Hospital Sutures Market Size, Trends & Revenue Forecast 2034

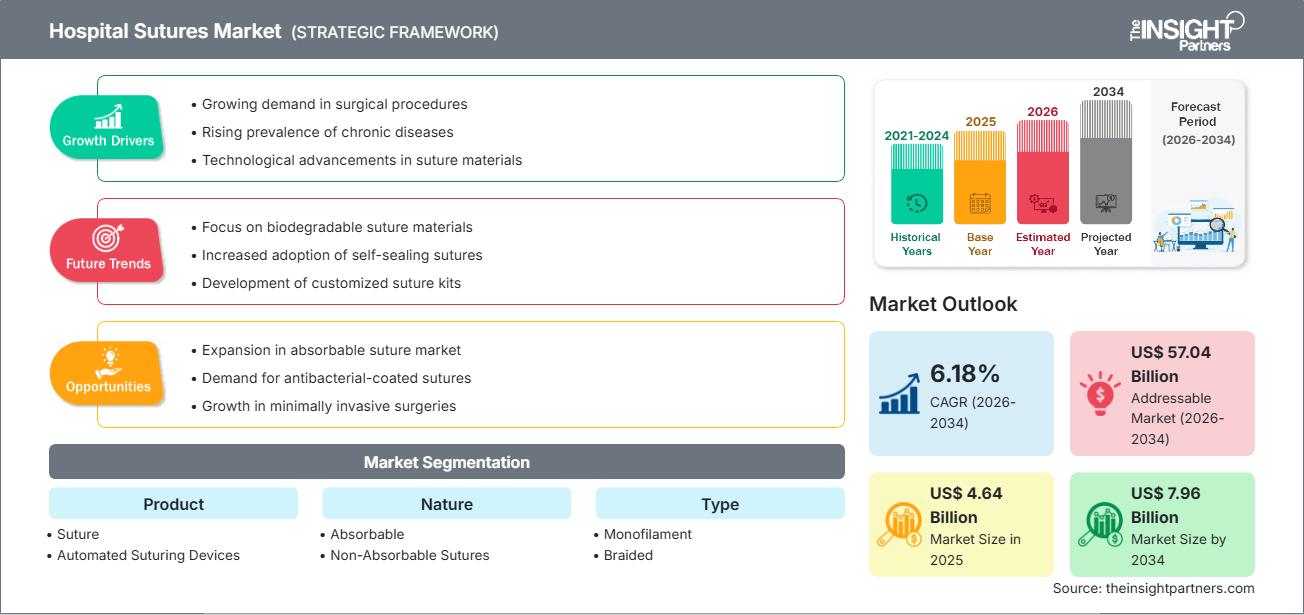

Hospital Sutures Market Size and Forecast (2021 - 2034), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product (Suture, Automated Suturing Devices, and Others), Nature (Absorbable and Non-Absorbable Sutures), Type (Monofilament and Braided), Application (General Surgery, Orthopedic Surgery, Cardiovascular Surgery, and Others)

Historic Data: 2021-2024 | Base Year: 2025 | Forecast Period: 2026-2034- Report Date : Mar 2026

- Report Code : TIPRE00027433

- Category : Life Sciences

- Status : Upcoming

- Available Report Formats :

- No. of Pages : 150

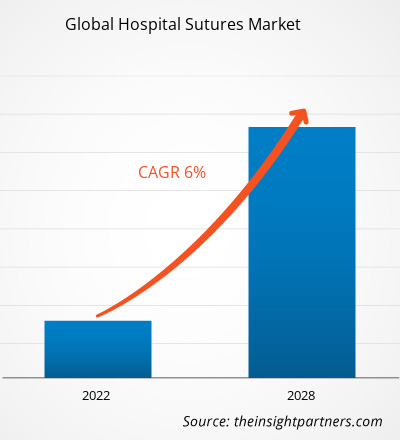

The AI in social media systems market size is expected to reach US$ 7.96 billion by 2034 from US$ 4.64 billion in 2025. The market is anticipated to register a CAGR of 6.18% during 2026–2034.

Hospital Sutures Market Analysis

The hospital suture market, popularly known as the Hospital Sutures Market, is thus growing rapidly, primarily driven by the increasing volume of surgeries performed globally. This trend is greatly influenced by the rising prevalence of chronic diseases, such as cardiovascular and orthopedic diseases, and lifestyle diseases, and also by the increasing population of geriatric people worldwide, which requires more surgical interventions. Advanced suturing materials, such as antimicrobial-coated, biodegradable (or bioabsorbable), and barbed sutures that enhance wound healing, minimize infection risk, and improve efficacy of surgical procedures, constitute continuous innovation in the market. Companies operate in a highly competitive environment with a focus on product innovations, strategic mergers, and geographical expansions, especially in emerging economies with rapidly improving healthcare infrastructure.

