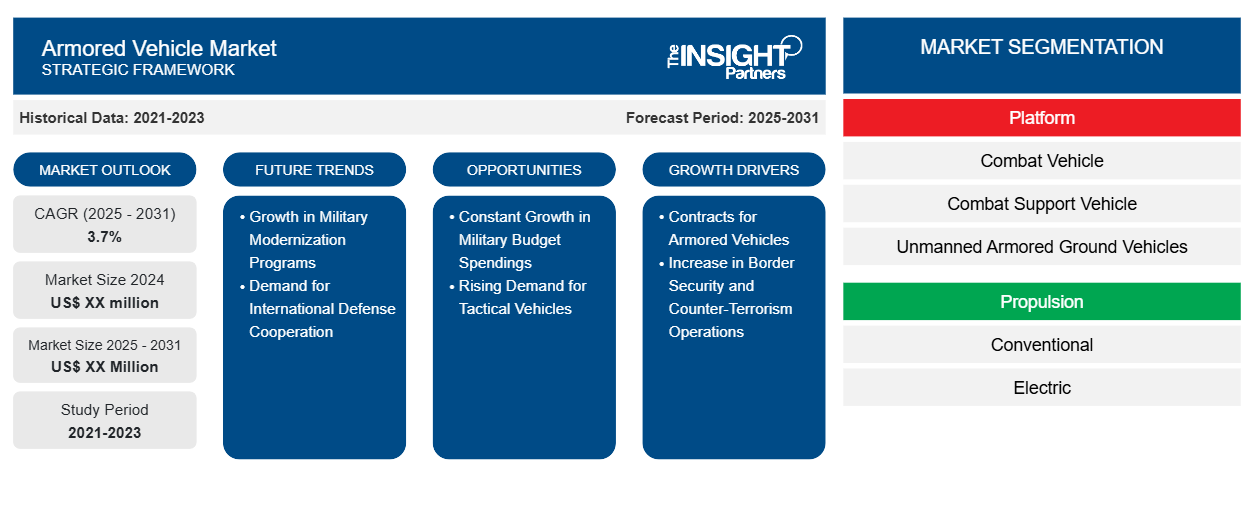

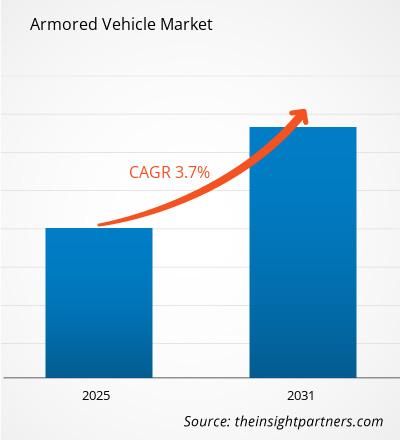

The Armored Vehicle Market is expected to register a CAGR of 3.7% from 2025 to 2031, with a market size expanding from US$ XX million in 2024 to US$ XX Million by 2031.

The report is segmented by Platform (Combat Vehicle, Combat Support Vehicle, Unmanned Armored Ground Vehicles); By Propulsion (Conventional, Electric); By Application (Defense, Commercial), By Vehicle Type (Armored Personnel Carrier, Infantry Fighting Vehicle, Main Battle Tanks, Tactical Truck, Others). The global analysis is further broken-down at regional level and major countries. The Report Offers the Value in USD for the above analysis and segments.

Purpose of the Report

The report Armored Vehicle Market by The Insight Partners aims to describe the present landscape and future growth, top driving factors, challenges, and opportunities. This will provide insights to various business stakeholders, such as:

- Technology Providers/Manufacturers: To understand the evolving market dynamics and know the potential growth opportunities, enabling them to make informed strategic decisions.

- Investors: To conduct a comprehensive trend analysis regarding the market growth rate, market financial projections, and opportunities that exist across the value chain.

- Regulatory bodies: To regulate policies and police activities in the market with the aim of minimizing abuse, preserving investor trust and confidence, and upholding the integrity and stability of the market.

