The Rise of E-commerce Bolster Paper Dry Strength Agent Market Growth

According to our latest study on " Paper Dry Strength Agent Market Size and Forecast (2021–2031), Global and Regional Growth Opportunity Analysis – by type and application," the market value is expected to grow from US$ 752.27 million in 2024 to US$ 986.51 million by 2031; it is estimated to register a CAGR of 4.1% during 2025–2031. The paper dry strength agent market report highlights key factors driving the paper dry strength agent market growth and prominent players along with their developments in the market.

Internet access has revolutionized consumer behavior, especially in how people shop. Currently, 64% of the world's 8 billion people use the internet, a rate that has doubled over the past decade. According to the International Trade Administration (ITA), the global B2C e-commerce revenue is expected to reach US$ 5.5 trillion by 2027, growing at a compound annual growth rate of 14.4%. With the booming e-commerce sector, especially post-pandemic, the demand for shipping and packaging materials is increasing. Online shopping relies on paper and paperboard packaging for products, including boxes, padded mailers, and other protective packaging. There is a need for durable packaging to prevent product damage during transit and handling. With the increasing frequency of shipping, the need for stronger and more reliable packaging materials is growing. Dry strength agents are chemicals added during the wet-end processing of paper, increasing its tensile strength and tear resistance and improving structural integrity; this helps paper and paperboard to withstand physical challenges such as tearing, bending/folding, and crushing during product shipping to longer distances. Thus, the rising e-commerce sector and the need for durable paper and paperboard packaging materials drive the demand for dry strength agents across the paper and pulp industries.

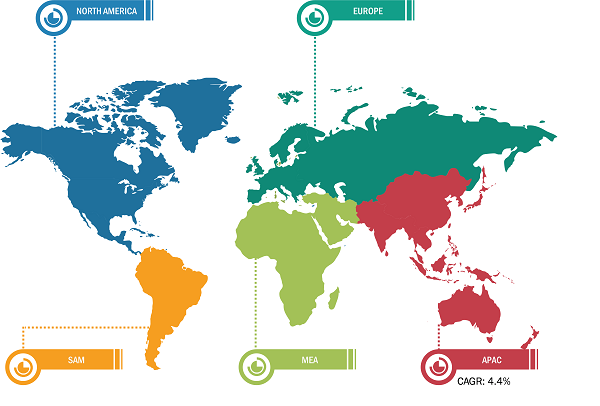

Paper Dry Strength Agent Market Breakdown – By Region

Paper Dry Strength Agent Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Polyvinyl Amine, Polyacrylamide [Amphoteric Polyacrylamide, Cationic Glyoxalated Polyacrylamide, Cationic Solution Polyacrylamide, and Others], Starch and Others), Application (Printing and Writing Paper, Tissue Paper, Packaging Paper, Specialty Paper, and Others), and Geography

Paper Dry Strength Agent Market Size, Trends, Shares by 2031

Download Free Sample

The paper and pulp industries are focusing on reducing environmental impact and carbon footprint. They are replacing petroleum-based additives with eco-friendly, plant-based polymers such as cellulose derivatives, plant gums including guar gum and locust bean gum, carrageenan, and chitosan that provide superior performance to the conventional dry strength agents along with minimizing carbon footprints. Kemia Oyj, a manufacturer of paper dry strength agents, offers Kemira's ECA (Engineered Cellulose Additive), which is chemically derived from wood pulp and is a bio-based dry strength additive. It is well-suited for paper mills where traditional synthetic polymer-based dry strength resins fail to perform effectively. ECA remains unaffected by high conductivity, calcium levels, or other contaminants in the papermaking system. It improves paper strength and machine runnability, even under challenging conditions.

The paper dry strength agent market analysis has been performed by considering the following segments: type and application. Based on type, the market is segmented into polyvinyl amine, polyacrylamide, starch, and others. The polyacrylamide segment is sub-segmented into amphoteric polyacrylamide, cationic glyoxalated polyacrylamide, cationic solution polyacrylamide, and others. The starch segment is expected to register a significant CAGR from 2025 to 2031. By application, the market is segmented into printing and writing paper, tissue paper, packaging paper, specialty paper, and others. The packaging paper segment is anticipated to hold a significant paper dry strength agent market share in the coming years.

