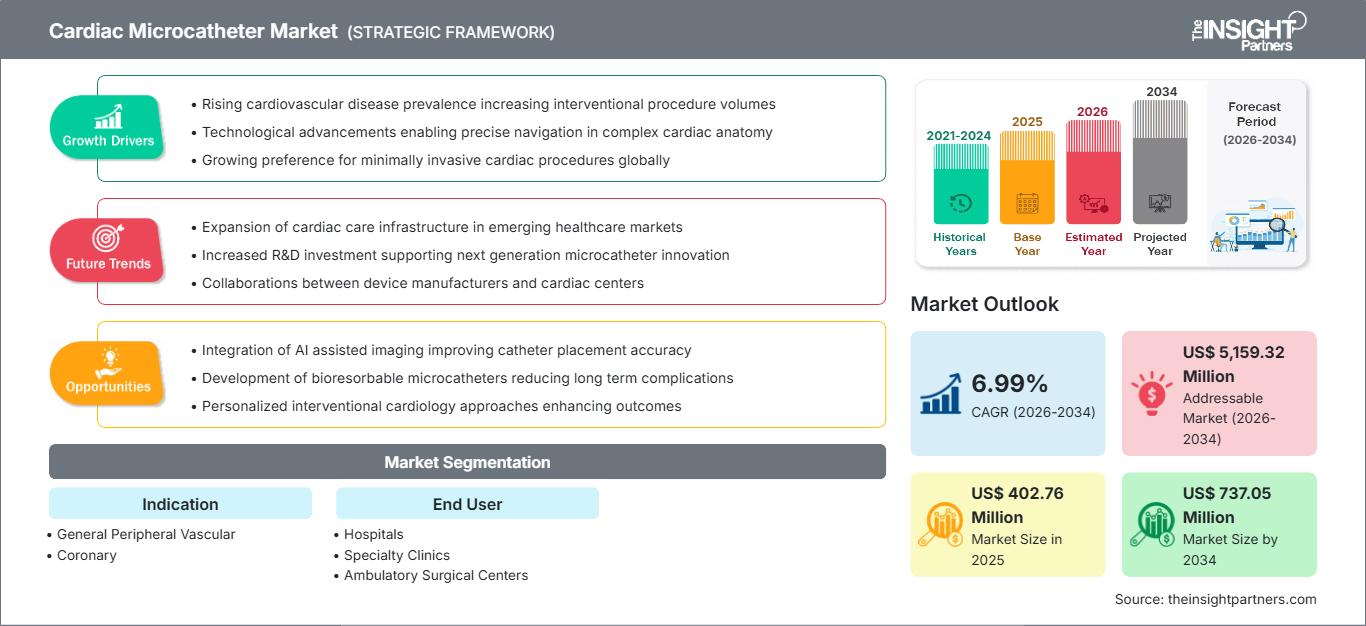

Cardiac Microcatheter Market Size, Share and Opportunities by 2034

Cardiac Microcatheter Market Size and Forecast (2021 - 2034), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Indication (General Peripheral Vascular and Coronary) and End User (Hospitals, Specialty Clinics, and Ambulatory Surgical Centers), and Geography

Historic Data: 2021-2024 | Base Year: 2025 | Forecast Period: 2026-2034- Report Date : Mar 2026

- Report Code : TIPRE00029957

- Category : Life Sciences

- Status : Upcoming

- Available Report Formats :

- No. of Pages : 150

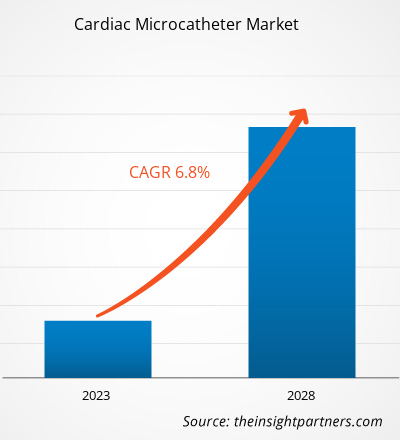

The cardiac microcatheter market size is expected to reach US$ 737.05 million by 2034 from US$ 402.76 million in 2025. The market is anticipated to register a CAGR of 6.99% during 2026–2034.

Cardiac Microcatheter Market Analysis

The cardiac microcatheter market is experiencing strong growth owing to the increasing prevalence of cardiovascular diseases worldwide. Microcatheters, measured in diameters less than 3 French, allow for intricate coronary anatomical pathway navigation to deliver drugs, place a stent, or aspirate thrombus. The market is experiencing an industry shift from the traditional hydrophilic-coated microcatheter to more sophisticated, steerable, and flow-directed models, which are less irritating to the coronary vessels. There is also an expanding role in the field of mitral valve repair. Priorities in the microcatheter market are focused on the need for radiopaque markers, together with PTFE or silicone-based lubricious materials. These features are useful in the event of long procedures when high frictional resistance is experienced.

