Increasing Number of Banks to Provide Growth Opportunities for WealthTech Solution Market during 2021–2028

According to our latest market study on “WealthTech Solution Market Forecast to 2028 – COVID-19 Impact and Global Analysis – by Component, End User, Organization Size, and Deployment Mode,” the market is expected to grow from US$ 54.62 million in 2021 to US$ 137.44 million by 2028; it is estimated to grow at a CAGR of 14.1% from 2021 to 2028.

According to US Bank Locations website data, North America has ~4,976 total banks as of March 2021; as per Statista data, Europe had 5,963 banks in total in January 2020; and according to Bankinfobook website data, Asia Pacific has ~1,900 banks, with ~300,000 branches, as of 2021. Thus, with the growing number of banks and their branches worldwide, the use of banking software has also increased. For instance, in February 2021, the Allahabad Bank, India, integrated core banking solutions/interactive telling machine (CBS/ITMS) software. Further, the WealthTech solutions are majorly used for retail banking and private banking. The importance of investment advisory services, portfolio analysis and portfolio reporting, portfolio risk management, and wealth management solutions in retail banking is increasing continuously. A few companies offering WealthTech solutions for retail banks are aixigo AG; InvestCloud, Inc.; Valuefy Solutions Private Limited; and InvestSuite. Thus, the growing number of banks worldwide is expected to fuel the WealthTech solution market growth in the coming years.

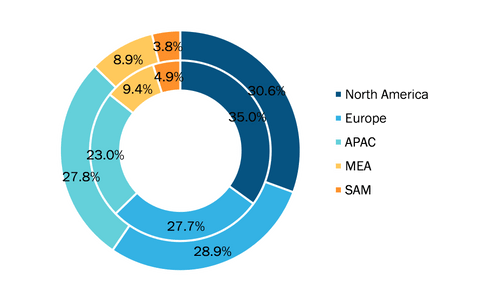

Based on component, the wealthtech solution market is bifurcated into solution and services. In 2020, the solution segment led the market, accounting for a larger share in the market. By end user, the wealthtech solution market is segmented into banks, wealth management firms, and others. In 2020, the wealth management firms segment accounted for the largest market share. Based on organization size, the wealthtech solution market is bifurcated into large enterprises and small and medium-sized enterprises. In 2020, the large enterprises segment accounted for a larger market share. By deployment mode, the market is bifurcated into cloud-based and on-premises. In 2020, the cloud-based segment accounted for a larger market share. Geographically, the market is broadly segmented into North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South America (SAM). In 2020, North America accounted for a significant share in the global market.

Impact of COVID-19 Pandemic on WealthTech Solution Market

According to latest situation report from the World Health Organization (WHO), the US, India, Spain, Austria, France, Germany, the UK, Switzerland, Turkey, Brazil, Iran, and China are among the worst affected countries due to the COVID-19 outbreak. The outbreak crisis is affecting the industries worldwide and the global economy witnessed worst hit in 2020 and it is continued in 2021 also. The outbreak has created significant disruptions in primary industries, such as food & beverage, medical, energy & power, electronics & semiconductor, petroleum, and chemicals. A sharp decline in the growth of mentioned industrial activities is impacting the growth of the global Wealthtech solution market as they are the major supply and demand sources for wealthtech solution products and solutions.

FinMason, Inc.; aixigo AG; InvestCloud, Inc.; WealthTechs Inc.; Valuefy Solutions Private Limited; 3rd-eyes analytics AG; BlackRock, Inc.; Synechron; Wealthfront Inc.; and InvestSuite are among the major companies operating in the wealthtech solution market.

WealthTech Solution Market — by Geography, 2020 and 2028 (%)

WealthTech Solution Market Growth Report and Size by 2031

Download Free Sample

WealthTech Solution Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component (Solution and Services), End User (Banks, Wealth Management Firms, and Others), Organization Size (Large Enterprises and Small and Medium-Sized Enterprises), and Deployment Mode (Cloud-Based and On-Premises), and Geography

Contact UsWealthTech Solution Market Growth Report and Size by 2031

Download Free SampleWealthTech Solution Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component (Solution and Services), End User (Banks, Wealth Management Firms, and Others), Organization Size (Large Enterprises and Small and Medium-Sized Enterprises), and Deployment Mode (Cloud-Based and On-Premises), and Geography

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com