Increasing Population and Rising Urbanization Bolster US Sewer and Drain Cleaning Services Market Growth

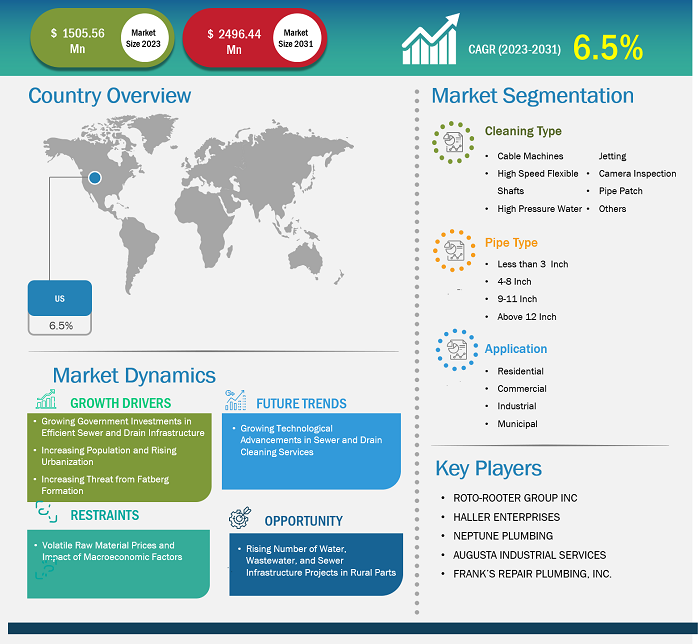

According to our latest study on "US Sewer and Drain Cleaning Services Market – Country Analysis – by Cleaning Type, Pipe Type, and End User," the market was valued at US$ 1,505.60 million in 2023 and is expected to reach US$ 2,496.40 million by 2031; it is anticipated to record a CAGR of 6.5% from 2023 to 2031. Apart from growth drivers, the report covers the US sewer and drain cleaning services market trends and their foreseeable impact during the forecast period.

Developed economies such as the US are registering population growth, which bolsters the number of commercial spaces and industrialization. According to the updated list of urban areas provided by the United States Census Bureau in December 2022, the US urban population increased by ~6.4% between 2010 and 2020. Urban areas have become denser because of urbanization, with an average population density rise from ~2,343 in 2010 to ~2,553 in 2020. As per the 2020 Census data, the western region is the most urban, with ~88.9% of its population inhabiting within an urban area, followed by the northeast region with ~84.0%. The Midwest and south regions exhibit a lower percentage of the population residing in urban sections, with rates of ~75.8% and ~74.3%, respectively. Thus, the urban standard of living requires proper, well-maintained sewer and drain infrastructure, which drives the US sewer and drain cleaning services market growth.

US Sewer and Drain Cleaning Services Market Share - by Country, 2023

US Sewer and Drain Cleaning Services Market Size and Forecast (2021 - 2031), Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Cleaning Type (Cable Machines, High Speed Flexible Shafts, High Pressure Water Jetting, Camera Inspection, Pipe Patch, and Others), Pipe Type (Less than 3 Inch, 4–8 Inch, 9–11 Inch, and Above 12 Inch), End User (Residential, Commercial, Industrial, and Municipal), and Country

US Sewer and Drain Cleaning Services Market Growth 2031

Download Free Sample

Source: The Insight Partners Analysis

According to the United States Census Bureau, more than 1.6 million people were added to the US population in 2023, and the population is reaching 334,914,895 with 0.5% growth rate. The southern part of the nation's most populated region accounted for ~87% of the nation's population growth in 2023, as the region added ~1.4 million residents for a total population of ~130,125,290. The population growth in 2023 is largely attributed to the region's migration trends, as the population increased by ~706,266 through net domestic migration. The rising population increases the demand for proper sewer and drain infrastructure, which contributes to the growing US sewer and drain cleaning services market size.

