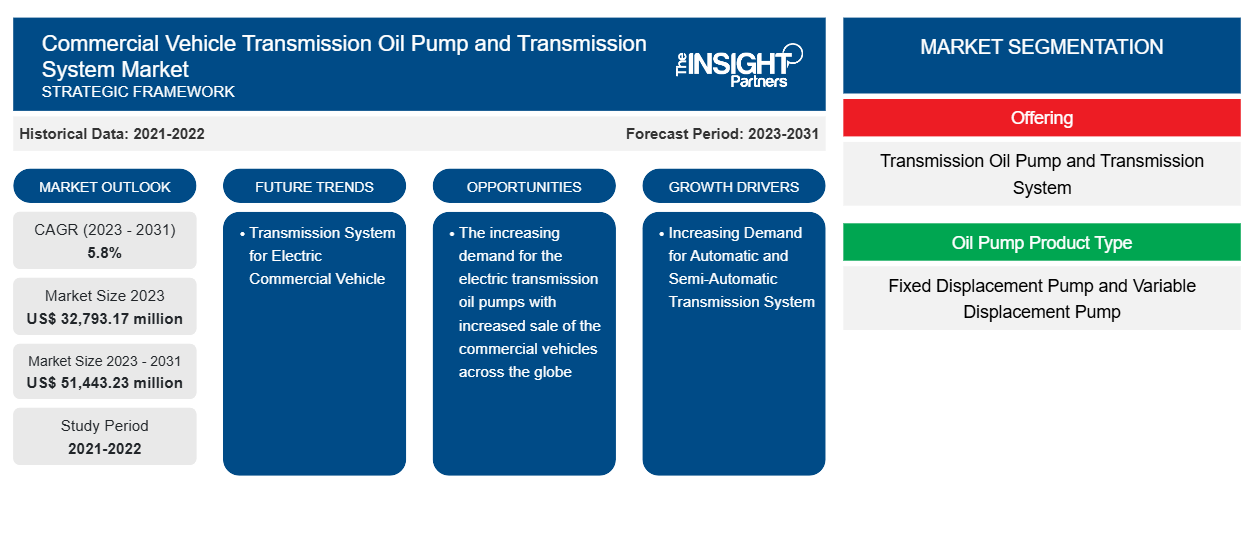

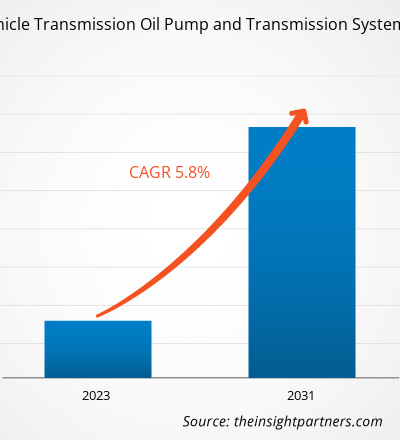

The commercial vehicle transmission oil pump and transmission system market size is projected to reach US$ 51,443.23 million by 2031 from US$ 32,793.17 million in 2023. The market is expected to register a CAGR of 5.8% during 2023–2031. The increasing demand for the electric transmission oil pumps with increased sale of the commercial vehicles across the globe is driving the trend in the market.

Commercial Vehicle Transmission Oil Pump and Transmission System Market Analysis

The commercial vehicle transmission oil pump and transmission system market is expected to witness significant growth in the coming years attributing to increasing demand for commercial vehicles from developing nations and growing trend of AMT transmission in commercial vehicles. Innovations and technological advancements are key stones of the US economy. The country retains technology supremacy in the various component of automobiles. This presents a significant opportunity for the commercial vehicle transmission oil pumps and transmission systems manufacturers to produce advanced technology commercial vehicles.

Commercial Vehicle Transmission Oil Pump and Transmission System Market Overview

Automotive is one of the key sectors driving the economy of Middle East with an increasing number of vehicles production. Saudi Arabia has one of the world’s largest vehicle population ratio. Saudi Arabia, the UAE, and Kuwait lead the gulf countries in terms of automobile on the road. The per capita income of these countries is high. Hence, the region is one of the ideal markets for the automotive sector due to the strong purchasing power of consumers

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Commercial Vehicle Transmission Oil Pump and Transmission System Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Commercial Vehicle Transmission Oil Pump and Transmission System Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Commercial Vehicle Transmission Oil Pump and Transmission System Market Drivers and Opportunities

