Cosmetic Bioactive Ingredients Market Size, Share & Demand by 2034

Cosmetic Bioactive Ingredients Market Size and Forecast (2021 - 2034), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Ingredient Type (Probiotics and Prebiotics, Omega-3 Fatty Acids, Vitamins, Carotenoids and Antioxidants, Plant Extracts, Minerals, Amino Acids, Proteins and Peptides, and Others); Sources (Plant, Animal, and Microbial), and Geography

Historic Data: 2021-2024 | Base Year: 2025 | Forecast Period: 2026-2034- Report Date : Apr 2026

- Report Code : TIPRE00023327

- Category : Chemicals and Materials

- Status : Upcoming

- Available Report Formats :

- No. of Pages : 150

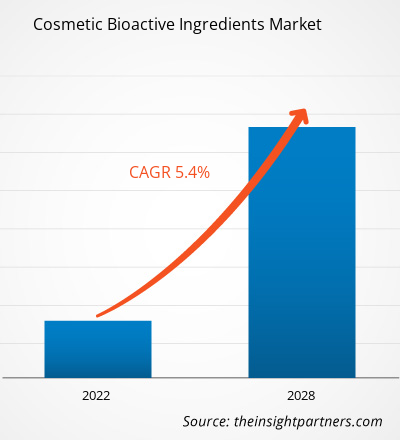

The global Cosmetic Bioactive Ingredients market size is projected to reach US$ 3.15 billion by 2034 from US$ 1.91 billion in 2025. The market is anticipated to register a CAGR of 5.7% during the forecast period 2026–2034. Key market dynamics include an intensifying consumer demand for evidence-based skincare, the rapid rise of the clean beauty movement, and significant advancements in biotechnology that allow for more stable and potent active compounds. Additionally, the market is expected to benefit from the growing geriatric population seeking anti-aging solutions, the expansion of premium male grooming sectors, and the increasing integration of bioactive substances in hair care and nutricosmetics.

Cosmetic Bioactive Ingredients Market Analysis

The cosmetic bioactive ingredients market analysis reveals a decisive shift toward performance-driven formulations where clinical efficacy is the primary competitive differentiator. Strategic opportunities are emerging in the development of microbiome-friendly and blue beauty (marine-derived) ingredients, which cater to the twin consumer desires for skin health and environmental stewardship. For businesses, the focus is increasingly on white biotechnology and green chemistry to replace synthetic molecules with sustainable, bio-identical alternatives. The analysis also suggests that market entry and expansion strategies should prioritize the stabilization of sensitive actives, such as polyphenols and probiotics, through advanced encapsulation technologies. By providing transparent clinical data and ethical sourcing narratives, ingredient suppliers can command premium pricing in an increasingly scrutinized global supply chain.

Cosmetic Bioactive Ingredients Market Overview

Cosmetic bioactive ingredients are evolving from simple emollients to sophisticated molecules that interact directly with skin cells. Traditionally dominated by vitamins and botanical extracts, cosmetic bioactive ingredients are now being revolutionized by peptides, amino acids, and microbial-derived ferments that offer targeted physiological benefits. Global urbanization and rising pollution levels have spurred a surge in anti-pollution and skin-barrier products, making antioxidants a staple of modern formulations. While Europe and North America remain mature hubs for research and development, the market is witnessing high-volume growth in the Asia-Pacific region. As consumers become more educated via digital platforms, the transparency of the INCI list has become a critical factor for brand loyalty across both mass and luxury segments. For instance, the market in the US is characterized by a mature consumer base that prioritizes scientific innovation and high-performance skincare. There is a strong movement toward personalized beauty solutions and clean-label products. Local manufacturers focus on leveraging advanced biotechnology to develop sustainable, multifunctional ingredients that align with rigorous regulatory standards.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONCosmetic Bioactive Ingredients Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Cosmetic Bioactive Ingredients Market Drivers and Opportunities

Market Drivers:

- The Rise of Bio-Hacking and Evidence-Backed Performance: The modern consumer, often termed a Skintellectual or Bio-hacker, has moved beyond superficial brand promises. There is an intensifying demand for clinical-grade efficacy and transparency in the INCI (International Nomenclature Cosmetic Ingredient) list. Ingredients like engineered peptides and polyglutamic acid are replacing generic fillers because they offer measurable physiological changes, such as cellular repair and targeted collagen synthesis.