The scope of the US sewer and drain cleaning services market report includes country analysis. Increasing government focus on proper household sewer and drainage systems in urban and rural areas positively impacts the market growth. The demand for housing construction in the US is growing due to increased immigration. In 2020, the US added 140.8 million housing units, including apartments, homes, and pre-fabricated homes. Additionally, the number of renter-occupied housing units increased from 43.9 million in 2022 to 44.5 million in 2023. The US added ~514,000 new rental households in 2023. The rising population and increasing urbanization drive the growth of the sewer and drain cleaning services market in the US. The development in the construction sector and the renovation of buildings are anticipated to positively influence the US sewer and drain cleaning services market size during the forecast period.

The US sewer and drain cleaning services market analysis is based on cleaning type, pipe type, and end user. Based on end user, the market is segmented into residential, commercial, industrial, and municipal. Growing population and urbanization and rising government focus on rural development drive the market growth for commercial segment. Furthermore, the commercial segment is anticipated to hold a significant US sewer and drain cleaning services market share during the forecast period.

The increasing concern for environmental pollution is encouraging the utilization of proper sewer and drain cleaning services in different commercial construction projects such as industrial buildings, malls, tunnels, airports, retail stores, warehouses, and restaurants. Commercial building sewers can gather various types of debris, including solid waste and plastics. With time, these components can stock up and create blockages in the pipeline. Blockages disturb the sewer operations, and they can also collapse the drainage system, resulting in huge damage and costly repairs. Periodic inspection and proper maintenance can reduce the risk of pipe leakage and blockage that might disrupt the proper flow of wastewater in the drainage system. The growing construction of commercial buildings and offices is anticipated to propel the growth of the US sewer and drain cleaning services market during the forecast period.

Municipal sewers can gather numerous types of debris, including sediment, mineral deposits, grease, roots, solid waste roots, and cave-ins. Most of the sewer problems occur in 4–18-inch sewer pipes, which account for almost ~95% of all the pipes installed in the ground across the US. Municipal drain and sewer systems are complex and much larger than residential systems. Municipal sewer and drain cleaning services include trenchless pipe cleaning activities, camera inspection and reporting, pipeline leak detection, and blockage removal. Growing concern toward mitigating pollution and increasing government focus on establishing a systematic drainage system is anticipated to propel the growth of the sewer and drain cleaning services market in the US during the forecast period. The US Department of Agriculture Rural Development forms partnerships with rural communities by funding projects that bring community facilities, housing, utilities, and other services to rural America. Such partnerships also act as major drivers for the US sewer and drain cleaning market expansion.

Based on cleaning type, the US sewer and drain cleaning services market is segmented into cable machines, high-speed flexible shafts, high-pressure water jetting, camera inspection, pipe patch, and others. The pipe patch segment is anticipated to hold a significant market share during the forecast period. Pipe patches are applied for spot repairs along a pipe to fix an exact issue where full-length repair is not required. Pipe patches are often created from a cured-in-place-pipe material, such as a glass fiber patch that is intensified with fast-curing Resin during installation. Fiberglass liner material appears to be a durable reinforcement for the damaged pipe. Additionally, resins are employed to bond the liner material to the damaged pipe and construct a reliable seal. A bladder is also considered a material for pipe patching. Bladders are injected into the damaged pipe and expanded to press the liner material alongside the inner wall of the pipe, confirming a compact fit. A pipe patch is a useful solution and can be leveraged to repair pipes made out of any material frequently used in commercial or residential drain, waste, and vent systems.

The US sewer and drain cleaning services market comprises well-established and industry-recognized players as well as emerging or private players. The market players compete with each other on various parameters such as cost, time, and additional services. All these parameters boost the competitiveness among the market players and keep a prominent level of competitive rivalry among the US sewer and drain cleaning services market players. Modern Plumbing Industries, Inc.; Drains By James Inc; Mr. Rooter; Mr. Drain Inc; Bob Oates; ZOOM DRAIN; Top Notch Sewer & Drain Cleaning, Inc.; Roto-Rooter Group Inc; Haller Enterprises; Neptune Plumbing; Augusta Industrial Services; and Frank’s Repair Plumbing, Inc. are among the key players profiled in the US sewer and drain cleaning services market report. The companies implement organic (such as product launches, expansion, and product approvals) and inorganic (such as collaborations and partnerships) strategies to stay competitive in the market.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com