Lithium-ion Battery Energy Storage Market Dynamics and Trends by 2031

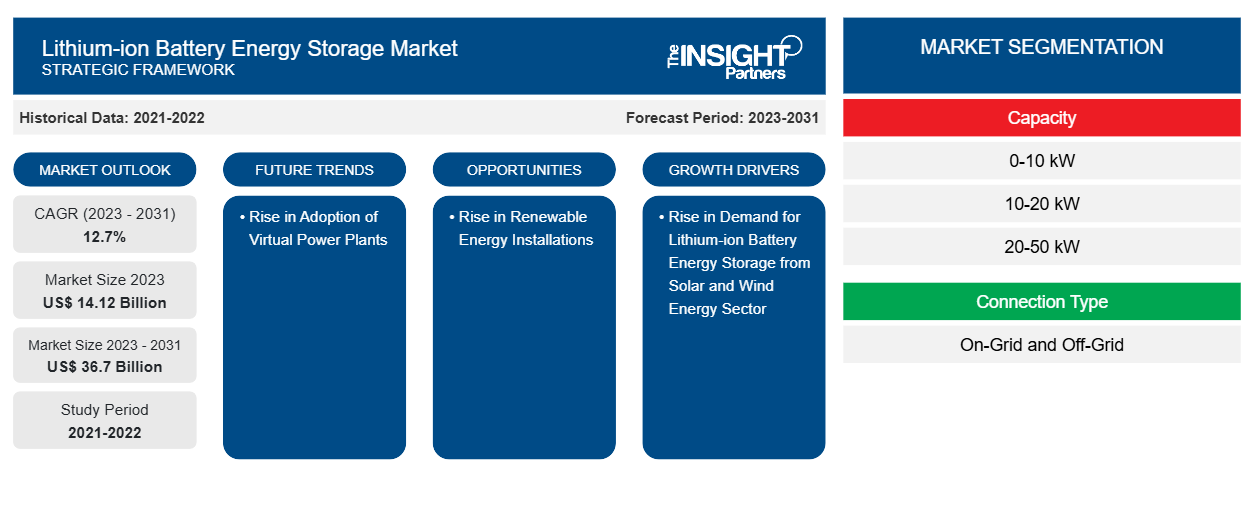

Lithium-ion Battery Energy Storage Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Capacity (0-10 kW, 10-20 kW, 20-50 kW, and Above 50 kW); Connection Type (On-Grid, and Off-Grid); End-use (Residential, Commercial, and Industrial, and Utility), and Geography

Historic Data: 2021-2022 | Base Year: 2023 | Forecast Period: 2023-2031- Report Date : Mar 2026

- Report Code : TIPRE00029895

- Category : Energy and Power

- Status : Data Released

- Available Report Formats :

- No. of Pages : 150

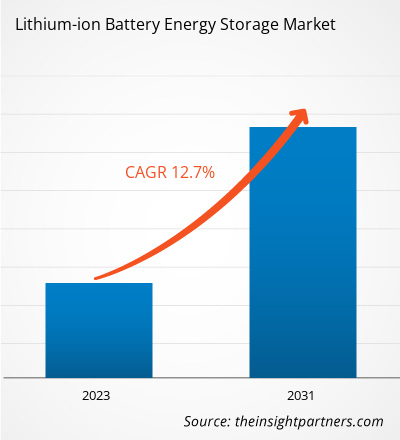

The lithium-ion battery energy storage market size is projected to reach US$ 36.7 billion by 2031 from US$ 14.12 billion in 2023. The market is expected to register a CAGR of 12.7% during 2023–2031. The rise in demand for virtual power plants is expected to remain a key trend in the lithium-ion battery energy storage market.

Lithium-ion Battery Energy Storage Market Analysis

The growing demand for renewable power generation across the world is projected to fuel market growth during the forecast period. In addition, the growing establishment of solar and wind power plants in the regions including Asia Pacific, Europe, and North America is anticipated to fuel the demand for lithium-ion battery energy storage, which in turn is projected to drive the market growth from 2023 to 2031. Moreover, the growth of the electric vehicle (EV) industry across the globe to reduce carbon emissions in the transportation industry is projected to fuel the demand for renewable power generation and battery energy storage solutions, which will result in fueling the market growth in the analyzed timeframe.

Lithium-ion Battery Energy Storage Market Overview

The key stakeholders in the lithium-ion battery energy storage market are raw material providers, component manufacturers, lithium-ion battery energy storage manufacturers, and end users. The raw material supplier is a crucial stakeholder in the ecosystem of the lithium-ion battery energy storage market. Australia alone produces 52% of the world's lithium. Based on electrode materials, there are six different types of lithium cells: LFP, NMC, LCO, NCA, LTO, and LMO. The most prominent raw materials used for lithium-ion batteries are cathode materials, anode materials, electrolytes, separators, and current collectors. Based on the cell shape, there are three types of lithium-ion batteries- cylindrical, pouch, and prismatic, each with distinct battery performance parameters. Raw materials required for Lithium-ion battery energy storage systems include Nonferrous metals and minerals like lithium, cobalt, nickel, manganese, graphite, copper, and aluminum. The key lithium-ion battery manufacturers include A123 Systems LLC, Panasonic Corporation, SAMSUNG SDI Co, Toshiba Corporation, and others.

