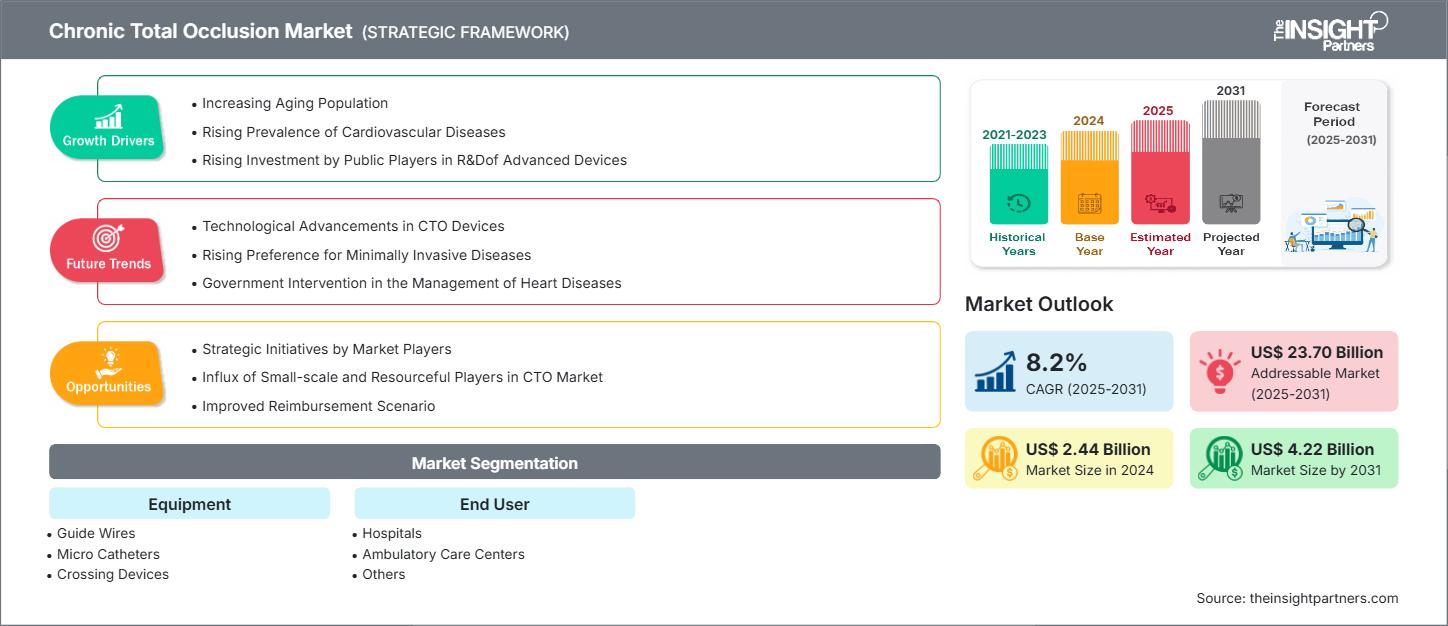

Chronic Total Occlusion Market Size, Growth & Key Trends 2025-2031

Chronic Total Occlusion Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage:By Equipment (Guide Wire, Micro Catheters, Crossing Devices, Re-Entry Devices, Others), End User (Hospitals, Ambulatory Care Centers and Others), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, South and Central America)

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : Sep 2025

- Report Code : TIPMD00002711

- Category : Life Sciences

- Status : Published

- Available Report Formats :

- No. of Pages : 195

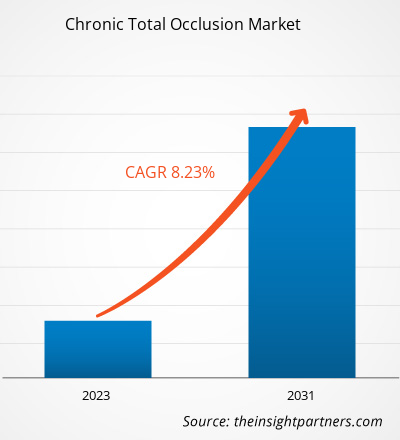

The Chronic Total Occlusion market size is projected to reach US$ 4.22 billion by 2031 from US$ 2.44 billion in 2024. The market is expected to register a CAGR of 8.2% during 2025–2031.

