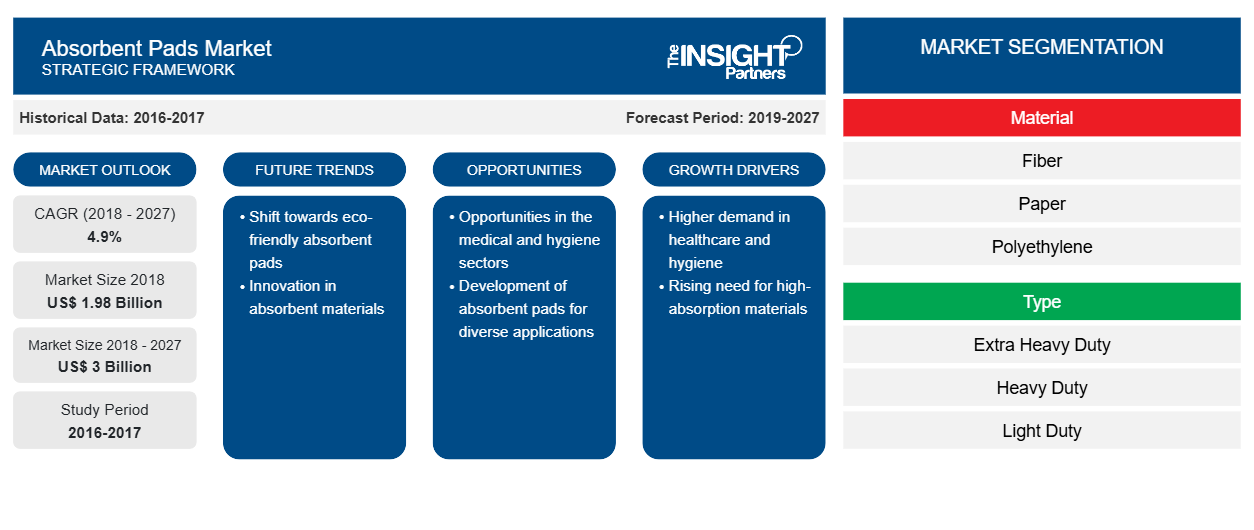

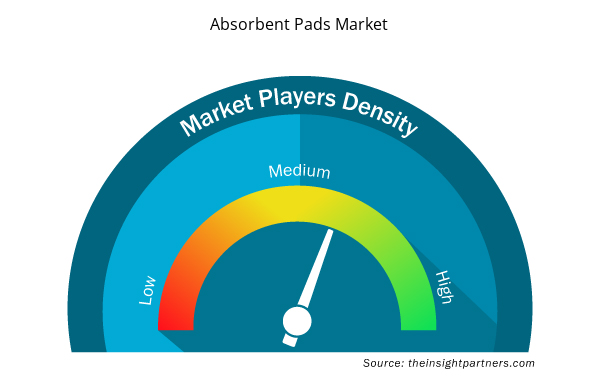

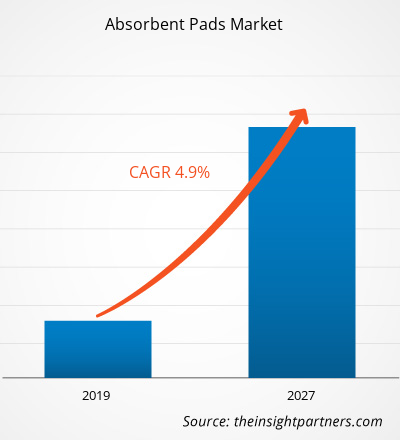

The absorbent pads market is expected to reach US$ 3,001.49 Mn in 2027 from US$ 1,978.51 in 2018. The market is estimated to grow with a CAGR of 4.9% from 2019-2027.

The growth of absorbent pads market is driven by factors such as, benefits offered by absorbent pads, growing environmental concerns with respect to chemical and oil spills are likely to boost the market over the years. In addition, the risk of diseases caused with the use of absorbent pads is likely to hinder the growth of the absorbent pads testing market in the coming years.

