Fishing Equipment Market Size, Share & Demand by 2034

Fishing Equipment Market Size and Forecast (2021 - 2034), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Fishing Rods, Nets and Traps, Hooks, Reels, Fishing Line, Sinkers, and Others) and Distribution Channel (Supermarkets and Hypermarkets, Specialty Stores, Online Retail, and Others)

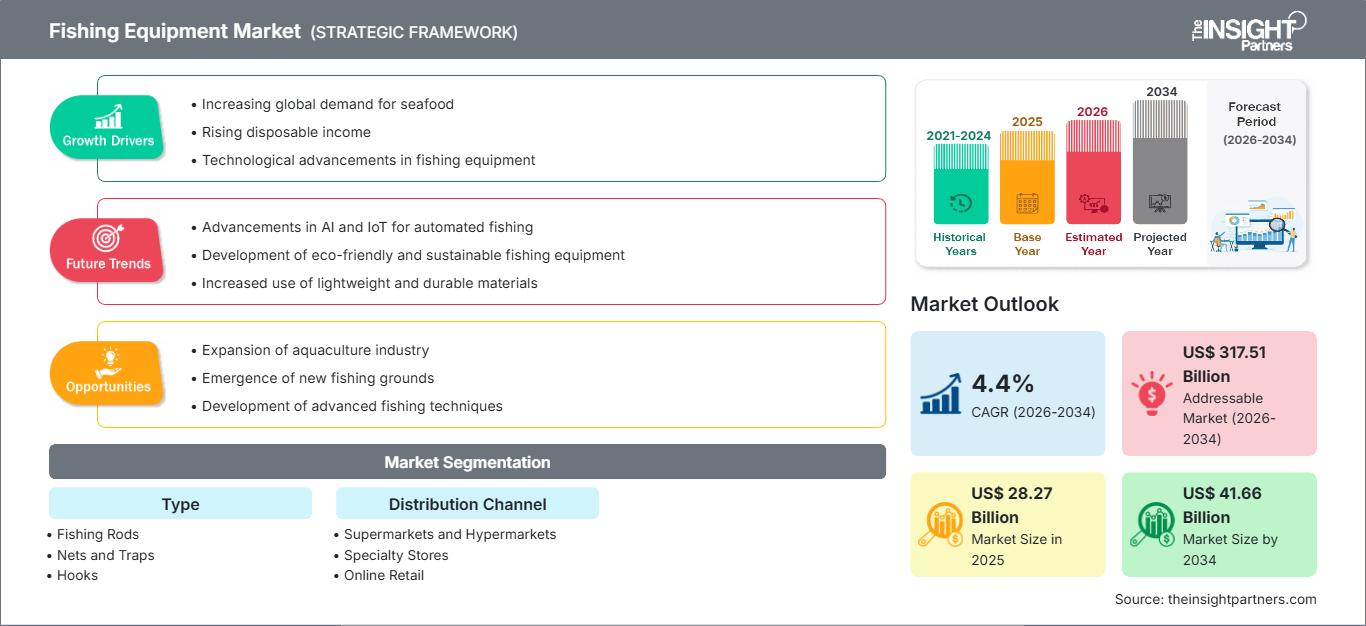

Historic Data: 2021-2024 | Base Year: 2025 | Forecast Period: 2026-2034- Report Date : Apr 2026

- Report Code : TIPRE00020555

- Category : Consumer Goods

- Status : Upcoming

- Available Report Formats :

- No. of Pages : 150

The global fishing equipment market size is projected to reach US$ 41.66 billion by 2034 from US$ 28.27 billion in 2025. The market is anticipated to register a CAGR of 4.4% during the forecast period 2026–2034. Key market dynamics include a rising global interest in recreational fishing as a leisure activity, increasing participation in competitive angling tournaments, and a significant shift toward high-performance, technologically advanced gear. Additionally, the market is expected to benefit from the growing popularity of fishing tourism, expansion in organized retail channels across emerging economies, and the increasing inclusion of smart electronics like GPS and AI-powered fish finders into consumer gear.

Fishing Equipment Market Analysis

The fishing equipment market analysis shows a shift toward high-performance and precision-engineered gear as consumers prioritize efficiency and the overall sporting experience. Procurement trends indicate the market is splitting into traditional, high-durability segments for local recreational use and high-growth premium gear sectors utilizing advanced materials like carbon fiber and graphene. Strategic opportunities are emerging in the sustainable equipment niche, where lead-free sinkers and biodegradable lures offer a clear competitive advantage amid tightening environmental regulations. The analysis also notes that market expansion depends on omni-channel retail strategies, blending the tactile experience of specialty tackle shops with the convenience of high-volume e-commerce. Competitive differentiation now stands out depending on branding that highlights durability, species-specific performance, and ethical manufacturing. This approach helps top-tier vendors maintain high margins in a market with a diverse range of participants.

