Strategic Initiatives by Key Manufacturers to Drive Sexual Wellness Products Market Trends

According to our latest market study on “Sexual Wellness Products Market Forecast to 2030 –Global Analysis – by Product Type and Distribution Channel,” the market was valued at US$ 53,461.62 million in 2022 and is expected to reach US$ 94,154.77 million by 2030; it is projected to register a CAGR of 7.3% from 2022 to 2030. The report highlights key factors driving the market and prominent players along with their developments in the market.

Sexual health and intimacy are increasingly being prioritized by consumers as an integral part of their overall physical and mental wellbeing. Considering how important it is to take care of every part of their body, many beauty customers see these items as an addition to their self-care regimen. Products such as sex toys, lubricants, and condoms are garnering mainstream attention across consumers. Growth in consumer comfort in discussing sexual health and pleasure has favored expansion of sexual wellbeing products market.

Sexual Wellness Products Market Growth Report by Size, Share & Scope 2030

Download Free SampleSexual Wellness Products Market Size and Forecasts (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type [Condoms (Male Condoms and Female Condoms), Sex Toys (Vibrators, Dildos, Male Masturbators, and Others), OTC Contraceptives, Personal Lubricants (Water-Based, Silicone-Based, Oil-Based, and Others), Sexual Enhancement Supplements (Capsules and Tablets, Softgels, Gummies, and Other Supplements), and Others] and Distribution Channel (Supermarkets and Hypermarkets, Drug Stores and Pharmacies, Online Retail, and Others)

The World Health Organization recognizes the significance of sexual health, breaking down the stigma associated with sex. Growing government initiatives in sexual health awareness have led to more people discussing and being curious about their sex lives. For example, the School Health & Wellness Programme was introduced by the Indian government in 2020 in districts receiving government assistance. The program's goals are to raise students' understanding of sexual health issues and assist them in developing healthy lifestyle choices. Additionally, the Canadian government declared in 2019 that it will be implementing a five-year action plan to expedite initiatives related to blood-borne diseases and STD prevention, diagnosis, and treatment. These campaigns have raised consumer awareness of sexual health, which has opened up a sizable market for items that promote sexual well-being.

Consumers prefer more sleek and stylish packaging and opt for modern designs. Manufacturers of sexual wellness products need to understand the consumer inclination towards design-focused products. To draw customers and strengthen their position in the market, producers of sexual wellness products throughout the world are heavily involved in strategic development initiatives such as new launches, product development, mergers and acquisitions, and partnerships. As an illustration of their dedication to sexual well-being, Adam & Eve announced the introduction of the Playboy Pleasure toy collection in August 2023. Furthermore, Mankind Pharma announced in May 2022 the introduction of EPIC condoms, a premium line of flavored condoms. Mankind Pharma and Interactive Avenues made the launch possible by designing a Digital-First product launch and a custom campaign that encouraged the youthful, gregarious, and enthusiastic audience to #MakeItEpic.

Further, key and emerging players in the market are taking initiatives to launch innovative products to cater to the growing demand. For instance, in February 2024, Canada-based Nixit, a women-owned company, announced it would be launching a new line of external condoms designed for vaginal health. The launch was aimed at prioritizing vaginal wellness.

In addition, a few major players focus on launching their products in emerging markets. The demand for sexual wellness products in emerging economies is attributed to increasing government and NGOs initiatives to promote awareness about sexual health among consumers. For instance, in November 2023, Setu Nutrition announced the launch of Desire Boost Gummies in collaboration with MyMuse. The launch was aimed to address the growing demand for sexual wellness. Thus, strategic initiatives by key market players fuel the sexual wellness products market growth.

Based on distribution channel, the market is segmented into supermarkets and hypermarkets, drug stores and pharmacies, online retail, and others. The drug stores and pharmacies segment held a significant share in the sexual wellness products market, and the online retail segment is expected to grow considerably during the forecast period. Online platforms offer diverse choices, and customer reviews contribute to informed decision-making. Consumers appreciate the ability to browse and purchase products from the comfort of their homes, especially when seeking specific brands or specialty options not readily available in physical stores. The convenience of doorstep delivery is a significant factor, especially for those with busy schedules or limited access to physical stores. The online retail channel provides a convenient and efficient way for consumers to explore and purchase various sexual wellness products.

Bijoux Indiscrets; Church & Dwight Co., Inc; Karex Berhad; Reckitt Benckiser Group plc; Lovehoney Group; Leading Edge Health; Calexotics; Tenga; KESSEL medintim GmbH; and Adam and Eve Stores are among the major players profiled in the global sexual wellness products market report. They are focused on product innovation, expansion, merger and acquisition, and innovative marketing strategies, which are expected to open new growth opportunities in the coming years.

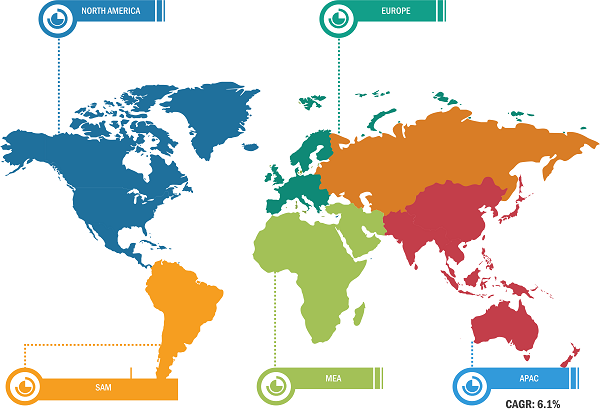

Sexual Wellness Products Market Size Breakdown – by Region

The sexual wellness products market analysis is carried out by considering the following segments: product type and distribution channel. Based on product type, the market is segmented into condoms, sex toys, OTC contraceptives, personal lubricants, sexual wellness supplements, and others. The condoms segment is further bifurcated into female condoms and male condoms. The sex toys segment is further segmented into vibrators, dildos, male masturbators, and others. The personal lubricant segment is divided into water-based, silicone-based, oil-based, and others. The market based on sexual wellness supplements is segmented into capsules and tablets, softgels, gummies, and other supplements. The market, based on distribution channel, is segmented into supermarkets and hypermarkets, drug stores and pharmacies, online retail, and others. In terms of revenue, the drug stores and pharmacies segment held a significant sexual wellness products market share in 2022.

The scope of the sexual wellness products market report covers North America (the US, Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and the Rest of Europe), Asia Pacific (China, India, Japan, Australia, South Korea, and the Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of MEA), and South & Central America (Brazil, Argentina, and the Rest of South & Central America). Among these regiions, North America held the largest sexual wellness products market share in 2022.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com