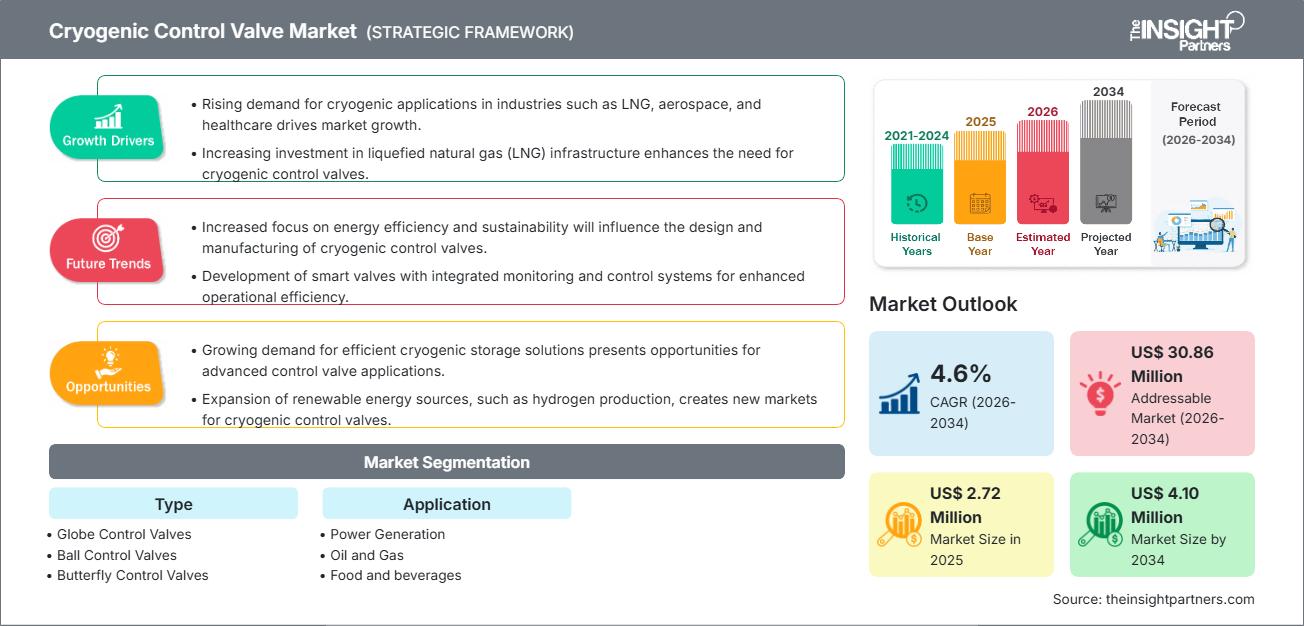

Cryogenic Control Valve Market Overview, Share, and Trends (2026-2034)

Cryogenic Control Valve Market Size and Forecast (2021 - 2034), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Globe Control Valves, Ball Control Valves, Butterfly Control Valves, and Others) and Application (Power Generation, Oil and Gas, Food and beverages, and Others)

Historic Data: 2021-2024 | Base Year: 2025 | Forecast Period: 2026-2034- Report Date : Apr 2026

- Report Code : TIPRE00023978

- Category : Manufacturing and Construction

- Status : Upcoming

- Available Report Formats :

- No. of Pages : 150

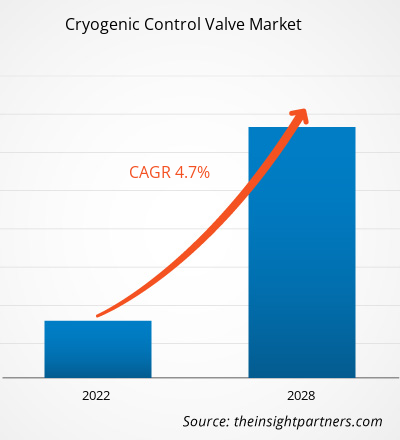

The Cryogenic Control Valve Market size is expected to reach US$4.10 million by 2034 from US$2.72 million in 2025. The market is anticipated to register a CAGR of 4.6% during the forecast period of 2026–2034.

Cryogenic Control Valve Market Analysis

The Cryogenic Control Valve Market forecast indicates steady and consistent growth, fundamentally driven by the escalating global Liquefied Natural Gas (LNG) trade and the corresponding expansion of the associated infrastructure. Growth is further necessitated by the increasing demand for industrial gases such as oxygen, nitrogen, and argon from critical high-tech sectors such as healthcare, electronics, and metallurgy. A wide range of cryogenic applications in power generation and food processing-for instance, flash freezing and carbonation-considerably accelerates the market growth rate. This is enabled through continuous technological advances in valve design related to extreme low-temperature conditions, with particular attention to improved sealing mechanisms and the seamless integration of automation to regulate flow precisely.