Hospital Sutures Market Overview

Surgical sutures are medical devices designed to approximate tissues after surgical interventions or traumatic injuries and support the wound healing process in various specialties, such as general surgery, orthopedic, gynecological, and cardiovascular surgeries. They are a basic component of operative care. The market has a wide variety of products and includes absorbable and non-absorbable sutures, which can be made from natural or synthetic materials and are presented in monofilament or multifilament forms. Innovations in sutures, such as antibacterial coatings (e.g., triclosan), are becoming increasingly popular due to their great efficacy in reducing postoperative infection incidence.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONHospital Sutures Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Hospital Sutures Market Drivers and Opportunities

Market Drivers:

- Growing Number of Surgical Procedures Worldwide: The increase in chronic diseases, trauma cases, and the aging global population necessitates a higher volume of surgeries (cardiovascular, orthopedic, general surgery, cosmetic), directly boosting suture demand.

- Technological Advancements in Suture Products: Innovations such as the development of antimicrobial-coated sutures to reduce Surgical Site Infections (SSIs) and the rise of biocompatible, high-tensile-strength absorbable sutures improve patient outcomes and drive product adoption.

- Expansion of Healthcare Infrastructure and Favorable Policies: Improving economic conditions and government support in developing nations lead to better healthcare facilities and increasing surgical capabilities, further driving demand.

Market Opportunities:

- Rising Demand for Advanced Sutures in Minimally Invasive Surgery (MIS): MIS procedures are growing in popularity, creating high demand for specialized sutures (like barbed sutures and those compatible with robotic systems) that facilitate wound closure in narrow anatomical access.

- Focus on Infection Prevention and Faster Healing: The market has a significant opportunity in the development and adoption of next-generation sutures (e.g., drug-eluting, bio-engineered, and antibacterial-coated) that actively promote wound healing and reduce hospital-acquired infections.

- Untapped Potential in Emerging Economies: Rapid modernization of hospitals and increasing healthcare expenditure in regions like Asia-Pacific and South & Central America present substantial opportunities for market expansion and distribution of advanced suturing products.

Hospital Sutures Market Report Segmentation Analysis

The hospital sutures market share is analyzed across various segments to provide a clearer understanding of its structure, growth potential, and emerging trends. Below is the standard segmentation approach used in most industry reports:

By Product

- Suture

- Automated Suturing Devices

By Nature

- Absorbable

- Non-Absorbable Sutures

By Type

- Monofilament

- Braided

By Application

- General Surgery

- Orthopedic Surgery

- Cardiovascular Surgery

By Geography

- North America

- Europe

- Asia-Pacific

- South & Central America

- Middle East & Africa

Hospital Sutures Market Regional Insights

The regional trends and factors influencing the Hospital Sutures Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Hospital Sutures Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Hospital Sutures Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2025 | US$ 4.64 Billion |

| Market Size by 2034 | US$ 7.96 Billion |

| Global CAGR (2026 - 2034) | 6.18% |

| Historical Data | 2021-2024 |

| Forecast period | 2026-2034 |

| Segments Covered |

By Product

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Hospital Sutures Market Players Density: Understanding Its Impact on Business Dynamics

The Hospital Sutures Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Hospital Sutures Market top key players overview

Hospital Sutures Market Share Analysis by Geography

North America has historically dominated the surgical sutures market and holds the highest market share. The dominance is attributed to a robust healthcare infrastructure, high healthcare spending, the presence of major key market players, high adoption of advanced suturing technologies, and favorable reimbursement policies for surgical procedures.

The market shows a different growth trajectory in each region:

- North America

- Market Share: Holds the highest market share, driven by the high volume of complex surgical procedures and readily available advanced medical technology.

- Key Drivers: Strong presence of leading medical device manufacturers, high prevalence of chronic diseases, and early adoption of innovative products like barbed and antimicrobial sutures.

- Trends: Continued growth driven by the shift towards high-value products and advancements in robotic-assisted surgery solutions.

- Europe

- Market Share: Holds a significant share, with countries focusing on stringent quality control and adopting biodegradable options.

- Key Drivers: Well-established healthcare system, increasing focus on reducing hospital-acquired infections, and R&D activities focused on biomaterials.

- Trends: Emphasis on biodegradable and antibiotic-coated sutures in alignment with public health goals.

- Asia Pacific

- Market Share: Anticipated to be the fastest-growing regional market during the forecast period, driven by the rapid expansion of healthcare.

