Advanced Air Mobility Market Growth and Recent Trends by 2030

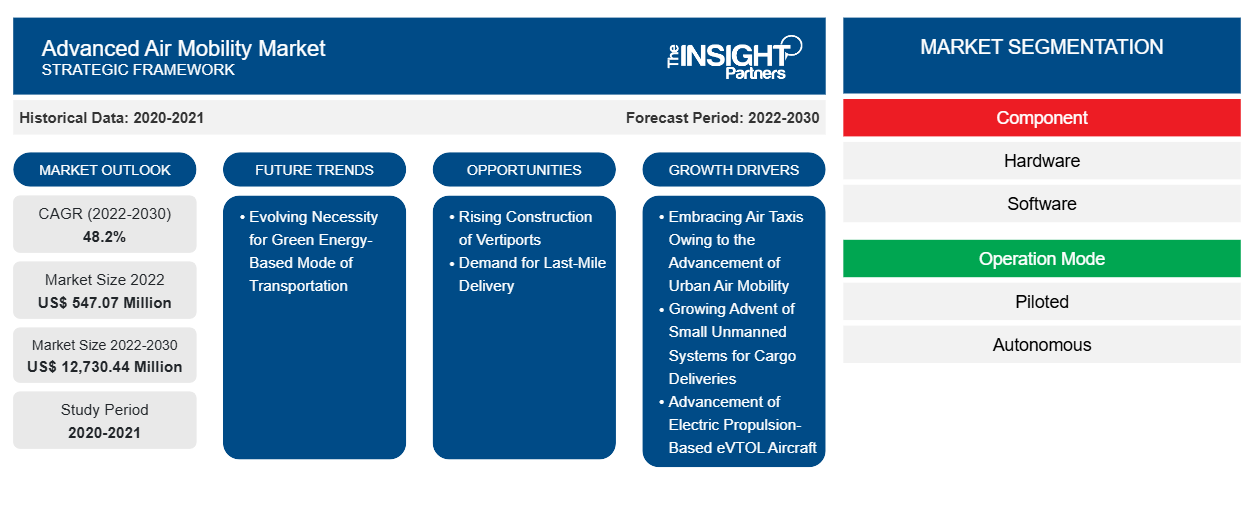

Advanced Air Mobility Market Size and Forecast (2020-2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component (Hardware, Software); Operation Mode (Piloted, Autonomous); Propulsion Type (Fully Electric, Hybrid); End Use (Passenger, Cargo); and Geography

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2022-2030- Report Date : Oct 2023

- Report Code : TIPRE00030066

- Category : Aerospace and Defense

- Status : Published

- Available Report Formats :

- No. of Pages : 174

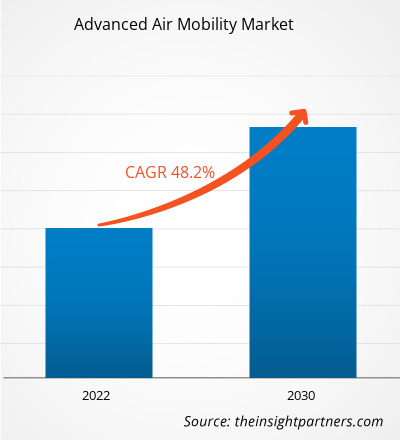

The advanced air mobility market was valued at US$ 547.07 million in 2022 and is projected to reach US$ 12,730.44 million by 2030; it is expected to grow at a CAGR of 48.2% from 2022 to 2030. The evolving need for green energy-based modes of transportation is likely to remain a key advanced air mobility market trend.

Advanced Air Mobility Market Analysis

The major stakeholders in the AAM market include raw material & component suppliers, battery manufacturers, and end users. As the market for eVTOL aircraft has not been commercialized yet and still in its testing and development phase, the battery & other component manufacturers for AAM aircraft companies are also focusing on the development of new and innovative battery technologies in order to have an early mover advantage in the market as many companies are trying to enter the AAM industry.

Advanced Air Mobility Market Overview

Urban air mobility is a whole new aspect of air transport that offers new opportunities to aviation stakeholders and aiding the development of eVTOL aircrafts. Many enterprises are developing eVTOL aircraft and are backed by investors and aviation authorities. For instance, in October 2021, the U.K. Civil Aviation Authority (CAA) established a new safety-focused international consortium of eVTOL aircraft developers and operators during the HeliTech Expo in London. This new consortium is tasked with considering the safety challenges that need to be resolved to allow eVTOL aircraft and drone taxis to be commercially available in the market. In 2018, the International Civil Aviation Organization (ICAO) headquartered in Montreal, Canada, founded the non-profit organization called Ambular. The goal of Ambular is to develop an open source eVTOL emergency medical services (EMS) aircraft. eVTOL aircraft technologies are currently being developed and experimented. However, challenges such as ground infrastructure, economical costs or energy density of batteries would need to be overcome by the players operating in the advanced air mobility market.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONAdvanced Air Mobility Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Advanced Air Mobility Market Drivers and Opportunities

