Industrial Vehicles Market Key Players and Forecast by 2030

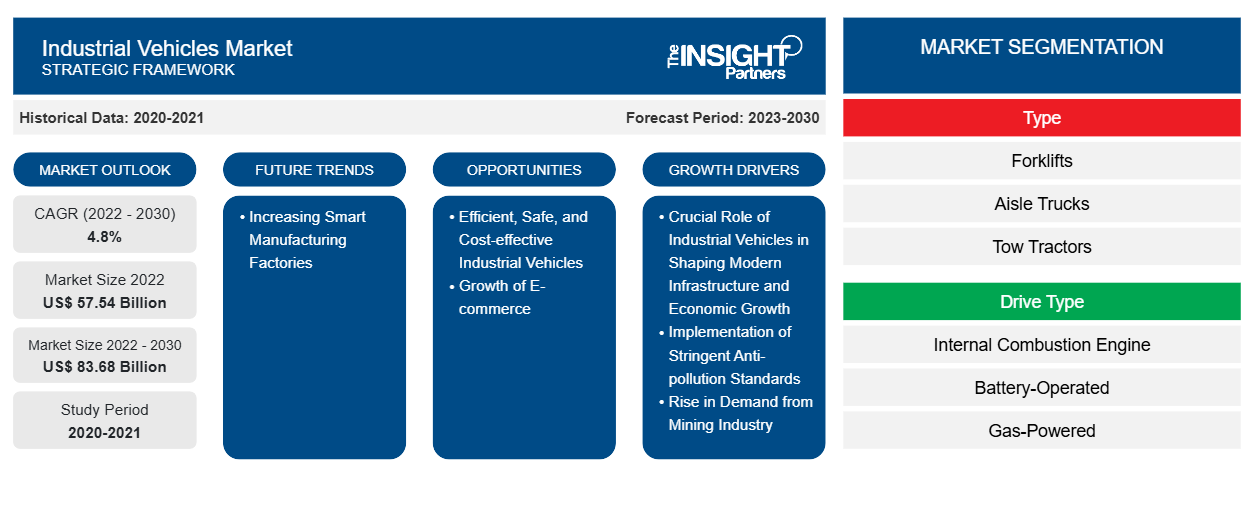

Industrial Vehicles Market Size and Forecasts (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Forklifts, Aisle Trucks, Tow Tractors, Container Handlers, and Others), Drive Type (Internal Combustion Engine, Battery-Operated, and Gas-Powered), Level of Autonomy (Non/Semi-autonomous and Autonomous), and Application (Manufacturing, Warehousing, and Others), and Geography

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2030- Report Date : Feb 2024

- Report Code : TIPRE00014078

- Category : Automotive and Transportation

- Status : Published

- Available Report Formats :

- No. of Pages : 213

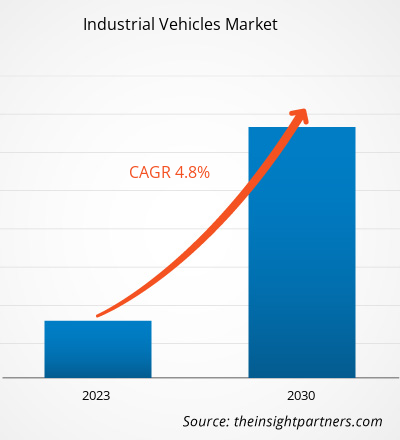

[Research Report] The industrial vehicles market was valued at US$ 57,543.40 million in 2022 and is projected to reach US$ 83,677.60 million by 2030; it is expected to register a CAGR of 4.8% from 2022 to 2030.

Analyst Perspective:

The report includes the global industrial vehicles market forecast by five major regions—North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South America (SAM). The global e-commerce industry is rising at a constant pace, which has encouraged companies to automate their warehouse with the help of several material-handling vehicles. The e-commerce industry is the major contributor to the growing demand for forklifts and other material-handling equipment. According to the United Nations Conference on Trade and Development (UNCTAD), in 2022, the global e-commerce industry's retail sales reached US$ 5.9 trillion, an increase of 9.26% compared to 2021. The average e-commerce spending per individual was ~US$ 737.51 in 2022. China has the largest e-commerce market across the globe. In 2022, China's e-commerce sales stood at US$ 1.3 trillion and are projected to reach US$ 2 trillion by 2025. Thus, the expansion of the e-commerce sector has created massive opportunities for the industrial vehicles market growth in Asia Pacific.

According to the World Industrial Vehicle Statistics Association (WITS), more than 2.34 million material-handling vehicles and equipment sales were recorded during 2021. The material handling industry saw a 43.0% increase in orders in 2021 compared to the previous year, 2020. Among the 2.34 million material handling units, ~68.8% or 1.61 million units were recorded as electric-powered forklifts. Electric forklift demand is increasing at a rapid pace with a surge in consumer popularity. With a surge in the number of orders, the demand for industrial vehicles such as forklifts, aisle trucks, and pallet trucks has increased. Thus, rising demand for material handling equipment and vehicles across the globe across the manufacturing sector drives the global industrial vehicles market growth.

