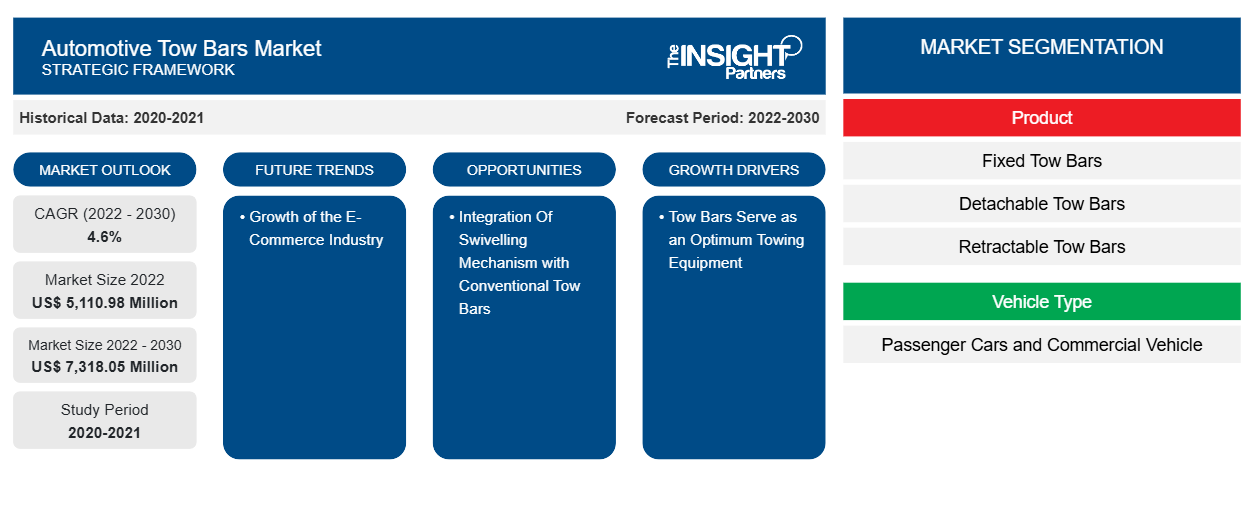

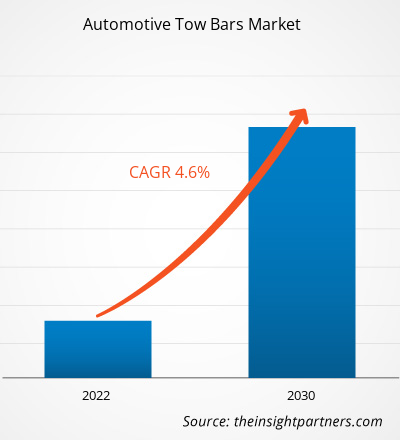

The automotive tow bars market was valued at US$ 5,110.98 million in 2022 and is projected to reach US$ 7,318.05 million by 2030; it is expected to record a CAGR of 4.6% during 2022–2030.

Analyst Perspective:

