According to our latest market study on "Smart Grid Sensors Market Forecast to 2027 – COVID-19 Impact and Global Analysis – by Sensor Type (Voltage and Current Sensor, Temperature Sensor, and Others), Voltage Range (Low to Medium Voltage and High Voltage), and Application (Substation Automation, Advanced Metering Infrastructure, Smart Grid Distribution Network, and Others),” the market was valued at US$ 325.0 million in 2019 and is projected to reach US$ 1,221.6 million by 2027; it is expected to grow at a CAGR of 18.3% from 2020 to 2027.

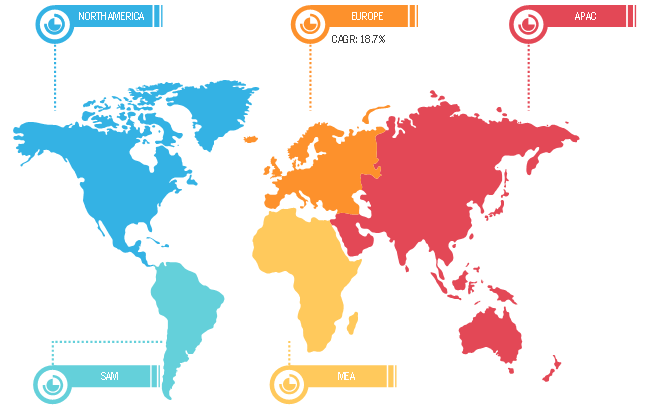

In 2019, North America led the global smart grid sensors market with the largest market share, followed by Europe and APAC. The constant technological advancements by tech giants empower North America to stay ahead in the competition. Companies operating in this region are continuously enhancing the overall business processes to meet customer demands for high-quality products and services in the best possible way. Increasing investments by the governments for the adoption of advanced metering infrastructure owing to the modernization of the electricity grid and reduce distribution as well as transmission losses is mounting the growth of the market in the region. As per the 2018 smart grid system report by the US Department of Energy, the annual smart grid investments rose by 41% from US$ 3.4 billion to US$ 4.8 billion between 2014 and 2016. These investments are anticipated to further grow up to US$ 13.8 billion in 2024. The long lifespans and high capital costs of distribution and transmission infrastructure make it extremely important that investments made would support an evolving grid for the future.

Governments across the North America are heavily investing in the development of a smart grid by planning different smart grid projects. For instance, in 2018, the Natural Resource Canada declared an investment of US$ 9,490,000 for a next-generation smart grid project that focuses on encouraging the implementation of renewable energy and the adoption of advanced technology to make use of new sources of clean energy-deprived of negotiating with the stability as well as reliability of existing grids. The American Recovery and Reinvestment Act of 2009, part of the US federal government, assigned ~US$ 3.4 billion for smart grid to utilities and ~US$ 615 million for smart grid demonstration projects. Similarly, the North American Electric Reliability Corporation, a regulatory authority, focuses on evaluating the majority transmission power system's reliability in the region. All smart grid projects demand the integration of smart grid distribution management solutions, such as supervisory control and data acquisition (SCADA). This smart grid distribution management solution requires integrating sensors into the system for large data acquisition, data security, energy counterfeit, and accurate data sensing in harsh environments.

In 2019, Europe stood second in the smart grid sensors market with a decent market share and it is anticipated to witness a steady CAGR from 2020 to 2027. The western part of Europe is known for better living standards, with people exhibiting higher income levels. The region has led the development of the industrial revolution, which has transformed a broad range of industries ranging from oil & gas to manufacturing to power generation. In power generation, the region highly focuses on building several renewable energy projects to reduce energy costs. For instance, Renewable Energy Integration Project, Turkey, empowers the reinforcement and development of transmission infrastructure to promote the integration of wind power plants into the power grid, executing smart grid investments to enhance management operations within the country. Owing to such projects, the demand for smart sensors in the energy & power sector is increasing. Moreover, these sensors offer a maximum output in a harsh environment

Companies perform inorganic market strategies to expand their footprints across the world and meet the growing demand. The smart grid sensors market players mainly focus on the acquisition strategy to expand their business and maintain a brand name in the global market. For instance, in 2020, Kamstrup partnered with Avance Metering. The partnership helped mutual clients put valuable data from Kamstrup metering solutions into business use. With this partnership, customers use their data for strategic purposes, such as enabling an easy transition from old to new intelligent metering generations.

According to the latest report from the World Health Organization (WHO), the US, India, Spain, Italy, France, Germany, the UK, Russia, Turkey, Brazil, Iran, and China are among the worst affected countries due to the COVID-19 crisis. The outbreak first began in Wuhan (China) in December 2019, and since then, it has spread at a rapid pace across the world. As per the latest WHO figures, on September 25, 2020, there were 32,029,704 confirmed COVID-19 cases with 979,212 total deaths around the world, and the number is growing at varying rates in various countries. The COVID-19 crisis is affecting the industries worldwide. The global economy is witnessing the worst hit in 2020, and it is likely to continue in 2021 also. The global energy & power industry is one of the major industries that are suffering serious disruptions due to the COVID-19 crisis, which in turn, impacts the growth of the global smart grid sensors market. Factory shutdowns, travel bans, trade bans, and border lockdowns to combat and contain the outbreak have impacted the smart grid sensors market.

Smart Grid Sensors Market - Geographic Breakdown, 2019

Smart Grid Sensors Market Dynamics and Analysis by 2031

Download Free Sample

Smart Grid Sensors Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Sensor Type (Voltage and Current Sensor, Temperature Sensor, and Others), Voltage Range (Low to Medium Voltage and High Voltage), Application (Substation Automation, Advanced Metering Infrastructure, Smart Grid Distribution Network, and Others), and Geography

Smart Grid Sensors Market Dynamics and Analysis by 2031

Download Free SampleSmart Grid Sensors Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Sensor Type (Voltage and Current Sensor, Temperature Sensor, and Others), Voltage Range (Low to Medium Voltage and High Voltage), Application (Substation Automation, Advanced Metering Infrastructure, Smart Grid Distribution Network, and Others), and Geography

The report segments the global smart grid sensors market as follows:

By Sensor Type- Voltage and Current Sensor

- Temperature Sensor

- Others

- Low to Medium Voltage

- High Voltage

- Substation Automation

- Advanced Metering Infrastructure

- Smart Grid Distribution Network

- Others

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- UK

- Russia

- Rest of Europe

- Asia Pacific (APAC)

- China

- India

- South Korea

- Japan

- Australia

- Rest of APAC

- Middle East and Africa (MEA)

- Saudi Arabia

- UAE

- South Africa

- Rest of MEA

- South America (SAM)

- Brazil

- Argentina

- Rest of SAM