Key factors bolstering the North America industrial vehicles market size include the expansion of logistics & transportation and e-commerce industries. Online shopping in the US has increased in recent years. Total US e-commerce sales reached US$ 1.03 trillion in 2022, an increase from US$ 518.5 billion in 2018. Many logistics giants in the market, such as UPS, FedEx, USPS, XPO Logistics, and Amazon, recognized the increasing demand for industrial vehicles in their warehouses. These companies have made significant investments in warehouse establishment and in automating their logistics operations. For instance, in November 2023, United Parcel Service opened the largest warehouse in Louisville, Kentucky, with an area of ~20 acres. This warehouse is made for storage and package handling, with a significant investment of US$ 79 million for the establishment of over 3,000 automated robots and industrial vehicles. These robots and industrial vehicles will handle several warehouse tasks, such as lifting and transportation of goods from one place to another, by reducing the requirement of manual labor.

Market Overview:

The industrial vehicles market encompasses a diverse range of specialized vehicles designed for use in various industrial applications. These vehicles are engineered to perform specific tasks within industrial settings, contributing to the efficiency, productivity, and safety of operations across different sectors. The market comprises a broad array of industrial vehicles specifically designed to meet the specific needs of manufacturing facilities, warehouses, construction sites, logistics operations, and other industrial environments. Industrial vehicles are also designed with a focus on addressing particular industrial challenges. This includes vehicles optimized for tasks such as material handling, heavy lifting, transportation of goods, excavation, and other specialized functions essential to industrial processes.

The industrial vehicles market is witnessing advancements in technology and innovation, with manufacturers constantly improving the capabilities and features of vehicles such as forklifts. This adaptability to evolving industry needs and technological advancements can bolster the market by attracting businesses seeking more efficient and advanced solutions for industrial mobility. Governments of various countries are investing in automating the manufacturing business in Europe. For instance, in July 2021, the UK government announced an investment of US$ 59.3 million (GBP 53 million) to drive the development of digital manufacturing technologies. Out of which, US$ 28.10 million (GBP 25 million) will be invested in setting up five new industry-sponsored research centers to support the development of cutting-edge digital solutions in order to transform manufacturing businesses. The remaining amount will be invested in a digital supply chain innovation hub and provided to 37 individual projects to digitalize and transform manufacturing supply chains. Thus, the growing government support to boost automation is expected to fuel the growth of the industrial vehicles market during the forecast period.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONIndustrial Vehicles Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Driver:

Implementation of Stringent Anti-pollution Standards Drives Industrial Vehicles Market

Stringent anti-pollution standards, such as European (Stage V) and North American (Tier 4 Final), are being implemented for industrial vehicles across the globe. These standards, introduced on January 1, 2019, place additional restrictions on nitrogen oxide (NOx) and particulate pollutant emissions from non-road vehicles—including those used in agriculture, construction sites, and industrial settings. The driving force behind these regulations is the urgent need to address public health concerns, improve air quality, and mitigate the impact of vehicle emissions on climate change. One of the notable responses to these environmental challenges is the accelerated electrification of industrial vehicles. This shift toward electrification is driven by the imperative to meet the emission targets set by these stringent standards. Electric and hybrid alternatives are increasingly preferred where various site vehicles are used in the construction industry, including excavators, mobile cranes, diggers, and bulldozers, as well as agricultural vehicles such as tractors and combine harvesters.

Electric and hybrid industrial vehicles help manufacturers and operators comply with stringent emission standards. These vehicles produce significantly lower levels of NOx and particulate pollutants, aligning with the regulations set by Stage V in Europe and Tier 4 Final in North America. The reduction of harmful emissions from industrial vehicles contributes to the improvement of air quality, positively impacting public health. As urbanization continues to grow, the deployment of cleaner and more sustainable industrial vehicles becomes crucial for mitigating the impact of vehicle emissions on densely populated areas. Also, the rising awareness of environmental issues and the increasing emphasis on sustainability drive the demand for cleaner and more efficient industrial vehicles. Companies that prioritize environmentally friendly practices and comply with emission standards are likely to attract a broader customer base and secure long-term market viability. The transition to electric and hybrid alternatives not only ensures compliance with regulations but also aligns with the broader goals of improving air quality, addressing climate change, and meeting consumer preferences for sustainable practices. Thus, the implementation of stringent anti-pollution standards associated with industrial vehicles drives the market.

