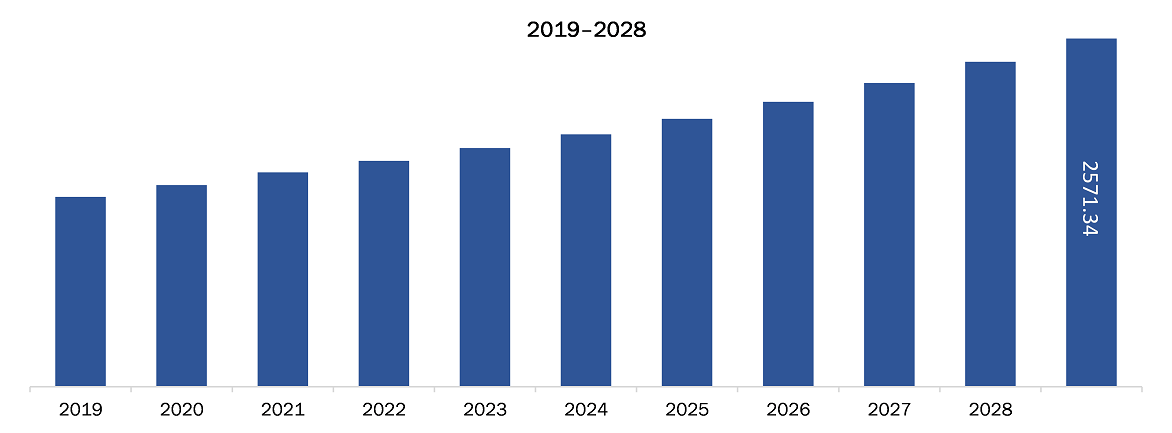

The Carbon Fiber Market in APAC is expected to grow from US$ 1098.99 million in 2019 to US$ 2571.34 million by 2027; it is estimated to grow at a CAGR of 11.4% from 2020 to 2027.

The China, India, and Japan are major economies in APAC. Increasing usage of carbon fiber in the sporting goods industry recently gained momentum after weak growth over the past few years The high-strength, modulus, and light-weight characteristics of carbon fiber have led to rising demand from the sporting goods manufacturing industry. Sporting goods such as golf shafts, racquets, skis, snowboards, hockey sticks, fishing rods, bats, and bicycles are manufactured using carbon fiber. Carbon fiber provides design flexibility when designing highly specific applications. The precise shape of equipment, which is critical to its performance, is easily achieved with the use of carbon fiber materials. Carbon fiber helps to enhance the performance of bikers and golfers. The most specific use of carbon fiber in the sporting equipment is seen in the tennis racket. Players can hit faster ball with the lighter racket and control the ball better with a larger area of the racket. These factors are driving the demand for carbon fiber in various sporting equipment’s. The increasing demand for carbon fiber-based sporting equipment provides a lucrative market opportunity for key and new market players. Many sports goods manufacturing in developed and developing countries such as China, Japan, India, and Taiwan are using carbon fiber.

The COVID-19 is anticipated to cause a significant economic loss in the Asia Pacific region. The consequence and impact can be even worse and totally depends on the spread of the virus. The governments of various Asia Pacific countries are taking possible steps to restrict the spread of the virus by announcing lockdown, which in turn has negatively impacted the overall carbon fiber market

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the Carbon Fiber Market APAC Carbon Fiber Market is expected to grow at a good CAGR during the forecast period.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

APAC Carbon Fiber Market Segmentation

APAC Carbon Fiber Market – By Raw Material

- PAN

- Pitch

APAC Carbon Fiber Market– By End Use Industry

- Automotive

- Aerospace and Defense

- Construction

- Sporting Goods

- Wind Energy

- Others

APAC Carbon Fiber Market – By Country

- China

- Japan

- India

- South Korea

- Taiwan

- Rest of APAC

APAC Carbon Fiber Market -Companies Mentioned

- Formosa Plastic Corporation

- Hexcel Corporation

- Hyosung Corporation

- Kureha Corporation

- Mitsubishi Chemical Corporation

- SGL Carbon

- Solvay

- Teijin Limited

- Toray Industries,Inc

Asia Pacific Carbon Fiber Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2019 | US$ 1098.99 Million |

| Market Size by 2027 | US$ 2571.34 Million |

| CAGR (2020 - 2027) | 11.4% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Raw Material

|

| Regions and Countries Covered |

Asia-Pacific

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For