Overactive Bladder Treatment Market Overview and Growth by 2028

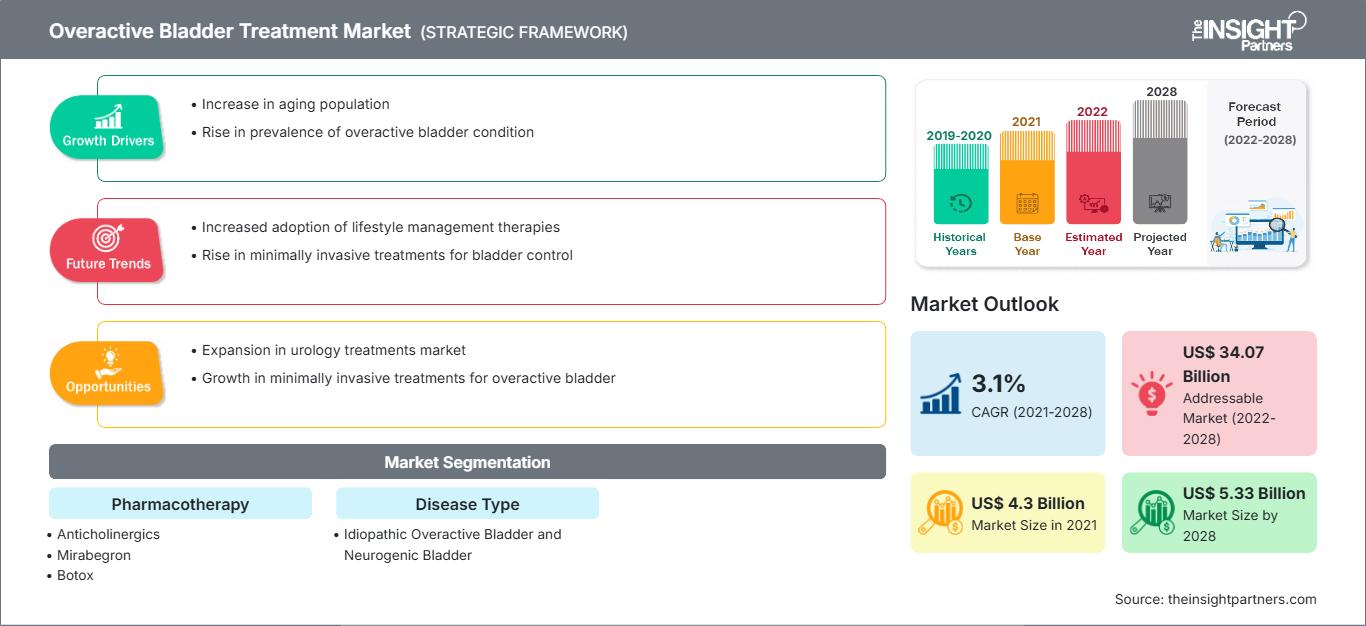

Overactive Bladder Treatment Market Forecast to 2028 - Analysis By Pharmacotherapy (Anticholinergics, Mirabegron, Botox, Neurostimulation, and Intravesical Instillation) and Disease Type (Idiopathic Overactive Bladder and Neurogenic Bladder)

Historic Data: 2019-2020 | Base Year: 2021 | Forecast Period: 2022-2028- Report Date : Oct 2022

- Report Code : TIPRE00004082

- Category : Life Sciences

- Status : Published

- Available Report Formats :

- No. of Pages : 209

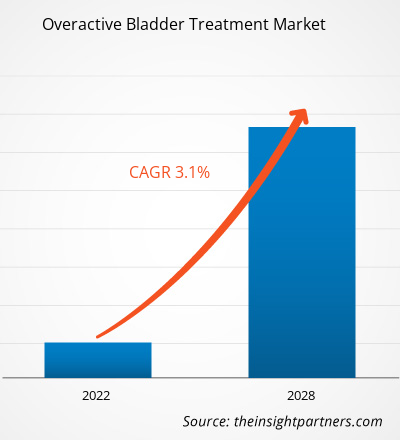

The overactive bladder treatment market is expected to grow from US$ 4,295.93 million in 2021 to US$ 5,333.92 million by 2028; it is estimated to grow at a CAGR of 3.1% from 2022 to 2028.

