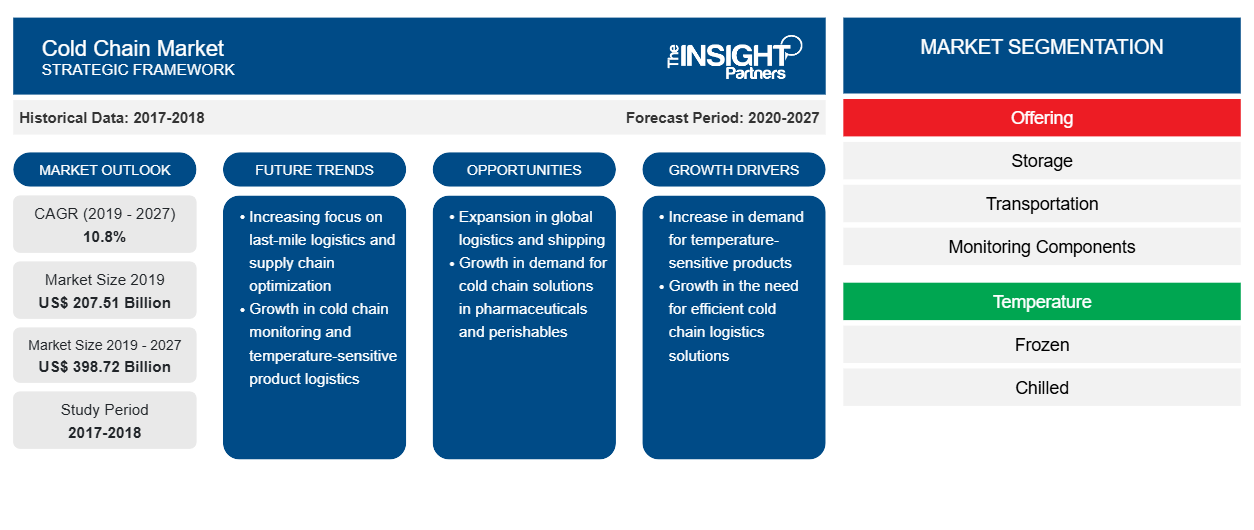

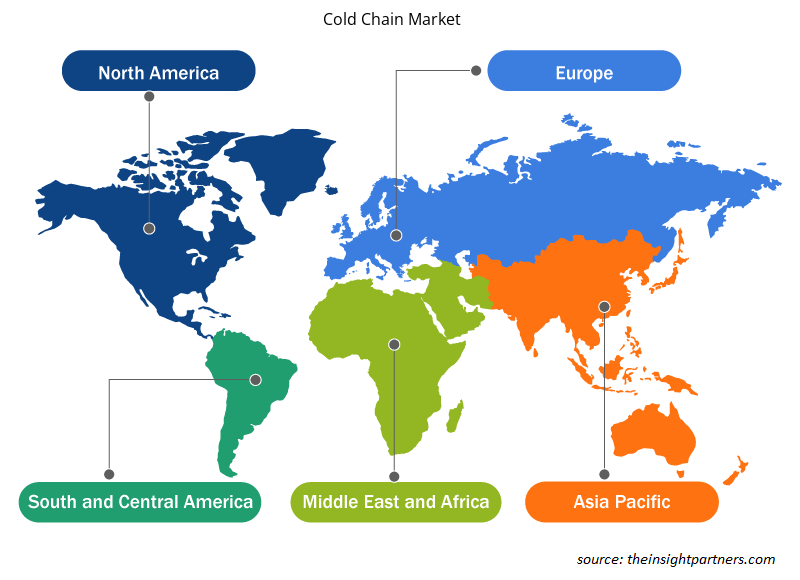

In terms of revenue, the cold chain market was valued at US$ 207,510.8 million in 2019 and is projected to reach US$ 398,723.4 million by 2027 and is expected to grow at a CAGR of 10.8% during the forecast period.