- Biotechnology as the New Standard for Sustainability: Clean beauty has evolved into Biotech Beauty. Precision fermentation and lab-grown actives (like microalgae-derived antioxidants) allow manufacturers to produce rare botanical compounds without the environmental footprint of traditional farming. This shift ensures ingredient purity, stability, and consistency, which are often compromised in wild-harvested natural extracts.

- The Barrier-First and Longevity Mindset: There is a global transition from aggressive, exfoliation-heavy routines to barrier-supportive regimens. Driven by rising skin sensitivity and environmental pollution, consumers are seeking bioactives that mimic the skin's natural ecosystem, such as ceramides, postbiotics, and lipids. This is coupled with a skin longevity trend, where the goal is to enhance deep biological resilience rather than just achieving a temporary glow.

Market Opportunities

- Hyper-Personalization via AI and Smart Diagnostics: A significant opportunity exists in integrating AI-driven skin analysis with modular formulation systems. By 2026, the market is shifting toward micro-dosing, where algorithms determine the exact concentration of an active based on a user's visual diagnostic or at-home hormone test. Suppliers who can provide customizable active concentrations at scale will lead the premium segment.

- Neurocosmetics and the Brain-Skin Axis: Psychodermatology is rapidly emerging as a high‑growth category, presenting significant opportunities for innovation in ingredients that address the interplay between psychological stress and skin health. Bioactive compounds such as neuropeptides and adaptogenic ingredients, including Ashwagandha and CBD, are being strategically positioned beyond traditional topical benefits. They now form part of a new class of “sensory skincare,” designed to help mitigate cortisol-driven skin aging and inflammation, while enhancing overall consumer well‑being.

- Nutricosmetics and Beauty from Within: The convergence of the food and beauty sectors is opening a significant market opportunity for dual‑purpose bioactive ingredients. Compounds that can be incorporated into both topical formulations and ingestible supplements—such as marine collagen or ferulic acid—enable brands to deliver comprehensive, 360‑degree beauty solutions. This integrated approach positions companies to capitalize on the accelerating demand within the wellness and longevity markets, where consumers increasingly seek holistic routines that support beauty from both the inside and the outside.

Cosmetic Bioactive Ingredients Market Report Segmentation Analysis

The Cosmetic Bioactive Ingredients Market share is analyzed across various segments to provide a clearer understanding of its structure, growth potential, and emerging trends. Below is the standard segmentation approach used in most industry reports:

By Ingredient Type:

- Probiotics and Prebiotics: A burgeoning segment focused on balancing the skin's microbiome and enhancing natural defense mechanisms against environmental stressors.

- Omega-3 Fatty Acids: Essential for maintaining skin lipid barriers and providing anti-inflammatory benefits in products for sensitive or dry skin.

- Vitamins: A foundational segment including Vitamin C, E, and A (Retinoids), widely utilized for their proven antioxidant and anti-aging properties.

- Carotenoids and Antioxidants: Critical for UV protection and neutralizing free radicals, increasingly popular in urban-focused anti-pollution formulations.

- Plant Extracts: The largest segment by volume, covering a vast array of botanicals valued for their natural appeal and diverse functional benefits.

- Minerals: Key components in sun protection (zinc/titanium) and skin-soothing products, often sourced from thermal waters or clays.

- Amino Acids: Utilized as building blocks for skin repair and moisture retention, frequently found in high-end moisturizing serums.

- Proteins and Peptides: The fastest-growing high-value segment, essential for stimulating collagen production and addressing deep-tissue aging concerns.

- Others: Includes enzymes and specialty organic acids that provide exfoliation and brightening benefits.

By Sources:

- Plant: The primary source for the market, favored for its alignment with organic and clean beauty trends.

- Animal: Includes traditional ingredients like collagen, honey, and elastin, though facing competition from synthetic and plant-based alternatives.

- Microbial: An innovative and sustainable source utilizing fermentation and biotechnology to produce high-purity actives like hyaluronic acid and certain peptides.

