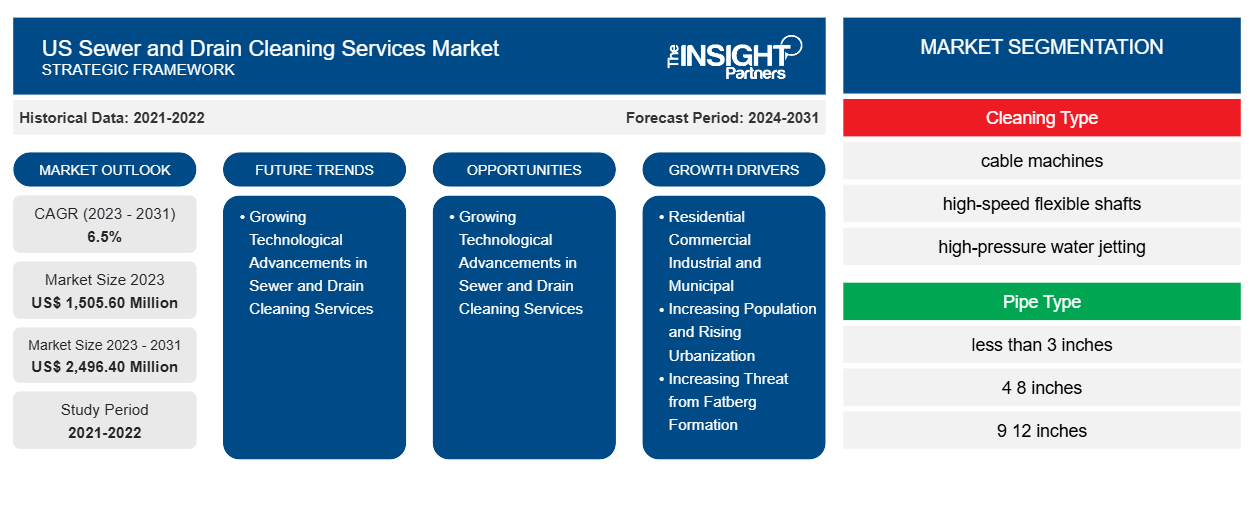

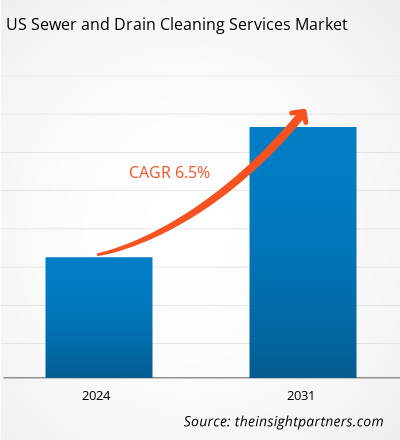

The US sewer and drain cleaning services market was valued at US$ 1,505.60 million in 2023 and is projected to reach US$ 2,496.40 million by 2031; the market is expected to register a CAGR of 6.5% during 2023–2031.

Analyst Perspective:

Major stakeholders in the US sewer and drain cleaning services market ecosystem are equipment providers, service providers, and end users. RIDGID Inc, Nilfisk Holding AS, Spartan Tool LLC, Gator Drain Tools, Gorlitz Sewer & Drain Inc, Flowplant Group Ltd, Australian Pump Industries, Duracable Manufacturing Co, Electric Eel Manufacturing Co Inc., and Goodway Technologies Corp. are among the notable equipment manufacturers in the US. The service providers procure drain cleaning equipment such as hand tools, sink machines, sectional machines, rodders, jetters, push rod cameras, location equipment, and flexible shaft machines from equipment manufacturers. These service providers, with the help of marketing, reach end users such as residential, commercial, industrial, and municipal. On average, the service providers charge ~US$ 300–1,000 for the residential end users for hydro jet service, whereas the cost increases to US$ 600–3,300 for the commercial end users. This cost changes according to the type of equipment used or service offerings. For instance, to clean a sewer line with a snake drain, the service provider charges from US$ 150 to 500. One of the notable service providers in the industry is Roto Rooters. The company has covered more than 90% of the total US and 40% of the total locations across Canada. Roto Rooters holds one of the major US sewer and drain cleaning services market share. Apart from Roto Rooters, a few of the other notable service providers in the US sewer and drain cleaning services market are Benjamin Franklin Plumbing; Haller Enterprises; Hirschberg Mechanical; Frank’s Repair Plumbing, Inc.; Tasco Plumbing Corp; BEHLE INC; Wayne’s Drains; Augusta Industrial Services; and Neptune Plumbing.