The rising trade of perishable products and favorable government support for the development of cold chain infrastructure are the key factors expected to propel the growth of the cold chain market. The cold chain service players are also adopting pioneering technologies to accommodate the increasing demand for food safety, particularly for processed foods. It is projected to offer abundant opportunities, thus propelling the proliferation of several multinational vendors into the market, intending to offer efficient cold chain solutions.

Further, strict food safety regulations, such as the Food Safety Modernization Act, which necessitates better attention toward creating a cold storage warehouse, are anticipated to support the growth of the market. However, challenges regarding environmental concerns such as the emission of greenhouse gasses are projected to hamper the market during the forecast period.

APAC is the second leading region in the cold chain market. It is anticipated to notice a significant growth over the estimated period owing to the growing government investments in logistics infrastructure development and deployment of the warehouses management systems (WMS). China is the key regional contributor and is anticipated to observe a considerable CAGR during the forecast period. Advancements in technologies pertaining to packaging, processing, and food storage are estimated to drive the growth of the cold chain market. Also, rapidly growing demand and development in cold chain infrastructure have made the country a key market. At present, China is witnessing a rapid shift from a manufacturing-led economy to a consumer-led economy.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Cold Chain Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Cold Chain Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on Cold chain Market

The COVID-19 outbreak, which began in Wuhan (China) during December 2019, has spread at a fast pace worldwide. The global factory shutdowns, travel bans, and border lockdowns, to combat and contain the outbreak, have impacted every industry and economy worldwide.The majority of the manufacturing plants are either temporarily shut or operating with minimum staff; due to which the cold chain and related components are disrupted. Additionally, the demand for frozen foods has been showcasing a slowdown since the outbreak of COVID-19 in the countries.

Market Insights

Increasing Omni Channel Distribution of Groceries in Asia Pacific

Asia's developing common populace is creating compelling interest for excellent food supplies sourced from home and abroad. Imports of organic berry products, including strawberries and blackberries to the Asia Pacific, recorded a CAGR of 7.5% from 2017to 2019.The development of omni channel dispersion is encouraging developing utilization. The online shopping for food is still at an early stage, with under 5% of essential food item spending in most Asia Pacific markets happening on the web in 2019. This proportion is relied upon to increment of quick delivery, particularly in Korea and China. At present, major online primary food delivery websites, such as JD.com and Suning.com in China, and Big Basket in India presently offer sameday or under 24-hour conveyance in top-level urban communities.

Offering-BasedInsights

In terms of offering, the storagesegment captured a dominating share of the global cold chain market in 2019.Frozen food & beverages, chemicals, medicinal products, and starting materials used in the manufacture of the above products, should be stored under preserved condition to maintain the quality. Manufacturers’ recommendations concerning storage temperatures should be followed, which involves the use of specialized storage facilities. Temperature-monitoring devices should be used to exhibit compliance with the preferred temperature ranges. Good warehousing practices include maintenance of optimum temperature for temperature-sensitive products as per the suggestion of manufacturers. Measuring and monitoring equipment should be calibrated and tested at defined intervals. These products should be transported in such a way that they are not subjected to unacceptable degrees of heat and cold, and specialized means of transportation should be used wherever necessary.

Temperature-Based Insights

Generally, frozen cargo refers to commodities or foodstuffs that need to be shipped and stored at the optimum temperature for the protection against decomposition, and growth of disease-forming organisms. Specific frozen cargo needs to be transported or stored at temperatures lower than -20°C (-4°F) to maintain quality, texture, and flavor. Commodities with high-fat content, such as ice cream and surimi, should be transported and stored at -26.1°C (-15°F) or lower. Low temperatures conserve the quality of frozen food, aroma, flavor, texture, and appearance and protect it from spoilage.

Industry Vertical- Based Insights

Cold chain for perishable foods generally refers to the continuous handling of the product within a low-temperature condition during the post-harvest steps of the value chain, including collection, harvest, processing, storage, packing, transport, and marketing until it reaches the consumer. A combined cold chain includes the management of the transportation of perishable food products from the ranch, field, or body of water through the entire post-harvest chain to the end user.

