Automotive Airbag ECU Market Size, Growth, Trends & Forecast 2034

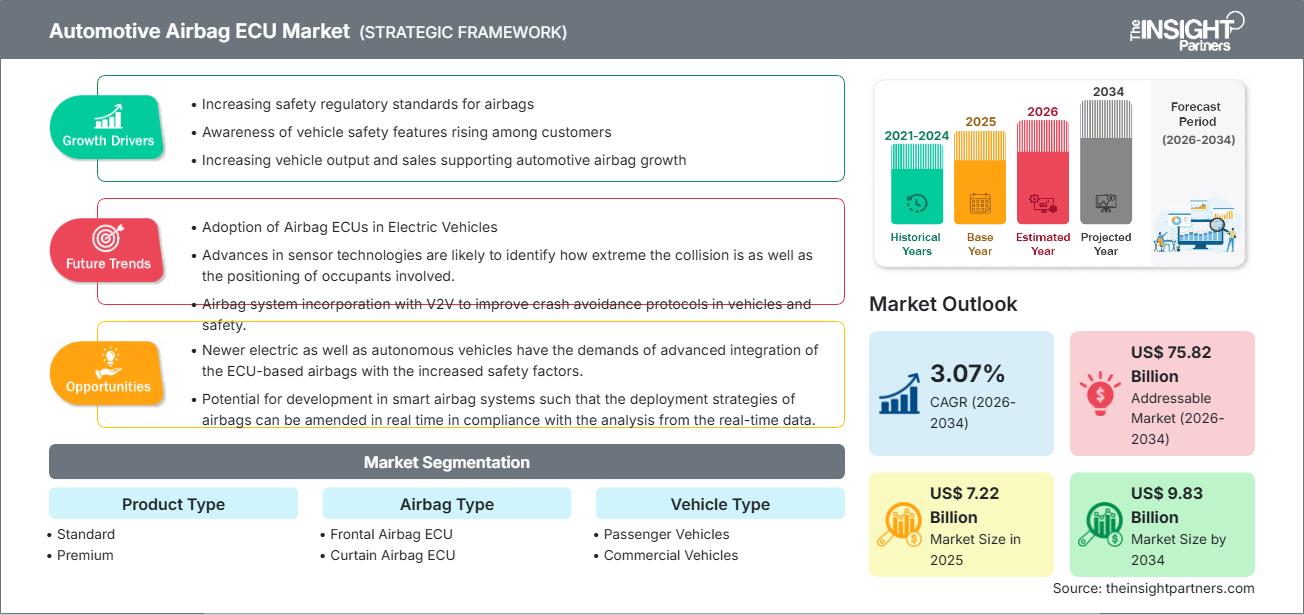

Automotive Airbag ECU Market Size and Forecast (2021 - 2034), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (Standard and Premium), Airbag Type (Frontal Airbag ECU and Curtain Airbag ECU), and Vehicle Type (Passenger Vehicles and Commercial Vehicles)

Historic Data: 2021-2024 | Base Year: 2025 | Forecast Period: 2026-2034- Report Date : Apr 2026

- Report Code : TIPRE00022355

- Category : Automotive and Transportation

- Status : Upcoming

- Available Report Formats :

- No. of Pages : 150

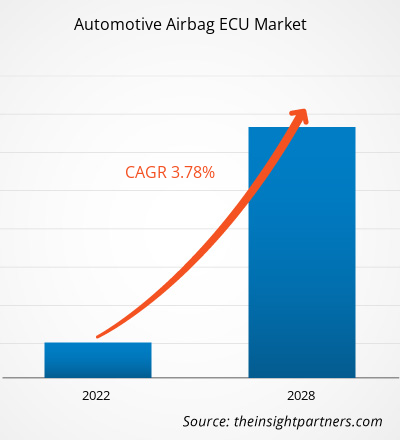

The automotive airbag ECU market size is expected to reach US$9.83 billion by 2034 from US$7.22 billion in 2025. The market is anticipated to register a CAGR of 3.07% during 2026–2034.

Automotive Airbag ECU Market Analysis

The automotive airbag ECU market forecast indicates steady growth, primarily driven by strict safety regulations worldwide and the rising expectations of consumers for higher passive safety features across all vehicle classes. The growth of the market is facilitated by the increasing adoption of Advanced Driver Assistance Systems and the need for sophisticated sensor fusion functionality in the ECU to enable real-time detection and mitigation of crashes. This emphasis on high performance and reliability is accelerating the pace of innovation in compact, lightweight ECU design, which is a necessity for vehicle performance optimization, especially in the fast-growing Electric Vehicle segment.