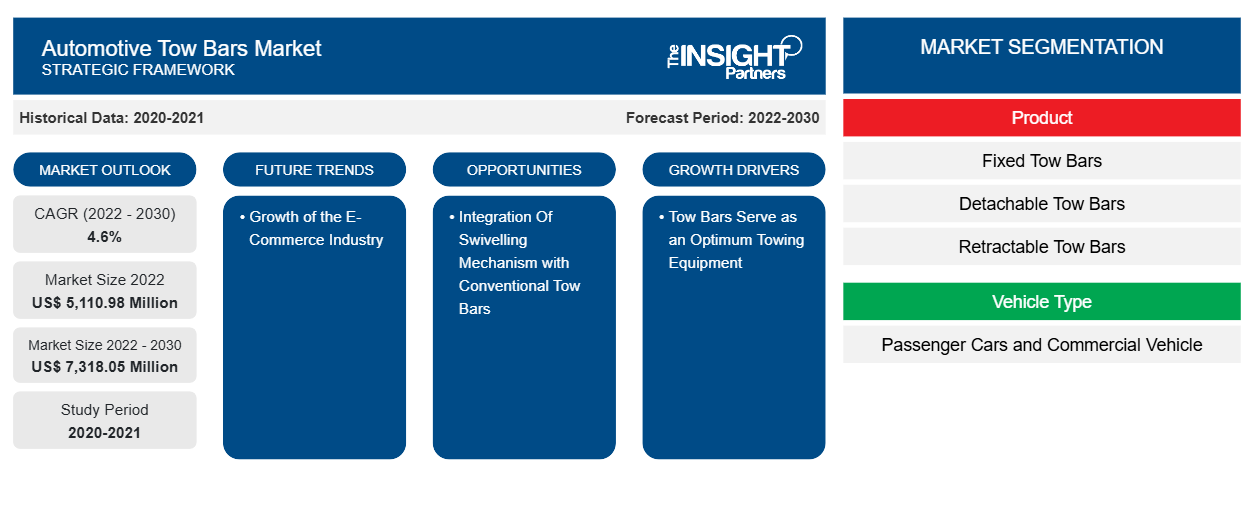

The tow bar is used for towing a broken-down vehicle while ensuring balance to avoid a skid. The global automotive tow bars market has been segmented into five major regions—North America, Europe, Asia Pacific, the Middle East and Africa, and South and Central America. Growing popularity of adventure sports and recreational vehicles (RVs) propels the demand for automotive tow bars. The increasing sales of passenger vehicles also support the growth of the Automotive Tow Bars Market. According to the European Automobile Manufacturers’ Association, or ACEA, Europe and North America account for about 34.6% share of the total automotive cars manufactured across the world. Europe is expected to register the highest CAGR in the automotive tow bars market, followed by North America and APAC.

The demand for automotive tow bars is directly related to the sales of passenger vehicles. Thus, the growing sales of passenger cars in developed regions such as Europe and North America support the growth of the automotive tow bars market.

Mostly, caravan users choose tow bars for towing caravans. There are various types of tow bars available in the market to carry a wide variety of accessories, and it is highly popular in the UK. The electric tow bar is gaining popularity, which would create opportunities for the companies operating in the automotive tow bars market to gain a strong customer base in the coming years.

Market Overview:

The growing disposable income of various developing countries, high inclination toward adventure activities, and rising use of caravans and motorhomes propel the automotive tow bars market growth. The demand for automotive tow bars is likely to surge owing to the increasing trend for towable recreational vehicles. Electric tow bars can be operated by a switch. Therefore, demand for electric tow bars is anticipated to grow at a moderate pace during the forecast period due to growing preference for Sports Utility Vehicles (SUV) and off-road vehicles. Increasing investments to set up factories and expand production houses of automobile would propel the demand for passenger vehicles and commercial vehicles. Thus, these key factors are predicted to drive the automotive tow bars market growth during 2020–2027.

Furthermore, various companies in the automotive tow bars market adopt many strategies such as product development and acquisition to stay ahead of the competition. In March 2020, Curt Manufacturing introduced a new non-binding tow bar—Rambler steel tow bar. The newly launched product features an automatic locking mechanism, three stowing positions, and slide-resistant arms for better control and handling. Hence, inorganic market strategies propel the automotive tow bars market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Automotive Tow Bars Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Automotive Tow Bars Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Driver:

Increased Automotive Production Drives Automotive Tow Bars Market Growth

In the past few years, the increase in automotive production, particularly in the advanced regions such as North America and Europe, has driven the growth of the automotive tow bars market. The tow bar for automobiles is available as a standard filament or as an additional feature with most premium passenger car models launched by automotive giants such as Audi, Range Rover, BMW, and Ford Motor Company. The rapid growth of automotive production in advanced economies across the world bolsters the demand for tow bars in the automotive sector. Electric vehicles and hybrid electric vehicles are gaining traction in the market. Sustainable development and subsequent demand for green cars have led to the emergence of electric vehicles and other renewable energy sources, including solar, wind, and biofuels. Moreover, the use of these vehicles is encouraged by several government initiatives such as the payment of incentives and tax benefits to green vehicle adopters. Thus, the rapidly increasing adoption rates of electric and hybrid vehicles drive the automotive tow bars market growth.

