Custom Procedure Kits Market Key Players and Forecast by 2028

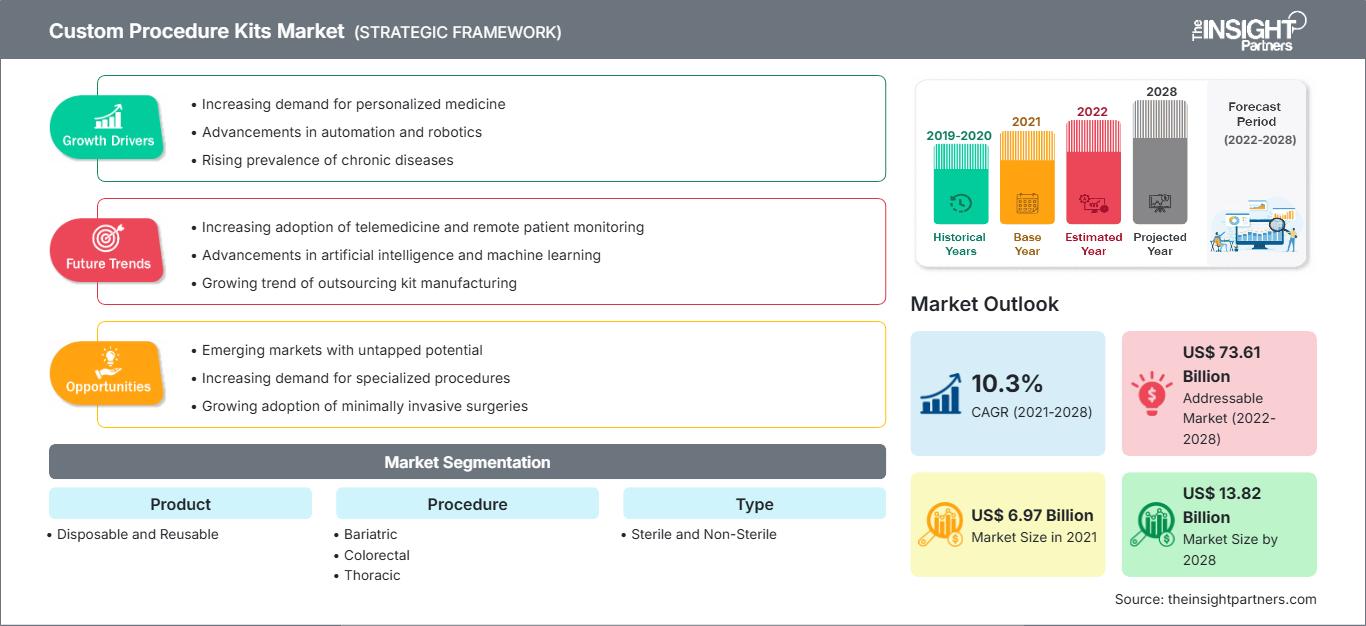

Custom Procedure Kits Market Forecast to 2028 - Analysis By Product (Disposable and Reusable), Procedure (Bariatric, Colorectal, Thoracic, Orthopedic, Ophthalmology, Spine Surgery, Cardiac Surgery, and Others), and Type (Sterile and Non-Sterile)

Historic Data: 2019-2020 | Base Year: 2021 | Forecast Period: 2022-2028- Report Date : Mar 2022

- Report Code : TIPRE00008772

- Category : Life Sciences

- Status : Published

- Available Report Formats :

- No. of Pages : 173

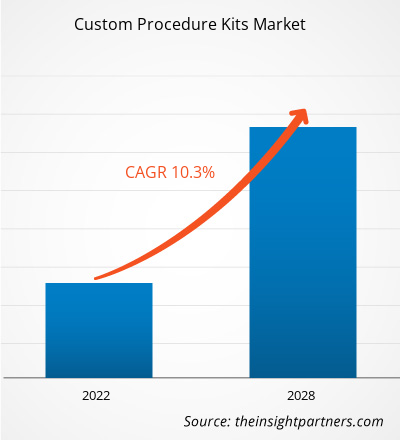

The custom procedure kits market is projected to reach US$ 13,816.53 million by 2028 from US$ 6,970.97 million in 2021. It is expected to grow at a CAGR of 10.3% from 2021 to 2028.

The increasing prevalence of chronic diseases and the rising incidence of cancers and leukemia worldwide have forced the medical industry to perform surgeries. Such factors are likely to drive the custom procedure kits market during the forecast period.

According to the statistics revealed by The Leukemia & Lymphoma Society (LLS), new cases associated with leukemia, lymphoma, and myeloma accounted for almost 9.8% of the estimated 1,898,160 new cancer cases that had been diagnosed in the US in 2021. Additionally, in 2021, 61,090 people were predicted to be diagnosed with leukemia. Furthermore, the Cancer Research UK report states that the proportion of cancer patients having surgery to remove their primary tumor is strongly influenced by the stage at diagnosis. For records, all stages of cancer account for almost 44.8%. Such factors mentioned above are highly responsible for accelerating the custom procedure kits market across the world.

