Page Updated:

Oct 2020

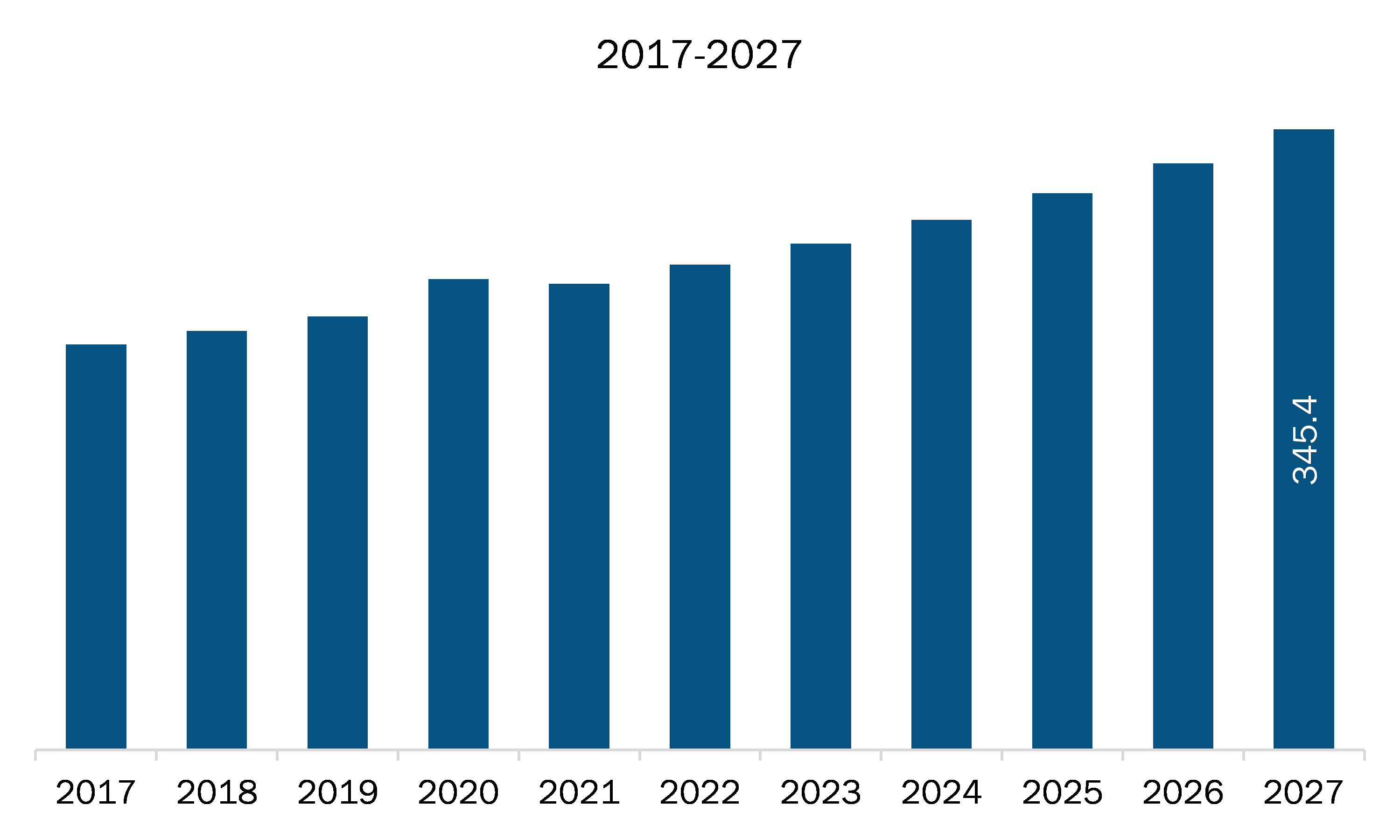

The APAC silicon anode battery market was valued at US$ 16.3 million in 2019 and is projected to reach US$ 124.3 million by 2027; it is expected to grow at a CAGR of 30.3% from 2020 to 2027.

Asian battery manufacturers dominate the market due to the robust manufacturing base established in Asia, which later enabled quick scaling up of the production volume and further development and optimization of the technology. Further, due to the growing community concern about the impact of waste lithium-ion batteries on the environment and public health, there is currently a shortage of appropriate policies and collection systems for cells in China. However, the importance of raw materials such as cobalt and nickel used in battery manufacturing has been successful in putting pressure on manufacturers and the government to regulate silicon anode battery properly. Therefore, by using appropriate policies and collection systems for lithium ion battery in China, a lot of silicon anode batteries can be manufactured and developed, which is contributing to the growth of the Asia Pacific Silicon Anode Battery Market.

Moreover, the medical device manufacturers, as well as energy industry technology developers, are constantly seeking advanced batteries for various applications, which is creating ample business opportunities for silicon anode battery manufacturers during the forecast period. In addition, the APAC silicon anode battery market comprises of several well-established players as well as emerging players or start-ups. The mix of these players is nurturing the industry, and with full-fledged commercialization, these APAC silicon anode battery market players are expected to witness significant growth in demand for their products.

Further, the increased spending on innovation and growing purchasing power of manufacturers in countries such as China, India, are likely to raise the demand for these batteries in APAC in the coming years. In addition, the presence of key automobile manufacturers is also anticipated to contribute to the APAC silicon anode battery market growth. However, COVID 19 is anticipated to negatively impact the market growth. The Airports Council International (ACI) Asia-Pacific warned that the prolonged duration of the coronavirus (COVID-19) outbreak would drastically impact the region’s airports’ connectivity and economic sustainability, significantly restricting them from achieving previously forecasted growth prospects. Such closures are anticipated to negatively impact market growth in the coming period.

Asia Pacific Silicon Anode Battery Market By Country 2019 and 2027(%)

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

APAC Silicon Anode Battery Market –Segmentation

Silicon Anode Battery Market– By Capacity

- < 1500 mAh

- 1500 mAh- 2500 mAh

- > 2500 mAh

Silicon Anode Battery Market – By Application

- Automotive

- Consumer Electronics

- Medical Devices

- Energy & Power

- Industrial

- Others

Silicon Anode Battery Market – By Country

- Australia

- China

- India

- Japan

- South Korea

- Rest of APAC

Company Profiles:

- Daejoo Electronic Materials Co., Ltd.

- Hitachi Chemical Company, Ltd.

- Huawei Technologies Co., Ltd.

- NEXEON LTD.

- Shin-Etsu Chemical Co., Ltd

- Targray Technology International

Asia Pacific Silicon Anode Battery Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2019 | US$ 16.3 Million |

| Market Size by 2027 | US$ 124.3 Million |

| CAGR (2020 - 2027) | 30.3% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Capacity

|

| Regions and Countries Covered |

Asia-Pacific

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Our Clients

Sales Assistance

US: +1-646-491-9876

UK: +44-20-8125-4005

Email:

sales@theinsightpartners.com

Chat with us

87-673-9708

ISO 9001:2015

Get Free Sample For

Get Free Sample For