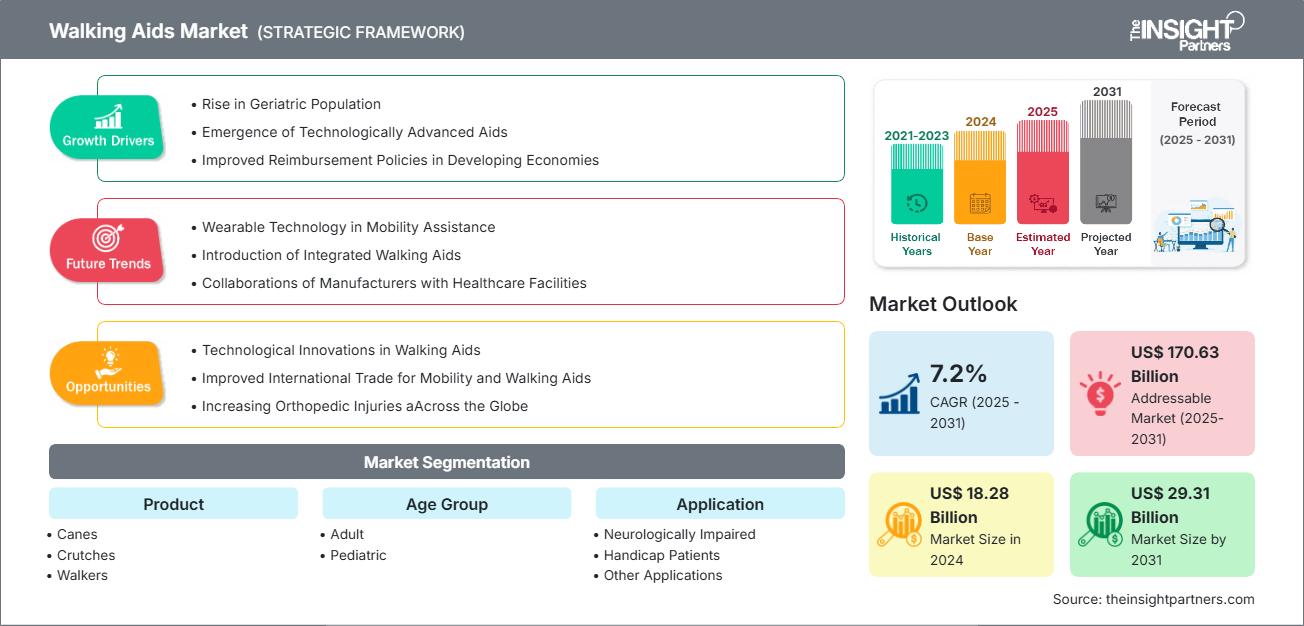

Walking Aids Market Size, Share & Growth Forecast 2025-2031

Walking Aids Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product (Canes, Crutches, Walkers, Rollators, and Others), Age Group (Adults and Pediatric), Application (Neurologically Impaired, Handicap Patients, and Others), End User (Homecare, Hospitals and Clinics, Rehabilitation Centers, and Others), and Distribution Channel (Online and Offline)

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : Aug 2025

- Report Code : TIPRE00040982

- Category : Life Sciences

- Status : Published

- Available Report Formats :