Customizee This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONLithium-ion Battery Energy Storage Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Lithium-ion Battery Energy Storage Market Drivers and Opportunities

Increasing Number of Solar and Wind Energy Projects to Favor Market

The rise in the establishment of solar and wind energy projects across the globe to promote renewable energy-based power generation is expected to drive market growth in the coming years. The increase in capacity resulted from numerous government initiatives and support, including auctions, feed-in tariffs, net metering and contracts for difference. From 2021 to 2022, the governments of various economies made significant policies and target adjustments that impacted the growth of solar PV. For example, in July 2021, the European Commission proposed increasing the Union's renewable energy target from 32% to 40% by 2030. The REPowerEU plan further increased the target, increasing it to 45% in May 2022 (which would require 1,236). GW of installed renewable energy, including 600 GW of solar PV). The Inflation Reduction Act, a law that would increase support for renewable energy over the following decade through tax credits and other measures, was introduced by the U.S. federal government in August 2022. Such initiatives by the government aim at establishing solar and wind power projects are expected to drive market growth in the coming years.

Renewable Energy Projects in the Future

Battery storage systems (BESS) incorporating renewable energy offer enormous benefits such as energy self-sufficiency, cost efficiency, energy resilience, environmental benefits and grid support. This is why many industrialized countries are relying on renewable energies. As per the International Energy Agency (IEA), China is projected to add about half of the world's new renewable power capacity between 2022 and 2027, as BESS growth is expected to accelerate over the following five years despite the removal of subsidies for solar and wind energy. BESS can maintain a stable voltage range by injecting reactive power into the electrical grid. The system is important for renewable energy sources as their intermittent nature can cause voltage fluctuations. It can provide a black start feature that allows a power system to restart after a complete power failure.

Lithium-ion Battery Energy Storage Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Lithium-ion battery energy storage market analysis are capacity, connection type, and end-user

- On the basis of capacity, the lithium-ion battery energy storage (LiBES) market is divided into 0-10 kW, 10-20 kW, 20-50 kW, and above 50 kW. The 10-20 kW segment held a larger market share in 2023.

- By connection type, the market is classified into on-grid and off-grid. The on-grid segment held the larger share of the market in 2023.

- In terms of end-use, the market is classified into residential, commercial, industrial, and utility. The utility segment held a significant share of the market in 2023.

Lithium-ion Battery Energy Storage Market Share Analysis by Geography

The geographic scope of the Lithium-ion battery energy storage market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

Asia Pacific is leading the market with a share of more than 43% in the year 2023. China is one of the prominent countries in the Lithium-ion battery energy storage market in the Asia Pacific. According to China's National Energy Administration (NEA), solar and wind energy production increased by 21%, reaching 1,190 TWh in 2022. This accounted for 13.8% of China's total electricity consumption, roughly equivalent to the consumption of all urban and rural households. In addition, supportive government policies will further expand the installation of renewable energy capacity. As per the People's Republic of China (PRC) State Council, China added a total capacity of 125 GW of solar and wind farms in 2022, bringing the total capacity to 1,213 GW, of which photovoltaics accounted for 87.4 GW. Such initiatives to develop solar and wind energy projects are expected to boost the lithium-ion battery energy storage market from 2023 to 2031.

Lithium-ion Battery Energy Storage Market Regional Insights

The regional trends and factors influencing the Lithium-ion Battery Energy Storage Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Lithium-ion Battery Energy Storage Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Lithium-ion Battery Energy Storage Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 14.12 Billion |

| Market Size by 2031 | US$ 36.7 Billion |

| Global CAGR (2023 - 2031) | 12.7% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Capacity

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Lithium-ion Battery Energy Storage Market Players Density: Understanding Its Impact on Business Dynamics

The Lithium-ion Battery Energy Storage Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Lithium-ion Battery Energy Storage Market top key players overview

Lithium-ion Battery Energy Storage Market News and Recent Developments

The Lithium-ion battery energy storage market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the Lithium-ion battery energy storage market are listed below:

- Morrow Batteries and ABB have signed two Memorandum of Understanding agreements to enhance their partnership and advance the shift to renewable energy sources and electrification across all sectors of society. As per the agreements, ABB has been selected as a non-exclusive preferred technology supplier for manufacturing and power supply to Morrow. The objective is to ensure that the planned giga factory at Eyde Energy Park in Norway becomes one of the most cost-effective and sustainable facilities globally. This partnership aims to leverage ABB's expertise and experience to optimize Morrow's manufacturing process and enable the production of high-quality, sustainable batteries. (Source: ABB Ltd, Press Release, September 2022)

- Exide Industries and its joint venture partner, Leclanche SA, have announced the launch of India's biggest lithium-ion battery plant in Gujarat. The plant has six automated assembly lines and an installed capacity of 1.5 GWh. It will focus on producing batteries for automobiles and energy storage applications. The joint venture company Nexcharge, released a statement confirming the start of mass production at the facility. (Source: Exide Industries Ltd, Press Release, May 2022)

Lithium-ion Battery Energy Storage Market Report Coverage and Deliverables

The “Lithium-ion Battery Energy Storage Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Lithium-ion battery energy storage market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Lithium-ion battery energy storage market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Lithium-ion battery energy storage market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Lithium-ion battery energy storage market

- Detailed company profiles

Frequently Asked Questions

Nivedita is an accomplished research professional with over 9 years of experience in Market Research and Business Consulting. Currently serving as a Project Manager in the ICT domain at The Insight Partners, she brings deep expertise in managing and executing Syndicated, Custom, Subscription-based, and Consulting research assignments across diverse technology sectors.

With a proven track record of delivering data-driven analysis and actionable insights, Nivedita has been a key contributor to several critical projects. Her work involves end-to-end project execution—right from understanding client objectives, analyzing market trends, to deriving strategic recommendations. She has collaborated extensively with leading ICT companies, helping them identify market opportunities and navigate industry shifts.

Nivedita holds an MBA in Management from IMS, Dehradun. Prior to joining The Insight Partners, she gained valuable experience at MarketsandMarkets and Future Market Insights in Pune, where she held various research roles and built a strong foundation in industry analysis and client engagement.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Related Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For