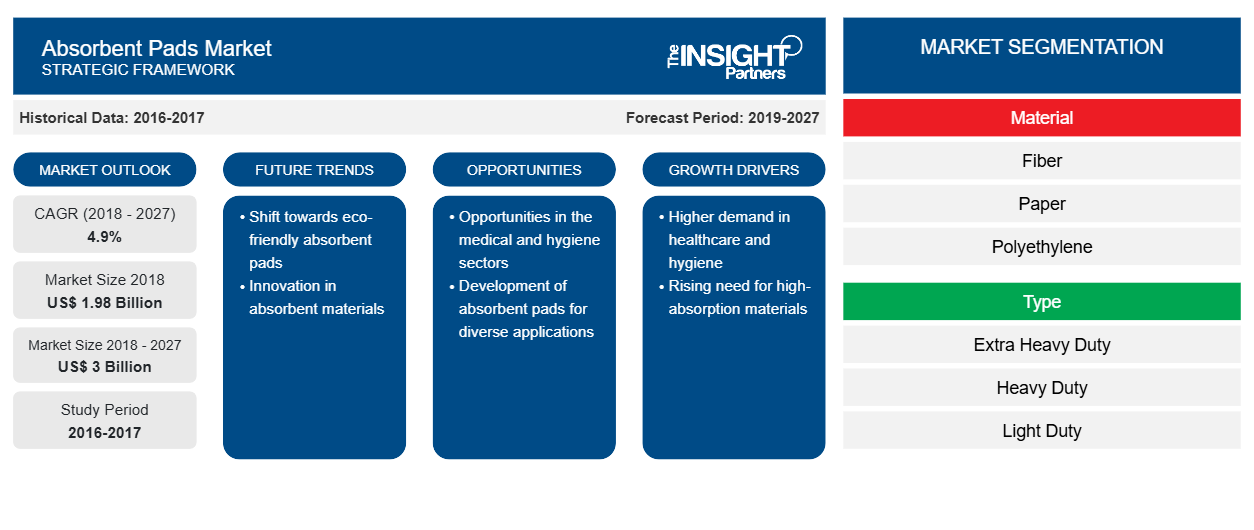

In 2018, North America accounted for the highest share in the global Absorbent Pads Market. The growth of the absorbent pads market in this region is primarily attributed to the growing awareness about the benefits offered by absorbent pads. Different types of absorbent pads for oil spills, chemical spills have also favored the rise of the absorbent pads market in North America. The easy availability of absorbent pads and presence of major market players expands the absorbent pads market in North America.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Absorbent Pads Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Absorbent Pads Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights

Advantages offered by absorbent pads

Spills and leaks of oil, chemicals and other liquids are inevitable in almost all the workplaces, where fuels are used. The conventional and historic ways for taking action over these spills prevailed only after they occurred. With the new advancements in industrial sectors, absorbent pads now help to change the conceptions. These absorbent pads offer numerous advantages across multiple industrial sectors that include automotive, medical, biotechnology, food and beverages, agriculture and others. The absorbent pads are one of the most cost-efficient and economical solution for usage and waste disposal of liquid-containing materials. These pads are commercially available with varying absorption capacities that caters to the specific demands of the end products. The development in textiles have led to making use of materials used in absorbent pads that causes no health risks and are environment friendly. For instance, polypropylene and polyester absorbents offer several advantages over messy, labor-intensive, first-generation absorbents. Typical industrial use is to simply place a pad below a leaky piece of equipment or on top of a spill, where they absorb the oil and prevent the oil from migrating on the shop floor to create a “slip-and-fall” hazard. On the other hand, Polypropylene pads are readily available and relatively inexpensive. These pads are clean and easy to store. Moreover, polypropylene is very resistant to absorbing moisture, which makes them ideal for use spills on the water. In case of absorbent pads designed for food packaging, liquids and moisture released from food materials is sealed inside the pads for a prolonged period of time that helps to increase the shelf life of the foods. Thus, the numerous advantages offered by absorbent pads is likely to increase their use across industries bolstering the market growth.

Material Insights

The absorbent pads market based on material has been segmented into fiber, paper, polyethylene, polypropylene and others. In 2018, the fiber segment accounted for the largest share in the global absorbent pads market. The absorbent pads are composed of fibers that are capable of absorbing gas or liquid components. The fiber absorbent pads are used to clean up the spills in automotive sector. The growing automotive sector across the world is likely to enhance the fiber segment during the forecast period..

Product Type Insights

The absorbent pads market based on product type is segmented into chemical absorbent pads, hazmat absorbent pads, oil absorbent pads and universal absorbent pads. In 2018, the universal absorbent pads segment accounted for the largest share in the global absorbent pads market. Universal absorbent pads are used to clear oils, water, or any other liquid. These are used in various setups like factories, laboratories, garages, and others. Thus the wide range of application of universal absorbent pads plays a vital role in the global expansion of growth of the absorbent pads market.

