Industrial Valves Market Key Players and Forecast by 2031

Industrial Valves Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Valves Type (Ball Valve, Butterfly Valve, Safety Valve, Control Valve, Check Valve, Plug Valve, and Others), Ball Valve Type (Top Entry, Fully Welded, and Side Entry), Size (Up-to 5 Inches, 6 to 15 inches, 16 to 24 inches, Above 25 Inches), Class (Below 150, 300, 400, 600, 800, 900, 1500, 2500), and Industry (Oil and Gas, LNG, Water Treatment, Power and Energy, Chemical and Petrochemical, and Others), Butterfly Valve Disc Closure Type (Centric or Concentric, and Eccentric), Construction Type (Wafer, Flanged, Welded, Lug), Control Valve Type (2 Way Control Valves, 3 Way Control Valves), Check Valve Type (Swing Check Valves, Wafer Check Valves, Tilted Disc Check Valves, and Others)

Historic Data: 2021-2022 | Base Year: 2023 | Forecast Period: 2023-2031- Status : Published

- Report Code : TIPMC00002517

- Category : Manufacturing and Construction

- No. of Pages : 417

- Available Report Formats :

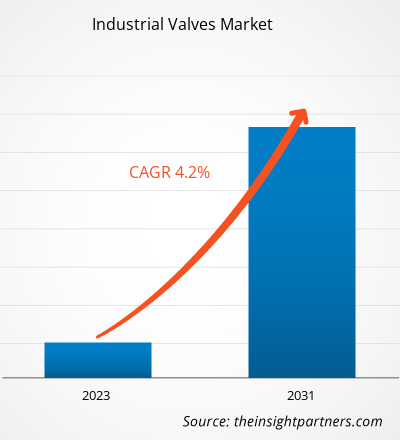

The industrial valves market size is projected to reach US$ 89,331.32 million by 2031 from US$ 64,335.89 million in 2023, with a CAGR of 4.2% by 2031. Increasing investment toward power generation and oil and gas infrastructure across the globe is expected to boost the demand for ball valves, which, in turn, is expected to fuel the market growth during the forecast period. In addition, constant development initiatives undertaken by global ball valve manufacturers are contributing to the market growth. For instance, in November 2021, Rusco announced the launch of a smart, automated ball valve for home filtration, well water, and commercial and municipal applications, which can be paired with smartphones for program automation and control sediment flushing and flow shutoff.

Industrial Valves Market Analysis

Companies in the global industrial valves markets focus on offering new, upgraded products to meet the evolving needs of customers. In April 2022, SANY UK launched SR235 multipurpose piling rig. With an operating weight of ~90 tons, the SR235 is powered by a Stage V Volvo engine, which contributes to its reliability and efficiency. In 2019, Soilmec S.p.A. introduced new SM drilling rigs for the foundation of micro piles and anchoring. In May 2021, the company introduced new Soilmec SM-11 medium-sized drilling rigs that have a very high nursing force. These rigs feature an appropriate combination of performance and effectiveness and provide a compact enterprise for limited-access job places. Moreover, they are easy to set for dissimilar working needs. In January 2020, Soilmec acquired a majority stake in Watson Inc., a Texas-based manufacturer of foundation rigs, as part of a more comprehensive project aimed at securing growth in foreign markets. Thus, such recent technological developments and product innovations in piling machines are likely to bring new trends in the market in the coming years.

Industrial Valves Market Overview

A piling machine is a gadget for setting heaps or shafts in the ground to support compositional structures. Piling machines bore in silty dirt, sandy soil, and others. These machines are utilized for developing water tanks, extensions, structures, and establishment ventures, for example, establishment fortification, stomach dividers, and others. A heaping rig is a development machine for heaping in an established building. It is primarily applied to bore in sandy soil, mud, silty earth, and others. It is generally utilized to set up heaps, stomach dividers, establishment fortification, and other establishment ventures. In addition, it is critical to consider the position and arrangement satisfactorily, as vital air would either harm or dislodge the machine from its unique position.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONIndustrial Valves Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Industrial Valves Market Drivers and Opportunities

Rise in Oil and Gas Exploration Activities in North America

In the oil & gas industry, industrial control valves found applications in storing natural gas with cryogenic temperature ranges due to their ability to function efficiently in pressure settings as high as 750 psi and temperatures as low as -196°C (-320°F). In addition, the North America’s oil & gas sector is proliferating year on year owing to the discovery of oil and gas rigs. Moreover, natural gas production in the US has grown significantly in recent years as improvements in drilling technologies have made it commercially viable to recover gas trapped in solid formations, such as shale and coal. Hence, the rise in exploration and production of oil and gas in the country is anticipated to propel the demand for industrial valves, which, in turn, is expected to fuel the market growth from 2023 to 2031.