- No. of Pages : 242

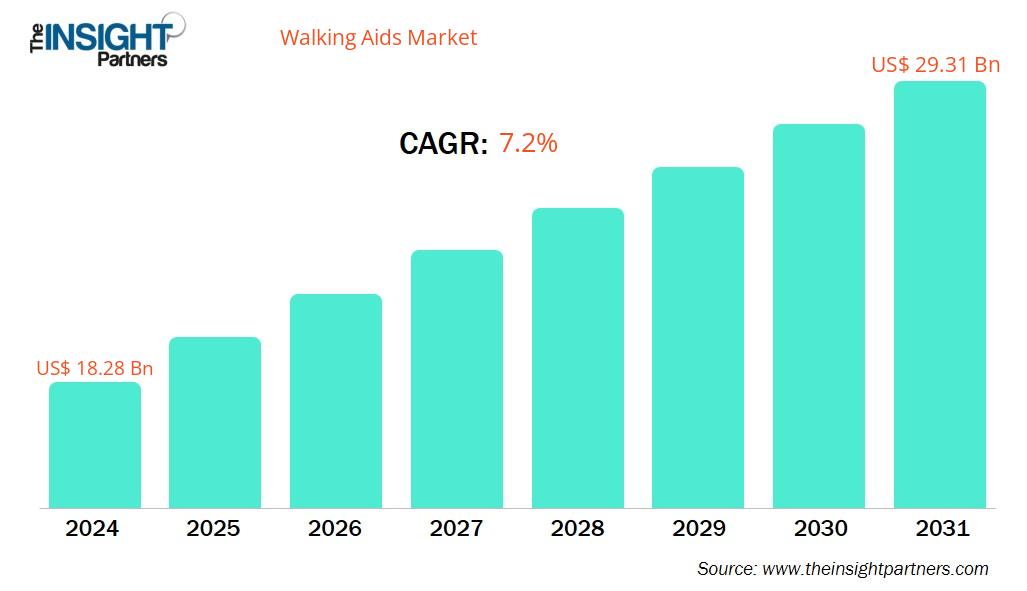

The Walking Aids Market size is projected to reach US$ 29.31 billion by 2031 from US$ 18.28 billion in 2024. The market is expected to register a CAGR of 7.2% from 2025 to 2031.

Walking Aids Market Analysis

The walking aids market is growing steadily globally, fueled by an aging population, growing incidence of mobility conditions, and rising need for rehabilitation options. The latest product developments in lightweight, foldable, and smart walking aids with sensor technologies are boosting user safety and convenience. Encouraging healthcare policies, government incentives, and increasing awareness are driving access, particularly in developed markets. E-commerce and growth in home healthcare further fuel market penetration. Europe and North America lead, with Asia Pacific indicating strong potential due to demographic changes and enhancing healthcare infrastructure. The market is confronted by challenges such as affordability and restricted access in developing markets.

Walking Aids Market Overview

The geographic scope of the walking aids market report mainly focuses on five regions: North America, Asia Pacific, Europe, South & Central America, and the Middle East & Africa. In terms of revenue, North America dominated the market in 2024. The rising prevalence of disabilities and chronic diseases among adults is the primary factor driving the growth of the walking aids market in the US. According to the Centers for Disease Control and Prevention (CDC) reports, ~12.1% of US adults have a mobility disability and have serious difficulty climbing and walking. Moreover, the country is observing a rise in the aging population. According to the US Census Bureau, by 2030, baby boomers in the country will be over 65, with a projected 20% of the population being senior citizens. This demographic transition increases the prevalence of mobility impairments, which creates a tremendous demand for walking aids such as walkers, canes, and crutches.

Established organizations, such as AARP (American Association of Retired Persons), have supported accessibility solutions for seniors, eventually influencing public policy and funding to improve mobility solutions. Their current initiatives and collaborations with healthcare providers emphasize the urgent need for enhanced mobility options for elders.

The country is observing an increasing initiative toward self-sustaining and environmentally friendly walking aids, which aligns with the comprehensive environmental objectives in the US. Moreover, there has been a notable move regarding the adoption of walking aids within smart city design. Cities are changing toward more unbiased frameworks, with improved public transit services and more walkable features, enabling easy access for people with mobility challenges.

Manufacturers are developing cutting-edge technologies to improve mobility devices' safety, performance, and comfort. They are rapidly innovating in lightweight materials, connectivity features, battery technology, and ergonomic designs. For instance, in April 2025, WeWalk launched Smart Cane 2.0 at CES 2025, adding lidar obstacle detection, haptic alerts, and Bluetooth navigation to its assistive-tech line.

Regulations play a critical role in boosting the market. Government organizations such as the Federal Trade Commission (FTC) and the Food and Drug Administration (FDA) have established policies and standards to ensure personal mobility device safety, quality, and efficacy. Compliance with regulatory needs is vital for manufacturers to acquire market approval and maintain consumer trust. In addition to federal and state rules, mobility devices are subject to industry norms. These standards are developed by organizations such as UL (Underwriters Laboratories), ASTM (American Society for Testing and Materials), and ANSI (American National Standards Institute).

