The oil & gas sector is experiencing technical improvements in exploration technologies for deep-water drilling activities and project economic viability. Current technological advancements enable oil firms to boost recovery and speed output. Offshore wells can have varying degrees of automation, ranging from essential one-way monitoring to complicated subsurface controls with intelligent completions. Petrobras has established a corporate program to investigate, develop, and apply digital integrated field management (GeDIg) among its production assets, anticipating near-term potential. Petrobras chose the Carapeba field as a test site. It is a mature field consisting of three wells located in the northeastern portion of the Campos Basin, with automated subsurface sensors installed in the wells. Cross-disciplinary teams of geoscientists, engineers, operations managers, and financial analysts communicate via remote command centers, boosting teamwork and collaboration while addressing issues quickly. Therefore, oil firms are substantially investing in command centers and remote monitoring to eliminate the need for operation specialists, engineers, and geoscientists to travel to remote oilfields. Oil and gas companies aim to install deep-water analytical technologies while selecting effective information solutions. Operators are required to modernize their existing offshore infrastructure to exploit data through the analytical technique. For instance, Rockwell Automation cooperated with Schlumberger to develop a production advising system. The digital solution, which combines linked production technology with Schlumberger's oil and gas software, services, and domain experience, helps maximize production by linking upstream operators with essential, real-time analytics and domain insights to decrease deployment risks and costs. Thus, the increasing number of offshore/deep water discoveries would create lucrative opportunities for the oilfield service market in the coming years.

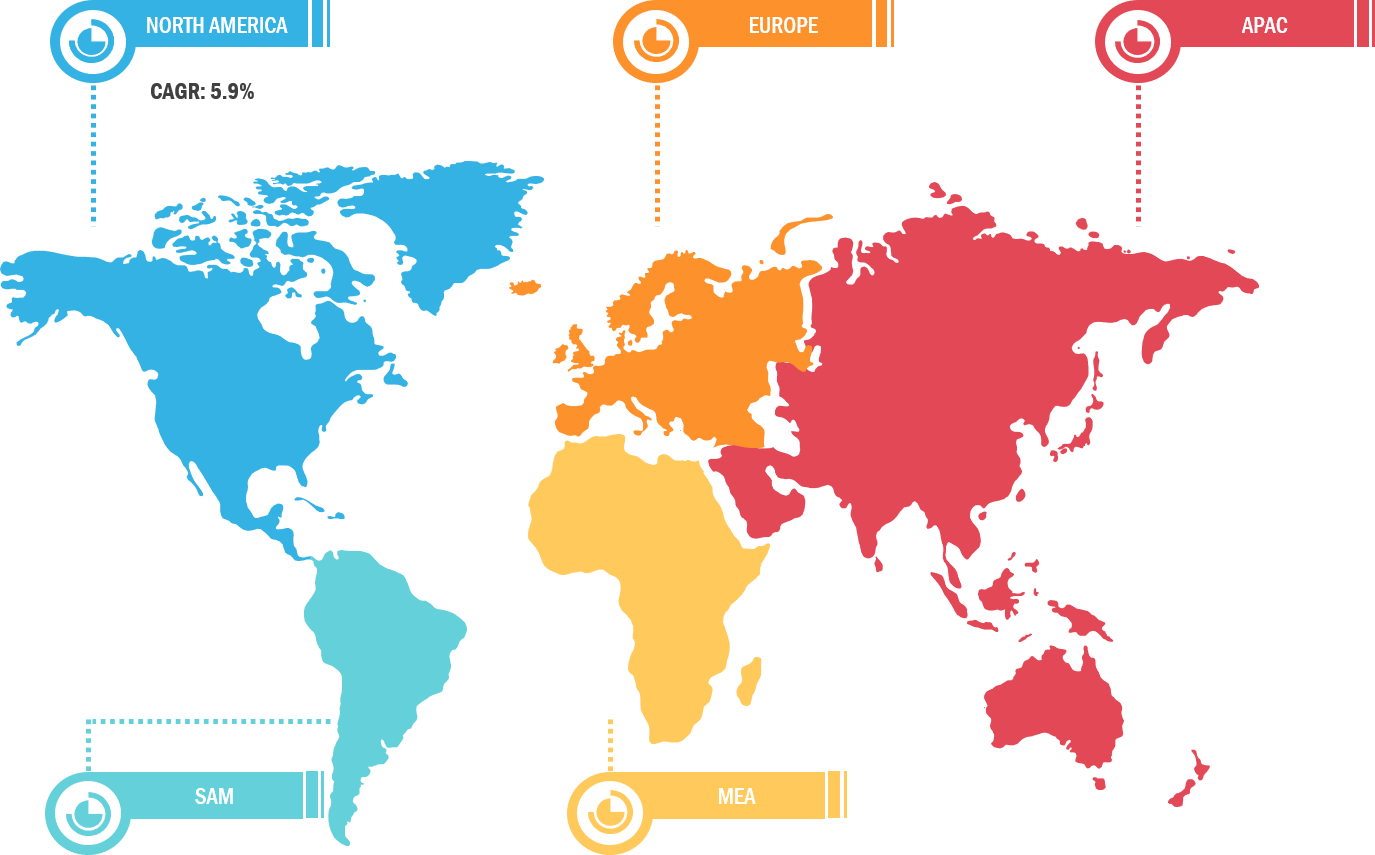

Lucrative Regions for Oilfield Service Market

Oilfield Service Market Growth Report | Size & Forecast 2031

Download Free Sample

Oilfield Service Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Service Type (Well Completion, Wire line, Artificial Lift, Perforation, Drilling and Completion Fluids, and Others), Application (Onshore and Offshore), and Geography

Oilfield Service Market Growth Report | Size & Forecast 2031

Download Free SampleOilfield Service Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Service Type (Well Completion, Wire line, Artificial Lift, Perforation, Drilling and Completion Fluids, and Others), Application (Onshore and Offshore), and Geography

The global oilfield service market is segmented on the basis of type, service type, and geography. By type, the oilfield service market is bifurcated into onshore and offshore. In 2020, the offshore segment held a larger market share. Based on service type, the oilfield service market is segmented into well completion, wire line, artificial lift, perforation, drilling and completion fluids, and others. In 2020, the others segment accounted for the largest market share. Geographically, the oilfield service market is broadly segmented into North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South America (SAM). In 2020, Europe accounted for a significant share in the global market.

Impact of COVID-19 Pandemic on Global Oilfield Service Market

The oilfield service market disrupted in 2020 due to the COVID-19 outbreak. Steps taken by corporations and governments to restrict the virus spread have resulted in a significant and rapid decrease in transportation and related operations, affecting demand for oil and gas. Due to the impact of COVID-19 pandemic on the global oil market, many corporations are rethinking their spending plans and implementing creative mitigation techniques. Exploration and production firms face continued pressure to improve operational efficiency and maximize resources in a cost-effective and environment-friendly way. Thus, the adoption of oilfield services is increasing to maintain competitiveness and profitability as the pandemic subsides. Companies in the market that can deliver innovative solutions at reasonable pricing will be best positioned to increase oilfield service market share and acquire new business in the coming years.

Schlumberger Limited; Halliburton Company; Baker Hughes Incorporated; GE Oil & Gas; Superior Energy Services, Inc; Hunting plc; Weatherford International PLC; Nov Inc; PETRODYN; Pioneer Energy Services Corp; and Archer Limited are among the major companies operating in the oilfield service market.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com