Starch is a widely used dry-strength agent in the papermaking industry, valued for its natural availability, cost-effectiveness, and strong fiber-bonding properties. As a renewable polysaccharide derived from corn, wheat, and potatoes, starch enhances paper strength by forming hydrogen bonds with cellulose fibers, improving tensile, burst, and folding endurance properties. It is effective in increasing the dry strength of paper grades, including packaging paper, printing paper, and tissue paper. The growing demand for sustainable and biodegradable strength agents has solidified starch's position in the market, as it provides an eco-friendly alternative to synthetic polymers. Native, cationic, and oxidized starches are utilized depending on the specific papermaking process. Cationic starch is preferred due to its improved retention and bonding efficiency in paper finishes. Starch-based dry strength agents work well in combination with polyacrylamides, such as cationic glyoxalated polyacrylamide and cationic solution polyacrylamide, to enhance paper properties while optimizing cost and production efficiency. With increasing regulatory emphasis on sustainable paper production and the rising adoption of recycled fibers, the demand for starch is surging, particularly in regions with strong pulp and paper industries, such as North America, Europe, and Asia Pacific.

In terms of revenue, Asia Pacific dominated the paper dry strength agent market share in 2024. China is a major market for paper dry strength in the Asia Pacific. Paper dry strength agents are important for the country's large pulp and paper industry, which is the biggest in the world. In 2022, China produced more than 254.01 million metric tons of pulp and paper products while consuming over 230 million metric tons. This remarkable output was fueled by the country's growing economy, surging e-commerce, and rising demand for sustainable packaging solutions. As environmental regulations tighten and manufacturers seek cost-effective solutions to improve paper performance, the demand for advanced dry strength agents is rising. Additionally, innovations in bio-based and eco-friendly additives that align with China's push for greener industrial practices and sustainable development in the paper sector bolster market growth.

Among the paper dry strength agent market trends include an increasing focus on sustainability and the adoption of bio-based dry strength additives. Companies are focusing on providing innovative products with advanced chemical properties that allow paper manufacturers to generate dry strength agents on-site, reducing shipping & logistics, handling costs, and carbon emissions. Solenis offers Hercobond Plus, an on-site generated dry strength additive with a longer shelf life, less waste, a 20% performance boost, a 60% reduction in freight costs, and delivery frequency than traditional additives. It helps lower the carbon footprint of the packaging made due to on-site generation. Such products are witnessing strong demand in the paper industry. Thus, increasing sustainability concerns and adopting bio-based alternatives to traditional fossil-based dry strength agents are expected to emerge as a key trend in the market over the forecast period.

The paper dry strength agent market forecast can help stakeholders plan their growth strategies. Applied Chemicals International Group AG, Solenis LLC, Seiko PMC Corp, Ecolab Inc, Buckman Laboratories lnternational Inc, BIM Kemi AB, Arakawa Chemical Industries Ltd, Kemira Oyj, Shandong Tiancheng Chemical Co Ltd, Axchem Korea Co Ltd, Wuxi Lansen Chemicals Co Ltd, Qingzhou Jinhao New Material Co Ltd, Mare SpA, Benzson Group, and Lanyao Water Treatment Co Ltd are prominent players profiled in the paper dry strength agent market report. These market players are focusing on providing high-quality products to fulfill customer demand. They are adopting strategies such as product launches, capacity expansions, partnerships, and collaborations to stay competitive in the market. In May 2023, Harima developed the world's first high molecular weight, amphoteric PAM-based paper strengthening agent, "Harmide T2," which is certified by the FDA, BfR, and GB9685 as an indirect food additive.

The paper dry strength agent market is segmented on the basis of type, application, and geography. Based on type, the market is segmented into polyvinyl amine, polyacrylamide, starch, and others. The polyacrylamide segment is sub-segmented into amphoteric polyacrylamide, cationic glyoxalated polyacrylamide, cationic solution polyacrylamide, and others. By application, the market is segmented into printing and writing paper, tissue paper, packaging paper, specialty paper, and others. As per geography, the paper dry strength agent market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America. The market in North America is subsegmented into the US, Canada, and Mexico. The market in Europe is subsegmented into Germany, France, the UK, Italy, Russia, and the Rest of Europe. The market in Asia Pacific is subsegmented into China, India, Japan, Australia, South Korea, and the Rest of Asia Pacific. The paper dry strength agent market in the Middle East & Africa is subsegmented into South Africa, Saudi Arabia, the UAE, and the Rest of the Middle East & Africa. The market in South & Central America is segmented into Brazil, Argentina, and the Rest of South & Central America.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com