Chronic Total Occlusion Market Analysis

The rising geriatric population is a key driver for the chronic total occlusion (CTO) market. As the world population grows older, cardiovascular diseases become more common. According to the US Census Bureau, the number of Americans aged 65 and above is expected to increase from 58 million in 2022 to 82 million by 2050, which is a 47% increase. The percentage of the population aged 65 and older is expected to increase from 17% to 23% by 2050. According to Statistics Canada, in 2022, around one in five Canadians (18.8% of the population; 7,329,910 people) were at least 65 years of age.

Older adults, particularly those over 60 years of age, are at higher risk of cardiovascular diseases due to age-related changes in the cardiovascular system, such as decreased blood vessel elasticity and arterial plaque. The growing elderly population worldwide is driving the need for efficient and minimally invasive treatments, such as percutaneous coronary intervention (PCI) for chronic total occlusion (CTO). Older adults often struggle to adjust to traditional surgical methods, which is why there is a rising preference for minimally invasive procedures that promote faster recovery and reduce risk. This is a phenomenon that can be seen in countries with high aging populations, such as the US, Japan, and European nations.

Chronic Total Occlusion Market Overview

The chronic total occlusion market in North America is divided into the US, Canada, and Mexico. North America accounts for a significant share of the global chronic total occlusion market. The market in this region is influenced by the increasing aging population and the surging cardiovascular disease (CVD) prevalence, especially coronary artery disease (CAD). According to the 2023 Profile of Older Americans, in 2022, there were 57.8 million adults aged 65 or more in the US, including 31.9 million women and 25.9 million men. The same report also stated that heart disease remains the number one cause of death in all Americans, affecting people of all ages and particularly harming those aged 75 and above (24.1%). Technological innovations, including percutaneous coronary interventions (PCI) and dedicated chronic total occlusion (CTO) devices, enabling minimally invasive procedures, are the major drivers of the demand for CTO procedures. Medtronic, Boston Scientific, and Abbott Laboratories are the key players in the market, which emphasize on creating innovative devices for CTO interventions. The US also has a high rate of adoption of these technologies because of the developed healthcare system and favorable reimbursement policies. The increasing awareness of early detection and treatment of CVDs is a major growth opportunity. In addition, growth in specialized centers and cardiology departments contributes to the enhanced availability of CTO procedures in the region.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONChronic Total Occlusion Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Chronic Total Occlusion Market Drivers and Opportunities

Market Drivers:

- Advancements in CTO PCI Techniques and Devices: Development of specialized wires, microcatheters, and re-entry devices with improved success ratesand safety profile

- Rising Prevalence of Coronary Artery Disease: Aging population and increasing rates of diabetes, hypertension, and obesity lead to more complex coronary lesions, including CTOs. Many patients with stable CAD have at least one CTO.

- Growing Evidence of Clinical Benefits: Studies have shown potential improvement in angina relief, quality of life, and left ventricular function in selected patients. Improved imaging and physiology tools support patient selection

Market Opportunities:

- Expanding Operator Training and Access: CTO PCI remains technically challenging; more operators need structured training and proctorship. Opportunity to develop dedicated CTO centers of excellence.

- Improved Patient Identification and Referral Pathways: Many CTOs are underdiagnosed or not referred for PCI due to outdated perceptions of futility or risk. Leveraging non-invasive imaging (CT angiography) and AI tools can help identify suitable candidates.

- Innovation in Technology and Imaging: Ongoing development of AI-guided navigation, robotics, and real-time 3D imaging. Potential for shorter procedures, reduced radiation exposure, and increased success in complex cases.

Chronic Total Occlusion Market Report Segmentation Analysis

The chronic total occlusions market is divided into different segments to give a clearer view of how it works, its growth potential, and the latest trends. Below is the standard segmentation approach used in most industry reports:

By Equipment:

- Guide Wire: As a critical element of chronic total occlusion (CTO) percutaneous coronary intervention (PCI) procedures, guidewires enable physicians to navigate through complex, blocked coronary arteries, enabling lifesaving treatments such as stent implantation, balloon angioplasty, and other therapeutic interventions.

