Cryptocurrency Payment Apps Market Size & Share by 2031

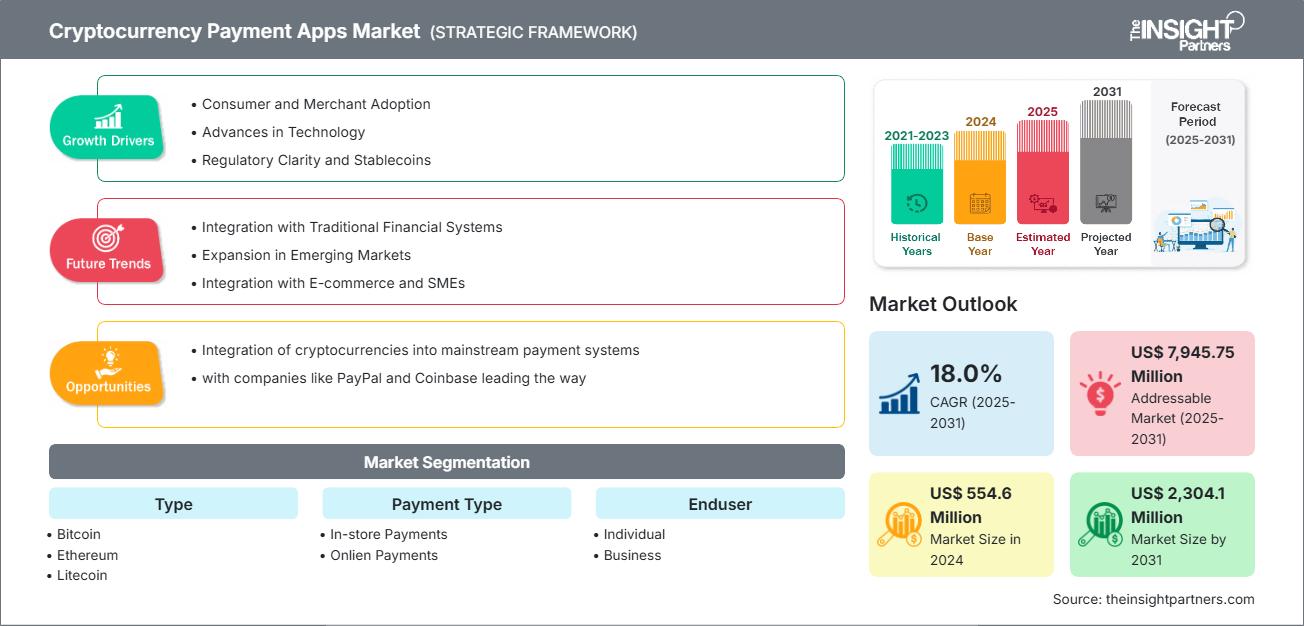

Cryptocurrency Payment Apps Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Report Coverage : by Type (Bitcoin, Ethereum, Litecoin, DAI, Ripple, Others), Payment Type (In-store Payments, Onlien Payments), Enduser (Individual, Business) and Geography

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : Apr 2026

- Report Code : TIPRE00042061

- Category : Banking, Financial Services, and Insurance

- Status : Upcoming

- Available Report Formats :