Overactive bladder (OAB) is the frequent and sudden urge to urinate, which might be difficult to control. OAB can be caused due to abdominal trauma, infection, nerve damage, and certain medications. OAB is common in people aged 65 and older. Women may have OAB after 45 years. The treatment includes changing certain behaviors, medications, and nerve stimulation.

The overactive bladder treatment market is segmented into pharmacotherapy, disease type, and geography. By geography, the market is broadly segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America. The overactive bladder treatment market report offers insights and in-depth analysis of the market, emphasizing parameters, such as market trends, market dynamics, and the competitive analysis of the globally leading market players.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONOveractive Bladder Treatment Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights

According to the National Association for Incontinence data, in 2018, ~200 million people worldwide were affected by urinary incontinence. Stress incontinence and urge incontinence are the two common types of urinary incontinence affecting women, wherein the latter is also known as overactive bladder. Similarly, a study conducted by a group of researchers at the American College of Physicians and Infectious Diseases Society of America in 2020 stated that urinary tract infection (UTI) was the cause of ~6 million physician visits each year in the US. In Canada, ~500,000 visits to the doctor's office are for UTI consultations annually. UTI is the eighth and fifth most common reason for ambulatory clinic visits and emergency department visits, respectively, in the country. Thus, increasing prevalence of urinary incontinence and growing incidence of urinary tract infections are driving the overactive bladder treatment market.

Following are a few examples of new products launches and approvals:

- In February 2022, Alembic Pharmaceuticals received approval from the US health regulator for its generic version of fesoterodine fumarate extended-release tablets, used for overactive bladder in adults with symptoms of urinary incontinence, urgency, and frequency. The approval by the US Food & Drug Administration (USFDA) for the abbreviated new drug application (ANDA) for fesoterodine fumarate extended-release tablets is for strengths of 4 mg and 8 mg.

- In April 2022, Axonics, Inc. a global medical technology company developing and commercializing novel products for the treatment of bladder and bowel dysfunction—announced the comprehensive launch of the Axonics F15 across the US. The newly developed, long-lived, fully recharge-free sacral neuromodulation (SNM) system received FDA approval in March. The Axonics recharge-free system is a welcome advancement for patients suffering from bladder and bowel dysfunction.

- In March 2021, Astellas Pharma's Myrbetriq—used for the treatment of neurogenic detrusor overactivity (NDO) in pediatric patients aged three years and older (weighing 35 kg or more)—and Myrbetriq Granules—for the treatment of NDO in pediatric patients aged three years and older—were approved by the US Food and Drug Administration (FDA).

Such product developments by market players are driving the overactive bladder treatment market.

Type Insights

Based on pharmacotherapy, the overactive bladder treatment market is segmented into mirabegron, botox, neurostimulation, anticholinergics, and intravesical instillation. The mirabegron segment held the largest share of the market in 2021 and is anticipated to register the highest CAGR during the forecast period. Mirabegron is used alone or with solifenacin to treat overactive bladder in adults. It is used to treat neurogenic detrusor overactivity (a bladder control condition caused by the brain, spinal cord, or nerve problem) in children aged three years or more. Mirabegron belongs to the class of drugs called beta-3 adrenergic agonists. It relaxes the bladder muscles to prevent urgent, frequent, or uncontrolled urination. Mirabegron is available as an extended-release (long-acting) tablet and an extended-release suspension that can be taken orally. In October 2022, Zydus Pharmaceuticals Inc. received approval from the USFDA to market Mirabegron Extended-Release Tablets USP 25 mg and 50 mg. The increasing demand for this therapy is expected to fuel the growth of the overactive bladder treatment market during the forecast period.