The advent of Small Unmanned Systems for Cargo Deliveries

The technological advancement in the field of air mobility is driving the development of small, unmanned drones for cargo deliveries. The increasing demand for speedy same-day delivery of shipments and the need for delivering essential supplies in unreachable and remote locations are boosting the demand for small, unmanned drones. The unmanned aerial drones can be used to deliver a range of cargo, which primarily includes spare parts, commercial goods, medical supplies, food items and vaccines. In addition, unmanned aerial drones can also be used to deliver postal in remote construction or offshore sites. The increasing proliferation of unmanned drones in the logistics and freight services. For instance, in 2022, Skye Air Mobility collaborated with Dunzo to test and trial drone-driven food delivery services in Karnataka. In 2022, Swiggy collaborated with Garuda Aerospace to trial drones to deliver groceries in Bengaluru and Delhi NCR. Cargo drones are also gaining momentum as it is a viable option to mitigate the carbon footprint and lower the level of environmental pollution. Growing focus on lowering the carbon footprint in the logistics and aviation sector is boosting the development of cargo drones globally. For instance, in 2021, Leonardo S.p.A. completed the first trial of its "Sumeri Moderni" drone-based delivery in Turin. In 2022, FedEx Corp. collaborated with Elroy Air to trial their autonomous eVTOL air cargo system for middle-mile logistics operations by 2023.

Rising Construction of Vertiports – An Opportunity in the Advanced Air Mobility Market

Vertiports are centers for vertical takeoff and landing vehicles such as eVTOL vehicles, drones, and air taxis. The increasing demand for competent urban transportation and developments in eVTOL technology and the shortage of available land to build conventional vertiports fuel the need for advanced vertiports, which, in a way, is one of the landmarks for the advanced air mobility market globally. In 2022, VPorts declared to establish a network of vertiports in Quebec and to form corridors between Quebec and the US specifically for eVTOL aircraft. The company also aimed at starting eVTOL test flights in 2023. In 2023, Siemens and Skyway collaborated to ensure the digital and electrical infrastructure required to facilitate vertiport operations. In 2023, Ferrovial Airports collaborated with Eva Air Mobility to develop vertiports for eVTOL aircraft. The growing demand for sustainable and low-carbon emission approaches in the aviation and logistics sector boost the demand for advanced air mobility services.

Advanced Air Mobility Market Report Segmentation Analysis

Key segments that contributed to the derivation of the advanced air mobility market analysis are component, operation mode, propulsion type, and end use.

- Based on component, the advanced air mobility market is divided into hardware and software. The hardware segment held a larger market share in 2022.

- Based on operation mode, the market is segmented into piloted and autonomous. The piloted segment held a larger market share in 2022.

- In terms of propulsion type, the market is segmented into fully electric and hybrid. The fully electric segment dominated the market in 2022.

- Based on end use, the market is segmented into passenger and cargo. The passenger segment held a larger market share in 2022.

Advanced Air Mobility Market Share Analysis by Geography

The geographic scope of the advanced air mobility market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America.

In 2023, North America accounted for a major share in the global advanced air mobility market followed by Europe and Asia Pacific. Geographic diversification across different North American countries and the presence of major aircraft manufacturers, such as Bell Textron Inc, Joby Aviation, and Kitty Hawk, are the major factors driving the sales of eVTOL aircraft in North America. The US Air Force had officially introduced its Agility Prime initiative to accelerate the growth of eVTOL technology. The growing competition in the market is mainly focusing on achieving the US Federal Aviation Administration aircraft certification and entering commercial service. In April 2022, Jaunt Air Mobility attracted two new private investors to help fund its plans to bring a four-passenger eVTOL aircraft to commercialize in 2026. Thus, such developments in eVTOL aircraft are fueling the market growth of advanced air mobility in North America.

Advanced Air Mobility Market Regional Insights

The regional trends and factors influencing the Advanced Air Mobility Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Advanced Air Mobility Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Advanced Air Mobility Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 547.07 Million |

| Market Size by 2030 | US$ 12,730.44 Million |

| Global CAGR (2022-2030) | 48.2% |

| Historical Data | 2020-2021 |

| Forecast period | 2022-2030 |

| Segments Covered |

By Component

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Advanced Air Mobility Market Players Density: Understanding Its Impact on Business Dynamics

The Advanced Air Mobility Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Advanced Air Mobility Market top key players overview

Advanced Air Mobility Market News and Recent Developments

The advanced air mobility market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for innovations, business expansion, and strategies:

- In 2023, Thales Group partnered with Eve Mobility for eVTOL development. Thales announced to support the development of its electric vertical take-off and landing aircraft in Brazil. The strategic partnership involves a series of joint studies over a twelve-month period, which started in January 2022, on the technical, economical, and adaptable feasibility of a 100% electrically powered aircraft. (Source: Thales Group, Press Release)

- In 2023, Joby received a Special Airworthiness Certificate for the first aircraft built at its Pilot Production Line in Marina, CA, allowing flight testing to begin; The aircraft is expected to become the first ever eVTOL aircraft to be delivered to a customer; Production line and aircraft built in close collaboration with strategic partner and investor, Toyota; California Governor Gavin Newsom visited Joby to mark the occasion. (Source: Joby Aviation, Newsletter)

Advanced Air Mobility Market Report Coverage and Deliverables

The “Advanced Air Mobility Market Size and Forecast (2020–2030)” report provides a detailed analysis of the market covering the following areas:

- Advanced Air Mobility Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Advanced Air Mobility Market trends

- Detailed Porter’s Five Forces

- Advanced Air Mobility Market analysis covering key market trends, Global and regional framework, major players, regulations, and recent market developments

- Advanced Air Mobility (AAM) Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For