Apart from these, rising cases of road and industrial accidents further drive the adoption of custom procedure kits among hospitals. Also, increasing medical tourism can act as an emerging trend responsible for accelerating the adoption of custom procedure kits at a large scale in the near future. Medical tourism contributes to a diverse landscape change in the healthcare industry as traveling to developing countries for performing surgeries at low rates has gained significant attention worldwide. For example, several patients from the United States travel abroad to receive healthcare services, with most procedures involved including weight loss surgery, dentistry, and cosmetic surgery. The reason more Americans experience medical tourism is simply because of less expensive healthcare. The number of US medical tourists and the number of medical tourists present worldwide is expected to increase by 25% every year as per the estimates by The American Journal of Medicine. Such trends are expected to fuel the sale of custom procedure kits over the next few years.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONCustom Procedure Kits Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

On the other hand, product recalls associated with custom procedure kits negatively impact the overall market growth. For example, in November 2021, the US Food and Drug Administration (USFDA) reported that Aligned Medical Solutions announced its custom procedure kits product recall. The FDA identified the recall as a Class 1 recall considered one of the most severe types of recall. Furthermore, Cardinal Health with the USFDA announced initiating two voluntary field actions for "Cardinal Health Presource Procedure Packs" in January 2020. These packs contain gowns called for product recalls and kept for voluntary hold. These factors are responsible for the sluggish growth of the custom procedure kits market over the coming years.

North America is likely to continue its dominance in the custom procedure kits market between 2021 and 2028. The US held the largest market share in this region in 2021, owing mainly to the growing awareness of aesthetic appearance and cosmetic surgeries performed at a larger scale in the US alone. For records, the International Society of Aesthetic Plastic Surgery (ISAPS) reported that breast procedures, body & extremities procedures, and face & head procedures accounted for 40.2%, 37.8%, and 22.0%, respectively, of the overall aesthetic surgeries performed in the US in 2020. Moreover, the same year, the US gained the first position in the total number of aesthetic procedures performed, accounting for 19.0%.

On the other hand, Asia Pacific is expected to witness lucrative growth over the forecast period. Advanced designs of custom graphic trays and sterilization trays to optimize operation theatre workflows in hospital settings and clinics have resulted in a higher demand for custom procedure kits in the regional market, and this trend is expected to continue over the coming years.

Market Insights

Sustainability and Green Management Across the Healthcare Sector Creates New Avenues for the Growth of Custom Procedure Kits Market

The custom procedure kits can save hospital time before, during, and after surgery by cutting preparation time and making it easier to remove waste. Additionally, custom procedure packs can reduce the amount of waste generated in units. For example, the Kingston Hospital witnessed the number of clinical waste bags reducing by 50%, and an initiative taken by the Royal Liverpool and Broadgreen University Hospitals found that utilizing custom procedure kits allows them to eliminate one load of waste per procedure. The Practice Greenhealth report states that a number of mechanisms can be used to reduce waste creation. Examples include strategies for streamlining supply, standardizing custom procedure kits supply, and others. Also, using custom procedure packs allows healthcare providers to work more efficiently and potentially deliver higher quality healthcare and maintain sustainability and green management across the overall healthcare sector. These factors are boosting the uptake of custom procedure kits at a large scale, ultimately stimulating the overall market growth during the forecast period.

Product Type Insights

Based on product type, the custom procedure kits market has been divided into disposable and reusable. The disposable segment is estimated to account for a larger market share from 2021 to 2028. The rising need for cost-efficiency has led to an increased focus on utilizing single-use and disposable products. Disposable items are majorly packaged in the custom procedure packs as it eliminates the need for the problems of sterilization units at hospitals. Additionally, all healthcare-related providers are responsible for preventing and controlling Healthcare-Associated Infections (HAIs). Adopting disposable items in custom procedure kits is a huge step in the right direction, straightforward, cost-effective, and time-effective for handling infection transmission and prevention among the hospital patient population. These factors are expected to positively influence the segment, eventually contributing to the custom procedure kits market over the forthcoming years.

Companies operating in the custom procedure kits market adopt the product innovation strategy to meet the evolving customer demands worldwide, permitting them to maintain their brand name in the global market.

Custom Procedure Kits

Custom Procedure Kits Market Regional InsightsThe regional trends influencing the Custom Procedure Kits Market have been analyzed across key geographies.

Custom Procedure Kits Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 6.97 Billion |

| Market Size by 2028 | US$ 13.82 Billion |

| Global CAGR (2021 - 2028) | 10.3% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Custom Procedure Kits Market Players Density: Understanding Its Impact on Business Dynamics

The Custom Procedure Kits Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Custom Procedure Kits Market – Segmentation

Based on product type, the custom procedure kits market has been bifurcated into disposable and reusable. By procedure, the market has been segmented into bariatric, colorectal, thoracic, orthopedic, ophthalmology, spine surgery, cardiac surgery, and others. Based on type, the market has been bifurcated into sterile and non-sterile. Based on geography, the market has been primarily segmented into North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South & Central America (SCAM). The market in North America has been further segmented into the US, Canada, and Mexico. The European custom procedure kits market has been segmented into France, Germany, the UK, Spain, Italy, and the Rest of Europe. The market in Asia Pacific has been segmented into China, India, Japan, Australia, South Korea, and the Rest of APAC. The custom procedure kits market in the MEA has been segmented into Saudi Arabia, the UAE, South Africa, and the Rest of MEA. The market in South and Central America has been segmented into Brazil, Argentina, and the Rest of South and Central America.

Some leading companies operating in the custom procedure kits market are Medline Industries, Inc.; Teleflex Incorporated; Owens & Minor Inc.; Medtronic; Cardinal Health Inc.; McKesson Corporation; Smith's Medical; Terumo Cardiovascular Systems Corporation; CPT Medical; and OneMed.

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For