Growing Government Initiatives

Gas chromatography is an analytical technique that is widely used across various industries, including the petroleum industry, for separating and analyzing compounds. As of January 1, 2023, the US had 129 operable petroleum refineries. These refineries continuously work to meet the global demand for petroleum products which further strengthens the industrial valves market. The US was the second-largest nation in manufacturing and industrial production after China in 2022. In 2022, the manufacturing industry contributed US$ 2,300 billion and accounted for more than 11% of the total US GDP. To raise the industrial output at the same pace, there is a need to boost the investment toward infrastructure development and expansion, which, in turn, is expected to create a demand for industrial valves in the coming years. The US economy depends on a broad network of infrastructure to maintain its position across the globe. The current infrastructure in the US is aging and needs upgradation and capacity expansion in the sectors, including oil & gas, power, and water & wastewater, among others. As per the Environmental Protection Agency, it is estimated that the drinking water & wastewater industry will need more than US$ 744 billion in investment over the next decade. For instance, in 2022, the US passed the Inflation Reduction Act aimed at funding US$ 150 billion for infrastructure funding for transportation, clean energy projects, and other infrastructure. Such government initiatives toward the development and expansion of infrastructure in the US are expected to fuel the demand for industrial valves, which is projected to fuel the market growth opportunities in the coming years.

Industrial Valves Market Report Segmentation Analysis

Key segments that contributed to the derivation of the industrial valves market analysis is valve type.

- Based on valve type, the Industrial Valves market is segmented into ball valve, butterfly valve, safety valves, control valves, check valves, plug valves, and others. The control valves segment accounted for the largest market share in 2023.

Industrial Valves Market Share Analysis by Geography

The global industrial valves market is broadly segmented into North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and South America (SAM). Asia Pacific dominated the Industrial Valves market in 2023 with a share of 39.5%; it would continue to dominate the market during the forecast period and account for 41.9% share by 2031. Asia Pacific dominated the Industrial Valves Market in 2023 with a share of 39.5%; it would continue to dominate the market during the forecast period and account for 41.9 % share by 2031. Europe is the second-largest contributor to the global Industrial Valves Market, followed by North America.

The industrial valves market is broadly segmented into five major regions—North America, Europe, Asia Pacific, Middle East & Africa, and South America. In 2023, Asia Pacific led the global industrial valves market with a 39.5% market share, followed by Europe and North America. Asia Pacific is anticipated to be the fastest-growing region and is expected to record an impressive CAGR of 5.0% from 2023 to 2031.

In the global industrial valves market, North America held the third position with a market share of more than 22.0% in 2023. North America is analyzed by the presence of well-developed countries such as the US, Canada, and Mexico, where oil and gas exploration, power generation, and manufacturing activities are growing at a significant pace. The increasing adoption of advanced and enhanced industrial valves drives the North America industrial valves market. North America is among the largest crude oil and natural gas producers worldwide. The US is the largest oil producer across the globe, with a crude oil production share of more than 20%. Additionally, the presence of several chemical and petrochemical companies and leading industrial valves market players such as Emerson, Inc., Cameron-Schlumberger, Flowserve Corporation, and Crane ChemPharma & Energy drives the North America industrial valves market.

Industrial Valves Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 64,335.89 Million |

| Market Size by 2031 | US$ 89,331.32 Million |

| Global CAGR (2023 - 2031) | 4.2% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Valves Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Industrial Valves Market Players Density: Understanding Its Impact on Business Dynamics

The Industrial Valves Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Industrial Valves Market News and Recent Developments

The industrial valves market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for innovations, business expansion, and strategies:

- In April 2024, Flomatic Valves, a leading provider of water control solutions, is delighted to unveil the new Model 745SC – 3″ swing check valve. This valve is designed to meet the requirements of AWWA Standard C508 and complies with American Iron & Steel (AIS) provisions, ensuring superior performance, reliability, and versatility. (Source: Flomatic Valves, Press Release)

- In December 2021, CIRCOR International, Inc., a leading manufacturer and marketer of differentiated technology products and sub-systems, announces the new CIR 3100 Control Valve, an economical valve body with multiple internal options for many applications across a wide range of industries. (Source: CIRCOR International, Inc., Press Release)

Industrial Valves Market Report Coverage and Deliverables

The “Industrial Valves Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering the following areas:

- Industrial valves market size and forecast at global, regional, and country levels for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities

- Industrial valves market trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Industrial valves market analysis covering key market trends, Global and regional framework, major players, regulations, and recent market developments

- Industrial valves market landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments.

- Detailed company profiles

Nivedita is an accomplished research professional with over 9 years of experience in Market Research and Business Consulting. Currently serving as a Project Manager in the ICT domain at The Insight Partners, she brings deep expertise in managing and executing Syndicated, Custom, Subscription-based, and Consulting research assignments across diverse technology sectors.

With a proven track record of delivering data-driven analysis and actionable insights, Nivedita has been a key contributor to several critical projects. Her work involves end-to-end project execution—right from understanding client objectives, analyzing market trends, to deriving strategic recommendations. She has collaborated extensively with leading ICT companies, helping them identify market opportunities and navigate industry shifts.

Nivedita holds an MBA in Management from IMS, Dehradun. Prior to joining The Insight Partners, she gained valuable experience at MarketsandMarkets and Future Market Insights in Pune, where she held various research roles and built a strong foundation in industry analysis and client engagement.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For