Fishing Equipment Market Overview

Fishing equipment is shifting from a traditional hardware industry to a global outdoor lifestyle commodity. While historically focused on basic rods and reels for subsistence, fishing equipment is expanding into value-added products like specialized lures, high-visibility lines, and sophisticated marine electronics. Both large heritage manufacturers and small artisanal brands are part of this market, making use of innovations in aerodynamics and sensor technology. More health-conscious consumers in North America and Asia-Pacific are looking for outdoor activities that promote mental well-being, which has helped fishing gain popularity as a "therapeutic" choice. North America is still the main consumer, but the Asia-Pacific region has become a leader in both production and innovation, especially through online sales to emerging middle-class demographics in China and Southeast Asia.

For instance, in the US, the market is primarily driven by a robust recreational fishing culture and extensive tournament circuits. Growth is fueled by a diversifying angler demographic and a strong preference for high-performance, technologically advanced gear. Increasing consumer focus on mental well-being and outdoor conservation further sustains long-term demand.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONFishing Equipment Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Fishing Equipment Market Drivers and Opportunities

Market Drivers:

- Technological Innovation and Smart Gear: The integration of AI-based tension sensing, GPS-enabled reels, and sonar-equipped fish finders is attracting a new generation of tech-savvy anglers, driving replacement cycles.

- Surge in Recreational Participation: Post-pandemic lifestyle shifts have solidified fishing as a top outdoor leisure activity. Increased government investment in fishing infrastructure is further boosting participation rates.

- Rapid Expansion of Digital and E-commerce Channels: Online retail has removed traditional geographic barriers for niche tackle. This is particularly evident in the rapid adoption of specialized rods and components in regions like Asia-Pacific and North America.

Market Opportunities:

- Expansion into Sustainable and Eco-Friendly Gear: Beyond traditional materials, there is a growing opportunity for lead-free sinkers and nets made from recycled ocean plastics to appeal to eco-conscious consumers.

- Growth in Emerging APAC Corridors: Forming strategic partnerships between Western-based brands and Asian distributors may facilitate access to high-margin market segments in China and India, where demand for premium sporting goods is increasing.

- Diversification into Female and Youth-Specific Gear: There is a growing opportunity for producers to target specific demographics through ergonomic, lightweight, and aesthetically diverse gear, as seen in recent successful retail expansions.

Fishing Equipment Market Report Segmentation Analysis

The Fishing Equipment Market share is analyzed across various segments to provide a clearer understanding of its structure, growth potential, and emerging trends. Below is the standard segmentation approach used in most industry reports:

By Type:

- Fishing Rods: The largest segment by value, driven by innovations in lightweight composites (carbon fiber) and technique-specific designs.

- Nets and Traps: Essential for both recreational and small-scale commercial use, focusing on "ghost-gear" prevention and sustainable materials.

- Hooks: A high-volume recurring purchase segment; growth is driven by specialized coatings and high-strength micro-wire technologies.

- Reels: The primary hub for technological innovation, featuring advanced drag systems and precision machining.

- Fishing Line: Driven by the demand for high-visibility braids and low-refraction fluorocarbon lines.

- Sinkers: Transforming as manufacturers pivot from lead to eco-friendly tungsten and steel alternatives.

By Distribution Channel:

- Specialty Stores: The leading channel, favored by serious anglers who require expert technical advice and high-end inventory.

- Online Retail: The fastest-rising channel, especially for standardized dry goods and D2C boutique brands, enabling global access to niche products.

- Supermarkets and Hypermarkets: Offers a select but growing range of "starter kits" and entry-level gear in urban markets.

By Geography:

- North America

- Europe

- Asia Pacific

- South & Central America

- Middle East & Africa

Fishing Equipment Market Regional Insights

The regional trends influencing the Fishing Equipment Market have been analyzed across key geographies.

Fishing Equipment Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2025 | US$ 28.27 Billion |

| Market Size by 2034 | US$ 41.66 Billion |

| Global CAGR (2026 - 2034) | 4.4% |

| Historical Data | 2021-2024 |

| Forecast period | 2026-2034 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Fishing Equipment Market Players Density: Understanding Its Impact on Business Dynamics

The Fishing Equipment Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Fishing Equipment Market Share Analysis by Geography

Asia-Pacific is expected to grow fastest in the coming years. Emerging markets in South & Central America, the Middle East, and Africa also have many untapped opportunities for premium sporting goods and recreational gear manufacturers to expand.

The fishing equipment market is undergoing a significant transformation, moving from a traditional pastime to a global high-value lifestyle sector. Growth is driven by the rising prevalence of fishing tourism, a surge in "adventure" sport demand, and the expansion of the luxury gear sector. Below is a summary of market share and trends by region:

1. North America

- Market Share: Holds the largest global share, driven by the world’s most lucrative tournament circuit.