Market Overview:

The growing urbanization and rapid industrialization in the US drive the development of the plumbing industry. Increasing infrastructure development owing to the rising number of schools, universities, housing apartments, and commercial office construction also boosts the requirement for plumbing services, which is contributing to the growing US sewer and drain cleaning services market size.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

US Sewer and Drain Cleaning Services Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

US Sewer and Drain Cleaning Services Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Driver:

Growing Government Investments in Efficient Sewer and Drain Infrastructure Boost US Sewer and Drain Cleaning Services Market Growth

The adoption of new machinery such as sewage cleaners, drain management machines, and other required equipment is rising with increasing urbanization. The US government has been pushing their investment limits to support their municipal departments with a better drainage system, which also allows them to keep their respective states cleaner. In July 2023, the Gatesville City Council in the US (Texas) announced its approval for the purchase of a trailer-mounted sewer machine worth US$ 87,642.64. Such procurements and initiatives have been pushing the adoption of sewer and drain cleaning services across the US, fueling the US sewer and drain cleaning services market growth.

A poorly maintained sewage infrastructure could negatively impact individuals' quality of health and wellness. Additionally, the lack of competent waste management and drain cleaning services could lead to several infections, diseases, and harmful components affecting the individual and compromising public safety. Thus, the US government and private agencies have educated the masses about the importance of competent management of waste and maintenance of sewer and drain infrastructure across commercial and residential units. The US government has been investing heavily in developing new sewer and drainage infrastructure and the upgradation of old sewage infrastructure. In 2020, the US Secretary of Commerce announced grants worth US$ 1.6 million to the Alabama government to improve stormwater drainage infrastructure. In 2023, the Tennessee Department of Environment and Conservation announced ~131 grants to improve water management infrastructure; one of the grants was given to the town of Nolensville to develop open channels, closed drainage systems, cross-drain culverts, and bridges. In January 2023, the EPA announced a US$ 500 million loan to improve wastewater and drinking water infrastructure in New Jersey. In January 2024, The Michigan Department of Environment, Great Lakes, and Energy announced grants worth US$ 67.1 million for the MI Clean Water Plan to help Michigan communities in advancing its water infrastructure. The main object of the project is to reduce sewage overflows into Lake St. Clair, and proper maintenance of drinking water service lines in several communities. The existing water systems across the US are grappling with the challenges posed by aging pipelines, treatment plants, and distribution networks, which are boosting the demand for sewer and drain cleaning services across the US. Government investments in drainage and wastewater projects have upsurged the usage of sewer and drain systems and the development of new drain networks, contributing to the growing US sewer and drain cleaning services market size.

Segmental Analysis:

The US sewer and drain cleaning services market analysis is carried out on the basis of the following segments: cleaning type, pipe type, and end user. Based on cleaning type, the market is segmented into cable machines, high-speed flexible shafts, high-pressure water jetting, camera inspection, pipe patch, and others. High sanitation standards and strict hygiene rules and regulations in the US boost the market growth. Furthermore, the pipe patch segment is anticipated to hold a significant US sewer and drain cleaning services market share during the forecast period.