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONWalking Aids Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Walking Aids Market Drivers and Opportunities

Market Drivers:

- Rise in Geriatric Population: In 2023, the US Census Bureau reported that approximately 16.9% of the US population was aged 65 and older, and the share is anticipated to reach 20% by 2030. Elderly individuals may require personal walking devices to maintain independence and quality of life. This demographic shift puts immense pressure on healthcare systems and social infrastructure, fostering a change toward in-home and outpatient care where walking aids enable independence, reduce falls, and delay or prevent hospitalization. In Asia, the elderly population is predicted to reach 923 million by mid-century. Chronic conditions such as diabetes and osteoarthritis often restrict movement long before the age of retirement.

- Surge in Mobility Impairment from Traumatic Injuries: Increased cases of mobility impairment due to accidents, falls, and sports injuries are creating growing demand for walking aids, as patients need short- and long-term support for rehabilitation, recovery, and independence during healing.

- Rise in Chronic and Neurological Conditions: Increasing occurrence of chronic diseases such as arthritis, Parkinson's, and stroke is driving demand for mobility aids. These diseases often result in long-term gait instability, making daily movement, therapy, and preventing falls possible with trustworthy walking devices.

Market Opportunities:

- Government Programs Encouraging Use of Assistive Devices: Subsidies and procurement incentives reduce costs and risks for users and providers, stimulating manufacturers and healthcare systems to innovate and introduce affordable, durable, and context-appropriate walking aids. Simultaneously, training programs such as WHO's TAP equip frontline healthcare workers in Ghana and Fiji to prescribe and maintain walking aids, boosting their legitimacy in public health. Hence, government-led programs—ranging from international resolutions to national subsidy schemes, regulatory mandates, insurance reimbursements, and public-private partnerships—actively dismantle barriers to walking aid access. These initiatives enhance affordability, distribution, device quality, and user education, propelling the walking aids market toward sustained growth.

- Home Healthcare & Rehabilitation Expansion: The movement towards home care and outpatient rehab is fueling the demand for simple-to-use walking canes. Elderly users and patients increasingly opt for recovery at home, accelerating sales of portable, ergonomic models appropriate for independent and assisted mobility.

- Emerging & Aging Markets in Asia-Pacific & South and Central America: In Asia-Pacific and South and Central America, rapid aging, increased health consciousness, and enhanced infrastructure are driving demand for walking aids that are affordable. Increasing middle-class consumers and government-backed support are opening up new avenues for manufacturers in these underpenetrated markets.

Walking Aids Market Report Segmentation Analysis

The walking aids market is divided into different segments to give a clearer view of how it works, its growth potential, and the latest trends. Below is the standard segmentation approach used in most industry reports:

By Product:

- Canes: Canes, also known as walking sticks or assistive canes, help individuals experiencing minor problems with balance or stability. They also assist individuals with mobility challenges to improve their balance and stability. Innovative designs and smart features have made canes more appealing and functional, broadening their user base. In October 2024, WeWALK launched Smart Cane 2, which integrates a GPT-powered voice assistant for real-time navigation, public transport information, and nearby points of interest. It also offers turn-by-turn guidance and menu reading capabilities. Therefore, the increasing demand of canes among the ageing and disabled population and new product launches is responsible for the market growth

- Crutches: Crutches are medical devices designed to assist users with walking by transferring body weight from the legs to the torso and arms. Ergonomics is another key driver of innovation, encouraging the development of crutches with improved grips, forearm cuffs, and shock-absorbing tips. These features help minimize fatigue, reduce nerve compression, and prevent secondary injuries. Additionally, forearm and platform crutches designed for better weight distribution and stability are becoming more popular. Therefore, the rising prevalence of neurological disorders and lower-extremity injuries, coupled with the availability of innovative crutches, favors the growth of the walking aids market for crutches

- Walkers: Walkers are mobility aids used by individuals with difficulty walking due to injuries, weakness, or other medical conditions. The increasing incidence of disorders that impair lower extremity mobility, ranging from musculoskeletal conditions and neurological diseases to traumatic injuries, is a significant catalyst fueling the expansion of the market for the walkers segment. In November 2024, IM by TotalCare Europe expanded its range of walkers by introducing the new Forum model. This innovative walker combines the functionality of a shopping cart with that of a traditional walker and features a double high-capacity basket.