Segmental Analysis:

Based on vehicle type, the industrial vehicles market analysis has been carried out by considering the following segments: forklifts, aisle trucks, tow tractors, container handlers, and others (pellet trucks, reach trucks, order pickers, and stackers). Among these, the forklifts segment dominates the industrial vehicles market share owing to the rapid growth of the logistics & transportation sector. According to the Global Logistics Association, in 2021, the global logistics industry was valued at US$ 8.6 trillion and is expected to reach US$ 13.5 billion by 2027. In 2021, ~45% of the global logistics industry was concentrated in Asia Pacific. Also, the logistics industry in North America share was ~24% in 2020 across the globe, followed by Europe. Asia Pacific is the fastest-growing region for the industrial vehicles market, owing to rising e-commerce industry sales. In 2022, in Asia Pacific, the logistics sector spending reached ~US$ 4.9 trillion and is projected to record a CAGR of 5.9% from 2022 to 2027. China has the largest share in Asia Pacific, representing 54.1% of the logistics sector spending. This is primarily owing to economic growth in the manufacturing and automotive sectors. Industrial vehicles are widely used in the logistics sector for material handling from one place to another owing to the increasing e-commerce sector with favorable government policies and regional trade initiatives. Aisle trucks, tow tractors, container handlers, pallet trucks, reach trucks, order pickers, and stackers are also used in the e-commerce logistics industry across the globe.

Regional Analysis:

The scope of the industrial vehicles market report focuses North America (US, Canada, and Mexico), Europe (Spain, UK, Germany, France, Italy, and Rest of Europe), Asia Pacific (South Korea, China, India, Japan, Australia, and Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, UAE, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America).

In terms of revenue, Asia Pacific dominated the industrial vehicles marketshare. Europe is the second-largest contributor to the global industrial vehicles market, followed by North America. The North America industrial vehicles market is driven by increasing building & construction activities and rising sales of commercial vehicles. According to the American Automotive Policy Council (AAPC) Report, Fiat Chrysler Automobiles N.V., Ford Motors, and General Motors are heavily investing in the manufacturing of commercial vehicles in the US market. Automotive manufacturing in the US is the eighth largest economy globally and added ~US$ 2.64 trillion in value in 2021. Manufacturing motor vehicles and their parts represent 6% of the total manufacturing. The automotive sector contributes more than US$ 1.0 trillion to the US economy annually, representing 4.9% of GDP.

Growing building and construction investments, including government investment toward infrastructure developments, are driving the demand for industrial vehicles in North America. For instance, in August 2021, the US Ministry of Transportation and Infrastructure invested ~US$ 837.0 million for the highway expansion project between Western Canada in Alberta and BC. This project includes the construction of bridges and the expansion of two lanes to four-lane highways. Construction vehicles help the crews to perform several construction activities quickly and more efficiently. These vehicles are used for digging trenches to haul construction materials such as stone or aggregate using different construction vehicles. Various industrial vehicles are designed for specific tasks to perform multiple functions in the construction sites. Such infrastructure development projects require various industrial vehicles, including forklifts, cranes, road rollers, and dump trucks. Thus, the automotive industry is expanding with a rise in construction projects across different countries in North America, which drives the industrial vehicles market.

Industrial Vehicles Market Regional InsightsThe regional trends and factors influencing the Industrial Vehicles Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Industrial Vehicles Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Industrial Vehicles Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 57.54 Billion |

| Market Size by 2030 | US$ 83.68 Billion |

| Global CAGR (2022 - 2030) | 4.8% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Industrial Vehicles Market Players Density: Understanding Its Impact on Business Dynamics

The Industrial Vehicles Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Industrial Vehicles Market top key players overview

Key Player Analysis:

KION Group AG; Toyota Industries Corporation; MITSUBISHI HEAVY INDUSTRIES, LTD.; Komatsu Limited, Konecranes; Anhui Heli Co., Ltd.; Hyster-Yale Materials Handling, Inc.; Jungheinrich AG; Crown Equipment Corporation; and Clark Material Handling Company are among the key players covered in the industrial vehicles market report. The report includes growth prospects in light of current industrial vehicles market trends and driving factors influencing the market.

Recent Developments:

Inorganic and organic strategies such as mergers and acquisitions are highly adopted by companies in the industrial vehicles market. The market initiative is a strategy adopted by companies to expand their footprint across the world and to meet the growing customer demand. The market players present in the market are mainly focusing on product and service enhancements by integrating advanced features and technologies into their offerings. A few recent developments by key industrial vehicles market players are listed below:

Year |

News |

Country |

|

September-2023 |

Jungheinrich and Mitsubishi Logisnext Americas collaboratively launched Rocrich AGV Solutions. Through this solution, the company aims to provide automation solutions for warehouses and production facilities in the North American market. |

North America |

|

July-2023 |

Vedanta Aluminium, India's largest aluminum manufacturer, has increased its electric lithium-ion forklift fleet, making it the country's largest fleet. Vedanta Aluminium exhibits its commitment to sustainability by having 44 units functioning in Odisha and Chhattisgarh. |

Asia Pacific |

Frequently Asked Questions

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For