- Micro Catheters: The market for CTO devices is primarily driven by microcatheters, as they enable minimally invasive procedures. These procedures decrease the necessity for more invasive surgical options, such as coronary artery bypass grafting (CABG). As a result, there is a growing preference for CTO PCI techniques over traditional surgery, leading to increased demand for microcatheters.

- Crossing Devices: Crossing devices are essential tools in CTO PCI, with a central role in navigating and crossing challenging and totally blocked coronary arteries. Crossing devices are developed to assist interventional cardiologists in crossing the occlusion to allow for the following treatment, e.g., balloon angioplasty or stenting. With the increasing number of CTO procedures, the market for crossing devices also continues to expand.

- Re-Entry Devices: Re-entry devices are the key elements in the CTO devices market that are specifically developed to allow re-entry into the true lumen of coronary arteries following a successful subintimal crossing. These devices are applied when interventional cardiologists are unable to cross an occlusion through the normal route, causing a dissection of the artery wall. Re-entry devices permit the re-establishment of the guidewire or catheter into the proper course, greatly enhancing procedure success rates. With CTO procedures on the rise all over the world, re-entry devices are becoming an integral component of PCI.

- Others: The growth of the chronic total occlusion (CTO) devices market is significantly influenced by the advancements in sheaths, snares, and balloon devices. These tools are essential in facilitating the complex navigation and intervention required for successful revascularization of occluded arteries. Sheaths provide support and access for other devices, snares aid in retrieving occluded material or crossing lesions, and balloon devices are crucial for dilating blockages.

By End User:

- Hospitals

- Ambulatory Care Centers

- Others

By Geography:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

The chronic total occlusions market in North America is expected to hold a significant share of the market. The the increasing aging population and the surging cardiovascular disease (CVD) prevalence, especially coronary artery disease (CAD) are factors likely to drive the market.

Chronic Total Occlusion

Chronic Total Occlusion Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 2.44 Billion |

| Market Size by 2031 | US$ 4.22 Billion |

| Global CAGR (2025 - 2031) | 8.2% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Equipment

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Chronic Total Occlusion Market Players Density: Understanding Its Impact on Business Dynamics

The Chronic Total Occlusion Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Chronic Total Occlusion Market Share Analysis by Geography

Asia Pacific is expected to grow the fastest in the next few years. Emerging markets in Latin America, the Middle East, and Africa also have many untapped opportunities for chronic total occlusion providers to expand.

The chronic total occlusions market grows differently in each region. This is because of factors such as growing demand for minimally invasive procedures, coupled with the rising elderly population and CVD infection rate. Below is a summary of market share and trends by region:

1. North America

- Market Share: Holds a significant portion of the global market

-

Key Drivers:

- High prevalence of coronary artery disease

- Advanced healthcare infrastructure and favorable reimbursement environment

- Ongoing R and D and technological innovation

- Trends: Increasing launches and adoption of advanced devices

2. Europe

- Market Share: Substantial share due to the increasing prevalence of ENT diseases

-

Key Drivers:

- Regulatory acceleration and updated guidelines

- High CAD incidence with aging populations and unhealthy lifestyle trends

- Evolution of procedural techniques and devices

- Trends: Advances in Guidewire and Imaging Technology

3. Asia Pacific

- Market Share: Fastest-growing region with a rising market share every year

-

Key Drivers:

- Rapidly growing cardiovascular disease burden and aging population

- Healthcare investment and infrastructure expansion

- Technology adoption and growth potential

- Trends: Improved awareness, minimally invasive procedure adoption, and broader access to sophisticated CTO devices

4. South and Central America

- Market Share: Growing market with steady progress

-

Key Drivers:

- Emerging healthcare infrastructure growth

- Increasing disease prevalence tied to lifestyle shifts

- Expansion of minimally invasive treatment access

- Trends: Expansion likely as treatment awareness and accessibility improve.