- Rollators: A rollator is a mobility aid designed to assist individuals with walking difficulties by providing stability, support, and greater independence. Rollators are equipped with three or four wheels, handlebars for steering, hand brakes, and usually a built-in seat for resting. They often come with storage options such as baskets or bags, allowing users to carry personal items conveniently. Benefits such as ergonomic features, enhanced mobility and maneuverability, and customizability offered by rollators boost their adoption among the geriatric population and individuals with impaired mobility for support.

- Others: The others segment includes gait trainers and exoskeletons. These specialized devices help individuals with significant mobility impairments learn, relearn, or improve their walking skills. Gait trainers, either manual or robotic, are supportive devices that assist users in standing, bearing weight, and practicing stepping. They facilitate the relearning of gait patterns. Further, exoskeletons are advanced wearable robots that can move the legs for or with the user.

By Age Group:

- Adult: The adult population is increasingly driving the walking aids market as more individuals under 65 face mobility challenges due to injuries, chronic conditions, or neurological disorders. Many adults in their 20s to 50s are turning to devices like rollators, canes, and walkers not just for long-term disabilities but for short-term recovery after surgeries or accidents. For instance, individuals with Ehlers-Danlos syndrome or POTS often begin using walkers in their 20s to manage instability or fatigue during daily tasks. One user shared their experience of using a rollator at age 27 to enjoy outings like fairs and parks again, highlighting how walking aids can restore independence.

- Pediatric: The pediatric population is increasingly driving demand for walking aids particularly among children with cerebral palsy or other mobility-impaired conditions whose early introduction of devices like chest‑support walkers, gait trainers, or posterior walkers supports balance, posture, and independence. For example, UK clinicians report prescribing support walkers to children as young as 1–2½ years old, often between ages 3–6, to help bridge toward independent walking and boost participation in school and community settings.

By Application:

- Neurologically Impaired: Neurological conditions such as dementia, Alzheimer, and Parkinson’s have a direct impact on the mobility of the patient. As per the European Academy of Neurology (EAN), ~60% of the European population suffers from neurological diseases. According to Alzheimer Europe, the number of people living with dementia is expected to increase to 14,298,671 in the EU27 by 2050 from the estimated 7,853,705 in 2019. In Europe, dementia is a growing public health concern among the aging populace. Therefore, the growing prevalence of neurological disorders is consequently propelling the demand for wheelchairs.

- Handicap Patients: In Europe, the prevalence of disability varies, with WHO estimates indicating that over 100 million people live with a disability. This accounts for approximately 27% of the EU population aged 16 and older, according to Consilium.europa.eu. The prevalence of disability is on the rise due to factors such as an aging population and an increase in chronic health conditions. Additionally, disability rates differ between countries. For instance, in 2023, Belgium had the highest proportion of people with disabilities among EU countries at 27.8%, while Romania had the lowest at 7.6%, according to Eurostat. Therefore, assistive technologies play a vital role in supporting individuals with disabilities, fostering greater independence and participation in society.

- Other Applications: Other applications include general hospital usage, such as patient movement and assistance for patients with temporary disabilities. According to data from the European Association for Injury Prevention and Safety Promotion, over 33 million individuals seek care annually at Accident and Emergency departments across more than 1,000 acute care hospitals in the European Union.

By End User:

- Homecare: The use of walking aids in home care is rapidly growing in globally, propelled by several key drivers and recent product innovations. The primary factors include aging population, increased prevalence of chronic and post-surgical conditions, and a strong policy push toward aging in place and home-based rehabilitation, particularly evident in countries like Germany, where statutory health insurance supports home rehabilitation with specialized devices.

- Hospitals and Clinics: Wheelchairs are easily accessible in hospitals and clinics for both patients and visitors who may need them. These facilities often offer wheelchair services, typically through referrals from healthcare professionals such as general practitioners (GPs) or physiotherapists. Wheelchairs are designed to accommodate a range of needs, including those that require extra postural support as well as those for general mobility.