In the cold chain market, companies are adopting different strategies including product development, acquisition, and other expansion related strategies to expand their footprint worldwide by meeting the growing demand for their offerings. A few of the recent initiatives in the cold chain market are listed below:

2020:Americold Realty Trust announced intentions to invest around US$ 43 million in a planned expansion of its Dalgety site in Auckland, New Zealand.

2020:AmerisourceBergen enhanced its logistics offering by integrating two of its businesses, World Courier, a global logistics provider, as well as ICS, a third-party logistics. This has created the first and only specialty logistics partner to deliver complete support from clinical trials through commercialization.

2020:Pelican BioThermal opened a network station in Toronto to service its Credo on Demand rental program. The new network station joined the company’s growing system of over 100 network stations and drop points worldwide. Apart from serving as a drop point for Credo On Demand rental customers, network stations service, refurbish, repair, and condition company's reusable Credo Cargo as well as Credo Xtreme shipping containers for reuse.

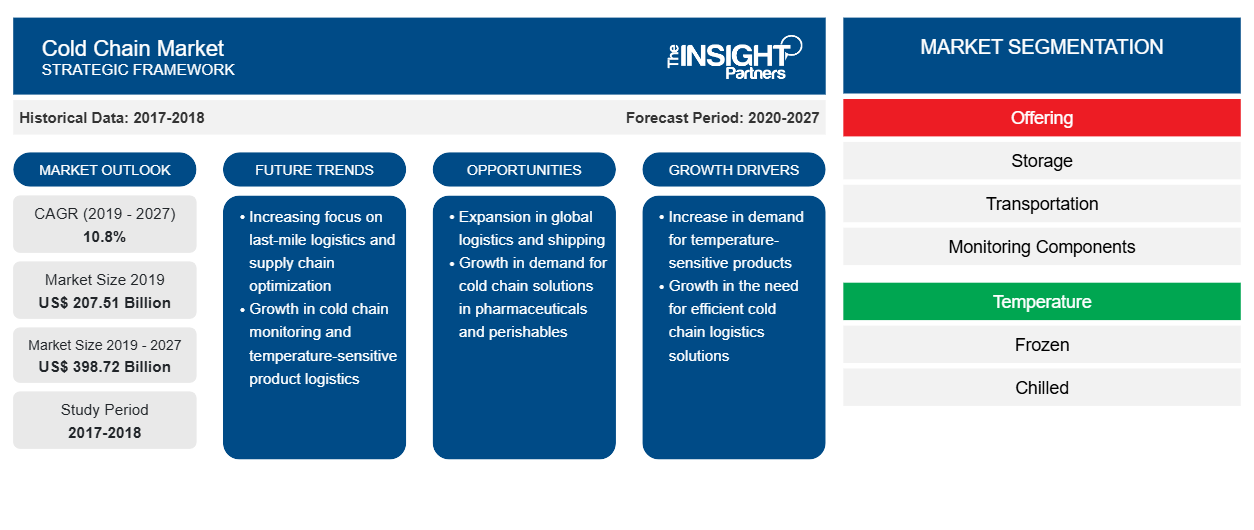

Cold Chain Market Regional Insights

The regional trends and factors influencing the Cold Chain Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Cold Chain Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Cold Chain Market

Cold Chain Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2019 | US$ 207.51 Billion |

| Market Size by 2027 | US$ 398.72 Billion |

| Global CAGR (2019 - 2027) | 10.8% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Offering

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Cold Chain Market Players Density: Understanding Its Impact on Business Dynamics

The Cold Chain Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Cold Chain Market are:

- Cold Chain Technologies, Inc.

