Amorphous Silica Market Size and Growth 2031

Amorphous Silica Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Grade (High-Purity, Medium-Purity, and Low-Purity), Product Type (Precipitated Silica, Silica Gel, Colloidal Silica, Fumed Silica, and Others), Application (Rubber, Electrical and Electronics, Building and Construction, Personal Care and Cosmetics, Food and Beverages, Oil and Gas, Pulp and Paper, Agrochemicals, and Others), and GeographyÂ

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : Jul 2025

- Report Code : TIPRE00040950

- Category : Chemicals and Materials

- Status : Published

- Available Report Formats :

- No. of Pages : 774

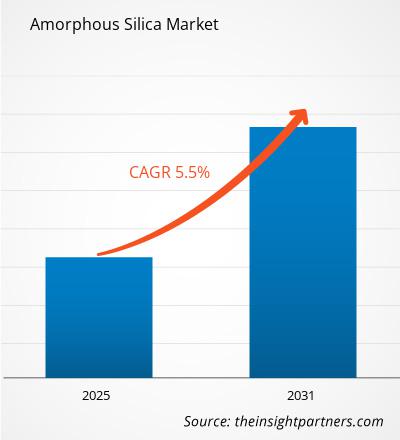

The amorphous silica market size is projected to reach US$ 17.47 billion by 2031 from US$ 12.17 billion in 2024. The market is expected to register a CAGR of 5.5% during 2025–2031. The rising adoption of green silica is likely to bring new trends in the market during the forecast period.

Amorphous Silica Market Analysis

The rapid expansion of the global building and construction industry, coupled with rising investment from governments, propels the demand for amorphous silica as a key component in modern construction materials in developing countries. Further, these economies present a growing market for personal care products and food processing businesses, where precipitated amorphous silica serves as a thickening agent, anti-caking agent, and carrier. Rising disposable incomes, changing lifestyles, and increasing awareness of hygiene and grooming are contributing to higher consumption of personal care products and processed food in these regions. Thus, the burgeoning use of amorphous silica in developing countries generates significant growth opportunities for the amorphous silica market.

Amorphous Silica Market Overview

The amorphous silica market is witnessing steady growth, driven by the increasing demand from diverse industrial applications. Amorphous silica, a non-crystalline form of silicon dioxide, is valued for its high surface area, porosity, and chemical stability, making it suitable for use in a range of industries. It is primarily used as a reinforcing filler in rubber and plastics, an anti-caking agent in food products, a thickening agent in cosmetics and personal care items, and a matting agent in paints and coatings. The amorphous silica market is driven by the increasing demand in sectors such as construction and rubber, where lightweight and durable materials are prioritized. This type of silica serves as an effective additive that enhances product performance without compromising sustainability. In the electronics and semiconductor sector, amorphous silica plays a crucial role in the manufacturing of advanced insulation materials and polishing slurries, which are used in chip fabrication. The cosmetic and personal care industry also leverages its oil absorption and light-diffusing properties in skincare formulations. Further, the market is witnessing innovation in production methods, with a shift toward greener processes such as rice husk ash-based silica, which reduces environmental impact.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONAmorphous Silica Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Amorphous Silica Market Drivers and Opportunities

Flourishing Building and Construction Industry

The need for infrastructure development and an upsurge in residential and commercial construction projects support the building and construction industry growth worldwide. With continuous infrastructure developments across developing and developed economies, the need for advanced construction materials that offer better mechanical strength, resistance to moisture, and improved longevity has surged. Amorphous silica, particularly in the form of silica fume, is used as a supplementary cementitious material in concrete and cement-based applications. It helps reduce the porosity of concrete, increases its density, and enhances its resistance to chemical attacks, making it especially suitable for additive applications in high-performance concrete used in bridges, dams, tunnels, and marine structures. Further, the construction of residential buildings has surged with the rise in the urban population and housing demands, especially in emerging economies. Government bodies of various countries also take initiatives to support residential construction projects. This growth necessitates materials that can enhance the strength, durability, and lifespan of structures. Amorphous silica—especially in silica fume form—proves highly beneficial in reinforcing building structures. Thus, the flourishing building and construction industry bolsters the amorphous silica market.

