Copper Wire Rods Market Size, Share, Trends & Growth 2031

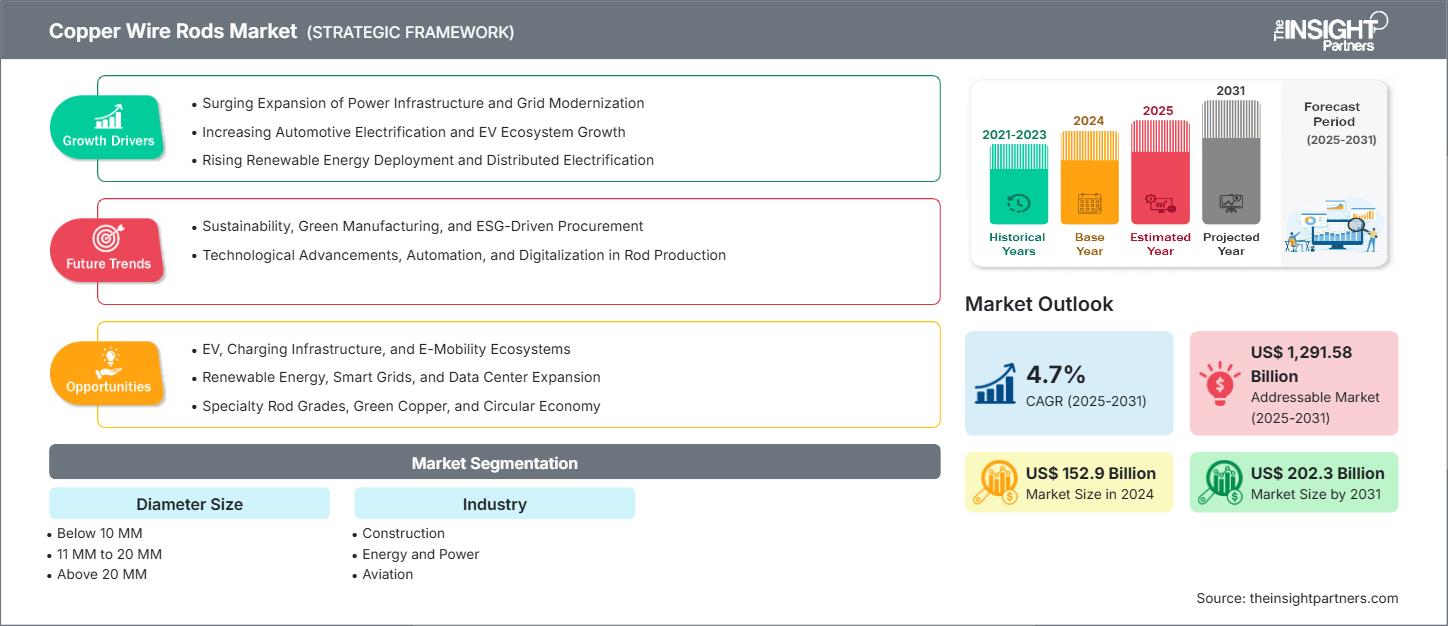

Copper Wire Rods Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Media (Diameter Size (Below 10 mm, 11 mm to 20 mm, and above 20 mm), Industry (Construction, Energy and Power, Aviation, Automotive, and Others), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South America)

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : Jan 2026

- Report Code : TIPRE00042052

- Category : Manufacturing and Construction

- Status : Published

- Available Report Formats :