- CSafe Global

- DoKaSch TEMPERATURE SOLUTIONS GmbH

- Envirotainer AB

- Pelican BioThermal LLC

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Cold Chain Market top key players overview

Market Segmentation

Cold chain Market – By Offering- Storage

- Transportation

- Monitoring Components

- Hardware

- Software

- Others

- Hardware

- Software

Cold chain Market – By Temperature- Frozen

- Chilled

Cold chain Market – By Industry Vertical- Pharmaceutical

- Healthcare

- Food & Beverages

- Chemical

- Others

Cold chain Market- By RegionNorth America- US

- Canada

- Mexico

Europe- France

- Germany

- Italy

- UK

- Russia

- Rest of Europe

Asia Pacific- China

- India

- South Korea

- Japan

- Australia

- Rest of APAC

Middle East and Africa- South Africa

- Saudi Arabia

- UAE

Rest of MEA- South America

- Brazil

- Argentina

- Rest of SAM

North America- US

- Canada

- Mexico

Europe- France

- Germany

- Italy

- UK

- Russia

- Rest of Europe

Asia Pacific- China

- India

- South Korea

- Japan

- Australia

- Rest of APAC

Middle East and Africa- South Africa

- Saudi Arabia

- UAE

Rest of MEA- South America

- Brazil

- Argentina

- Rest of SAM

Companies Profiled in Cold chain Market are as Follows:- Cold chain Technologies, Inc.

- CSafe Global

- DoKaSch TEMPERATURE SOLUTIONS GmbH

- Envirotainer AB

- Pelican BioThermal LLC

- SKYCELL AG

- Softbox Systems Ltd.

- Sonoco ThermoSafe

- va-Q-tec AG

- World Courier

Frequently Asked Questions

Which offering of cold chain led the cold chain market?

Frozen food and beverages, chemicals, and medicinal products, and starting materials used in the manufacture of the above products, should be stored under conditions that ensure that their quality is maintained. Manufacturers’ recommendations concerning storage temperatures should be observed, and this may involve the use of specialized storage facilities. Temperature-monitoring devices should be used to exhibit compliance with the preferred temperature ranges. Good warehousing practices require that storage areas for temperature-sensitive products should be maintained within acceptable temperature limits and that, where the manufacturer specifies special storage conditions, they should be provided, checked, and monitored. Measuring and monitoring equipment should be calibrated and tested at defined intervals. These products should be transported in such a way that they are not subjected to unacceptable degrees of heat and cold, and specialized means of transportation should be used where necessary.

Which region led the cold chain market in 2019?

The North America region led the cold chain market in 2019. The US signifies one of the world’s largest temperature-sensitive healthcare products market. Transportation of temperature-sensitive healthcare products such as biopharmaceuticals, vaccines, as well as clinical trial materials, occupies a huge share in the US cold chain market. In addition, the developed healthcare sector has led to automation for products, thereby removing the possibility of human handling errors in the cold chain. In addition to this, several cold chain logistics, as well as transportation providers such as AmerisourceBergen and FedEx, have accelerated their market growth in the region. Rapid innovations in technology and growing consumer awareness for healthcare cold chain products are expected to spur the market demand during the forecast period.

Which factor is driving the cold chain market?

Asia's developing common populace is creating compelling interest for excellent food supplies sourced from home and abroad. Imports of organic berry products, including strawberries and blackberries to the Asia Pacific, recorded a CAGR of 7.5% from 2017to 2019.The development of Omni channel dispersion is encouraging developing utilization. In any case, online shopping for food is still at an early stage, with under 5% of essential food item spending in most Asia Pacific markets happening on the web in 2019. This proportion is relied upon to increment of quick delivery speed, particularly in Korea and China. Major online primary food delivery websites, such as JD.com and Suning.com in China, Big Basket in India presently offer that day or under 24-hour conveyance in top-level urban communities.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Boat Sails Market

- Heavy Commercial Vehicle Air Brake Systems Market

- Heavy Commercial Vehicle Clutch Market

- Electric Vehicle Heat Pump Systems Market

- Event Logistics Market

- Industrial Vehicles Market

- Motorsport Transmission Market

- Automotive Telematics Market

- Third Party Logistics Market

- Low Speed Electric Vehicle Market

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

The List of Companies - Cold Chain Market

- Cold Chain Technologies, Inc.

- CSafe Global

- DoKaSch TEMPERATURE SOLUTIONS GmbH

- Envirotainer AB

- Pelican BioThermal LLC

- SKYCELL AG

- Softbox Systems Ltd.

- Sonoco ThermoSafe

- va-Q-tec AG

- World Courier

Get Free Sample For

Get Free Sample For