- Homecare: The rehabilitation centers refer to the healthcare facility that offers unique and individual programs for the betterment of patients with chronic conditions. According to the WHO, in the European Region, 394 million people—almost half of the population—live with a health condition that requires rehabilitation care. These rehabilitation centers provide services such as physical therapy, rehabilitation, and occupational therapy.

- Rehabilitation Centers: The rehabilitation centers refer to the healthcare facility that offers unique and individual programs for the betterment of patients with chronic conditions. According to the WHO, in the European Region, 394 million people—almost half of the population—live with a health condition that requires rehabilitation care. These rehabilitation centers provide services such as physical therapy, rehabilitation, and occupational therapy.

- Others: The "Others" category in the walking aids market by end user includes ambulatory surgical center (ASC) and institutions and environments outside traditional healthcare and home settings. This segment covers nursing homes, long-term care facilities, elderly care centers, special education schools, community health programs, and NGOs that support mobility-impaired individuals. It may also include public infrastructure settings like airports, malls, and transportation hubs offering rental or shared-use mobility aids. These users prioritize durability, ease of maintenance, and cost-effective solutions. As aging populations rise and public accessibility improves, demand from this diverse category continues to grow, contributing significantly to overall market expansion.

By Distribution Channel:

- Online: The online distribution of walking aids has significantly increased in recent past, transforming consumer access to mobility solutions. This shift is driven by consumers' preference for e-commerce, which provides convenience by allowing them to compare prices, review product features, and read customer feedback from the comfort of their homes. Online platforms such as Amazon and Walmart, and specialized retailers such as Vitality Medical and SpinLife have extended their selections of walkers, rollators, canes, and advanced technological aids (e.g., exoskeletons), making these products available to a broadened audience. Major manufacturers, e.g., Drive Medical and Invacare Corporation, utilizing direct-to-consumer e-commerce models to connect with individuals seeking specialized mobility aids.

- Offline: Pharmacies, medical supply stores, and healthcare facilities are the main offline points of sale of walking aids. Large pharmacy chains in North America and Europe, such as CVS, Walgreens, Boots, and Best Buy Health, continue to serve as important retail hubs that make various walking assistive devices accessible to customers. They also provide them with professional recommendations and access to fitting sessions. Hospitals and rehabilitation centers directly prescribe and supply walking aids to patients recovering from surgeries, injuries, or other chronic conditions, extending accessibility and inculcating trust in these devices. This hands-on approach fosters consumer confidence and improves proper device selection and fitting, leading to higher user satisfaction and consistent adoption. As the market expands—boosted by demographic trends, namely population aging and surge in orthopedic procedures—offline distribution provides a critical link for consumers who are less comfortable with online shopping or who require specialized products.

By Geography:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

The walking aids market in North America is expected to hold a significant share of the market. Rise in geriatric population and mobility impairment from traumatic injuries and business expansion strategies by the market players are factors likely to drive the market.

Walking Aids Market Regional InsightsThe regional trends and factors influencing the Walking Aids Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Walking Aids Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Walking Aids Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 18.28 Billion |

| Market Size by 2031 | US$ 29.31 Billion |

| Global CAGR (2025 - 2031) | 7.2% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Walking Aids Market Players Density: Understanding Its Impact on Business Dynamics

The Walking Aids Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Walking Aids Market top key players overview

Walking Aids Market Share Analysis by Geography

Asia Pacific is expected to grow the fastest in the next few years. Emerging markets in Latin America, the Middle East, and Africa also have many untapped opportunities for walking aids providers to expand.

The walking aids market grows differently in each region. This is because of factors like rise in geriatric population and mobility impairment from traumatic injuries. Below is a summary of market share and trends by region:

1. North America

- Market Share: Holds a significant portion of the global market

-

Key Drivers:

- Aging population with increasing prevalence of mobility disorders and arthritis.

- Strong presence of major market players and advanced healthcare infrastructure

- High adoption of connected and smart walking aids

-

Trends:

Growing use of technology-enabled walking aids.