End User Insights

The absorbent pads market based on product type is segmented into food & agriculture, oil & gas, medical and others. In 2018, the food & agriculture segment accounted for the largest share in the global absorbent pads market. Food and agriculture use absorbent pads in food packaging as the absorbent pad absorbs the water dripping from the food stuff which thereby maintains hygiene and prevents food spoilage. Furthermore, the growing food and agriculture industry is expected to drive the absorbent pad market during the forecast period..

Absorbent Pads Market Regional Insights

The regional trends and factors influencing the Absorbent Pads Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Absorbent Pads Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Absorbent Pads Market

Absorbent Pads Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2018 | US$ 1.98 Billion |

| Market Size by 2027 | US$ 3 Billion |

| Global CAGR (2018 - 2027) | 4.9% |

| Historical Data | 2016-2017 |

| Forecast period | 2019-2027 |

| Segments Covered |

By Material

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

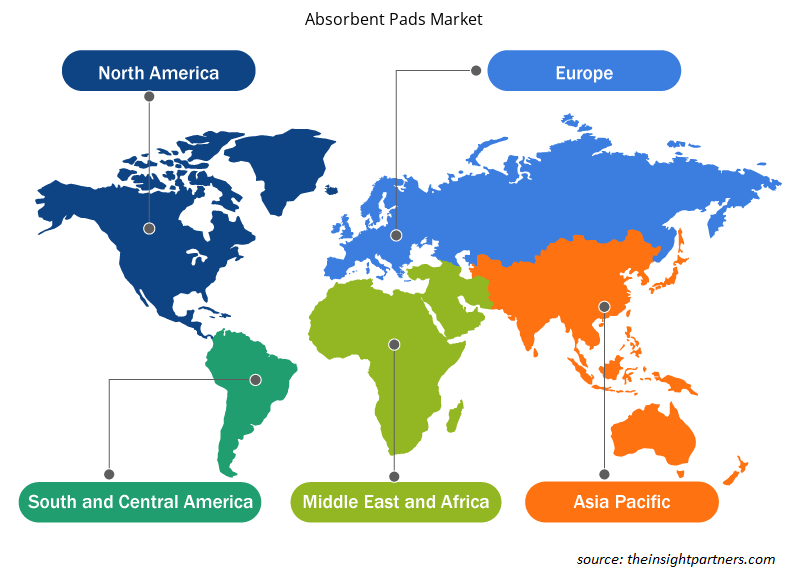

Absorbent Pads Market Players Density: Understanding Its Impact on Business Dynamics

The Absorbent Pads Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Absorbent Pads Market are:

- 3M COMPANY

- BRADY CORPORATION

- CELLCOMB AB

- COCOPAC LIMITED

- GELOK INTERNATIONAL CORPORATION

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Absorbent Pads Market top key players overview

3M Company; Brady Corporation; Gelok International; Novipax LLC and Pactiv LLC, are amongst others are the key players present in the global absorbent pads market. These companies are implementing new product development and mergers and acquisition strategies to enlarge the customer base and gain significant market share across the world, which, in turn permit the players to maintain their brand name globally.

Report Spotlights

- Progressive industry trends in the global absorbent pads market help players develop effective long-term strategies

- Business growth strategies adopted by developed and developing markets

- Quantitative analysis of the global absorbent pads market from 2017 to 2027

- Estimation of global absorbent pads demand across various industries

- PEST analysis to illustrate the efficacy of buyers and suppliers operating in the industry to predict market growth

- Recent developments to understand the competitive market scenario and global absorbent pads demand

- Market trends and outlook coupled with factors driving and restraining the growth of the global absorbent pads market

- Decision-making process by understanding strategies that underpin commercial interest with regard to global absorbent pads market growth

- Global absorbent pads market size at various nodes of market

- Detailed overview and segmentation of the global absorbent pads market, as well as its dynamics in the industry

- Global absorbent pads market size in various regions with promising growth opportunities