By Geography:

- North America

- Europe

- Asia Pacific

- South & Central America

- Middle East & Africa

Cosmetic Bioactive Ingredients Market Regional Insights

The regional trends influencing the Cosmetic Bioactive Ingredients Market have been analyzed across key geographies.

Cosmetic Bioactive Ingredients Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2025 | US$ 1.91 Billion |

| Market Size by 2034 | US$ 3.15 Billion |

| Global CAGR (2026 - 2034) | 5.7% |

| Historical Data | 2021-2024 |

| Forecast period | 2026-2034 |

| Segments Covered |

By Ingredient Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Cosmetic Bioactive Ingredients Market Players Density: Understanding Its Impact on Business Dynamics

The Cosmetic Bioactive Ingredients Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Cosmetic Bioactive Ingredients Market Share Analysis by Geography

Asia-Pacific is expected to grow fastest in the coming years. Emerging markets in South & Central America, the Middle East, and Africa also have many untapped opportunities for high-performance ingredient suppliers and premium personal care brands to expand.

The cosmetic bioactive ingredients market is undergoing a significant transformation, moving from traditional botanical use to a global science-driven industry. Growth is driven by the rising prevalence of pollution-related skin concerns, a surge in anti-aging and skin-longevity demand, and the expansion of the luxury cosmeceutical sector. Below is a summary of market share and trends by region:

North America

- Market Share: A dominant and highly innovative segment driven by a robust R&D ecosystem and the presence of major specialty chemical players.

- Key Drivers:

- High consumer spending on performance-driven skincare and professional-grade medical beauty products.

- Rapid adoption of biotechnology-derived actives, such as bio-identical peptides and synthetic growth factors.

- Strong regulatory focus on safety and transparency, pushing brands toward high-purity, clean-label ingredients.

- Trends: Scaling of the nutricosmetics sector and the successful integration of AI-driven skin analysis to recommend targeted bioactive formulations for personalized regimes.

Europe

- Market Share: Holds a leading global position, anchored by the headquarters of major industry giants like BASF and Evonik and a deep heritage in luxury formulation.

- Key Drivers:

- Strict REACH regulations and the European Green Deal are driving a massive shift toward biodegradable and upcycled ingredients.

- High domestic demand for advanced anti-aging serums containing established actives like Retinoids and Vitamin C.

- Strong government and institutional support for White Biotechnology and green extraction methods.

- Trends: A strategic pivot toward Circular Beauty, where bioactive molecules are extracted from food industry by-products (e.g., grape pomace or olive leaves) to meet eco-conscious consumer demands.

Asia-Pacific

- Market Share: The fastest-growing region, with South Korea, Japan, and China acting as the global engines for innovative ingredient trends and high-volume consumption.

- Key Drivers:

- Massive consumer base seeking high-performance brightening and UV-protection bioactives.

- Rapid urbanization and rising disposable incomes are leading to a preference for premium, sophisticated multi-step skincare routines.

- Strong regional expertise in fermentation technology, leading the world in probiotic and prebiotic cosmetic applications.

- Trends: Heavy reliance on J-Beauty and K-Beauty influence, focusing on Glass Skin aesthetics and the use of exotic microbial ferments and marine-derived bioactives.

South and Central America

- Market Share: An emerging market with a unique focus on biodiversity-sourced actives, particularly from the Amazonian biomes.

- Key Drivers:

- Increasing awareness of the benefits of natural bioactives for hair health and sun-damaged skin repair.

- Modernization of local manufacturing hubs in Brazil and Chile to produce export-quality botanical extracts.

- Rising middle-class interest in Clean Beauty that combines indigenous wisdom with modern dermatological science.

- Trends: Growth of Farm-to-Face boutique brands and the introduction of regional superfood-based actives, such as Acai and Buriti oils, into global luxury formulations.

Middle East and Africa

- Market Share: A developing market with significant cultural roots in essential oils, transitioning toward high-tech commercial bioactive production.

- Key Drivers:

- The traditional presence of high-value resins and oils (e.g., Argan, Prickly Pear) is now being refined into standardized bioactive ingredients.