Cryogenic Control Valve Market Overview

Cryogenic control valves are highly specialized, engineered devices designed to regulate and isolate ultra-cold fluid flow, typically below 150C °C (-238°F), such as liquid natural gas (LNG), liquid oxygen (LOX), and liquid nitrogen (LN2). Such valves are indispensable parts in any system where the precise handling of cryogenic media is required. Their robust design has to consider extreme thermal cycling and possible thermal shock to ensure safety, operational precision, and efficiency in mission-critical applications for the Oil & Gas, Power Generation, and Food & Beverage industries. In providing dependable flow control under such drastic temperature conditions, such valves form an indispensable backbone component in modern cryogenic systems and infrastructure.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONCryogenic Control Valve Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Cryogenic Control Valve Market Drivers and Opportunities

Market Drivers:

- Growing LNG Infrastructure and Global Energy Transition: The push for cleaner energy sources has led to significant investments in new LNG liquefaction plants, storage facilities, and regasification terminals globally. Since LNG is transported at −162°C, this infrastructure is the single largest driver for high-performance cryogenic control valves.

- Rising Demand for Industrial Gases in High-Value Sectors: Industries such as advanced electronics manufacturing (requiring ultra-pure LN2, medical oxygen supply in healthcare, and the steel/metallurgy industry rely heavily on cryogenic gases for various processes, increasing the requirement for new and replacement valve installations.

- Increasing Adoption of Cryogenic: The Food and beverage industries utilize cryogenic freezing (for instance, with LN2 or liquid CO2 to perform faster processing and preservation. This kind of application requires high-precision, high-speed valves for maintaining quality and optimizing process control.

Market Opportunities:

- Integration of Smart Sensors and IoT: The integration of smart sensors and IoT for real-time monitoring and predictive maintenance allows valves to transmit data on real-time stem position, pressure, and temperature through advanced digital positioners and sensors. This allows for predictive maintenance that minimizes unplanned downtime while enhancing operational safety and efficiency.

- Expansion in Emerging Economies with Rising: Countries in the Asia-Pacific (APAC) and Middle East & Africa (MEA) regions are investing heavily in new energy and industrial projects, creating a vast, untapped market for modern cryogenic control valve technology providers to expand their footprint.

- Development of Advanced Materials and Coatings: Continuous R&D into specialized low-temperature alloys, high-performance sealing materials (like PTFE and PCTFE), and anti-corrosion coatings will further improve valve reliability and extend service life, reducing the overall Total Cost of Ownership (TCO).

Cryogenic Control Valve Market Report Segmentation Analysis

The cryogenic control valve market size is analyzed across various segments to provide a clearer understanding of the product preference, application landscape, and regional dynamics. Below is the standard segmentation approach used in most industry reports:

By Type:

- Globe Control Valves: Globe valves are the most common type used in cryogenic systems, primarily due to their superior throttling capabilities and ability to provide precise flow modulation, which is critical in maintaining stable cryogenic temperatures and pressures.

- Ball Control Valves: Ball valves are utilized mainly for on/off isolation applications due to their quick-opening features and high flow capacity. Specialized, trunnion-mounted designs are engineered to handle the thermal contraction inherent in cryogenic service while maintaining tight shut-off.

- Butterfly Control Valves: Butterfly valves typically show a preference for larger pipe sizes where lightweight design and cost-effectiveness are important design parameters. However, in extreme cryogenic service, their use is more restricted, although expanding, due to innovations in materials and construction of the sealing elements.

By Application:

- Power Generation: Primarily used in gas turbine power plants and cogeneration facilities for handling liquid fuels and cooling gases used in the combustion cycle.

- Oil and Gas: The largest application segment, covering LNG liquefaction, transportation, storage, and regasification processes, as well as the handling of natural gas liquids (NGLs).

- Food and Beverages: Encompasses the use of cryogenic gases for flash freezing, transportation of chilled foods, and carbonation processes in the beverage industry, requiring sanitary, robust valves.

By Geography:

- North America

- Europe

- Asia-Pacific

- South & Central America

- Middle East & Africa

The cryogenic control valve market in Asia-Pacific is expected to witness the fastest growth and hold the largest share during the forecast period, driven by massive investments in new energy infrastructure.

Cryogenic Control Valve Market Regional Insights

The regional trends influencing the Cryogenic Control Valve Market have been analyzed across key geographies.

Cryogenic Control Valve Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2025 | US$ 2.72 Million |

| Market Size by 2034 | US$ 4.10 Million |

| Global CAGR (2026 - 2034) | 4.6% |

| Historical Data | 2021-2024 |

| Forecast period | 2026-2034 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Cryogenic Control Valve Market Players Density: Understanding Its Impact on Business Dynamics

The Cryogenic Control Valve Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Cryogenic Control Valve Market Share Analysis by Geography

Asia-Pacific is expected to grow fastest in the coming years due to unprecedented LNG infrastructure development. Emerging markets in South & Central America, the Middle East, and Africa also have many untapped opportunities for control valve providers to expand. The market shows a different growth trajectory in each region due to factors such as energy policy, industrialization pace, and investment in gas infrastructure. Below is a summary of market share and trends by region:

1. Asia-Pacific

- Market Share: Dominates the global market share owing to the rapid pace of LNG infrastructure development across China, India, and Japan, which are expanding their energy import and gas processing capabilities significantly.

