Human Recombinant Albumin Segment Drives Recombinant Albumin Market Growth

According to our new research study named "Recombinant Albumin Market Forecast to 2031 – Global Analysis – by Source, Application, and End User," the market was valued at US$ 392.50 million in 2024 and is projected to reach US$ 767.54 million by 2031; it is expected to register a CAGR of 10.1% during 2025–2031. The increasing prevalence of liver diseases and associated conditions, advancements in biotechnological manufacturing and product development, and growing demand for albumin in critical care and emergency settings are key factors driving the Recombinant Albumin market size. However, the high cost of recombinant albumin production and limited reimbursement, stringent regulatory approval processes and limited awareness, competition from plasma-derived albumin and biosimilars hinder market growth. Shift to animal-origin-free and plant-derived expression systems, shift toward recombinant alternatives for safety in liver disease management, integration in regenerative medicine and cell culture optimization is projected to bring new Recombinant Albumin market trends in the coming years.

The rising incidence of liver diseases significantly drives the demand for recombinant albumin globally. According to the World Health Organization (WHO), liver cirrhosis was responsible for approximately 1.3 million deaths worldwide in 2022, with increasing prevalence noted in both developed and developing countries. In the US, data from the CDC indicate a 7% rise in hospitalizations for liver-related conditions from 2022 to 2023, highlighting the growing clinical need for albumin-based therapies. As liver dysfunction often results in hypoalbuminemia, clinicians increasingly rely on albumin products to manage volume expansion, correct plasma protein deficits, and improve patient outcomes. Recent advancements, such as the approval of recombinant human albumin by the FDA in 2023, provide safer and more scalable alternatives to plasma-derived products. Moreover, countries like China and India have reported a surge in liver disease prevalence, driven by rising alcohol consumption and hepatitis infections. The development of novel recombinant albumin formulations with enhanced stability and reduced immunogenicity supports the market growth.

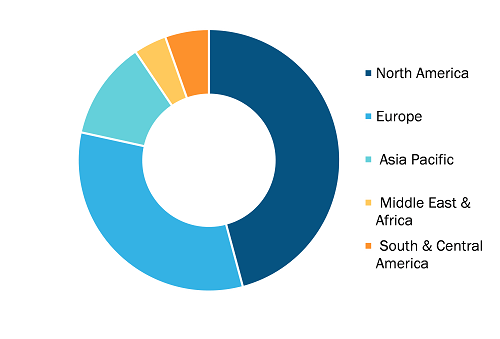

Recombinant Albumin Market, by Region, 2024 (%)

Recombinant Albumin Market Share & Demand Insights 2031

Download Free SampleRecombinant Albumin Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Source (Human Recombinant Albumin, Bovine Recombinant Albumin, and Others), Application (Excipient in Biotherapeutics And Vaccines, Cell Culture, Drug Delivery, Diagnostics, and Others), and End User (Pharmaceutical and Biotechnology Companies, Research Institutes, Hospitals and Diagnostic Laboratories, and Others)

Source: The Insight Partners Analysis

Recombinant Albumin Market Analysis Based on Segmental Evaluation:

- Based on product type, the market is segmented into human recombinant albumin, bovine recombinant albumin, and others. The human recombinant albumin segment held a significant recombinant albumin market share in 2024. Human recombinant albumin is highly pure, safe, and is increasingly used in biologics, cell therapies, vaccines, and animal-free bioprocessing.

- Based on application, the recombinant albumin market is categorized into excipient in biotherapeutics and vaccines, cell culture, drug delivery, diagnostics, and others. The excipient in biotherapeutics and vaccines segment held a significant share in 2024. The growth of this segment is due to its safety and stability for biologics and vaccine formulations.

- Based on end user, the recombinant albumin market is divided into pharmaceutical and biotechnology companies, research institutes, hospitals and diagnostic laboratories, and others. The pharmaceutical and biotechnology companies segment held the largest recombinant albumin market share in 2024. Hospitals and clinics show a high demand for biologics, vaccines, and cell-culture products requiring safe, high-purity recombinant albumin.

The geographical scope of the Recombinant Albumin market report includes the assessment of the market performance in North America, Europe, Asia Pacific, South and Central America, and the Middle East and Africa. North America dominated the Recombinant Albumin market share in 2024. increasing prevalence of liver diseases and associated conditions, advancements in biotechnological manufacturing and product development, and growing demand for albumin in critical care and emergency settings drive the Recombinant Albumin market growth in North America. The US leads the region, supported by a well-established biopharmaceutical sector, extensive plasma collection networks, and strong R&D investments in drug delivery and recombinant technologies.

There is an increasing global prevalence of chronic liver diseases. During treatments, recombinant albumin is used as the mainstay for blood volume expansion and osmotic support due to its safety and pathogen-free nature compared to plasma-derived albumin.

The global burden of chronic liver disease is rising rapidly, with complications such as hypoalbuminemia affecting a large proportion of advanced cases. The World Health Organization (WHO) estimated in 2022 that viral hepatitis and cirrhosis together would lead to 1.3 million deaths, and the number was estimated to reach 1.43 million in 2023 and 1.5 million in 2024. Hypoalbuminemia is one of the conditions that complicate 60% of the advanced cases where therapeutic albumin is being infused.. Non-alcoholic fatty liver disease (NAFLD) was one of the major contributors, affecting 30% of adults, and hypoalbuminemia was found in 70% of decompensated cirrhosis patients. The Korea Centers for Disease Control and Prevention (KDCA) reported a steep increase in the number of NAFLD cases from 1,200 new cases per 100,000 population in 2022, to 1,350 in 2023, and 1,450 in 2024.

Recombinant albumin’s clinical and regulatory landscape is evolving, underscoring its role in liver disease management. In July 2023, Grifols' recombinant albumin-infused IVIG received FDA marketing authorization for liver failure support, demonstrating a 40% improvement in serum level. In March 2024, Octapharma's Octalbumin received EMA approval for cirrhosis trials, leading to a 30% reduction in transfusion needs. In the US, the NIH confirmed in 2023 that recombinant albumin carries a 70% lower contamination risk compared to plasma-derived albumin.

CSL Ltd, Merck KGaA, HiMedia Laboratories Pvt Ltd, Thermo Fisher Scientific Inc, InVitria, Medxbio Pte Ltd, Lazuline Biotech Private Limited, Cyagen Biosciences, Sartorius AG, and Akron Biotech are among the leading companies profiled in the Recombinant Albumin market report.

Geographically, the market is categorized into North America (US, Canada, and Mexico), Europe (France, Germany, UK, Spain, Italy, and the Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, and the Rest of Asia Pacific), the Middle East and Africa (Saudi Arabia, South Africa, the UAE, and the Rest of Middle East and Africa), and South and Central America (Brazil, Argentina, and the Rest of South and Central America).

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com