Cardiac Microcatheter Market Overview

Cardiac microcatheters are ultra-thin, specialized devices for targeted delivery of contrast agents, therapies, or devices during diagnostic angiography or therapeutic interventions in the coronary and peripheral vasculature. Growth factors driving the market include catheter navigation technology and indications for challenging anatomies, such as CTOs. The most consumed are hydrophilic-coated microcatheters owing to their better trackability and minimum risk for spasm/dissection. However, demand is leading from hospitals, which is further developing into ASCs and specialized cath labs. There is also a growing focus on low-profile designs for pediatric and congenital heart applications, whereby small vessel sizes are putting high demands on flexibility and pushability.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONCardiac Microcatheter Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Cardiac Microcatheter Market Drivers and Opportunities

Market Drivers:

- Increasing Prevalence of Cardiovascular Diseases: The global rise in heart disease incidence, influenced by aging populations and lifestyle factors such as sedentary behavior and poor diet, significantly drives the demand for diagnostic and interventional cardiac devices like microcatheters.

- Growing Use of PCI Procedures: The use of percutaneous coronary interventions has grown rapidly around the world, and the number of PCI procedures performed to treat chronic total occlusions and complex lesions continues to increase. Recent advances in microcatheter systems have allowed for greater precision and procedural success for these interventions.

- Rising Adoption of Minimally Invasive PCI: Growth in complex procedures like CTO recanalization and bifurcation stenting sustains the need for high-performance microcatheters.

Market Opportunities:

- Development of Drug-Eluting and Bioabsorbable Microcatheters: Opportunity to create localized drug-delivery systems for restenosis prevention in high-risk patients.

- Expansion in Emerging Markets: Healthcare infrastructure improvements and increasing cardiovascular procedure volumes in nations across the Asia Pacific, Latin America, and the Middle East offer untapped potential for cardiac microcatheter vendors to expand their geographical reach.

- Innovation in Catheter Technologies: Ongoing R&D aimed at refining microcatheter design, such as enhanced flexibility, improved torque response, and better radiopacity, represents significant opportunities for product differentiation and market expansion.

Cardiac Microcatheter Market Report Segmentation Analysis

The Cardiac Microcatheter Market share is analyzed across various segments to provide a clearer understanding of its structure, growth potential, and emerging trends. Below is the standard segmentation approach used in most industry reports:

By Indication:

- General Peripheral Vascular: This is used in peripheral vascular interventions to access complex vessel anatomies to support diagnostic image acquisition and device delivery.

- Coronary: Used primarily in percutaneous coronary interventions to navigate complex coronary arteries, enabling precise delivery of guidewires and therapeutic devices.

By End User:

- Hospitals: Hospitals dominate usage due to high volumes of complex cardiac procedures, advanced infrastructure, and availability of skilled interventional cardiologists.

- Specialty Clinics: These provide appropriate, focused cardiovascular interventions through microcatheters that apply efficiently in controlled clinical settings.

- Ambulatory Surgical Centers: ASCs utilize microcatheters in minimally invasive cardiac procedures to stay, on average, less time with the patient and reduce overall procedural costs.

By Geography:

- North America

- Europe

- Asia-Pacific

- South & Central America

- Middle East & Africa

Cardiac Microcatheter Market Regional Insights

The regional trends and factors influencing the Cardiac Microcatheter Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Cardiac Microcatheter Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Cardiac Microcatheter Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2025 | US$ 402.76 Million |

| Market Size by 2034 | US$ 737.05 Million |

| Global CAGR (2026 - 2034) | 6.99% |

| Historical Data | 2021-2024 |

| Forecast period | 2026-2034 |

| Segments Covered |

By Indication

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Cardiac Microcatheter Market Players Density: Understanding Its Impact on Business Dynamics

The Cardiac Microcatheter Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Cardiac Microcatheter Market top key players overview

Cardiac Microcatheter Market Share Analysis by Geography

North America commands the largest market share, bolstered by advanced cath lab infrastructure, high PCI volumes, and rapid uptake of next-gen devices. Asia-Pacific is poised for the fastest growth, propelled by surging CVD cases, expanding interventional cardiology programs, and investments in countries like India and China.

North America

- Market Share: Holds a significant share, dominated by the U.S. and its cutting-edge interventional centers.