- Key Drivers:

- Massive government and private investment in LNG receiving terminals.

- Rapid industrialization is fueling demand for bulk industrial gases.

- Growing adoption of cryogenics in high-tech manufacturing.

- Trends: Adoption of highly automated valves with intelligent diagnostics to ensure process safety and efficiency in new, large-scale energy projects.

2. North America

- Market Share: Holds a substantial market share driven by the mature shale gas production sector and the region’s dominant role as an LNG exporter, leading to continuous valve upgrades and expansions in liquefaction facilities.

- Key Drivers:

- An extensive network of existing and planned LNG export terminals.

- Stringent safety and environmental regulations demand high-integrity valves.

- High demand for specialized valves in chemical and petrochemical cryogenic processes.

- Trends: Focus on high-performance globe and ball valves designed for severe service conditions and extreme temperature stability.

3. Europe

- Market Share: Exhibits steady growth, supported by a strong and mature industrial gas market and ongoing energy diversification efforts aimed at securing stable gas supplies.

- Key Drivers:

- Sustained demand for industrial gases in metallurgy and electronics.

- Energy security mandates leading to investment in gas storage and transmission infrastructure.

- Strict adherence to global safety and quality certifications (e.g., ISO, CE).

- Trends: Increasing use of valves compatible with hydrogen and other future cryogenic energy carriers, aligning with long-term energy transition goals.

Cryogenic Control Valve Market Players Density: Understanding Its Impact on Business Dynamics

Moderate Market Consolidation and Competition

The Cryogenic Control Valve Market is moderately consolidated, characterized by the presence of a few dominant global leaders who command significant market share due to their long heritage and extensive product portfolios. Key global vendors include Emerson Electric Co., Flowserve Corporation, and Baker Hughes Company.

This competitive landscape drives innovation and differentiation through:

- Compliance with Stringent Safety Standards: Vendors must continually invest in R&D to meet certifications from global regulatory bodies, ensuring valves can safely operate under thermal stress and prevent leakage.

- Automation Compatibility and Digital Integration: Developing valves that integrate seamlessly with advanced Distributed Control Systems (DCS) and smart positioners to offer remote diagnostics and real-time control.

- Innovation in Valve Design: Creating new designs focused on minimizing heat leak, enhancing sealing integrity through specialized bellows and packing systems, and offering superior flow characteristics at cryogenic temperatures.

Major Companies Operating in the Cryogenic Control Valve Market are:

- Emerson Electric Co. (United States)

- Flowserve Corporation (United States)

- Baker Hughes Company (United States)

- Neles Corporation (Finland)

- Velan Inc. (Canada)

- Larsen & Toubro Limited (India)

- SAMSON USA (United States)

- Bac Valves (Spain)

- KORVAL Co., Ltd. (South Korea)

Disclaimer: The companies listed above are not ranked in any particular order.

Cryogenic Control Valve Market News and Recent Developments

-

Emerson Electric Co. introduced the AEV ²XC™ C‑Ball Valve for LNG applications: Emerson Electric Co. launched the AEV ²XC™ C‑Ball Valve in June 2025, featuring a unique “C” shaped ball design that ensures zero leakage and enhanced torque-seated isolation. This innovation improves safety and reliability for cryogenic LNG systems, aligning with global emission compliance standards.

-

Flowserve Corporation unveiled new Worcester Cryogenic Ball Valves with advanced emission control: Flowserve introduced its latest Worcester cryogenic ball valve series in February 2025, offering bolted cryogenic bonnets, live-loaded PTFE packing, and compliance with ISO 15848 and API 641 standards. These valves are designed to minimize fugitive emissions and enhance maintainability in LNG and industrial gas applications.

Cryogenic Control Valve Market Report Coverage and Deliverables

The “Cryogenic Control Valve Market Size and Forecast (2021–2034)” report provides a detailed analysis of the market covering below areas:

- Cryogenic Control Valve Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Cryogenic Control Valve Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Cryogenic Control Valve Market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the Cryogenic Control Valve Market

- Detailed company profiles

Frequently Asked Questions

Nivedita is an accomplished research professional with over 9 years of experience in Market Research and Business Consulting. Currently serving as a Project Manager in the ICT domain at The Insight Partners, she brings deep expertise in managing and executing Syndicated, Custom, Subscription-based, and Consulting research assignments across diverse technology sectors.

With a proven track record of delivering data-driven analysis and actionable insights, Nivedita has been a key contributor to several critical projects. Her work involves end-to-end project execution—right from understanding client objectives, analyzing market trends, to deriving strategic recommendations. She has collaborated extensively with leading ICT companies, helping them identify market opportunities and navigate industry shifts.

Nivedita holds an MBA in Management from IMS, Dehradun. Prior to joining The Insight Partners, she gained valuable experience at MarketsandMarkets and Future Market Insights in Pune, where she held various research roles and built a strong foundation in industry analysis and client engagement.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For