5. Middle East and Africa

- Market Share: Although small, but growing quickly

-

Key Drivers:

- Growing healthcare infrastructure and accessibility

- Rising cardiovascular disease incidence

- Technology diffusion from global markets

- Trends: As public health systems mature and emerging specialized cardiac centers increasing adoption of CTO

Chronic Total Occlusion Market Players Density: Understanding Its Impact on Business Dynamics

High Market Density and Competition

Competition is strong due to the presence of established players such as Asahi Intecc Co Ltd, Cordis Corp, Integer Holdings Corp, Boston Scientific Corp, Becton Dickinson and Co, SoundBite Medical Solutions, Medtronic Plc, Terumo Corp, Abbott, and Koninklijke Philips NV.

This high level of competition urges companies to stand out by offering:

- Advanced Products

- Value-added services such as customization and sustainable solutions

- Competitive pricing models

- Compliance with regulatory guidelines

Opportunities and Strategic Moves

- Major market players such as Medtronic, Abbott, Boston Scientific, Cardinal Health, and Becton Dickinson have expanded its product portfolios through acquisitions and collaborations, especially in advanced device segments such as re-entry systems and atherectomy devices. Strategic planning around scalable production, supplier qualification, and risk management are essential to maintain cost competitiveness and supply reliability for new CTO device launches.

- There is rapid development in guidewires, microcatheters, re-entry devices, and imaging modalities to improve procedural success and safety. Innovations like real-time fusion imaging and robotics will drive future market expansion and differentiation

- Companies excel by bundling CTO devices with other endovascular offerings to provide comprehensive solutions to healthcare providers. Strategic planning around scalable production, supplier qualification, and risk management are essential to maintain cost competitiveness and supply reliability for new CTO device launches.

Major Companies operating in the Chronic Total Occlusion Market are:

- Asahi Intecc Co Ltd

- Cordis Corp

- Integer Holdings Corp

- Boston Scientific Corp

- Becton Dickinson and Co

- SoundBite Medical Solutions

- Medtronic Plc

- Terumo Corp

- Abbott

- Koninklijke Philips NV

Disclaimer: The companies listed above are not ranked in any particular order.

Other companies analysed during the course of research:

- Baylis Medical Company, Inc

- SPECTRANETICS, C. R. Bard, Inc.

- IntraLuminal Therapeutics

- Acrostak Int. Distr. Sarl

- Cardinal Health

- Cook Medical

- Merit Medical Systems

- Penumbra, Inc.

- Reflow Medical

- Teleflex Incorporated

- Infraredx, Inc.

- Vascular Solutions, Inc.

- Acrostak Corporation

- AngioDynamics, Inc.

- Biotronik SE & Co. KG

- Biosensors International Group, Ltd.

- Philips Healthcare

- Boston Scientific Corporation

Chronic Total Occlusion Market News and Recent Developments

- Integer to Showcase Leadership in Medical Device Innovation and Recent Acquisition of Precision Coating at MD and M West 2025 Integer Holdings exhibited at MD&M West 2025 from February 4-6 at the Anaheim Convention Center, showcasing their medical device manufacturing capabilities. The company demonstrated their expertise in cardio and vascular solutions, cardiac rhythm management, and neuromodulation products, including their global rapid prototyping services with two-week turnarounds..

- Philips announces 1500+ Cath Lab installations in the Indian Subcontinent Royal Philips announced at India Live 2024 in New Delhi that it had completed over 1,500 Cath Lab (interventional suite) installations in the Indian Subcontinent. The completion of these 1,500+ Cath Lab installations marked a significant milestone in Philips’ mission to create innovative solutions aimed at achieving the company’s Quadruple Aim of better health outcomes, improved patient experience, enhanced staff experience, and lower cost of care. At the event, Philips also announced the launch of two groundbreaking products to address the burden of cardiovascular disease in India.

Chronic Total Occlusion Market Report Coverage and Deliverables

The "Chronic Total Occlusion Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Chronic Total Occlusion Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Chronic Total Occlusion Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Chronic Total Occlusion Market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Chronic Total Occlusion Market

- Detailed company profiles

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For