Segmental Analysis:

Based on product, the automotive tow bars market is segmented into retractable tow bars, fixed tow bars, detachable tow bars, and Others.

A retractable tow bar is a slim, swan neck shaped tow bar, which can spin beneath the bumper. The retractable tow bar is easy to retract or extend as needed; in the retracted position, the tow bar is completely concealed. The tow ball and tow bar neck for the retractable product are all in one piece, and one can effortlessly rotate it by hand in seconds, where it will be placed in the space between the rear panel and bumper of the vehicle. This tow bar provides convenience and ease of use. It can easily be folded; it is user-friendly and ready to use in seconds. It works electrically or through a conveniently positioned release mechanism. The retractable tow bar automatically rotates out from below the bumper and can be used immediately. Retractable tow bars offer a discrete appearance; their added complexity might potentially cause issues in the future. However, proper maintenance and servicing would mitigate any potential reliability issues. Further, the growing number of passenger cars and commercial vehicles in several potential regions is likely to boost the demand for retractable tow bars during the forecast period.

Automotive Tow Bars Market Regional Insights

The regional trends and factors influencing the Automotive Tow Bars Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Automotive Tow Bars Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Automotive Tow Bars Market

Automotive Tow Bars Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 5,110.98 Million |

| Market Size by 2030 | US$ 7,318.05 Million |

| Global CAGR (2022 - 2030) | 4.6% |

| Historical Data | 2020-2021 |

| Forecast period | 2022-2030 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

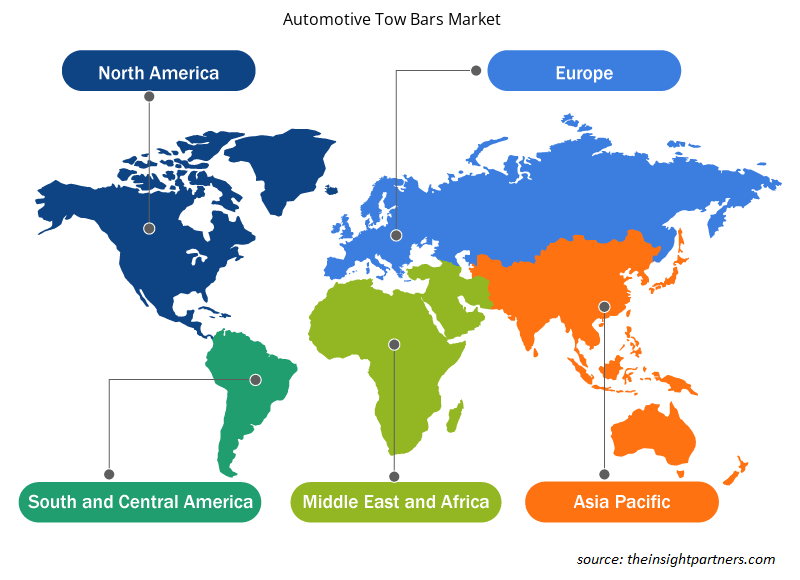

Automotive Tow Bars Market Players Density: Understanding Its Impact on Business Dynamics

The Automotive Tow Bars Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Automotive Tow Bars Market are:

- AutoPacific Australia Pty Ltd

- Bosal Group

- Brink Group

- BTA Towing Equipment

- CURT Manufacturing LLC

- Oris

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Automotive Tow Bars Market top key players overview

Regional Analysis:

The automotive tow bars market share is segmented into five major regions: North America, Europe, APAC, the MEA, and SAM.