- Key Drivers:

- High PCI Procedure Volumes

- Aging Demographics & CVD Prevalence

- Strong Reimbursement Policies

- Trends: Move towards CTO-specific micro-catheters and AI-assisted navigation systems.

Europe

- Market Share: Strong presence via universal healthcare and innovation hubs.

- Key Drivers:

- Emphasis on Device Safety & Durability

- Robust Clinical Trial Networks

- EU Regulatory Support for Medtech

- Trends: Focus on low-profile designs for transradial access to cut complications.

Asia-Pacific

- Market Share: Fastest-growing, fueled by population scale and infrastructure boom.

- Key Drivers:

- Massive CVD Incidence

- Hospital Expansion & Training Programs

- Rising PCI Adoption

- Trends: Localization of manufacturing and portable cath lab solutions.

South and Central America

- Market Share: Emerging with growth in metro areas.

- Key Drivers:

- Increasing Heart Disease Rates

- Private Sector Investments

- Public Health Campaigns

- Trends: Transition to hydrophilic models in expanding public facilities.

Middle East and Africa

- Market Share: Nascent but accelerating in Gulf states.

- Key Drivers:

- Healthcare Modernization Efforts

- Medical Tourism Surge

- Physician Skill Enhancement

- Trends: Procurement of premium microcatheters for flagship cardiology centers.

Cardiac Microcatheter Market Players Density

High Market Density and Competition

The Cardiac Microcatheter Market is moderately fragmented, with global leaders in interventional devices competing alongside niche vascular specialists. Rivalry centers on trackability, biocompatibility, and compatibility with imaging modalities like IVUS or OCT.

The competitive landscape drives differentiation through:

- Advanced Tip Technologies: Tapered, atraumatic tips with radiopacity to navigate microvasculature safely.

- Integrated Delivery Systems: Bundling microcatheters with guidewires or balloons for streamlined workflows.

- Clinical Collaborations: Partnerships for trials validating efficacy in complex anatomies like bifurcations.

Opportunities and Strategic Moves:

- Majors acquiring startups in steerable catheter tech to lead innovation.

- Launching training simulators and service bundles for cath lab teams.

- Regional manufacturing to counter supply chain risks.

Major Companies Operating in the Cardiac Microcatheter Market Are:

- Boston Scientific Corp

- Teleflex Inc

- Medtronic Plc

- OrbusNeich Medical Group Holdings Ltd

- Asahi Intecc USA Inc

- Merit Medical Systems Inc

- Nipro Corp

- Terumo Corp

- Tokai Medical Products Inc

Disclaimer: The companies listed above are not ranked in any particular order.

Cardiac Microcatheter Market News and Recent Developments

- In October 2025, Terumo Interventional Systems (TIS) announced that the U.S. Food and Drug Administration (FDA) had approved its OPUSWAVE® Dual Sensor Imaging System. The OPUSWAVE Imaging System features the DualView® imaging catheter, which also received FDA 510(k) clearance. The OPUSWAVE Imaging System combines Optical Frequency Domain Imaging (OFDI) and intravascular ultrasound (IVUS) to enable simultaneous views, offering physicians the ability to comprehensively evaluate coronary artery disease (CAD).

- In February 2025, Teleflex Incorporated, a leading global provider of medical technologies, announced it had entered into a definitive agreement to acquire substantially all of the Vascular Intervention business of BIOTRONIK SE & Co. KG. The acquisition reflects Teleflex’s commitment to investing in the estimated $10 billion interventional cardiology and peripheral vascular market served by the Company’s portfolio post close. The acquired business will expand the Teleflex Interventional portfolio to include a broad suite of vascular intervention devices such as drug-coated balloons, drug-eluting stents, covered stents, balloon and self-expanding bare metal stents, and balloon catheters.

- In October 2024, Gentuity, LLC, a global leader in advanced intravascular imaging technologies, announced that the U.S. Food and Drug Administration (FDA) has granted 510(k) clearance for its Gentuity HF-OCT Imaging System, featuring the Vis-Rx Micro-Imaging Catheter, for use both before and after percutaneous coronary intervention (PCI), making it the only intravascular imaging platform specifically indicated for the assessment of the coronary vessel pre and post intervention.

Cardiac Microcatheter Market Report Coverage and Deliverables

The "Cardiac Microcatheter Market Size and Forecast (2021–2034)" report provides a detailed analysis of the market covering the below areas:

- Cardiac Microcatheter Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Cardiac Microcatheter Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Cardiac Microcatheter Market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the Cardiac Microcatheter Market

- Detailed company profiles.

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For