Automotive Airbag ECU Market Overview

Automotive airbag ECUs form one of the most fundamental building blocks for electronic control and offer central intelligence within a restraint system. Their cardinal functions involve processing signals from various crash sensors, namely accelerometers and pressure sensors, in a manner that is accurate to identify the severity and nature of the collision. Such identification is essential to activate the airbags and pretensioners in a very time-critical manner to minimize occupant injury. Modern ECUs use microcontrollers and diagnostics that monitor the health of the system continuously to ensure reliability and mandatory compliance with international safety norms such as Euro NCAP and NHTSA standards. With increasing vehicle complexity, the function of ECUs for handling an expanding number of safety devices like frontal, curtain, and far-side airbags requires continuous adaptation.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONAutomotive Airbag ECU Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Automotive Airbag ECU Market Drivers and Opportunities

Market Drivers:

- Stringent Global Safety Regulations: Governments and regulatory bodies worldwide mandate the inclusion of advanced airbag and passive safety systems in all vehicle categories, directly accelerating the demand and adoption rate of certified ECUs.

- Rising Vehicle Production and Premiumization: Increasing production volumes, especially in emerging markets, coupled with the growing penetration of advanced safety features (e.g., knee airbags, far-side airbags) in mid-range cars, boost the overall demand for complex ECUs.

- Technology Advances in Sensing: Ongoing refinements in the development of sensor fusion and real-time crash detection algorithms continue to improve ECU performance, enabling adaptive deployment strategies based on occupant size, position, and crash severity.

Market Opportunities:

- Integration with ADAS and Autonomous Platforms: ECUs are evolving to be part of broader safety architectures, seamlessly integrating with ADAS and autonomous driving systems in the future to enable sophisticated, pre-crash mitigation strategies.

- Lightweight and Compact ECUs for EVs: The rapid growth of the electric vehicle (EV) sector drives the demand for smaller, lighter, and more energy-efficient ECUs that do not compromise battery life or vehicle performance.

- Emerging Markets Expansion: Regulatory harmonization and increasing disposable incomes in key regions, such as the Asia-Pacific and Latin America, where there is significant untapped growth potential, have upped their vehicle safety standards.

Automotive Airbag ECU Market Report Segmentation Analysis

The automotive airbag ECU market share is analyzed across various segments based on product complexity, airbag type, and vehicle application. Below is the standard segmentation approach used in most industry reports:

By Product Type:

- Premium ECUs: This segment is growing at the fastest pace owing to the need for multi-loop firing, advanced ADAS integration, complex diagnostic features, and the management of a greater number of restraint devices in high-end and luxury vehicles.

- Standard ECUs: These are primarily featured in entry-level and mid-range vehicles. They support basic, two-loop frontal and side airbag deployments.

By Airbag Type:

- Frontal Airbag ECU: This segment holds the largest market share, as frontal airbags are mandatory in most global regulations and represent the core function of the passive safety system.

- Curtain Airbag ECU: This type is gaining traction significantly due to strict side-impact safety mandates and growing consumer demand for comprehensive side and rollover protection.

By Vehicle Type:

- Passenger Vehicles: This segment is the dominant application area, driven by high production volumes and continuous updates to passenger safety standards.

- Commercial Vehicles: Includes heavy trucks and buses, which require robust and reliable ECUs to protect the occupants and driver in harsh operational conditions.

By Geography:

- North America

- Europe

- Asia Pacific

- South & Central America

- Middle East & Africa

Automotive Airbag ECU Market Regional Insights

The regional trends and factors influencing the Automotive Airbag ECU Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Automotive Airbag ECU Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Automotive Airbag ECU Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2025 | US$ 7.22 Billion |

| Market Size by 2034 | US$ 9.83 Billion |

| Global CAGR (2026 - 2034) | 3.07% |

| Historical Data | 2021-2024 |

| Forecast period | 2026-2034 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Automotive Airbag ECU Market Players Density: Understanding Its Impact on Business Dynamics

The Automotive Airbag ECU Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Automotive Airbag ECU Market top key players overview

Automotive Airbag ECU Market Share Analysis by Geography

Asia Pacific is expected to grow fastest in the coming years. Emerging markets in South & Central America, the Middle East, and Africa also have many untapped opportunities for automotive safety providers to expand their reach.