Increasing Use in Emerging Economies

Rapid industrialization and urbanization, and expanding manufacturing sectors in China, India, Brazil, and Southeast Asian nations result in the demand for amorphous silica across various applications, including those in the rubber, paints, coatings, construction, and electronics industries. The ramped-up vehicle production in emerging economies is also fueling the need for high-performance rubber compounds in the automotive and tire industries, where amorphous silica is widely used as a reinforcing agent. According to the International Energy Agency's annual Global Electric Vehicle Outlook, electric car sales topped 17 million worldwide in 2024, rising by more than 25%. As the automotive industry witnesses a transformative shift toward EVs, the role of amorphous silica has become more pivotal in the automotive sector. Amorphous silica enhances tire durability, grip, and fuel efficiency, aligning with the global push for energy-efficient and environmentally friendly vehicles.

Amorphous Silica Market Report Segmentation Analysis

Key segments that contributed to the derivation of the amorphous silica market analysis are grade, product type, and application.

- By grade, the market is segmented into high-purity, medium-purity, and low-purity. The medium-purity segment held the largest share of the market in 2024.

- In terms of product type, the amorphous silica market is categorized into precipitated silica, silica gel, colloidal silica, fumed silica, and others. The precipitated silica segment held the largest share of the market in 2024.

- Based on application, the market is categorized into rubber, electrical and electronics, building and construction, personal care and cosmetics, food and beverages, oil and gas, pulp and paper, agrochemicals, and others. The building and construction segment held the largest market share in 2024.

Amorphous Silica Market Share Analysis by Geography

The geographic scope of the amorphous silica market report entails North America, Asia Pacific, Europe, the Middle East & Africa, and South & Central America. The market in North America is expected to grow significantly during the forecast period. The construction industry is a significant enabler of the amorphous silica market growth in North America. The industry has been growing with the rise in residential and commercial projects and significant infrastructure development. According to a report by the US Census Bureau, total construction investment (in both private and public projects) rose by 1.5% to reach US$ 2,099.0 billion in 2023 from US$ 1,907.8 billion in 2022. According to the Associated General Contractors of America (AGC), the construction industry in the US generates a turnover of nearly US$ 2.1 trillion every year. The increased use of fumed silica, colloidal silica, and precipitated silica in the building and construction industry drives the demand for amorphous silica in the region.

Further, the personal care and cosmetics industry has boomed in North American countries as a large share of the population pays considerable attention to physical well-being. According to the International Trade Administration, Mexico is one of the top 10 markets globally for cosmetics and personal care products. It is the second-largest market for beauty products in North America. The Canadian cosmetic industry has also been booming for the past few decades, with Toronto being at the forefront of cosmetic development. Colloidal silica, silica gel, and fumed silica are incorporated as a natural ingredient in cosmetics and personal care products owing to their role in improving skin attributes, product stability, texture, and UV protection. Thus, the strong presence of the cosmetics industry presents huge opportunities for the amorphous silica market growth in North America.

Amorphous Silica

Amorphous Silica Market Regional InsightsThe regional trends influencing the Amorphous Silica Market have been analyzed across key geographies.

Amorphous Silica Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 12.17 Billion |

| Market Size by 2031 | US$ 17.47 Billion |

| Global CAGR (2025 - 2031) | 5.5% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Grade

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Amorphous Silica Market Players Density: Understanding Its Impact on Business Dynamics

The Amorphous Silica Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Amorphous Silica Market News and Recent Developments

The amorphous silica market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the key developments in the amorphous silica market are mentioned below:

- Evonik, one of the world's leading silica producers, invested in the expansion of its precipitated silica at its site manufacturing plant in Charleston, US. The new line in South Carolina focuses on satisfying the high demand for this material, particularly the demand generated by the tire industry in North America. This expansion is meant to make the supply chains of Evonik partners in the region resilient by enabling local silica sourcing. (Source: Evonik, Press Release, January 2024)

- Solvay SA invested at its Livorno site in Italy to launch the company's first unit of circular highly dispersible silica (HDS) made with bio-based sodium silicate derived from rice husk ash. Renewable energy integration at the plant will allow Solvay to achieve a 50% reduction in CO2 per ton of silica. This will make the Livorno site Solvay’s best-in-class silica production site in Europe in terms of CO2 footprint. The company had plans to commence production by the end of 2024. (Source: Solvay SA, Press Release, January 2023)

Amorphous Silica Market Report Coverage and Deliverables

The "Amorphous Silica Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Amorphous silica market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Amorphous silica market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed Porter's Five Forces and SWOT analysis

- Amorphous silica market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the amorphous silica market

- Detailed company profiles

Frequently Asked Questions

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For