- No. of Pages : 250

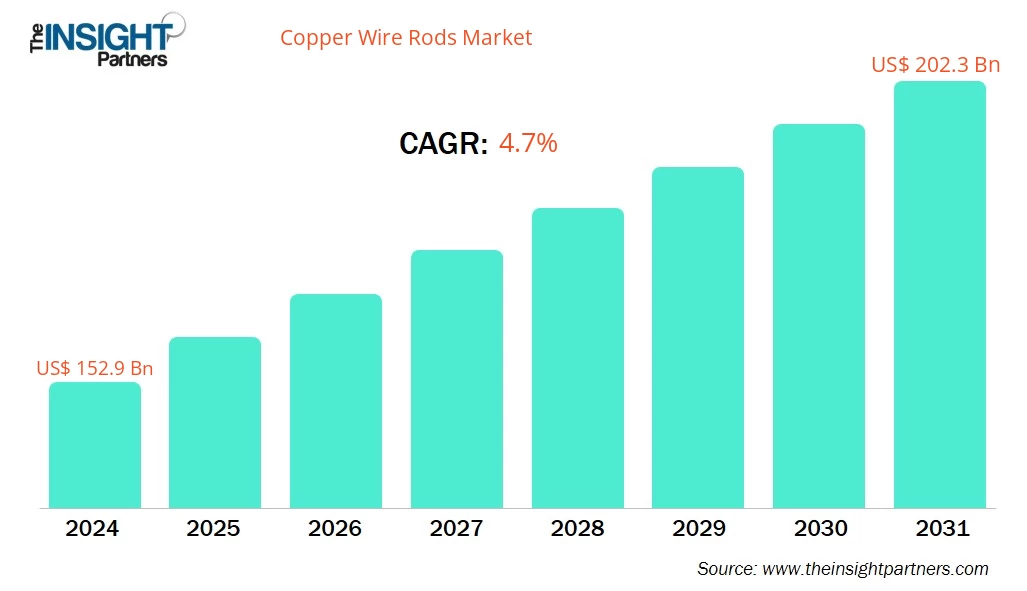

The copper wire rods market size reached US$ 152.8 billion in 2024 and is expected to reach US$ 202.3 billion by 2031. The copper wire rods market is estimated to register a CAGR of 4.2% during 2025–2031.

Copper Wire Rods Market Analysis

Copper wire rods are one of the semi-finished metal products that come in long, continuous, round, usually high-purity copper wire strands are the basic raw material used in the fabrication of copper wires, copper cables, and other copper-based electrical conductors. Mostly, they are made from copper cathodes of high purity through continuous casting and rolling operations, are available in coil form (commonly about 8 mm in diameter), and are characterized by their extremely high electrical conductivity, mechanical properties of the material, and good corrosion resistance when used in the electrical and industrial fields.

Copper Wire Rods Market Overview

Growth is dependent on the extension and modernization of the power grid, the expansion of renewable energy sources, the increase in the use of electric vehicles and the development of their charging infrastructure, urban construction, and the growth of the telecom and data centre sectors powered by copper wire rods.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONCopper Wire Rods Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Copper Wire Rods Market Drivers and Opportunities

Market Drivers:

- Expansion of Power Infrastructure and Grid Modernization: The build-out and modernization of the T&D networks, rural and urban electrification, as well as the integration of renewables, are structurally increasing the use of copper in conductors, transformers, busbars, and cables. Copper’s conductivity, durability, and use in smart, resilient grids are the main reasons for the sustained demand, supported by regulated utility and government-backed capex.

- Automotive Electrification and EV Ecosystem Growth: The rising adoption of EVs and hybrids is resulting in a sharp increase in the amount of copper used per vehicle, and thus is creating additional demand for the charging networks. Copper wire rods are used in traction motors, inverters, HV harnesses, and power electronics, while the development of AC/DC charging and vehicle electrification trends in both EVs and ICE vehicles is leading to an increase in wiring and cabling, which are copper-intensive.

- Renewable Energy Deployment and Distributed Electrification: The growth of wind, solar, storage, and distributed energy systems is leading to a substantial increase in copper demand for generators, transformers, inverters, and long runs of AC/DC cabling. Large-scale and rooftop projects, microgrids, and grid-integration equipment depend on copper conductors with high conductivity, thus making wire rods the core of power investments driven by decarbonization and the long-term renewable build-out globally.

Market Opportunities:

- Specialty Rod Grades, Green Copper, and Circular Economy: The transition to high-performance, traceable, and low-carbon materials is beneficial for specialty rod grades, green copper, and recycling-centric models. Oxygen-free copper and alloy rods are used to meet the needs of the automotive, electronics, and industrial sectors, while production with low emissions and supported by environmental product declarations enhances the ESG value.