- High demand for Barrier-Repair and ultra-hydrating actives due to the harsh, arid regional climates.

- Strategic investments in Smart Agriculture and local processing facilities to reduce reliance on imported luxury actives.

- Trends: Implementation of advanced encapsulation technologies to preserve the stability of heat-sensitive actives, coupled with a growing focus on Halal-certified bioactive certifications.

High Market Density and Competition

Competition is intensifying due to the presence of established leaders such as Koninklijke DSM N.V., Ajinomoto Co., Inc., Roquette Frères, ADM, BASF SE, FMC Corporation, Vytrus Biotech, Cargill, Inc., and Sensient Technologies Corporation, which also contribute to a diverse and rapidly expanding market landscape.

This competitive environment pushes vendors to differentiate through:

- Premiumization and Clinical Validation: Positioning bioactive ingredients as high-performance cosmeceuticals by emphasizing clinical trial data, bioavailability, and targeted physiological benefits such as collagen synthesis and microbiome regulation for health-conscious consumers.

- Biotech-Driven Portfolio Diversification: Moving beyond basic plant extracts to include lab-engineered peptides, plant exosomes, and fermented actives. Companies now offer specialized solutions for anti-aging, neurocosmetics (mind-skin axis), and blue-light protection.

- Vertical Integration and Ethical Sourcing: Managing the entire value chain—from the lab-bench engineering of bio-identical molecules to the upcycling of food industry by-products. This approach ensures maximum transparency, sustainability, and adherence to clean-label standards.

- Advanced Delivery Technologies: Utilizing innovative processing such as nano-encapsulation, liquid microneedling formulations, and membrane filtration to ensure the stability and deep dermal penetration of sensitive active compounds.

Opportunities and Strategic Moves

- Partner with Luxury and Indie Brand Channels: Collaborate with high-end clinical skincare brands and rapidly growing indie beauty labels to tap into the surging demand for science-backed and personalized beauty solutions in the North American and Asia-Pacific markets.

- Incorporate White Biotechnology and Regenerative Sourcing: Adopt precision fermentation and circular economy certifications to appeal to environmentally conscious Gen Z and Millennial consumers seeking ethical, carbon-neutral, and vegan-certified dairy or botanical alternatives.

Major Companies operating in the Cosmetic Bioactive Ingredients Market are:

- Koninklijke DSM N.V.

- Ajinomoto Co., Inc.

- Roquette Frères

- ADM

- BASF SE

- FMC Corporation

- Vytrus Biotech

- Cargill, Inc.

- Sensient Technologies Corporation

Disclaimer: The companies listed above are not ranked in any particular order.

Cosmetic Bioactive Ingredients Market News and Recent Developments

- In June 2025, L'Oréal Groupe announced that it had signed a definitive agreement to acquire a majority stake in the British skincare brand Medik8. This strategic acquisition allowed the beauty giant to integrate Medik8's specialized range of Cosmetic Bioactive Ingredients, particularly its proprietary vitamin A and stable retinaldehyde technologies, into its Luxe Division. As part of the transaction, the European private equity firm Inflexion remained a minority shareholder. At the same time, the founder continued to serve on the board alongside the existing management committee to ensure operational continuity.

- In September 2024, Evonik launched two new products to meet the increasing demand for sustainable, natural actives within the beauty and personal care sectors. These newly released Cosmetic Bioactive Ingredients included CapilAcid, an active derived from the Maqui fruit designed as a comprehensive hair protector and antioxidant, and Oleobiota, an ingredient sustainably sourced from the Misiones rainforest for sebum-normalizing skincare. Both products originated from Novachem, which Evonik acquired one year prior as part of a strategic move to integrate high-performance biotechnologies into its Care Solutions business.

Cosmetic Bioactive Ingredients Market Report Coverage and Deliverables

The Cosmetic Bioactive Ingredients Market Size and Forecast (2021–2034) report provides a detailed analysis of the market covering below areas:

- Cosmetic Bioactive Ingredients Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Cosmetic Bioactive Ingredients Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Cosmetic Bioactive Ingredients Market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the Cosmetic Bioactive Ingredients Market.

- Detailed company profiles

Frequently Asked Questions

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For