Armored Vehicle Market Segmentation

Platform

- Combat Vehicle

- Combat Support Vehicle

- Unmanned Armored Ground Vehicles

Propulsion

- Conventional

- Electric

Application

- Defense

- Commercial

Vehicle Type

- Armored Personnel Carrier

- Infantry Fighting Vehicle

- Main Battle Tanks

- Tactical Truck

- Others

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Armored Vehicle Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Armored Vehicle Market Growth Drivers

- Contracts for Armored Vehicles: The growing number of contracts for armored vehicles is another major factor supporting the market growth. For instance, in February 2024, Elbit Systems won a contract worth US$ 300 million to supply armored vehicle systems to a European customer. Similarly, June 2024, BAE Systems awarded contract worth up to US$ 44 million to Tatra Defense Vehicle of the Czech Republic, for the welding, paint, and installation of hull insulation for BvS10 vehicles in the new three-nation Collaborative All-Terrain Vehicle (CATV-3N) program.

- Increase in Border Security and Counter-Terrorism Operations: Countries with significant border security concerns and counter-terrorism operations, especially in regions like South Asia, Africa, and the Middle East, are increasingly adopting armored vehicles to safeguard their borders, patrol conflict zones, and combat organized crime.

Armored Vehicle Market Future Trends

- Growth in Military Modernization Programs: Armored vehicles are a critical component of modernization programs aimed at enhancing the operational capabilities of national armed forces. Modern armored vehicles equipped with advanced protection systems, mobility, and firepower are being integrated into national defense strategies, contributing to market growth.

- Demand for International Defense Cooperation: Joint military exercises, peacekeeping operations, and international collaborations are driving the need for standardized, interoperable armored vehicles. NATO, the United Nations, and other international security organizations require armored vehicles for peacekeeping, humanitarian aid, and joint military operations, further boosting demand.

Armored Vehicle Market Opportunities

- Constant Growth in Military Budget Spendings: The growth in defense expenditures from different countries is one of the major factors likely to support the adoption of armored vehicles in the coming years. For instance, according to the SIPRI, the global military expenditure in 2022 was estimated to be around US$ 2.24 trillion that further reached to around US4 2.44 trillion in 2023. This shows an increase of around 6% in increase of military expenditure globally in 2023. Such surge in military budgets is likely to boost the growth of armored vehicle market in the coming years as well.

- Rising Demand for Tactical Vehicles: Law enforcement agencies around the world are increasingly utilizing armored vehicles to enhance their ability to respond to high-risk situations such as terrorist attacks, hostage rescues, and riots. Armored vehicles like SWAT trucks, riot control vehicles, and armored rescue vehicles are essential for ensuring the safety of law enforcement officers and civilians in public order situations.

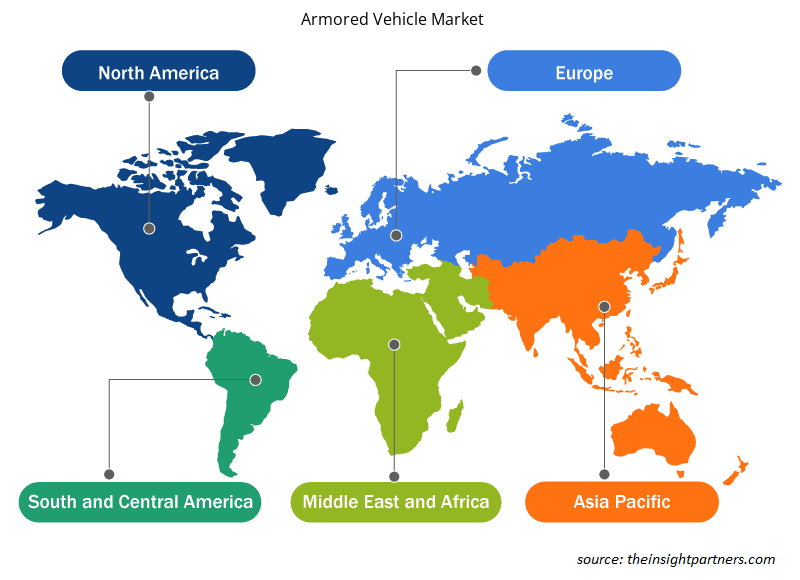

Armored Vehicle Market Regional Insights

The regional trends and factors influencing the Armored Vehicle Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Armored Vehicle Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Armored Vehicle Market