The US, Canada, and Mexico are among the major economies in North America. Technological advancements have led to a highly competitive market in North America as the increasing population attracts several technological developments due to high spending power. The region has one of the largest automotive manufacturing hubs across the world. The presence of prominent automotive manufacturers and component manufacturers is propelling the market value. The economic growth of North America has increased the sale of passenger cars and commercial vehicles. Tow bars are used by passenger cars, light commercial vehicles, and heavy commercial vehicles; they are strong enough that they do not disintegrate when they are used to pull trailers. The growing passenger car and commercial vehicle sales are raising the demand for automotive tow bars. The European Automobile Manufacturers’ Association, or ACEA, stated in 2021 that the production of passenger cars and commercial vehicles was 13.58 million units in Europe. The use of lightweight materials to design tow bars can reduce the weight of vehicles and enhance fuel efficiency, which would offer lucrative opportunities for the automotive tow bars market in the coming years. Several technological advancements in material science have resulted in a boom in the automotive tow bars market. The developments have allowed manufacturers to use polymers or metals with higher tensile strengths, which could substantially enhance the functionality of tow bar and its operational life. Major factor propelling the automotive tow bars market growth is the swift development in the manufacturing techniques of tow bars and their materials. Further, advancements in electric tow bars are anticipated to grow at a moderate speed in North America during the forecast period, owing to rising SUVs demand, which encourages manufacturers to increase the production of SUVs.

Key Player Analysis:

AutoPacific Australia Pty Ltd, Bosal Group, Brink Group, BTA Towing Equipment, CURT Manufacturing LLC, Oris, PCT Automotive Limited, Alois Kober GmbH, North Shore Tow bars, and GDW NV are among the key automotive tow bars market players operating in the market.

Recent Developments:

Inorganic and organic strategies such as mergers and acquisitions are highly adopted by companies in the global automotive tow bars market. A few recent developments by key automotive tow bars market players are listed below:

Year | News |

Nov 2020 | Exhaust and touring equipment brand Bosal announced the rebuild of its towbar division to serve both the aftermarket and dealer fitment on new vehicles. |

Mar 2020 | Curt Manufacturing introduced a new non-binding towbar Rambler steel towbar. The newly launched product features with an automatic locking mechanism, three stowing positions and slide-resistant arms for better control and handling. |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, and Vehicle Type

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

What are reasons behind automotive tow bars market growth?

In the past few years, the increase in automotive production, particularly in the advanced regions, including North America and Europe, has driven the growth of the automotive tow bars market. The tow bar for automobiles is available as a standard filament or as an additional feature with most premium passenger car models launched by automotive giants such as Audi, Range Rover, BMW, and Ford Motor Company.

What is the future trend for the automotive tow bars market?

Prominent market vendors have launched electrically operated tow bars for both OEMs and the aftermarket segments of the automotive sector. These tow bars are designed to improve the functionality of conventional tow bars and offer users convenience in terms of operability.

Which region to dominate the automotive tow bars market in the forecast period?

The US, Canada, and Mexico are major economies in North America. Technological advancements have led to a highly competitive market in the region as the increasing population attracts several technological developments due to high spending power. The region has one of the largest automotive manufacturing hubs in the globe.

Who are the major vendors in the automotive tow bars market?

Bosal Group, Brink Group, CURT Manufacturing LLC, Oris, and PCT Automotive Limited are the key market players operating in the global automotive tow bars market.

What are market opportunities for the automotive tow bars market?

Smart tow bars equipped with wireless connectivity and remote-control capabilities make it easier for users to manage towing tasks. Users can control the tow bar from their smartphone or tablet, eliminating the need for manual adjustments and simplifying the hitching and unhitching process.

Trends and growth analysis reports related to Automotive and Transportation : READ MORE..

The List of Companies - Automotive Tow Bars Market

- AutoPacific Australia Pty Ltd

- Bosal Group

- Brink Group

- BTA Towing Equipment

- CURT Manufacturing LLC

- Oris

- PCT Automotive Limited

- Alois Kober GmbH

- North Shore Tow bars

- GDW NV

Get Free Sample For

Get Free Sample For