Amplifier and Comparator Market Size and Competitive Analysis by 2030

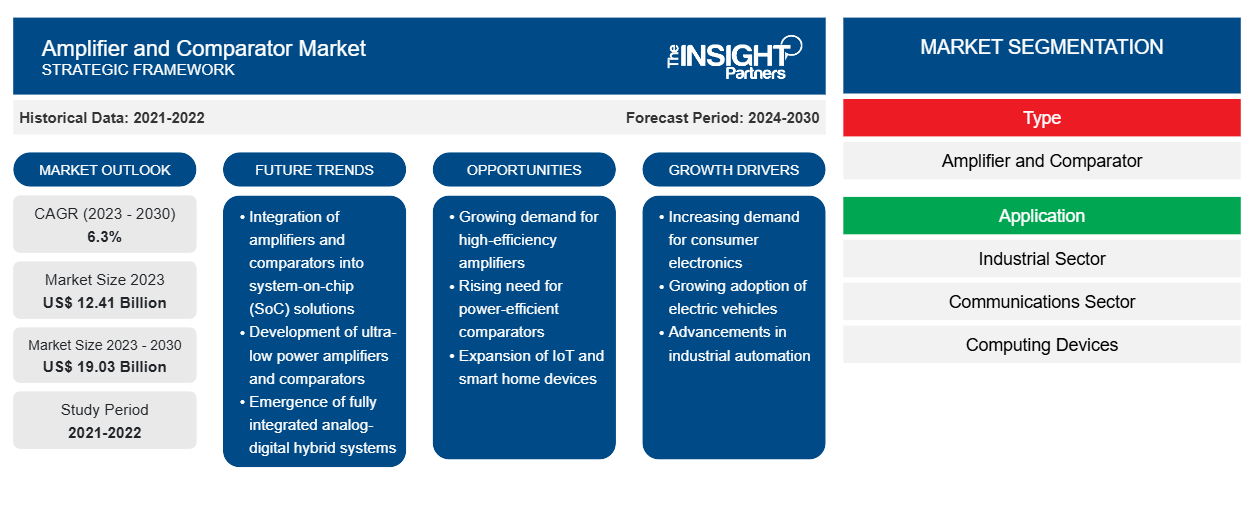

Amplifier and Comparator Market Forecast to 2030 - Global Analysis by Type (Amplifier and Comparator), Application (Industrial Sector, Communications Sector, Computing Devices, Consumer Electronics Devices, Automotive, Military & Aerospace, and Others)

Historic Data: 2021-2022 | Base Year: 2023 | Forecast Period: 2024-2030- Report Date : Jul 2023

- Report Code : TIPRE00016955

- Category : Electronics and Semiconductor

- Status : Published

- Available Report Formats :

- No. of Pages : 167

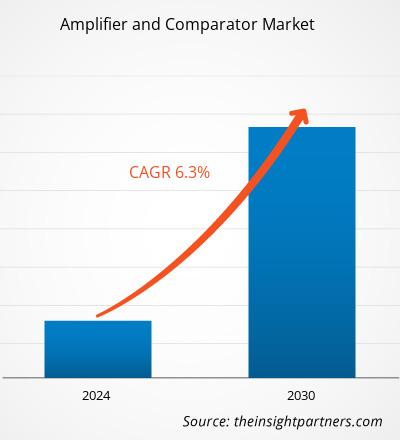

[Research Report] The amplifier and comparator market is expected to grow from US$ 12.41 billion in 2023 to US$ 19.03 billion by 2030; it is estimated to register a CAGR of 6.3% from 2023 to 2030.

Analyst Perspective:

The need for computing devices and the increase in the production of computing devices are a few major factors driving the amplifier and comparator market. With the growing need for computing devices and consumer electronics, various governments are takings steps to increase the production of consumer electronics. The Indian government established India as a worldwide hub for Electronics System Design and Manufacturing (ESDM) by fostering and advancing national skills for designing key components, such as chipsets, and fostering a climate allowing the sector to compete internationally. According to the Press Information Bureau (PIB), the Production Linked Incentive Scheme (PLI) for Large Scale Electronics Manufacturing launched in 2020 under the National Policy on Electronics 2019 offers incentives from 4% to 6% on incremental sales (over a base year) to eligible companies. Manufacturers of mobile phones and specified electronic components, including assembly, testing, marking, and packaging (ATMP) units, are the eligible scheme beneficiaries.

Asia Pacific Market Overview:

The amplifier and comparator market in APAC is segmented into South Korea, India, China, Japan, Australia, and the Rest of APAC. The region comprises various growing economies—India, China, Indonesia, and the Philippines. These countries are witnessing a gradual rise in the adoption of advanced technologies. Further, the availability of low labor costs, low taxes and duties, and a strong business ecosystem are luring global players in the electronic manufacturing industry to expand their manufacturing facilities in this region. In September 2021, Molex, one of the world's leading manufacturers of electronic, electrical, and fiber optic connectivity systems, announced it is expanding its existing manufacturing operations in Hanoi, Vietnam. With this strategic development, the company is expected to support the growing demand for its products across various applications, including smartphones, TVs, and home appliances. Thus, the growing manufacturing industry in APAC is anticipated to offer lucrative opportunities for the amplifier and comparator market in the coming years.