Armored Vehicle Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 3.7% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Platform

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

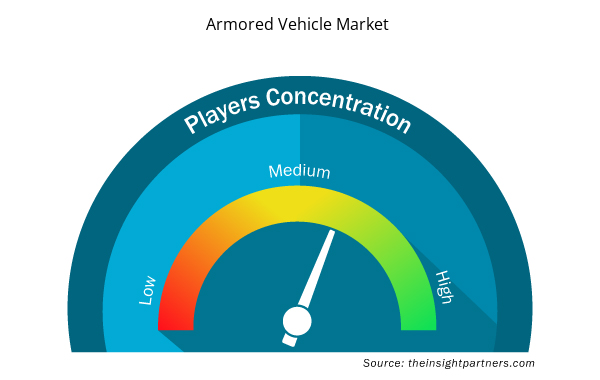

Armored Vehicle Market Players Density: Understanding Its Impact on Business Dynamics

The Armored Vehicle Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Armored Vehicle Market are:

- BAE Systems PLC

- CNH Industrial N.V.

- General Dynamics Corporation

- IMI Systems Ltd.

- Krauss-Maffei Wegmann GmbH and Co. KG

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Armored Vehicle Market top key players overview

Key Selling Points

- Comprehensive Coverage: The report comprehensively covers the analysis of products, services, types, and end users of the Armored Vehicle Market, providing a holistic landscape.

- Expert Analysis: The report is compiled based on the in-depth understanding of industry experts and analysts.

- Up-to-date Information: The report assures business relevance due to its coverage of recent information and data trends.

- Customization Options: This report can be customized to cater to specific client requirements and suit the business strategies aptly.

The research report on the Armored Vehicle Market can, therefore, help spearhead the trail of decoding and understanding the industry scenario and growth prospects. Although there can be a few valid concerns, the overall benefits of this report tend to outweigh the disadvantages.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Surgical Gowns Market

- Dropshipping Market

- Fishing Equipment Market

- Emergency Department Information System (EDIS) Market

- Health Economics and Outcome Research (HEOR) Services Market

- Equipment Rental Software Market

- Single Pair Ethernet Market

- Nuclear Waste Management System Market

- Arterial Blood Gas Kits Market

- Sterilization Services Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Platform, Propulsion, Application, Vehicle Type

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

What are the options available for the customization of this report?

Some of the customization options available based on request are additional 3-5 company profiles and country-specific analysis of 3-5 countries of your choice. Customizations are to be requested/discussed before making final order confirmation, as our team would review the same and check the feasibility.

What are the deliverable formats of the armored vehicles market report?

The report can be delivered in PDF/PPT format; we can also share excel dataset based on the request.

What are the driving factors impacting the armored vehicles market?

The major factors driving the armored vehicles market are:

1. Contracts for Armored Vehicles

2. Increase in Demand for Safety During Border Security

What are the future trends of the armored vehicles market?

Some of the major trends driving the armored vehicles market are:

1. Demand for Electric Propulsion Armored Vehicles

2. Demand for Military Vehicle Modernisation

What is the expected CAGR of the Armored Vehicle Market?

The Armored Vehicle Market is estimated to witness a CAGR of 3.7% from 2023 to 2031

Trends and growth analysis reports related to Aerospace and Defense : READ MORE..

The List of Companies

1. BAE Systems PLC

2. CNH Industrial N.V.

3. General Dynamics Corporation

4. IMI Systems Ltd.

5. Krauss-Maffei Wegmann GmbH and Co. KG

6. Mitsubishi Heavy Industries, Ltd.

7. Oshkosh Corporation

8. Otokar Otomotiv ve Savunma Sanayi A.S.

9. Singapore Technologies Engineering Ltd

10. Textron Systems Corporation

Get Free Sample For

Get Free Sample For