Increasing Demand for Automatic and Semi-Automatic Transmission System

Transmission system ensures a smooth and comfortable drive by transferring the maximum amount of power from an engine to the wheels via gearbox. The majority of low- and mid-range vehicles now use semi-automatic and automatic transmission systems. The mobility and fuel efficiency of a car can be considerably influenced by an automated transmission system, depending on the electrical technology utilized in the transmission and the design of the transmission system. Automatic gearboxes or dual pedal technology is available in various configurations, such as Automatic Transmission (AT), Automated-Manual Transmission (AMT), Continuously Variable Transmission (CVT), Dual-Clutch Transmission (DCT), Direct Shift Gearbox (DSG), and Tiptronic Transmission. The shift from manual to automatic transmissions is driven by an increased desire for comfort and safety. Automatic gearboxes are comfortable, safe, environment friendly, and cost effective. They also provide a superior driving experience. A driver does not need to handle the clutch with an automatic transmission, which is quite convenient, especially in urban stop-and-go traffic. Autonomous parking assistants, for example, make daily living accessible and are a precursor to utterly automated driving.

Transmission System for Electric Commercial Vehicle

Transmission for electric vehicles is utilized to transfer mechanical power from an electric traction motor to the wheels. Most of the electric cars are equipped with single-speed transmissions, which are sufficient for efficient operation in today's world. However, several vehicle types benefit from the usage of a multi-speed transmission. Furthermore, many of the major manufacturers in the EV transmission market are developing multi-speed transmission sailing operations and load shifting capabilities for electric vehicles to launch them shortly. To follow government rules regarding emission limits and future fuel usage, the development of electric vehicles is gaining traction at a rapid pace. Apart from the traction motor, the transmission or gearbox in the drive system is another critical component in an electric vehicle's power performance. Electric vehicles require enough power to overcome road load when driving.

Commercial Vehicle Transmission Oil Pump and Transmission System Market Report Segmentation Analysis

Key segments that contributed to the derivation of the commercial vehicle transmission oil pump and transmission system market analysis are offering, oil pump product type, transmission system type, vehicle type, powertrain type and geography.

- Based on offering, the market is divided into transmission oil pump and transmission system. Among this transmission system has a larger share in 2023, owing to increasing advancement of the transmission systems.

- Depending upon the oil pump product type, the market is divided into fixed displacement pump and variable displacement pump. Among these, fixed displacement pump has a larger share in 2023.

- Based on oil pump type, the market is divided into vane type, gear type, and rotor type.

- Depending upon the transmission system type, the market is divided into manual transmission, automatic transmission, and automated manual transmission. Among these, automatic transmission has a largest share in 2023.

- Based on vehicle type, the market is divided into MCV and HCV. Based on MCV, the market is divided into class III and class VI. Depending upon the HCV, the market is divided into Class VII to Class VIII. Among these, HCV has largest share in 2023.

- Depending upon the powertrain type, the global market is divided into internal combustion engine, electric, and hybrid. Among these, internal combustion engine has a largest share in 2023. This is owing to increasing commercial vehicles sale across the globe.

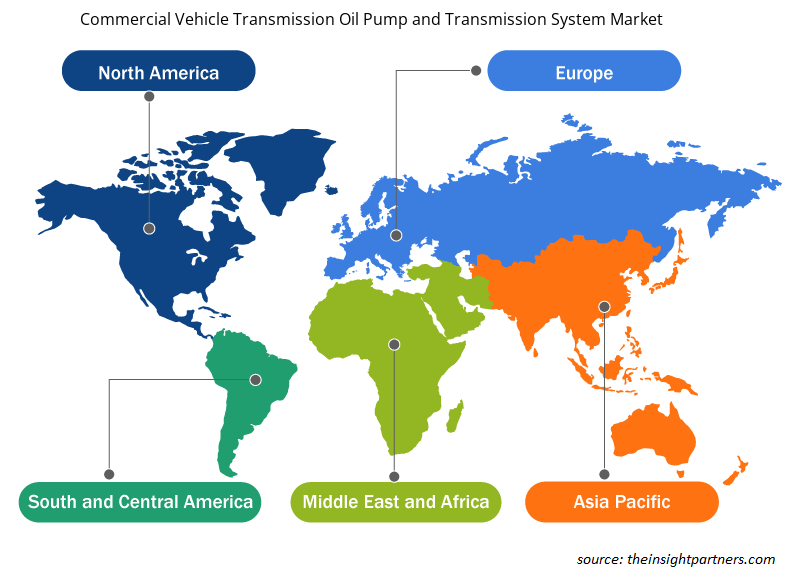

Commercial Vehicle Transmission Oil Pump and Transmission System Market Share Analysis by Geography

The geographic scope of the commercial vehicle transmission oil pump and transmission system market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

The governments of various countries in Asia Pacific are focusing on the manufacturing of automobiles in their respective countries. For instance, through Made in China 2025, the government of China is supporting local companies to compete with foreign automakers. Furthermore, initiatives by the government of India, such as Automotive Mission Plan 2016-26, are supporting the country’s growing automotive manufacturing industry. Therefore, theses government initiatives would boost the growth of the automotive sector in the region, which would subsequently drive the commercial vehicle transmission oil pump and transmission system market during the forecast period.