- Key Drivers:

- Rising consumer preference for high-end electronics like side-scanning sonar

- Mainstreaming of "specialty" angling in high-end grocery and sporting chains

- Increased domestic manufacture of premium "American Original" tackle

- Trends: Scaling of digital sales platforms and the successful adoption of youth-focused initiatives to appeal to health-focused demographics.

2. Europe

- Market Share: A mature market anchored by deep-seated traditions in fly-fishing and carp-specific equipment in the UK, Germany, and France.

- Key Drivers:

- High domestic participation in recreational freshwater fishing

- Strict regulatory frameworks favoring sustainable and lead-free tackle

- Robust government support for fishing-related tourism and conservation

- Trends: A strategic shift toward prioritizing eco-certified products to meet the demands of environmentally conscious European consumers.

3. Asia-Pacific

- Market Share: The fastest-growing region, with Japan and China acting as the primary engines for innovation and manufacturing.

- Key Drivers:

- Massive consumer base seeking premium, high-tech angling gear

- Government-supported agricultural and marine initiatives

- Rapid urbanization and rising disposable incomes are leading to a preference for "luxury" outdoor hobbies

- Trends: Heavy reliance on e-commerce platforms and B2B contracts for high-end components used in the global gear assembly industry.

4. South and Central America

- Market Share: Emerging market with a growing artisanal and tourism sector in countries like Brazil and Chile.

- Key Drivers:

- Increasing awareness of fishing as a sustainable outdoor lifestyle choice

- Modernization of retail channels in urban centers

- Rising interest in freshwater fly-fishing among middle-to-high income segments

- Trends: Growth of "farm-to-table" equivalent fishing lodges and the introduction of specialized tropical saltwater gear.

5. Middle East and Africa

- Market Share: Developing market with deep cultural roots in coastal fishing, transitioning toward formalized recreational production.

- Key Drivers:

- Traditional presence of fishing in regional coastal economies

- High demand for durable, corrosion-resistant gear for use in arid, high-salinity climates

- Strategic investments in "Smart Tourism" to improve local outdoor amenities

- Trends: Implementation of modern retail and refrigeration technologies to formalize the local tackle market.

High Market Density and Competition

Competition is intensifying due to the presence of established leaders such as Shimano Inc., Globeride, Inc. (Daiwa), and Pure Fishing, Inc. This competitive environment pushes vendors to differentiate through:

- Positioning gear as a superior nutritional and technical alternative by emphasizing high-performance carbon fiber and precision drag systems.

- Including more than just basic rods, companies offer specialized apparel, probiotic baits, and high-end marine electronics.

- Producers manage the entire supply chain, from the development of proprietary alloys to final assembly.

- New technologies, like membrane filtration for line manufacturing and 3D-printing for lures, help create high-quality products worldwide.

Opportunities and Strategic Moves

- Partner with high-end retail channels and e-commerce platforms to tap into the surging demand for smart and artisanal gear in the Asia-Pacific and North American markets.

- Incorporate sustainable manufacturing practices and recycled material certifications to appeal to environmentally conscious millennials and Gen Z consumers.

Major Companies operating in the Fishing Equipment Market are:

- Eagle Claw Fishing Tackle Co.

- Okuma Fishing Tackle Co. Ltd.

- Decathlon SA

- SHIMANO INC.

- TICA FISHING TACKLE

- AFTCO.

- RAPALA VMC CORPORATION

- Weihai Guangwei Group Co., Ltd

- Daiwa

Disclaimer: The companies listed above are not ranked in any particular order.

Fishing Equipment Market News and Recent Developments

- In January 2026, Rapala VMC and Okuma announced a new distribution agreement in Australia. This agreement marks a strategic expansion of Rapala Australia’s product portfolio, supporting a more complete range across key fishing categories and enhancing service for retail partners and anglers nationwide. With Okuma’s rods and reels complementing Rapala Australia’s existing brands, the combined portfolio is positioned to meet the needs of a broad range of Australian fishing styles, target species, and conditions.

- In October 2025, GOV.UK announced the Fishing and Coastal Growth Fund will boost regional economies. £56 million of new money will support Scottish, Welsh, and Northern Irish fishing industries and boost local economies. Investment in new technology and equipment, revitalising the UK’s fishing fleet, and training the next generation of fishers will drive growth across the industry. Regional delivery will target investment to where it matters most across the UK, boosting the sector and local communities for the future.

Fishing Equipment Market Report Coverage and Deliverables

The "Fishing Equipment Market Size and Forecast (2021–2034)" report provides a detailed analysis of the market covering below areas:

- Fishing Equipment Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Fishing Equipment Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Fishing Equipment Market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the Fishing Equipment Market.

- Detailed company profiles

Frequently Asked Questions

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For