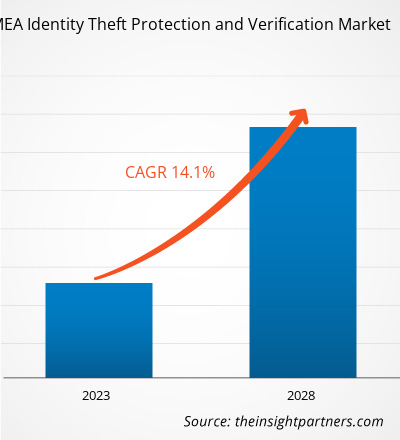

The APAC & MEA identity theft protection and verification market is projected to reach US$ 9,232.35 million by 2028 from US$ 4,380.54 million in 2022; it is expected to register a CAGR of 14.1% during 2023–2028.

Major economies of APAC and MEA are witnessing an upward trend of digital transactions. As per an April 2023 press release of Al Ansari Financial Services (a leading integrated financial services group in the UAE), the company's digital channels recorded 340,000 transactions in March 2023, signifying a growth of 30% in the first quarter of 2023 as compared to that of 2022. Conformably to the data released in August 2022, a study conducted in 2021 by the Saudi Central Bank found electronic payments to represent 94% of all payment values. The report also conveyed that electronic payment methods for all outward payments to individuals, business establishments, or other government agencies are the most preferred payment methods for the Saudi government sector. As per the data from the Reserve Bank of India (RBI), digital transactions in India for the financial years 2018–2019, 2019–2020, 2020–2021, and 2021–2022 were ~US$ 283.38 million, US$ 414.10 million, US$ 532.75 million, and US$ 876.58 million, respectively. The rise in digital transactions has fueled the requirement to authenticate users remotely. The Know Your Customer (KYC) requirements for new users have also gone up. These factors cumulatively favor the APAC & MEA identity theft protection and verification market growth.

APAC & MEA Identity Theft Protection and Verification Market -

Strategic Insights

Market Insights – APAC & MEA Identity Theft Protection and Verification Market

Telecommunications Sector to Offer Opportunities for APAC & MEA Identity Theft Protection and Verification Market Growth in Coming Years

The global economic downturn and high-interest rates are disrupting the banking industry's growth. Similarly, high semiconductor prices and inflation are restricting the smartphone market. Despite this, banking penetration in several APAC countries has risen steadily and quickly. As per the RBI, the per capita bank deposits to income ratio rose to 71.2 in 2022 from 15.8 in 1972, supported by both developments in the banking system and financial inclusion policies. It also mentions that in 2022, one commercial bank branch was available for every 9,000 citizens, compared to one for 40,000 citizens in 1972. Again, the rollout of 5G is transforming the telecom sector in India. CLSA Ltd estimates that the country’s mobile data penetration could increase to 80% by 2025, from 69% in 2022, primarily fueled by 5G rollouts of Jio Telecom and Bharti Airtel. Both telecom and banks are required to perform thorough KYC checks of customers. This rise in user base is expected to offer ample growth opportunities for APAC & MEA identity theft protection and verification market players.

Impact of COVID-19 Pandemic on APAC & MEA Identity Theft Protection and Verification Market

The onset of the COVID-19 crisis in 2020 led to a steep rise in digital transactions, positively impacting APAC & MEA identity theft protection and verification market size. Several factors led to the same. All major regions suffered a significant downturn in the first half of 2020. Enactment of lockdowns and travel restrictions, shutdown of production facilities, and shortage of employees adversely affected the performances of most verticals. According to the Organization for Economic Co-operation and Development (OECD), the pandemic affected major countries such as India, China, Australia, and Japan. Additionally, the 'waves' came at different time points in each country of the region. Hence, multinational companies operating in APAC had to reconfigure their businesses to accommodate all their employees. Employees were granted WFH to keep the companies functional, resulting in scattered and less congested enterprise networks. It caused a decline in telecom services demand from the enterprise sector while increasing individual demand. Non-homogenous travel restrictions in different countries led multinational companies in the region to continue remote operations. It led to a rise in new mobile data connections, prompting the requirement for remote user verification and online payment of subscriptions. Hence, digital transactions witnessed a record growth despite such a tumultuous business scenario. Such factors collectively boosted the APAC & MEA identity theft protection and verification market size.

The report provides detailed market insights, which help the key APAC & MEA identity theft protection and verification market players strategize their market growth. A few developments are mentioned below:

- In March 2023, STC Kuwait adopted AccuraScan’s solution for identity verification and digital KYC during customer onboarding.

- In January 2023, McAfee launched three McAfee+ family plan that offers increasing levels of identity and privacy protection for consumers. The solution also removes personal information from risky data broker sites with Personal Data Clean-up.

APAC & MEA identity theft protection and verification market players profiled in this report are as follows:

- AllClear ID

- Bitdefender

- CrowdStrike

- Equifax Inc

- IDMERIT

- Mcaffe LLC

- Gen Digital Inc

- Ravelin Technology Ltd

- Shuftipro Ltd

- Thales Group

APAC & MEA Identity Theft Protection and Verification Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 4,380.54 Million |

| Market Size by 2028 | US$ 9,232.35 Million |

| Global CAGR (2023 - 2028) | 14.1% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Component, Fraud Type, and Vertical

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Australia, Bahrain, India, Indonesia, Kenya, Kuwait, Malaysia, Nigeria, Philippines, Qatar, Saudi Arabia, Singapore, South Africa, Thailand, United Arab Emirates, Vietnam

Frequently Asked Questions

The estimated market size for the APAC & MEA identity theft protection and verification market in 2022 is expected to be around US$ 4,380.54 million.

The surge in digital transactions and supportive initiatives from authorities are driving the market.

Higher integration of AI and ML are expected in identity theft protection and verification solutions.

Gen Digital Inc, Thales SA, CrowdStrike Holdings Ltd, McAfee Corp, and Bitdefender SRL are the key market players expected to hold a major market share of APAC & MEA identity theft protection and verification market in 2022.

China is expected to hold a major market share of APAC & MEA identity theft protection and verification market in 2022.

The global market size of APAC & MEA identity theft protection and verification market by 2028 will be around US$ 9,232.35 million.

Trends and growth analysis reports related to Technology, Media and Telecommunications : READ MORE..

The List of Companies - APAC and MEA Identity Theft Protection and Verification Market

- AllClear ID

- Bitdefender

- CrowdStrike

- Equifax Inc

- IDMERIT

- Mcaffe LLC

- Gen Digital Inc

- Ravelin Technology Ltd

- Shuftipro Ltd

- Thales Group

Get Free Sample For

Get Free Sample For