Global Absorbent Pads Market – By Material

- Fiber

- Paper

- Polyethylene

- Polypropylene

- Others

Global Absorbent Pads Market, by Type

- Extra Heavy Duty

- Heavy Duty

- Light Duty Others

Global Absorbent Pads Market, by Product Type

- Chemical Absorbent Pads

- Hazmat Absorbent Pads

- Oil Absorbent Pads

- Universal Absorbent Pads

Global Absorbent Pads Market, by End User

- Food & Agriculture

- Oil & Gas

- Medical

- Others

Company Profiles

- 3M COMPANY

- BRADY CORPORATION

- CELLCOMB AB

- COCOPAC LIMITED

- GELOK INTERNATIONAL

- NOVIPAX LLC

- PACTIV LLC

- SIRANE LTD

- TRICO CORPORATION

- W. DIMER GMBH

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Material ; Type ; Product Type ; End User , and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

US, Canada, Mexico, UK, Germany, Spain, Italy, France, India, China, Japan, South Korea, Australia, UAE, Saudi Arabia, South Africa, Brazil, Argentina

Frequently Asked Questions

What end-user emerged as the fastest growing segment in the global absorbent pads market?

The Medical segment emerged as the fastest growing end-user segment. Surgical, operation and medical absorbent pads are very useful in the healthcare industry. These pads are composed of sustainable fibers, polyethylene and other material. These technologically advanced pads are more absorbent than the commonly available absorbent pads. These pads possess high liquid retention capacity and plays important role in infection control in hospitals or medical facility. These are available in multiple sizes depending on the requirement. Hospitals use absorbent bed pads to protect mattresses from urinary incontinence and other liquid accidents and thereby prevent infections. Thus the increasing use of absorbent pads in medical facilities to control infections is likely to enhance the market growth during the forecast period.

Based on product type, which segment is the largest segment in the global absorbent pads market?

Universal pads accounted for the largest share in the global absorbent pads market. These pads are used to clean up both oil as well as water-based liquids. These pads are dimpled which enhances their absorption capacity. These pads are excellent for machine, industrial plants, and maintenance shops. Sonic bonded for strength and quick absorbency. These pads are lint-free, all-purpose absorbent are used for all applications. The favorite for industrial applications. Use these universal absorbent pads where aggressive and non-aggressive fluids are present. These pads are usually used in factories, laboratories, garages, or any place where chemicals need to be absorbed. These universal absorbent pads are available in a wide range of options ranging from cost-effective basic solutions like wipes, drips and leaks to highly durable, low-linting products designed for high wear resistance.

On the basis of material, why Fiber’s segment accounted for the largest share in the global absorbent pads market?

Based on material, the fiber’s segment is anticipated to account for the largest share in the global absorbent pads market. Fiber has been the most highly used material for construction of absorbent pads, which still accounts for a significant volume of wound care products around the world. The fiber absorbent pads are used to clean up the spills in automotive sector. The pads made from fibers are capable of absorbing gas or liquid components. The fiber absorbent pads also find their applications in the test kit of immune chromatography that comprises of cellulose fibers, glass fibers, cotton made of a fiber such as pulp, nonwoven fabric, filter paper, etc.

Which type segment led the global absorbent pads market in 2020?

Extra heavy duty led the market for absorbent pads in 2020. Extra heavy duty absorbent pads consist of multiple layers of fabric which include as a central layer. These pads are used for moderate to heavy protection. Some of them have absorption capacity of 15oz and above depending on the purpose and application of the pad. The extra heavy-duty oil and fuel absorbent pads and mats have an approximate absorbent capacity of 1.68 liters per sheet and above. Moreover, the extra heavy duty absorption pads are also used in sorbent waste bags to handle the weight of sorbents.

Can you list some of the major players operating in the global absorbent pads market?

The major players operating in the global absorbent pads market are Companies such as 3M, Brady Corporation, Oil-Dri Corporation of America, Cellcomb, Gelok international, Novipax LLC.

During the forecast period, which region is anticipated to account for the largest share of the global absorbent pads market?

During the forecast period, North America is anticipated to account for the largest share in the global absorbent pads market. The dominance of North America in the absorbent pads market is attributed by the high consumption and trade of meat and poultry that uses absorbent packaging, launch of new and innovative products and presence of high technology automotive and medical industry in the region that are among the significant consumers of absorbent pads.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies

- 3M COMPANY

- BRADY CORPORATION

- CELLCOMB AB

- COCOPAC LIMITED

- GELOK INTERNATIONAL CORPORATION

- NOVIPAX LLC

- PACTIV LLC

- SIRANE LTD

- TRICO CORPORATION

- W. DIMER GMBH

Get Free Sample For

Get Free Sample For