2. Europe

- Market Share: Substantial share due to government funding

-

Key Drivers:

- Growing elderly population and support of public healthcare

- Government funding for elderly mobility programs and disability aids

- Trends: Shift toward design-conscious and customized walking aids for aged users looking for comfort and aesthetics

3. Asia Pacific

- Market Share: Fastest-growing region with rising market share every year

-

Key Drivers:

- Rapidly aging population in countries like China and Japan

- Growing awareness of rehabilitation and elderly care.

- Trends: Emerging focus on affordable and portable walking aids for urban and semi-urban home care settings

4. South and Central America

- Market Share: Growing market with steady progress

-

Key Drivers:

- Growing aging population and rise in chronic diseases

- Enhancing awareness of assistive mobility solutions

- Trends: Adoption of imported and branded walking aids through private healthcare channels and online distribution

5. Middle East and Africa

- Market Share: Although small, but growing quickly

-

Key Drivers:

- Gradual improvement in healthcare access and disability care

- Rising prevalence of injuries and diabetes-related mobility issues

- Trends: Development of basic, cost-effective walking aids to serve underserved and rural populations.

Walking Aids Market Players Density: Understanding Its Impact on Business Dynamics

High Market Density and Competition

Competition is strong due to the presence of established players such as Sunrise Medical, NOVA Ortho-Med Inc, HOGGI GmbH, Karma Medical Products Co LTD, Drive Devilbiss Healthcare Ltd, MEYRA GMBH, Merits Health Products Co Ltd, Invacare Corp, Medline Industries LP, and Carex Health Brands Inc are also adding to the competitive landscape across different regions.

This high level of competition urges companies to stand out by offering:

- Advanced Products

- Value-added services like customization and sustainable solutions

- Competitive pricing models

- Compliance with regulatory guidelines

Opportunities and Strategic Moves

- Companies are launching lightweight, smart, and multi-functional, walking aids to meet evolving comfort and mobility requirements of across all the age groups.

- Collaborating with rehabilitation centers, hospitals, and insurers enables better product penetration and presence of brand in clinical and home-care settings.

- Companies are investing in online platforms and online education to reach tech-savvy users and enhance accessibility in remote regions.

Major Companies operating in the Walking Aids Market are:

- Sunrise Medical

- NOVA Ortho-Med Inc

- HOGGI GmbH

- Karma Medical Products Co LTD

- Drive Devilbiss Healthcare Ltd

- MEYRA GMBH

- Merits Health Products Co Ltd

- Invacare Corp

- Medline Industries LP

- Carex Health Brands Inc

Disclaimer: The companies listed above are not ranked in any particular order.

Other companies analysed during the course of research:

- Ottobock SE & Co. KGaA

- Ekso Bionics Holdings Inc.

- Cadence Biomedical (Kickstart™ device)

- Permobil AB

- GF Health Products, Inc.

- Pride Mobility Products Corp.

- ReWalk Robotics

- Topro Industri AS

- Ossenberg GmbH

- Human Care HC AB

- Benmor Medical Ltd

- Graham Field Health Products, Inc.

- Ergo Agil

- Kaye Products, Inc.

- Stander Inc.

- Roma Medical Aids Ltd.

- Yuwell Group

- Authority Medical Group

- RIHA Industries

- The FlexSTICK Company

Walking Aids Market News and Recent Developments

- Drive DeVilbiss Healthcare (DDH) announced that it has acquired the product line of De Oro Devices Drive DeVilbiss Healthcare (DDH) announced that it has acquired the product line of De Oro Devices, the California-based company behind NexStride, a groundbreaking mobility aid designed to help people with Parkinson’s disease and other mobility-limiting conditions walk with greater safety and confidence.

- King’s College Hospital NHS Foundation Trust has launched a walking aids return scheme King’s College Hospital NHS Foundation Trust has launched a walking aids return scheme. This initiative will benefit the environment by reducing waste and carbon emissions while also generating cost savings and improving patient access to walking aids.

Walking Aids Market Report Coverage and Deliverables

The "Walking Aids Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Walking aids Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Walking aids Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Walking aids Market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the walking aids Market

- Detailed company profiles

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For