The automotive airbag ECU market shows a different growth trajectory in each region due to factors such as stringent safety mandates, high vehicle production volume, and the complexity of integrated safety systems. Below is a summary of market share and trends by region:

North America

- Market Share: Holds the largest market share globally due to the presence of leading vehicle OEMs and Tier-1 suppliers, coupled with highly enforced safety compliance standards (e.g., NHTSA).

- Trends: Continuous integration of predictive safety features and advanced diagnostics into ECU platforms to achieve maximum vehicle safety ratings.

Europe

- Market Share: Commands a significant share, driven by the strict Euro NCAP standards and a high rate of adoption of premium vehicles and technologies.

- Trends: Focus on cybersecurity in ECU software and pioneering new safety protocols for vulnerable road users and occupants in future vehicle designs.

Asia Pacific

- Market Share: Projected to be the fastest-growing region, fueled by massive increases in automotive production (especially in China and India) and the gradual harmonization of local safety regulations with global benchmarks.

- Trends: High investment in local manufacturing capacity by key players (e.g., Autoliv expansion) to meet the rapidly rising safety demand.

South & Central America

- Market Share: Emerging market characterized by increasing regulatory enforcement and modernization of local fleet safety standards.

- Trends: Growth is driven by the demand for cost-effective, reliable ECU solutions for mainstream vehicle segments, aligning with basic global safety requirements.

Middle East and Africa

- Market Share: Developing market with strong potential, supported by expanding automotive sectors and growing consumer awareness of vehicle safety.

- Trends: Implementation of standard and mid-range ECUs as part of regulatory baseline requirements for imported and locally assembled vehicles.

Automotive Airbag ECU Market Players Density: Understanding Its Impact on Business Dynamics

The automotive airbag ECU market is moderately consolidated due to the high barrier to entry associated with product liability, complex safety certifications, and long-term OEM supply contracts. Global players such as Aptiv, Autoliv Inc., Continental AG, Denso Corp, Robert Bosch GmbH, and ZF Friedrichshafen AG dominate, leveraging their existing relationships with major automakers.

This competitive environment pushes vendors to differentiate through:

- Advanced R&D in Software: Developing proprietary crash-sensing algorithms and multi-loop deployment logic for complex crash scenarios.

- Scalability and Modularity: Creating scalable ECU platforms that can be easily adapted for multiple vehicle models and electric vehicle architectures.

- Strategic Partnerships: Collaborating with OEMs on next-generation vehicle programs, including systems for autonomous and purpose-built vehicles.

Major Companies Operating in the Automotive Airbag ECU Market are:

- Aptiv

- Autoliv Inc.

- Continental AG

- Denso Corp

- Hyundai Mobis

- Robert Bosch GmbH

- Hella GmbH & Co. KGaA

- ZF Friedrichshafen AG

- Mitsubishi Electric Corporation

Disclaimer: The companies listed above are not ranked in any particular order.

Automotive Airbag ECU Market News and Recent Developments

- Aptiv announced advancements in Smart Vehicle Architecture™ (SVA) : Aptiv introduced domain controllers that consolidate passive safety functions, including airbag ECUs, into secure, OTA-capable zone controllers. These innovations aim to enhance safety and cybersecurity while reducing hardware complexity in software-defined vehicles.

- Autoliv launched Bernoulli™ Airbag Module for EV interiors : Autoliv unveiled its Bernoulli™ airbag technology, leveraging fluid dynamics to inflate larger cushions using ambient airflow. This innovation reduces weight, cost, and heat generation, making it ideal for electric vehicles and next-generation cabin designs.

- Continental partnered with AWS to develop virtual ECUs : Continental announced its Virtual ECU Creator (vECU) initiative with AWS, enabling cloud-based ECU development for software-defined vehicles. Additionally, Continental showcased adaptive occupant protection systems with dynamic airbag inflation at IAA and CES events.

- Denso expanded its Collision Safety Systems portfolio : Denso highlighted integrated airbag ECUs and satellite sensors designed for reliable deployment and occupant protection. The company is also transitioning toward centralized ECU architectures to support advanced safety and connectivity features.

- Hyundai Mobis focused on modular safety systems : Hyundai Mobis introduced innovative airbag solutions for purpose-built vehicles (PBVs), including curtain airbags and modular ECU designs, aligning with evolving mobility trends and automated driving requirements.

Automotive Airbag ECU Market Report Coverage and Deliverables

The "Automotive Airbag ECU Market Size and Forecast (2021–2034)" report provides a detailed analysis of the market covering below areas:

- Automotive Airbag ECU Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Automotive Airbag ECU Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Automotive Airbag ECU Market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the Automotive Airbag ECU Market

- Detailed company profiles

Frequently Asked Questions

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For