Commercial Vehicle Transmission Oil Pump and Transmission System Market Regional Insights

The regional trends and factors influencing the Commercial Vehicle Transmission Oil Pump and Transmission System Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Commercial Vehicle Transmission Oil Pump and Transmission System Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Commercial Vehicle Transmission Oil Pump and Transmission System Market

Commercial Vehicle Transmission Oil Pump and Transmission System Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 32,793.17 million |

| Market Size by 2031 | US$ 51,443.23 million |

| Global CAGR (2023 - 2031) | 5.8% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Offering

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Commercial Vehicle Transmission Oil Pump and Transmission System Market Players Density: Understanding Its Impact on Business Dynamics

The Commercial Vehicle Transmission Oil Pump and Transmission System Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Commercial Vehicle Transmission Oil Pump and Transmission System Market are:

- Allison Transmission Holding INC

- BorgWarner Inc.

- Qijiang Gear Transmission Co., Ltd.

- Daimler AG

- Eaton Group

- Mack Trucks

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Commercial Vehicle Transmission Oil Pump and Transmission System Market top key players overview

Commercial Vehicle Transmission Oil Pump and Transmission System Market News and Recent Developments

The commercial vehicle transmission oil pump and transmission system market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the Commercial Vehicle Transmission Oil Pump and Transmission System Market are listed below:

- Nidec Power Train Systems Corporation (the “Company”) announced today that it has successfully developed a new electric oil pump for automotive CVT (continuously variable transmission) systems. This latest product is used to supply oil pressure to the CVT system of a vehicle in the idling-stop mode, and support a car’s engine-driven mechanical oil pump. In an active attempt to reduce their vehicles’ CO2 emissions, individual car manufacturers are shifting toward producing electric and hybrid vehicles and other eco-friendly cars installed with an idling-stop function (Source: Company Website, August 2023)

Commercial Vehicle Transmission Oil Pump and Transmission System Market Report Coverage and Deliverables

The “Commercial Vehicle Transmission Oil Pump and Transmission System Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Commercial vehicle transmission oil pump and transmission system market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Commercial vehicle transmission oil pump and transmission system market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Commercial vehicle transmission oil pump and transmission system market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Commercial Vehicle Transmission Oil Pump and Transmission System market

- Detailed company profiles

Frequently Asked Questions

Which region dominated the commercial vehicle transmission oil pump and transmission system market in 2023?

Asia Pacific is expected to dominate the commercial vehicle transmission oil pump and transmission system market in 2023.

What are the driving factors impacting the commercial vehicle transmission oil pump and transmission system market?

The increasing demand for automatic and semi-automatic transmission system drives the market growth.

What are the future trends of the commercial vehicle transmission oil pump and transmission system market?

The increasing demand for the electric transmission oil pumps with increased sale of the commercial vehicles across the globe drives the market growth

Which are the leading players operating in the commercial vehicle transmission oil pump and transmission system market?

Allison Transmission Holding INC, BorgWarner Inc., Qijiang Gear Transmission Co., Ltd., Daimler AG, Eaton Group, Mack Trucks, ScaniaSinotruk (Hong Kong) Limited, Shaanxi Fast Auto Drive Co. Ltd., Volvo AG are among the major companies operating in the commercial vehicle transmission oil pump and transmission system market.

What would be the estimated value of the commercial vehicle transmission oil pump and transmission system market by 2031?

The commercial vehicle transmission oil pump and transmission system market size is projected to reach US$ 51,443.23 million by 2031 from US$ 32,793.17 million in 2023.

What is the expected CAGR of the commercial vehicle transmission oil pump and transmission system market?

The market is expected to register a CAGR of 5.8% during 2023–2031.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Boat Sails Market

- Heavy Commercial Vehicle Air Brake Systems Market

- Heavy Commercial Vehicle Clutch Market

- Electric Vehicle Heat Pump Systems Market

- Event Logistics Market

- Industrial Vehicles Market

- Motorsport Transmission Market

- Automotive Telematics Market

- Third Party Logistics Market

- Low Speed Electric Vehicle Market

Testimonials

I wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA, MANAGING DIRECTOR, PineCrest Healthcare Ltd.The Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

Yukihiko Adachi CEO, Deep Blue, LLC.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Strategic Planning

- Investment Justification

- Identifying Emerging Markets

- Enhancing Marketing Strategies

- Boosting Operational Efficiency

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

Get Free Sample For

Get Free Sample For