- Renewable Energy, Smart Grids, and Data Center Expansion: Renewable energy technologies, smart grids, and data centers are driving a strong and long-term demand for copper rods with high conductivity that are used in generators, transformers, inverters, and LV/MV cabling. The digitalization of the grid and the hyperscale/edge data centers increase the demand for copper-intensive power and control networks. Suppliers who provide reliable, thermally stable, and low-carbon rod grades that are specifically designed for these applications can secure their position where infrastructure investments are prioritized.

Copper Wire Rods Market Report Segmentation Analysis

The copper wire rods market is divided into different segments to give a clearer view of how it works, its growth potential, and the latest trends. Below is the standard segmentation approach used in industry reports:

By Diameter Size:

- Below 10 mm: High-speed fine and medium wire drawing, which is used for building wiring, power, and communication cables, magnet wire, automotive harnesses, connectors, and precision components, mainly consumes copper wire rods below 10 mm. These are the places where a large number of drawing passes, close dimensional tolerances, and excellent surface finish are indispensable; thus, low oxygen or oxygen‑free casting, precise rolling, controlled cooling, and strict surface defect control are increasingly being employed to achieve maximum drawability, die life, and minimum wire breaks.

- 11 mm to 20 mm: Copper wire rods with a diameter of 11–20 mm serve as the intermediate material for the production of busbars, connectors, earthing rods, large cable cores, and industrial conductors, thus ensuring an adequate combination of electrical conductivity, mechanical strength, and metalworking properties for power distribution, industrial electrification, and renewable energy and infrastructure sectors.

- Above 20 mm: Copper rods with a diameter of more than 20 mm are used for heavy-duty purposes such as the manufacture of large busbars, switchgear parts, high-current terminals, and specialized connectors. Cutting, high strength, and fatigue resistance, resistance to wear, uniform quality, and complete traceability are of utmost importance.

By Industry:

- Construction

- Energy and Power

- Aviation

- Automotive

- Others

By Geography:

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

The regional trends and factors influencing the Copper Wire Rods Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Copper Wire Rods Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Copper Wire Rods Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 152.9 Billion |

| Market Size by 2031 | US$ 202.3 Billion |

| Global CAGR (2025 - 2031) | 4.7% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Diameter Size

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Copper Wire Rods Market Players Density: Understanding Its Impact on Business Dynamics

The Copper Wire Rods Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Copper Wire Rods Market Share Analysis by Geography

The copper wire rods industry is growing globally, with Asia Pacific being the major contributor to the growth because of rapid urbanization, power and telecom projects, and the rise of electric vehicles. However, North America and Europe are gaining from the modernization of grids, the increasing use of renewable energy sources, and the demand for data centers. At the same time, Latin America and MEA are progressing through electrification, construction, and infrastructure investment.

Below is a summary of market share and trends by region:

1. North America

- Market Share: Largest market, especially in the US, due to power, construction, automotive, and data‑center sectors.

- Key Drivers:

- Grid modernization

- Renewables and EV rollout

- High standards for electrical safety and reliability

- Trends: Increased use of recycled content to meet sustainability.

2. Europe

- Market Share: Significant share, underpinned by mature power infrastructure and automotive and industrial bases.

- Key Drivers:

- Strict EU energy‑efficiency and circular‑economy regulations

- E-mobility

- Trends: Strong focus on low‑carbon, certified green copper rods and higher recycling rates.

3. Asia Pacific

- Market Share: Fastest growing market owing to rapid industrialization.

- Key Drivers:

- Rapid urbanization

- Massive energy transmission and distribution (T&D)

- Strong power cable manufacturing base

- Trends: Investments in advanced continuous casting, automation, and higher‑purity rod grades.

4. Middle East and Africa

- Market Share: Emerging market driven by the power sector projects.

- Key Drivers:

- Strong construction sector

- Growing solar and desalination capacity

- Trends: Initiatives and incentives to localize copper rods and cables manufacturing

5. South America

- Market Share: A growing market largely supported by the growing industrial sector in Brazil and Chile.

- Key Drivers:

- Power and construction investments

- Automotive and appliance manufacturing.

- Trends: Collaboration with global suppliers.

Copper Wire Rods Market Players Density: Understanding Its Impact on Business Dynamics

Medium Market Density and Competition

Competition is strong due to the presence of established players such as Mitsubishi Materials Trading Corp, Hindalco Industries Ltd, APAR Industries Ltd, and Leebo Metals Pvt Ltd. Regional and niche players are also adding to the competitive landscape across different regions.