- No. of Pages : 150

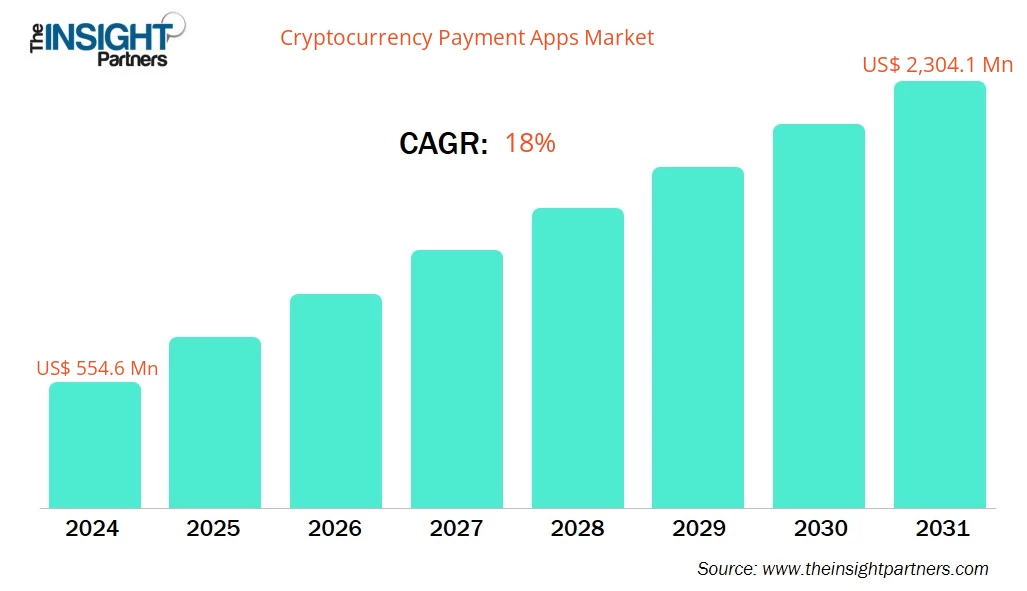

The Cryptocurrency Payment Apps Market size is expected to reach US$ 2,304.1 million by 2031 from US$ 554.6 million in 2024. The market is anticipated to register a CAGR of 18.0% during 2025–2031.

Cryptocurrency Payment Apps Market Analysis

A major force propelling growth in the market is the global acceptance of cryptocurrencies. The decentralized nature of blockchain is driving users to utilize cryptocurrency payment platforms because cryptocurrencies eliminate the need to use banks and other third-party services in the payment process; this results in reduced processing time and increased transaction speed, increasing the excitement surrounding cryptocurrency payment platforms. User acceptance of cryptocurrencies as an investment option is also benefiting the cryptocurrency payment apps market, especially the millennial-age demographic.

Cryptocurrency Payment Apps Market Overview

The increasing uptake of mobile payments and advancements in cybersecurity are also driving market growth. Cryptocurrency payment applications use biometric authentication, multi-signature wallets, and dedicated hardware security modules to provide greater transaction protection. Together with the continued rise in global smartphone penetration, especially in developing economies, these innovations will make digital asset payments much more accessible and secure to a growing pool of users. Additionally, ongoing developments to improve the consumer’s experience in the blockchain space are expected to generate a positive outlook for the market.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONCryptocurrency Payment Apps Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Cryptocurrency Payment Apps Market Drivers and Opportunities

Market Drivers:

- Consumer and Merchant Adoption: Rapid growth in cryptocurrency holders globally fuels demand for payment apps. Merchants seek crypto payment options to attract crypto-native consumers, reduce costly traditional fees, and enable faster settlements. This acceptance drives mainstream use, making digital currencies spendable beyond speculative holding, expanding market reach, and usability.

- Advances in Technology: The improvements being made in blockchain technology via Layer 2 scaling solutions like the Lightning Network are resulting in increased transaction speed and decreased transaction cost. Increased cryptographic security, better user interfaces for applications, and ease of use are building the trust necessary for retailers and consumers looking for efficient and safe payment systems.

- Regulatory Clarity and Stablecoins: Increasingly developed regulatory frameworks across jurisdictions provide businesses with confidence to accept and implement cryptocurrency payments. The emergence of stablecoins tied to fiat currencies mitigates volatility risk within transactions that make cryptocurrency payments practical for everyday commerce and cross-border remittances, and results in broader acceptance and market expansion.

Market Opportunities:

- Integration with Traditional Financial Systems: The integration of cryptocurrency payment apps with traditional financial systems presents substantial opportunities. Working with traditional financial institutions to facilitate the transition to using cryptocurrencies from fiat allows users to access and use them with confidence. Integrating with traditional payment systems also encourages adoption for users who feel comfortable with traditional banking products.

- Expansion in Emerging Markets: Emerging markets represent as-yet unconsidered areas for cryptocurrency payment apps. In regions with limited banking services and access to banking institutions, digital currencies create an opportunity for financial inclusion. Cryptocurrency payment apps can leverage emerging markets by providing safe and effective payment methods, stimulating financial participation, and economic growth.