- Key Drivers: Rapidly growing population, rising geriatric population, expanding healthcare infrastructure, increasing healthcare expenditure, and a surge in domestic medical tourism and surgical procedures in countries like China and India.

- Trends: Growing adoption of high-quality surgical consumables due to government initiatives and a rise in awareness about advanced surgical outcomes.

- South and Central America

- Market Share: Emerging regions with growing adoption driven by modernization initiatives.

- Key Drivers: Increasing access to modern healthcare, rising awareness, and growing investment in digital and medical infrastructure

- Trends: Gradual modernization of surgical techniques and increased reliance on international suppliers for high-quality, advanced suture products.

- Middle East and Africa

- Market Share: Emerging regions with growing potential.

- Key Drivers: Major national digital and healthcare transformation initiatives (e.g., UAE, Saudi Arabia), and high incidence of trauma and lifestyle-related chronic diseases requiring surgery.

- Trends: Growing investment in new hospitals and surgical centers, leading to increased procurement of advanced surgical consumables, including sutures.

Hospital Sutures Market Players Density: Understanding Its Impact on Business Dynamics

The Surgical Sutures Market is intensely competitive, characterized by the presence of a few major global medical device companies alongside several specialized regional and niche players. Competition is primarily based on product innovation, material quality, pricing, and distribution network strength. Major players are actively engaging in strategic initiatives to consolidate their market position.

The competitive landscape is driving vendors to differentiate through:

- Continuous R&D into enhanced materials like antimicrobial coatings to reduce infection risk and barbed sutures to simplify complex laparoscopic closures and reduce operative time.

- Focus on mergers, acquisitions, and partnerships to expand product portfolios and gain a stronger footprint, especially in fast-growing emerging markets.

- Developing sutures and delivery systems compatible with advanced surgical techniques, such as robotic-assisted surgery and minimally invasive procedures.

Opportunities and Strategic Moves

- Focus on Cost-Efficiency and Quality: With increasing cost pressures in hospital systems, companies are striving to offer advanced, high-performance sutures that also provide overall value by reducing procedure time and lowering complication rates.

- Developing Specialty Sutures: There is a significant focus on creating specialized sutures and closure devices for specific clinical needs, such as orthopedic repair or wound closure for diabetic patients, leading to increased adoption by specialty surgeons.

- Partnerships and Localization: Global players often form strategic alliances with local distributors or manufacturers, particularly in the Asia-Pacific and Latin American markets, to navigate regional regulatory complexities and leverage local distribution channels.

Major Companies Operating in the Hospital Sutures Market Are:

- Assut Medical Sarl

- Péters Surgical

- SERAG-WIESSNER GmbH & Co. KG Zum Kugelfang

- DemeTECH Corporation

- Teleflex Incorporated

- Smith & Nephew

- B. Braun Melsungen AG

- Johnson and Johnson Services, Inc.

- Medtronic

Disclaimer: The companies listed above are not ranked in any particular order.

Hospital Sutures Market News and Recent Developments

- For instance, on July 07, 2025, Smith+Nephew, the global medical technology company, announced the release of its Q-FIX KNOTLESS All-Suture Anchor for soft tissue-to-bone fixation indications across multiple joint spaces, including Shoulder, Hip, and Foot & Ankle.

- On July 01, 2025, Teleflex Incorporated, a leading global provider of medical technologies, announced that it had completed the previously announced acquisition of substantially all of the Vascular Intervention business of BIOTRONIK SE & Co. KG. The acquisition adds a broad portfolio of therapeutic products to Teleflex’s portfolio of interventional access products, driving an enhanced global presence in the cath lab. The Vascular Intervention business will also establish Teleflex's global footprint in the fast-growing peripheral intervention market and provide a channel for Teleflex products that currently have a peripheral indication.

- On March 04, 2025, Smith+Nephew, the global medical technology company, announced its pioneering efforts to develop technology in the field of Spatial Surgery - a revolutionary new frontier in arthroscopic surgical innovation. We envision Spatial Surgery as an opportunity to provide personalized planning, augmented reality, and real-time data processing into platforms that interpret the surgical field intraoperatively.

- In March 2024, Advanced Medical Solutions Group plc, a world-leading specialist in tissue healing technologies, announced it had agreed to the proposed acquisition of Peters Surgical, a leading global provider of specialty surgical sutures, mechanical haemostasis, and internal cyanoacrylate devices.

Hospital Sutures Market Report Coverage and Deliverables

The "Hospital Sutures Market Size and Forecast (2021–2034)" report provides a detailed analysis of the market covering below areas:

- Hospital Sutures Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Hospital Sutures Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Hospital Sutures Market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the Hospital Sutures Market. Detailed company profiles

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For