This high level of competition urges companies to stand out by offering:

- Superior performance: Essentially, these are high-conductivity, low-loss, and long-life copper wire rods that reduce resistive losses, extend the life of the asset in cables, transformers, and motors, and lower the total lifecycle cost for grid, EV, and industrial users.

- Energy-efficient designs: Diameter, temper, and alloy combinations that go hand in hand with compact, higher ampacity conductors and system energy consumption are reduced; thus, utilities, OEMs, and end-users can comply with their ESG and decarbonization commitments.

- Flexible, customer-centric supply: Cable manufacturers and OEMs can debottleneck operations, scale capacity, and quickly adapt to the new EV, renewable, and telecom specifications with the help of modular, multi-diameter rod production, customized alloys (e.g., high strength or corrosion-resistant grades), and logistics/just-in-time programs, which give them freedom from constraints.

Opportunities and Strategic Moves

- Strengthening ecosystem partnerships: Leading copper rod producers deepen collaboration with cable makers, transformer and motor OEMs, EV/charging solution providers, and utilities to co-develop optimized conductor designs, busbars, and harness platforms for grid, EV, and data center projects, ensuring seamless integration with equipment and faster project deployment.

- Developing modular, application-ready conductor platforms: Key suppliers promote “modular” rod and conductor families (standardized diameters, tempers, and alloy options) that can be quickly drawn, stranded, or fabricated into power cables, busbars, and connectors, simplifying design-in across diverse voltage levels and installation environments, and enabling rapid scaling of capacity in renewables, EV charging, and industrial electrification.

Disclaimer: The companies listed above are not ranked in any particular order.

Other companies analyzed during the course of research:

- Elcowire Group AB

- Cunext Copper Industries SL

- International Metal Industry Co Ltd

- KME Germany GmbH

- Union Copper Rod

Copper Wire Rods Market News and Recent Developments

- Conticon announced copper wire rods production: Conticon, a joint venture between Grupo Condumex and Xignux, a manufacturer of electrolytic tough pitch (ETP) copper rod, has commissioned SMS group to expand production capabilities at its plant in Celaya-Villagrán, Mexico, by installing a new CONTIROD CR3700 line.

- Aurubis upgrades shaft furnace: Aurubis AG, a leading global provider of nonferrous metals and one of the world’s largest copper recyclers, successfully modernized its shaft furnace at the Avellino site, marking a significant step toward more efficient and sustainable copper wire rods production.

Copper Wire Rods Market Report Coverage and Deliverables

The "Copper Wire Rods Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Copper wire rods market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Copper wire rods market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Industrial liquid filters market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the copper wire rods market

- Detailed company profiles

Frequently Asked Questions

2. Supply chain, trade, and geopolitical risks affecting raw material and rod availability.

3. Rising environmental and low‑carbon compliance costs in production.

2. Automotive Electrification and EV Ecosystem Growth

3. Renewable Energy Deployment and Distributed Electrification

1. Rising demand from electrical, electronics, EV, and construction sectors in Asia Pacific and other high‑growth regions.

2. Strong pull from grid modernization, renewable energy, and broadband/5G infrastructure requiring high‑conductivity copper conductors.

Nivedita is an accomplished research professional with over 9 years of experience in Market Research and Business Consulting. Currently serving as a Project Manager in the ICT domain at The Insight Partners, she brings deep expertise in managing and executing Syndicated, Custom, Subscription-based, and Consulting research assignments across diverse technology sectors.

With a proven track record of delivering data-driven analysis and actionable insights, Nivedita has been a key contributor to several critical projects. Her work involves end-to-end project execution—right from understanding client objectives, analyzing market trends, to deriving strategic recommendations. She has collaborated extensively with leading ICT companies, helping them identify market opportunities and navigate industry shifts.

Nivedita holds an MBA in Management from IMS, Dehradun. Prior to joining The Insight Partners, she gained valuable experience at MarketsandMarkets and Future Market Insights in Pune, where she held various research roles and built a strong foundation in industry analysis and client engagement.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For