Customizee This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONAmplifier and Comparator Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Driver:

Rising Adoption of Electronic Transportation to Drive Growth of Contraceptives Market

The electronic mode of transportation is perceived to benefit the environment and reduce fuel consumption. Many governments across the world have embraced the Electric Vehicles Initiative (EVI), a multi-government policy forum coordinated by the International Energy Agency (IEA) to accelerate the introduction and adoption of electric vehicles worldwide. According to the IEA, 16 countries are the current participants of this program: Canada, Chile, China, Finland, France, Germany, India, Japan, the Netherlands, New Zealand, Norway, Poland, Portugal, Sweden, the UK, and the US. An electric battery is a core component of the electric mode of transportation. In these batteries, the output of the comparator is used to alert a microcontroller regarding their discharged or low power status. Also, the amplifier is used in EV battery management, and the isolated amplifier offset determines the initial precision of the current sense. Thus, the large-scale application of amplifiers in batteries required for electronic transportation would bolster the consumption of amplifier and comparator in the future.

Segmental Analysis:

Based on type, the amplifier and comparator market is segmented into amplifier ad comparators. The amplifier segment held the largest amplifier and comparator market share in 2022. Also, amplifiers segment is likely to be the fastest growing amplifier and comparator market segment during the forecast period. This is owing to the constant demand for PCB-based (printed circuit board) amplifiers for different electronic products used among various industries worldwide. For instance, the industries such as consumer electronics, military electronics, aerospace electronics, automotive electronics, and other industrial electronic products that includes PCBs inside the products. This is one of the major factors aiding the amplifier and comparator market growth for the amplifier segment.

Amplifiers are essential building components in sensing, communication, and control systems, as they magnify weak signals. The increasing demand for compact and low-power devices, the need for high-speed data communication, and an upsurge in the Internet of Things (IoT) applications are among the factors propelling the use of amplifiers. In December 2021, the Ministry of Communications, India, exempted the use of very-low-power radio frequency devices or equipment for inductive applications from licensing requirements. According to India Cellular and Electronics Associations (ICEA), the exemption of licensing for very-low-power devices would benefit the telecommunications, electronics, and allied sectors in the medium to long term by encouraging the use of these devices. Such initiatives by governments boost the demand for amplifiers and propel the amplifier and comparator market growth.

Regional Analysis:

The amplifier and comparator market are segmented into five major regions—North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South America. In 2022, North America led the amplifier and comparator market with a substantial revenue share, followed by Europe. Further, Asia Pacific is expected to register the highest CAGR in the amplifier and comparator market from 2023 to 2030.

Asia Pacific accounted for the largest share in the global amplifier and comparator market. One of the major reasons behind the higher amplifier and comparator market share for the region is the presence of largest number of semiconductor fabricating foundries. Further the presence of countries such as Taiwan, China, Japan, and South Korea that are one of the largest bases for electronic products and component manufacturing is another major factor driving the growth of amplifier and comparator market across the region.

Moreover. the European region is likely to be the fastest growing region in the manufacturing and sales of amplifier and comparator market. This is mainly due to the increase in demand for setting up MEMS foundaries across the region wherein several companies along with government of different countries have been collaboratively working to establish a strong electronics and semiconductor manufacturing setup across the region. Moreover, the presence of a strong industrial and automotive sector is another major factor propelling the growth of amplifier and comparator market. This is also due to the growth in deployment of electronic components in the industrial manufacturing and automotive products.

Key Player Analysis:

The amplifier and comparator market analysis consists of the players such as Analog Devices Inc, Broadcom Inc, STMicroelectronics, Microchip Technology Inc, NXP Semiconductors, On Semiconductor, Renesas Electronics Corporation, Skyworks Solutions Inc, Texas Instruments Inc, and ABLIC Inc. Among the amplifier and comparator market players, Analog Devices Inc and Texas Instruments Inc are the top two players owing to the diversified product portfolio offered.

Amplifier and Comparator Market Regional InsightsThe regional trends and factors influencing the Amplifier and Comparator Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Amplifier and Comparator Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Amplifier and Comparator Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 12.41 Billion |

| Market Size by 2030 | US$ 19.03 Billion |

| Global CAGR (2023 - 2030) | 6.3% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Amplifier and Comparator Market Players Density: Understanding Its Impact on Business Dynamics

The Amplifier and Comparator Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Amplifier and Comparator Market top key players overview

Recent Developments:

Inorganic and organic strategies such as mergers, acquisitions, new product launches, etc., are highly adopted by companies in the amplifier and comparator market. A few recent key amplifier and comparator market developments are listed below:

- In 2023, Tata Consultancy Services and Renesas partnered plan to work together With the opening of a joint innovation center in Bengaluru and Hyderabad on software development, radio frequency, digital, and mixed-signal design for cutting-edge next-generation semiconductor solutions that will serve the needs of numerous industries.

- In 2023, Renesas unveiled three new MCU groups designed for applications involving motor control. Devices from the RX and RA families are among the more than 35 new products that Renesas launched. With several MCU and MPU families, analog and power solutions, sensors, communications equipment, signal conditioners, and other devices, the new MCUs expanded the leading motor control range in the market.

- In 2022, Hypex Electronics revealed the NCx500 OEM, the first of a new NCOREx family of modules, and announced an updated version of its well-known NCORE Class-D amplifier technology.

Frequently Asked Questions

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For