The overactive bladder treatment market size expected to reach US$ 5,333.92 million by 2028, registering at a CAGR of 3.1% from 2022 to 2028, according to a new research study conducted by The Insight Partners.

Mirabegron to Account for Largest Market Share in Overactive Bladder Treatment Market During 2022–2028

Based on pharmacotherapy, the overactive bladder treatment market is segmented into anticholinergics, mirabegron, botox, intravesical instillation, and neurostimulation. The neurostimulation segment is further segmented into transcutaneous sacral nerve stimulation, transcutaneous tibial nerve stimulation, percutaneous posterior tibial nerve stimulation, and others. The anticholinergics segment is further segmented into solifenacin, oxybutynin, fesoterodine, darifenacin, tolterodine, trospium, and other anticholinergics. The mirabegron segment held the largest share of the market in 2021, and the neurostimulation segment is anticipated to register the highest CAGR in the market during the forecast period. Based on disease type, the overactive bladder treatment market is bifurcated into idiopathic overactive bladder and neurogenic overactive bladder. The idiopathic overactive bladder segment held a larger market share in 2021, and it is also anticipated to register a higher CAGR in the market during the forecast period.

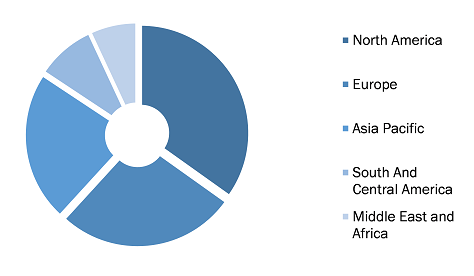

Overactive Bladder Treatment Market, by Region, 2021 (%)

Overactive Bladder Treatment Market Forecast to 2028 - Analysis By Pharmacotherapy (Anticholinergics, Mirabegron, Botox, Neurostimulation, and Intravesical Instillation) and Disease Type (Idiopathic Overactive Bladder and Neurogenic Bladder)

Overactive Bladder Treatment Market Regional Overview - 2028

Download Free Sample

Source: The Insight Partners Analysis

Mirabegron is used alone or with solifenacin to treat overactive bladder in adults. It is used to treat neurogenic detrusor overactivity (a bladder control condition caused by the brain, spinal cord, or nerve problem) in children aged three years or more. Mirabegron belongs to the class of drugs called beta-3 adrenergic agonists. It relaxes the bladder muscles to prevent urgent, frequent, or uncontrolled urination. Mirabegron is available as an extended-release (long-acting) tablet and an extended-release suspension that can be taken orally. In October 2022, Zydus Pharmaceuticals Inc. received approval from the USFDA to market Mirabegron Extended-Release Tablets USP 25 mg and 50 mg.

According to a study by American Urological Association, patients with COVID-19 infections were at an increased risk for developing new or worsening overactive bladder symptoms. Moreover, approximately one-third of patients with COVID-19 reported a significant increase in clinical symptoms during the International Consultation on Incontinence Questionnaire Overactive Bladder Module (ICIQ-OAB) conducted two months after infection. Out of these one-third of patients, approximately 1 in 5 patients, reported that their OAB symptoms were new. This increased prevalence of OAB due to COVID-19 positively impacted the demand for overactive bladder treatment during the pandemic.

Alembic Pharmaceuticals Limited; Astellas Pharma Inc; Pfizer Inc.; AbbVie Inc; Teva Pharmaceutical Industries Ltd; Endo Pharmaceuticals Inc.; Hisamitsu Pharmaceutical Co. Inc; Medtronic Plc; Allergan; and Colorado Urology Associates, PLLC are among the leading companies operating in the global overactive bladder treatment market.

Various organic and inorganic strategies are adopted by companies operating in the overactive bladder treatment market. Organic strategies mainly include product launches and product approvals. On the other hand, acquisitions, collaborations, and partnerships are among the inorganic growth strategies witnessed in the market. These growth strategies allow the market players to expand their businesses and enhance their geographic presence, thereby contributing to the overall market growth. Further, acquisition and partnership strategies help them strengthen their customer base and expand their product portfolios. A few significant developments by key players in the overactive bladder treatment market are listed below:

- In April 2022, Axonics, Inc. announced the comprehensive launch of the Axonics F15 across the US. The newly developed, long-lived, fully recharge-free sacral neuromodulation (SNM) system received FDA approval in March. The Axonics recharge-free system is a welcome advancement for bladder and bowel dysfunction patients.

- In March 2021, the US Food and Drug Administration (FDA) approved Astellas Pharma's Myrbetriq and Myrbetriq Granules. Myrbetriq and Myrbetriq Granules are used for the treatment of neurogenic detrusor overactivity (NDO) in pediatric patients aged three years and older.

- In July 2019, Teva Pharmaceutical Industries Ltd launched Solifenacin Succinate Tablets. Solifenacin Succinate Tablets are muscarinic antagonists indicated for the treatment of overactive bladder with symptoms of urinary incontinence, urgency, and urinary frequency.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com