- Integration with E-commerce and SMEs: The increased uptake of cryptocurrency payment gateways in e-commerce platforms (mainstream) and in small to medium enterprises (SMEs) creates substantial opportunities. This trend supports global market expansion by providing merchants and consumers with seamless, secure, and cost-effective ways to transact using cryptocurrencies, reducing reliance on traditional payment systems and expanding use cases.

Cryptocurrency Payment Apps Market Report Segmentation Analysis

The cryptocurrency payment apps market share is analyzed across various segments to provide a clearer understanding of its structure, growth potential, and emerging trends. Below is the standard segmentation approach used in most industry reports:

By Cryptocurrency Type:

- Bitcoin: The initial and most commonly recognized cryptocurrency, recognized for its security and decentralized technology.

- Ethereum: Recognized for its functionality in smart contracts and decentralized applications (dApps), it opens the door to many different digital transactions.

- Litecoin: Often called the silver to Bitcoin’s gold, it has a shorter confirmation time and a different hashing algorithm.

- Ripple: Designed for fast and low-cost international payments, often used in banks and financial institutions.

- Stablecoins (e.g., USDT, DAI): Cryptocurrencies that are tied to stable assets (like the US dollar) limit volatility, which makes them appropriate for transactions.

- Others: Including newer cryptocurrencies or niche cryptocurrencies that are emerging in the market.

By Payment Type:

- In-Store Payments: Transactions are conducted at physical retail locations using QR codes or Near Field Communication (NFC) technology.

- Online Payments: Digital purchases are made through e-commerce using a crypto wallet or crypto payment gateway.

By Platform Type:

- Android: Cryptocurrency payment applications intended for use on Android devices are available to a large number of users.

- iOS: Apps designed for Apple's iOS devices, focusing on security and user experience.

- Others: Applications are available through web browsers or available for desktop platforms for greater accessibility.

By End User:

- Individuals: Consumers are using cryptocurrency as a form of payment or for investment or remittance purposes.

- Businesses: Merchants and enterprises are accepting cryptocurrency as a form of payment for goods and services.

By Geography:

- North America

- Europe

- Asia-Pacific

- South & Central America

- Middle East & Africa

Cryptocurrency Payment Apps Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 554.6 Million |

| Market Size by 2031 | US$ 2,304.1 Million |

| Global CAGR (2025 - 2031) | 18.0% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Cryptocurrency Payment Apps Market Players Density: Understanding Its Impact on Business Dynamics

The Cryptocurrency Payment Apps Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Cryptocurrency Payment Apps Market Share Analysis by Geography

North America dominated the cryptocurrency payment apps industry and accounted for a share in 2024. The presence of several prominent players in the region stimulates market growth. The Asia Pacific cryptocurrency payment apps industry is expected to grow during the forecast period. The growth is attributable to the rapid technological advancements and growing acceptance of digital currency across the region.

The cryptocurrency payment apps market shows a different growth trajectory in each region due to factors such as advanced smart technology, urbanization, intelligent traffic systems, and real-time information initiatives. Below is a summary of market share and trends by region:

1. North America

- Market Share: Holds the highest market share, leading in adoption due to technological infrastructure and regulatory clarity.

- Key Drivers: Early adoption of digital currencies, advanced technological infrastructure, and a mature financial ecosystem.

- Trends: Integration of cryptocurrencies into mainstream payment systems, with companies like PayPal and Coinbase leading the way.

2. Europe

- Market Share: The growth of this region is due to strong regulatory frameworks and increasing merchant acceptance, driving growth.

- Key Drivers: Progressive regulatory frameworks, high volume of cross-border trade, and increasing adoption in financial services.

- Trends: Growing collaborations between banks and blockchain companies, fostering seamless integration of digital currencies into mainstream financial systems.

3. Asia Pacific

- Market Share: The fastest-growing regional market driven by rapid technological advancements and growing acceptance of digital currency across the region.

- Key Drivers:

- High mobile payment penetration, supportive regulatory frameworks in countries like Japan, Singapore, and South Korea, and growing interest in decentralized finance solutions.

- Trends: Expansion of cryptocurrency acceptance among merchants and the rise of crypto-based remittances.

4. South and Central America

- Market Share: Emerging region propelled by financial inclusion needs and unstable local economies.

- Key Drivers: Economic instability, inflation, and the need for alternative financial systems.