Regional Analysis:

The scope of the US sewer and drain cleaning services market report encompasses the US. Growing government funding and initiatives toward the development of drainage systems in the rural part of the country are posing opportunities for sewer and drain cleaning service providers. Additionally, the growing number of water and wastewater treatment plants and increasing sewer infrastructure projects are acting as a major driver for the US sewer and drain cleaning services market. In March 2024, the US Department of Agriculture Rural Development announced a contribution of US$ 16.9 million for water and sewer development projects in rural Michigan. In April 2024, the US government announced US$ 320 million for the development of Tribal Domestic Water Infrastructure. In February 2024, the US government invested US$ 772.6 million across 216 projects in 45 states, Puerto Rico, and the Northern Mariana Islands. Further, US$ 644.2 million is committed to strengthening rural utilities, allowing 158 projects to offer wastewater systems for over ~900,000 individuals. In 2023, Massachusetts secured more than US$ 260 million for upgrading sewer and water infrastructure. The major share of the funding came from the US government’s US$ 1 trillion infrastructure law, authorized in November 2021, along with the American Rescue Plan Act, which assigns nearly US$ 2 trillion in funding for several infrastructure projects across the US. The city of Haverhill secured more than US$ 12.8 million in 2023 for upgrading water and sewer infrastructure. In addition, the city of Lawrence secured US$ 6.8 million for several stormwater and sewer projects.

Key Player Analysis:

Modern Plumbing Industries, Inc.; Drains By James Inc; Mr. Rooter; Mr. Drain Inc; Bob Oates; ZOOM DRAIN; Top Notch Sewer & Drain Cleaning, Inc.; Roto-Rooter Group Inc; Haller Enterprises; Neptune Plumbing; Augusta Industrial Services; and Frank’s Repair Plumbing, Inc. are among the key players profiled in the US sewer and drain cleaning services market report. The report includes growth prospects in light of current US sewer and drain cleaning services market trends and driving factors influencing the market growth.

Recent Developments:

Following are a few recent developments by the US sewer and drain cleaning services market players, as per their press releases:

Year | News |

March 2024 | A.J. Alberts expanded its plumbing offerings to include drain cleaning. The 35-year-old family-run business began its operations in plumbing, remodeling, and new construction. Over their career, they have built up a following of loyal customers and an extensive showroom for plumbing products and fixtures. Now, AJ Alberts's customers can schedule their stand-out drain cleaning with the same plumber they have come to trust over the years. |

February 2024 | Seacoast Service Partners (SSP), a platform formed by White Wolf Capital Group (White Wolf) dedicated to providing top-tier plumbing, HVAC (Heating, Ventilation, and Air Conditioning), and refrigeration services across the Southeastern United States, announced its acquisition of GMS Sheet Metal and Air Conditioning (GMS), the platform’s fourth acquisition. |

April 2024 | Orion Group (Orion), a commercial facility services business, announced their partnership with L.A. Hydro-Jet & Rooter Service (L.A. Hydro-Jet). L.A. Hydro-Jet is a leading plumbing business offering drain cleaning, jetting, and sewer repair solutions to commercial facilities throughout Southern California. Orion is building leading national providers by partnering with exceptional family-owned facility services businesses and by providing resources to help fuel their next chapter of growth. L.A. Hydro-Jet joins Orion’s national light mechanical service provider, Helios Service Partners, further expanding the business’ service breadth and geographic reach. Imperial Capital acted as an exclusive advisor to L.A. Hydro-Jet throughout the partnership process. |

US Sewer and Drain Cleaning Services Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 1,505.60 Million |

| Market Size by 2031 | US$ 2,496.40 Million |

| CAGR (2023 - 2031) | 6.5% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Cleaning Type

|

| Regions and Countries Covered | US

|

| Market leaders and key company profiles |

|

US Sewer and Drain Cleaning Services Market Players Density: Understanding Its Impact on Business Dynamics

The US Sewer and Drain Cleaning Services Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the US Sewer and Drain Cleaning Services Market top key players overview

Frequently Asked Questions

Who are the major vendors in the US sewer and drain cleaning services market?

What are market opportunities for the US sewer and drain cleaning services market?

What are reasons behind the US sewer and drain cleaning services market growth?

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For