Services Insights

Based on pharmacotherapy, the overactive bladder treatment market is segmented into mirabegron, Botox, neurostimulation, anticholinergics, and intravesical instillation. The neurostimulation segment is anticipated to register the highest CAGR in the market during the forecast period. Neurological control of the bladder is complex and depends on different spinal, central, and peripheral nerves, and their multiple reflex pathways. Neurological control is performed at different human body sites and, therefore, targets various nerves. Some of these target nerves are directly involved in lower urinary tract sensory-motor control, such as sacral or pudendal nerves, while others are more indirectly involved. Electrical stimulation is used to activate these nerves to control the bladder.

Partnerships and collaborations are highly adopted strategies by the global overactive bladder treatment market players. A few of the recent key market developments are listed below:

- In April 2021, Medtronic plc announced approval from the US Food and Drug Administration (FDA) to proceed with an investigational device exemption (IDE) trial to evaluate its internally developed implantable tibial neuromodulation (TNM) device a therapy designed to provide relief from symptoms of bladder incontinence.

- In July 2020, Hisamitsu Pharmaceutical Co., Inc. announced the approval of manufacturing and marketing for OABLOK PATCH in Thailand. The product is a systemic transdermal formulation developed using Hisamitsu’s Transdermal Drug Delivery System (TDDS) technology for treating overactive bladder with symptoms such as urinary urgency and frequent urination.

- In July 2019, Teva Pharmaceuticals Ltd. launched Solifenacin Succinate Tablets, which are muscarinic antagonists indicated for the treatment of overactive bladder with symptoms of urinary incontinence and increase in urinary frequency.

The COVID-19 pandemic has shown some favorable scenarios for players operating in the overactive bladder treatment market. The US was the highly affected country in North America. The infection severely affected the geriatric population in the country, causing various complications and leading to the death of a large population. For instance, as of May 16, 2022, the US reported 84,230,829 COVID cases with 1,026,670 deaths. Therefore, overactive bladder treatment and proper care are required to prevent chronic cases of infection and health conditions.

After the COVID-19 outbreak, there has been an increase in the occurrence of OAB. According to a study by American Urological Association, patients with COVID-19 infections were at an increased risk for developing new or worsening overactive bladder symptoms. Moreover, approximately one-third of patients with COVID-19 reported a significant increase in clinical symptoms during the International Consultation on Incontinence Questionnaire Overactive Bladder Module (ICIQ-OAB) conducted two months after infection. Out of these one-third of patients, approximately 1 in 5 patients, reported that their OAB symptoms were new. This increased prevalence of OAB due to COVID-19 positively impacted the demand for overactive bladder treatment during the pandemic.

Overactive Bladder Treatment Market Regional InsightsThe regional trends and factors influencing the Overactive Bladder Treatment Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Overactive Bladder Treatment Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Overactive Bladder Treatment Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 4.3 Billion |

| Market Size by 2028 | US$ 5.33 Billion |

| Global CAGR (2021 - 2028) | 3.1% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Pharmacotherapy

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Overactive Bladder Treatment Market Players Density: Understanding Its Impact on Business Dynamics

The Overactive Bladder Treatment Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Overactive Bladder Treatment Market top key players overview

Overactive Bladder Treatment – Market Segmentation

The global overactive bladder treatment market is analyzed based on pharmacotherapy, disease type, and geography. Based on pharmacotherapy, the overactive bladder treatment market is classified into mirabegron, Botox, neurostimulation, anticholinergics, and intravesical instillation. Based on disease type, the market is divided into idiopathic overactive bladder and neurogenic bladder.Geographically, the overactive bladder treatment market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America.

Company Profiles

- Alembic Pharmaceuticals Limited

- Astellas Pharma Inc

- AbbVie Inc

- Teva Pharmaceuticals Industries Ltd

- Endo Pharmaceuticals Inc

- Hisamitsu Pharmaceutical Co. Inc

- Medtronic Plc

- Colorado Urology Associates, PLLC

- Axonics Modulation Technologies, Inc

- Pfizer Inc

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For