- Trends: Integration of stablecoin-powered remittance technology into mobile banking apps, enabling cross-border transfers in under 20 seconds for a flat fee.

5. Middle East and Africa

- Market Share: The region’s financial ecosystem benefits from low-cost, instant crypto transactions and growing integration of crypto wallets.

- Key Drivers: Growth is driven by rising consumer interest in decentralized finance, increased merchant acceptance, and advances in mobile payment infrastructure.

- Trends: Increasing small-value transactions, expanding B2B segments, and growing integration of AI-based fraud detection and NFC-enabled payments.

Cryptocurrency Payment Apps Market Players Density: Understanding Its Impact on Business Dynamics

The cryptocurrency payment apps market is witnessing intensified competition due to the presence of major global technology providers alongside emerging niche players and specialized startups. Companies are actively innovating to strengthen their market position and meet the growing demand for intelligent decision-making platforms across industries.

The competitive landscape is driving vendors to differentiate through:

- Companies place a premium on improving transaction time, increasing safety through sophisticated encryption, and implementing approachable interfaces.

- Partnerships with banks and firms will accelerate the adoption of digital currency and improve settlement times.

- As regulators change the focus of the regulations, businesses will separate themselves by having the compliance of regional regulations and improved transparency.

Opportunities and Strategic Moves

- Firms can capitalize on increasing merchant demand for crypto payment options at digital and physical points of sale, facilitating faster, cross-border transactions with lower costs.

- These provide currency stability, reducing volatility risks, encouraging mainstream adoption for everyday payments and remittances.

- Vendors can innovate with Layer 2 scalability, biometric security, AI-based fraud detection, and multi-currency wallet support to enhance usability and security, driving broader adoption.

Major Companies Operating in the Cryptocurrency Payment Apps Market Are:

- Binance Pay

- Coinbase

- BitPay

- NOWPayments

- MoonPay

- Crypto.com Pay

- CoinJar UK Limited

- Binance

- SecuX Technology Inc

- Paytomat

Disclaimer: The companies listed above are not ranked in any particular order.

Cryptocurrency Payment Apps Market News and Recent Developments

- As an example, on October 16, 2025, MoonPay, a global leader in cryptocurrency payments, has just announced the launch of MoonPay Commerce, the fastest and easiest way for merchants, creators, and developers to accept cryptocurrency payments anywhere in the world.

- On September 29, 2025, Crypto.com and Sharps Technology, Inc. announced that STSS has expanded its digital asset treasury strategy with Crypto.com services for its holdings.

- On May 20, 2025, Binance, the world's biggest cryptocurrency platform by trading volume and number of users, is now integrated into Brazil's Pix system for its payment service, Binance Pay, which allows for instant payment in local currency and for cryptocurrencies as well as transfers to anyone or a merchant across Latin America's largest country, Brazil.

- For instance, on May 07, 2025, Bhutan and Binance Pay partner to launch the world's first national-level crypto tourism payment system.

- BitPay, the world’s largest provider of Bitcoin and cryptocurrency payment services, has partnered with MoonPay, the world's leading Web3 infrastructure company, to provide BitPay users with significantly increased ways to buy cryptocurrency instantly and at great rates.

Cryptocurrency Payment Apps Market Report Coverage and Deliverables

The "Cryptocurrency Payment Apps Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Cryptocurrency Payment Apps Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Cryptocurrency Payment Apps Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Cryptocurrency Payment Apps Market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the Cryptocurrency Payment Apps Market. Detailed company profiles

Frequently Asked Questions

Ankita is a dynamic market research and consulting professional with over 8 years of experience across the technology, media, ICT, and electronics & semiconductor sectors. She has successfully led and delivered 100+ consulting and research assignments for global clients such as Microsoft, Oracle, NEC Corporation, SAP, KPMG, and Expeditors International. Her core competencies include market assessment, data analysis, forecasting, strategy formulation, competitive intelligence, and report writing.

Ankita is adept at handling complete project cycles—from pre-sales proposal design and client discussions to post-sales delivery of actionable insights. She is skilled in managing cross-functional teams, structuring complex research modules, and aligning solutions with client-specific business goals. Her excellent communication, leadership, and presentation abilities have enabled her to consistently deliver value-driven outcomes in fast-paced and evolving market environments.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For